Spencer Platt/Getty Images News

Spending shifts slowly back to services. But spending on goods still massively above trend, despite supply shortages.

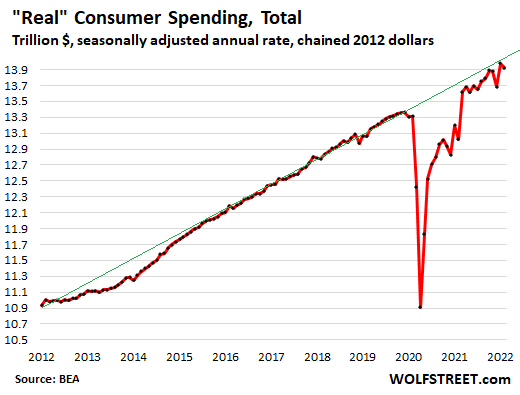

What happened is that income growth has been getting eaten up by inflation for months, but inflation-adjusted spending jumped by a huge and upwardly revised amount in January from December (+2.1%), and then dipped a little in February from that record (-0.4%), but was still the second highest ever, and up by a huge 6.9%, adjusted for inflation, from a year ago.

Inflation is a massive problem and is eating up the substantial growth in income. But for now, consumers are still making heroic efforts to out-spend inflation, with many of them spending money they’d extracted from their homes through cash-out refis, brokerage accounts, and from other assets they could leverage, and from running up their credit card balances.

Spending shifting back from durable goods to services, gradually.

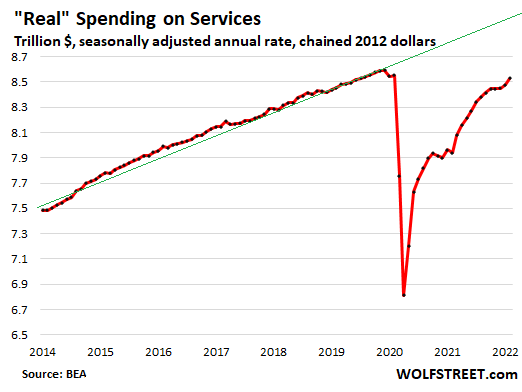

The long-awaited shift from pandemic-crazed spending on durable goods to services is now taking place. Services include lodging, airfares, rental cars, insurance, healthcare, repairs, haircuts, sports and entertainment venues, rents, etc. During the pandemic, spending on services collapsed.

Adjusted for inflation, spending on services in February rose by 0.6% from January and by 7.4% from a year ago, according to the Bureau of Economic Analysis today. But it still remains way below the long-term trend (green line) and was down by 0.3% from February 2020, and still accounted for only 61.2% of total consumer spending, down from 64.3% pre-Covid.

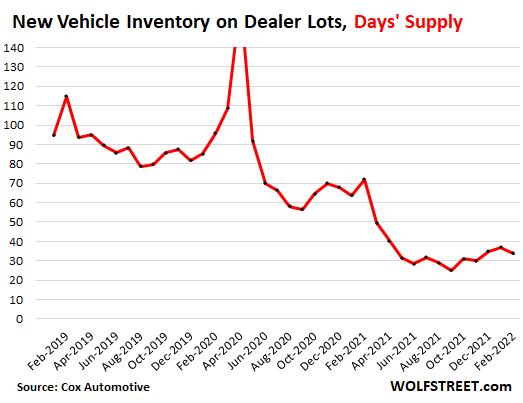

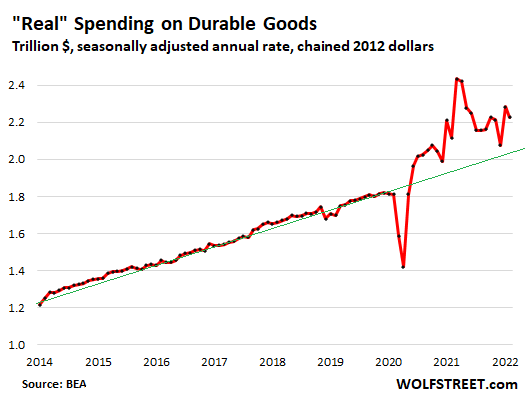

Spending on durable goods continues to be handicapped by large-scale supply issues, particularly with new vehicles, where global production continues to get hit by semiconductor shortages. Spending on motor vehicles is by far the largest category of durable goods spending. But demand exceeds supply by a wide margin as dealers have been desperately low on inventories since early 2021. Consumers, frustrated by nearly empty lots, have switched to ordering new vehicles, and then are waiting patiently.

