sturti/E+ via Getty Images

Inflation is rapidly increasing this year, and investors are fleeing high-multiple growth stocks as a result. Realty Income Corporation (NYSE:O) is a possible long-term place to park some of your money, as it is not only set to grow adjusted funds from operations at a rapid pace following the VEREIT acquisition, but an investment in the net-lease real estate investment trust provides protection against unruly inflation and dividend growth.

Inflation Protection Is A Key Consideration For Investors Right Now

Inflation is expected to skyrocket in 2022, reaching a depressing 40-year high amid aggressive fiscal spending and supportive monetary policy in response to the Covid-19 pandemic. Inflation is a major issue for investors and, frankly, anyone with a fixed income, such as a salary or a government pension.

Inflation, on the other hand, is not a problem for everyone: Landlords benefit from rising consumer prices primarily because real estate values and rents rise as inflationary pressures spread to all sectors of the economy.

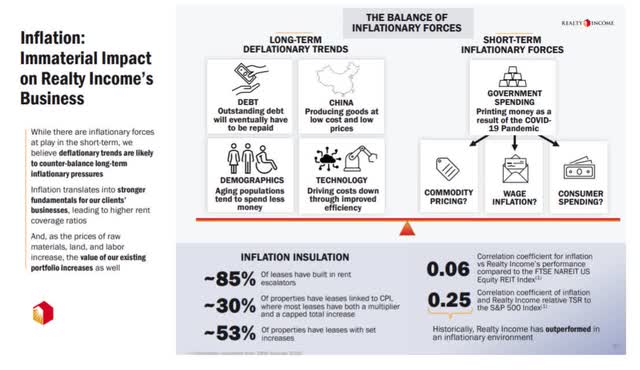

Realty Income, which invests in physical real estate, stands to benefit from sky-high inflation rates. Rent escalators are commonly found in Realty Income leases, which assist the trust in automatically counteracting inflation rates and growing cash flow. These rent escalators provide an internal hedge against inflation in a climate of skyrocketing inflation.

Inflation Insulation (Realty Income Corp)

Focus On Real Estate Quality And Diversification

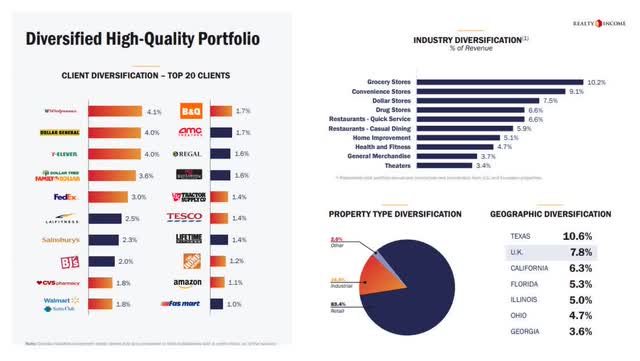

Realty Income owns a diverse portfolio of high-quality real estate assets in the United States and, increasingly, abroad. The trust’s tenants are highly diverse, with Walgreens accounting for only 4.1% of total rent. Realty Income also focuses on necessity-based businesses such as grocery and convenience stores, which are recession-proof and can pay their rent even when the economy is struggling.

Diversified Portfolio (Realty Income Corp)

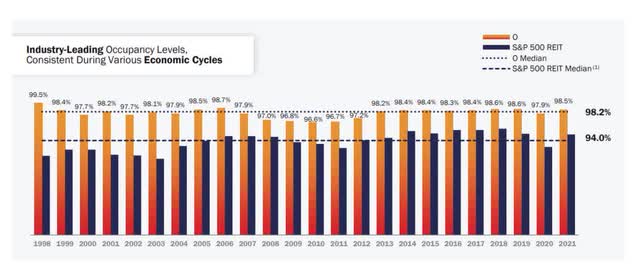

Realty Income has a strong track record of long-term performance. Realty Income’s real estate portfolio has a median occupancy rate of 98.2%, with the calculation encompassing all years beginning in 1998. This equates to a more than two-decade track record of exceptional portfolio quality. The trust’s focus on high-quality real estate assets and high occupancy rates results in very low-risk rental cash flow that can be reinvested in the trust’s real estate portfolio or used to pay a higher dividend.

Track Record (Realty Income Corp)

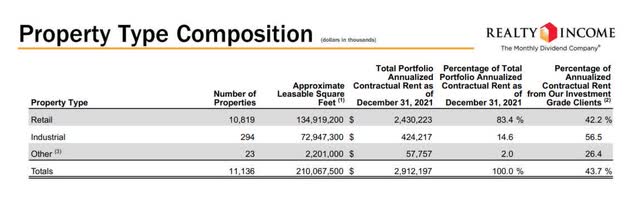

The trust’s portfolio is primarily retail-oriented, but it also includes some real estate investments in industrial property types. Retail, on the other hand, is Realty Income’s mainstay sector, accounting for nearly 11K properties. The VEREIT acquisition positions Realty Income for greater diversification and growth in adjusted funds from operations.

Property Type Composition (Realty Income Corp)

Growth In Europe

Realty Income began its real estate business in the United States, but the trust has long sought to expand its presence in other markets in order to diversify its existing U.S.-centric real estate portfolio and to establish a presence in markets with growth potential.

Realty Income is making inroads into the European market, having invested $4.3 billion in its European real estate portfolio thus far. Investors should expect more acquisitions in Europe in the future, as part of an aggressive diversification drive and a thirst for growth.

Quarterly Investment Volumes In Europe (Realty Income Corp)

With The Ukraine-Russia Conflict Raging, Investing In Realty Income Will Provide You Stability

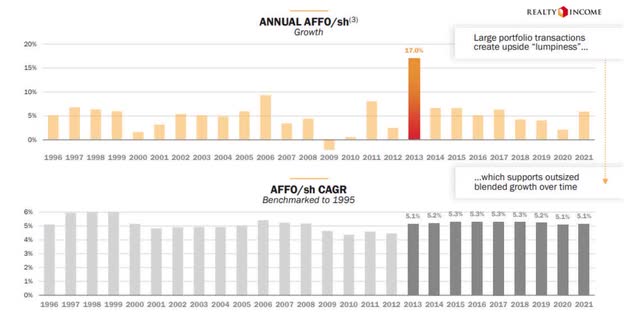

Since 1995, Realty Income has grown adjusted funds from operations at a rate of 5.1% on average. Realty Income has produced positive earnings growth in 25 of the last 26 years, indicating that the company’s strategy of focusing on high-quality real estate assets is paying off for the trust.

Investors can protect themselves against geopolitical events such as the Ukraine-Russia standoff, which has recently destabilized the stock market, by purchasing Realty Income and the trust’s predictable adjusted funds from operations growth.

Annual AFFO (Realty Income Corp)

Guidance And Multiple

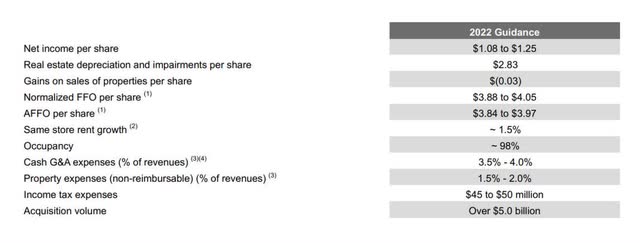

Realty Income expects to make more than $5.0 billion in acquisitions in 2022. Acquisitions are likely to take place primarily in the United States, but the trust may look to Europe for a couple of transactions this year as well. Realty Income expects to earn $3.84 to $3.97 per share in adjusted funds from operations, translating into a P-AFFO multiple of 16 to 17.

2022 Guidance (Realty Income Corp)

Potential Issues That Would Challenge My Thesis

Rent escalators are used in approximately 85% of Realty Income’s leases, so the trust will benefit from inflation in the form of rising rents and property values. This suggests that the trust’s profitability is not jeopardized by inflation.

Even though the trust has maintained very high occupancy rates during economic contractions, a recession is likely to be a significant risk factor for Realty Income.

A significant deterioration in portfolio quality, higher vacancy rates, and lower rental cash flow would most likely cause me to reconsider Realty Income.

My Conclusion

In these times of increasing anxiety and geopolitical tensions, nothing beats quality stocks that provide me with peace of mind. Realty Income and other companies with extremely high-quality assets are must-own stocks.

Following the VEREIT transaction, Realty Income is poised for robust adjusted funds from operations growth, with a portfolio that is both stable and diverse.

The fact that Realty Income’s leases include rent escalators protects shareholders from skyrocketing inflation because they result in growing cash flow from existing leases. Furthermore, Realty Income’s monthly dividend is increasing, which helps to mitigate the impact of rising consumer prices.

Be the first to comment