alexsl

Realty Income (NYSE:O) is one of the largest REITs in the world with a market capitalization of roughly $40 billion and a dividend yield of almost 5%. The company has seen its share price recover by more than 13% recently, however, it still remains substantially below its recent highs. Despite that recent recovery, we see the company as still having the potential to drive substantial returns.

Realty Income Investment Thesis

Realty Income offers investors a unique investment proposition that highlights its strength.

Realty Income Investor Presentation

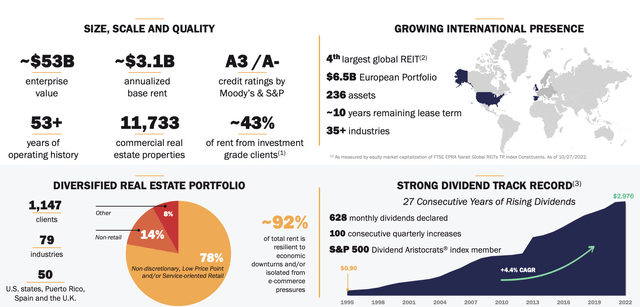

Realty Income has a unique history of providing substantial shareholder returns. The company has a more than $50 billion enterprise value and a $40 billion market capitalization. The company’s annual base rent of more than $3 billion implies a 6% yield on enterprise value diversified across almost 12 thousand properties.

The company has more than 50 years of operating history, a strong credit rating, and 43% of rent from investment grade clients. The company has a strong dividend track record of 4.4% annualized increases, with an almost 5% dividend yield.

Realty Income Casino Business

Realty Income recently agreed to purchase the land and real estate assets of the Encore Harbor Boston for $1.7 billion in a sale-leaseback. It marks the company’s first foray into the gaming world, which is an incredibly unique opportunity in our view. That’s because the industry has incredibly strong revenue but has incredibly high capital costs.

Sale-leaseback transactions can help alleviate these capital costs while bringing billions in deals towards Realty Income.

Realty Income Sourcing Growth

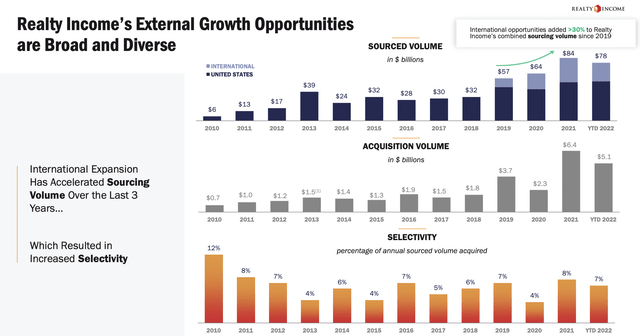

Overall, the company has focused on increasing sourcing volumes as it grows its overall business.

Realty Income Investor Presentation

Realty Income has continued to maintain incredibly low selectivity in the mid-single digits. This shows how the company rejects the majority of opportunities that come its way. The company has had $80 billion in sourced volume the last few years and has taken advantage of this to make substantial acquisitions to the tune of $5-6 billion annualized.

We expect, especially as rising interest rates push down prices, for the company to see more opportunities coming its way. That will enable the company to close out more interesting deals.

Realty Income Return Potential

Putting this together, the company, with minimal volatility, has the ability to drive substantial returns.

The base of these returns are the company’s monthly dividend of 0.4%. Annualized, that comes out to roughly 4.8% in dividends, growing at several % annualized. That alone comes up to high single-digit annualized returns. However, that doesn’t count any growth for the company outside of its dividends.

The company continues to have massive growth potential and a massively addressable market. The company also has multi-decade rental terms and built in rent escalators for inflation etc. As a result, we expect the company to continue generating high single-digit or low double-digit returns. Overall this return potential makes the company a valuable investment.

Our View

Realty Income is a unique company with a unique business and substantial volatility. Unfortunately for the company, REITs in general don’t allow you to take advantage of the low-interest fix-rate leverage that buying property does. However, in exchange, they provide a substantial amount of diversification and reliable cash dividends.

We recommend Realty Income forms a core addition to any quality portfolio, one that’s worth taking advantage of.

Thesis Risk

The largest risk to our thesis is that REITs have a different suite of risks. They’re more subject to the fluctuations of the markets, and something like COVID-19, which shut down movie theaters, can represent a black swan event. These risks are worth paying close attention to as a real estate company.

Conclusion

Realty Income is a reliable real-estate company known as the monthly dividend company, with a long history of backing that up. The company also has a substantial history of increasing that dividend. That combination of things put together, with reliable and increasing dividends, will provide a high single-digit dividend yield.

The company’s largest focus is continuing to expand its business. The company is continuing to source almost $100 billion in opportunities annually, but it only accepts a low single digit %, resulting in billions in annual accepted deals. That will result in continued rent growth for the company’s business, and future returns.

Be the first to comment