New vehicle supply at dealers should be about 60 days. In 2019, it was 90 days, which was a sign of too much inventory. Last year, supply collapsed below the 30-day line, and in February was still only at 34 days. Consumers cannot spend money on stuff they cannot get:

Durable goods inflation, given the blistering overstimulated demand that triggered the shortages, has been gigantic. The durable goods CPI spiked by 18.7% in February, by far the highest in the monthly CPI data going back to the 1950s.

Adjusted for inflation, “real” spending on durable goods fell by 2.5% in February from January, but was still up by 5.2% from a year ago, and up by a blistering 23.0% from two years ago. Americans are still spending a gigantic amount on durable goods, and this spending remains way above trend (green line), and shortages keep them from spending even more:

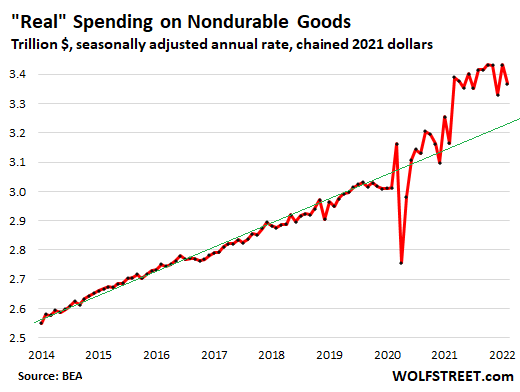

“Real” spending on nondurable goods – mostly food, beverages, household supplies, and energy – had spiked during the pandemic in part because spending shifted from the office (paid for by companies and not part of consumer spending) to the home, as more people were working from home.

“Real” spending on nondurable goods fell 1.9% in February from January, but was still up 6.4% from a year ago and by 11.8% from two years ago, and remains way above trend. All this is adjusted for inflation, and inflation has been huge in nondurable goods, with the nondurable goods CPI reaching 10.7% in February.

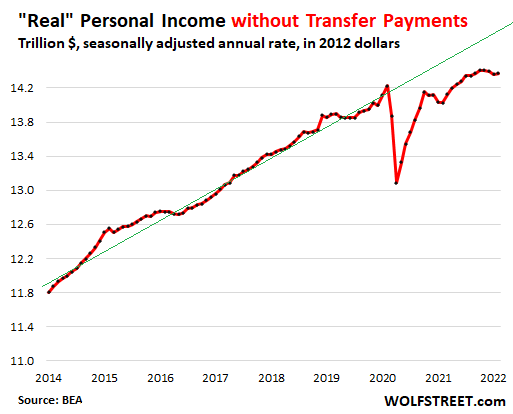

Incomes fail to keep up with inflation.

“Real” personal income without transfer payments – income from wages, salaries, rents, farms, businesses, etc., but not from government transfer payments, such as stimulus, unemployment, welfare, Social Security, etc. – edged up by just 0.1% in February from January, and was up just 1.0% from February two years ago. It peaked in October and November last year and has since declined by 2.3% and remains substantially below trend, as inflation is starting to eat everyone’s lunch:

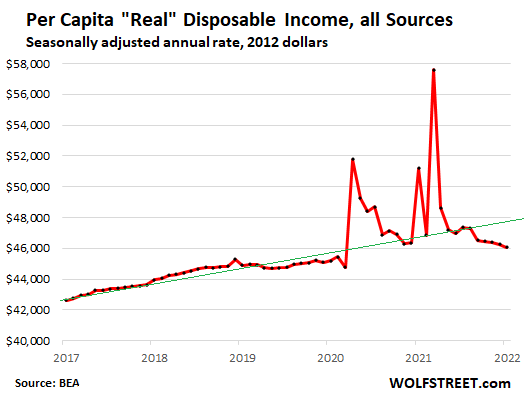

Per-capita “real” disposable income gives a broader picture. This is income from all sources combined, including income from wages, salaries, rents, farms, businesses, and transfer payments, minus income-based taxes, and then adjusted for inflation, and then figured on a per-capita basis.

This per-capita “real” disposable income declined by 0.2% in February from January, the seventh month in a row of month-to-month declines, down 1.9% from a year ago, and at the lowest level since March 2020, and heading further below pre-pandemic trend:

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment