frender

After the recent price collapse, Real Estate Select Sector SPDR ETF (NYSEARCA:XLRE) is now in a buying zone as the indices are nearing the bottom of the current bear market. A dividend ETF like this one could be very attractive for long-term investors who want to watch their investments appreciate steadily while collecting hefty dividends. Its portfolio concentration on high-quality equity REITs makes it less sensitive to high rates when compared to mortgage REITs. Furthermore, most of its portfolio holdings are set to post record financial numbers in 2022 with expectations that the momentum will continue in the coming year.

The Bottom is in Sight

In the past two quarters, interest rates have increased at the fastest pace in four decades. In addition, the Fed is likely to raise rates by 75 basis points next month and by a small percentage point in December to reach a projected level of 4.25 to 4.50%. This means real estate and broader market index might experience more volatility in the weeks ahead and hit the bottom once the Fed starts slowing the pace of rate hikes, which is most likely to happen in December. However, the volatility doesn’t mean that XLRE could lose hefty value before hitting the bottom. The loss could be smaller than in previous quarters because real estate stocks have already priced in the impact of rate hikes. The limited downside is also reflected in analysts’ year-end targets for the broader market index. For instance, Goldman Sachs analysts predict the S&P 500 to finish the year at around 3,600, which is down around a few percentage points from the current level.

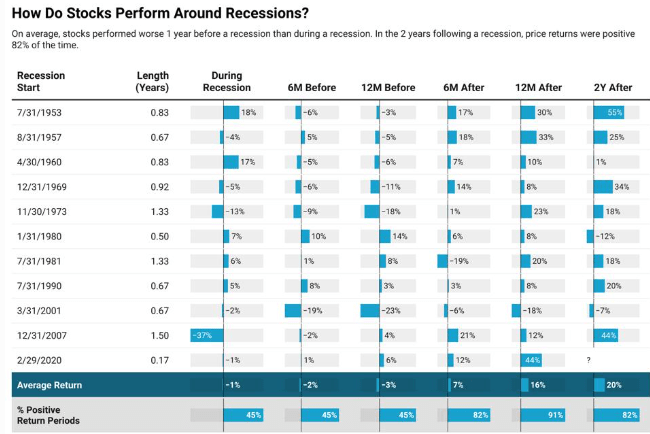

Stock Performance Before, During and After Recession (Forbes)

It is important to note that I am not ignoring the increasing likelihood of a recession in 2023. Recessions mean unfavorable market conditions, which are generally bad for stocks. I believe that stocks perform worse in the year before the recession than during the recession, and historical data supports that trend. This is because it is more common for stock market investors to react in anticipation of an event rather than when the event actually happens. Additionally, history shows returns grow significantly after a recession, and bull markets are longer and stronger than bear markets.

A Faster Recovery is Possible for XLRE

High rates are bad for the entire real estate sector but equity REITs are less sensitive to interest rates than mortgage REITs. This is because equity REITs collect revenue in the form of rental, lease, or property income because they own or operate property while mortgage REITs earn income in the form of interest through investments in mortgages and other related assets. In current market conditions, the equity REITs appear well positioned to grow despite the fastest rate increases in more than four decades, thanks to their healthy balance sheets and growth strategies. Solid dividend hikes in 2022 showcase their strong balance sheet and resilient business model. Through September, 83 US REITs have raised dividends, representing 51.6% of the entire REIT industry.

In the case of XLRE, which tracks the performance of real estate select stocks and holds stakes in 31 high-quality equity REITs, most of the top ten stock holdings have already raised dividends in 2022. Moreover, most of the holdings are expected to post record top and button line numbers in 2022 and 2023. This means end markets are strong and real estate stocks are poised for a faster recovery as soon as the broader market stabilizes.

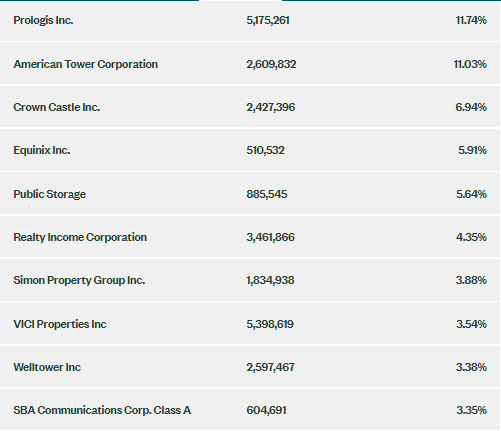

XLRE’s Top 10 Holdings (ssga.com)

As an example, Prologis, Inc. (PLD), XLRE’s largest stock holding, has easily exceeded third-quarter top and bottom line estimates. Its quarterly revenue of $1.75 billion topped the $1.13 billion consensus estimate and jumped significantly from revenue of $1.18 billion in the year-ago period. Its core FFO of $1.73 has beaten the average analyst estimate of $1.67 and climbed from $1.04 in the same period last year. For the full 2022, the company expects core FFO in the range of $5.12-5.14 compared with the $5.07 consensus. The company’s top and bottom line growth enabled it to increase its quarterly dividend by 25% in 2022, while Wall Street’s consensus estimate of $5.62 indicates dividend growth is safe for the next year. Moreover, the company’s recent acquisition of Duke Realty Corporation for $23 billion indicates that its balance sheet has helped it take advantage of growth opportunities. There are no significant debt maturities for the company until 2026, with cash and credit facilities totaling $5.3 billion at the end of the third quarter.

Furthermore, American Tower Corporation (ATM), its second-largest holding, exceeded both top and bottom line estimates for the second quarter. The REIT raised the midpoint of its full-year 2022 AFFO guidance to the range of $9.62-$9.86. Additionally, the company continues to invest in building new towers and increased its dividend by a double-digit rate. Similarly, Crown Castle’s (CCI) growth trends also look sustainable. The company reported year-over-year adjusted FFO growth of 5% for the third quarter and has issued a robust outlook for the full year and for 2023. Recently, the company raised its common stock dividend by 6.5% in anticipation of solid cash flow growth in 2023. As 5G development is still in its early stages, its CEO Jay Brown believes that demand for towers, small cells, and fiber is likely to grow significantly over the long term.

XLRE’s Dividend Growth is Sustainable

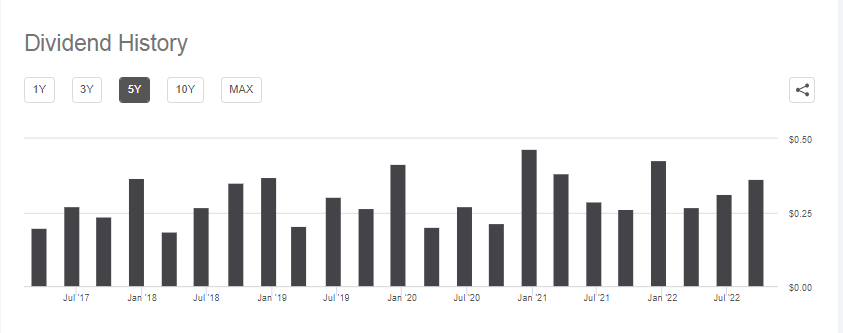

XLRE Dividend History (Seeking Alpha)

XLRE appears to be in a position to raise its dividend for the final quarter to surpass its 2021 annual dividend of $1.37 a share. As many of its top stock holdings, such as American Tower and Prologis, have announced healthy dividend growth, the chances of a lofty dividend for the final quarter are high. Moreover, its other top stock holdings, such as Equinix Inc. (EQIX), Realty Income Corporation (O), Simon Property Group Inc. (SPG), VICI Properties Inc. (VICI), and SBA Communications (SBAC), have already raised their dividends in 2022. A special dividend of 13.15 per share paid by Public Storage (PSA) could also have a significant impact on XLRE’s full-year dividend payout.

In Conclusion

Although the current bear market has wiped out trillions of dollars of stock market value, it has opened up attractive opportunities for dip buyers. XLRE is among the investment opportunities that can generate substantial returns through both price appreciation and dividend growth. Top line, bottom line, and cash flow outlooks for its top 10 portfolio holdings indicate that end markets are strong for equity REITs, which can help XLRE shares rebound sharply once the broader stock market stabilizes.

Be the first to comment