Douglas Rissing

Co-produced with Treading Softly

Have you ever had to admit to being wrong? It can be incredibly hard. People often refuse to admit error, even when the facts to the contrary are clearly present in front of them.

I’m not talking about divergent views of the same set of data. That happens frequently in the market when two investment methods or goals view data differently. Take a trader and a long-term investor for example:

- The trader sees a price drop as a missed call and a reason to pack it in and move on.

- The investor sees a price drop as a point to add to their position on their long-term holding timeframe. A chance to boost their overall return.

In Seeking Alpha’s comment section, people sharing that XYZ was a bad pick because it dropped x% in 2 weeks – clearly a trader’s perspective. Then someone else will tell them they’re wrong because it’s a great place to add – an investor’s outlook. The great thing about Seeking Alpha is that all types of investors, traders, and individuals can come together and share ideas and thoughts. However, just like when you read a book, article, or newspaper, you need to be aware of the goals and perspective of the person writing the comment or article.

I digress.

What I am talking about is when facts are clear as day. No grey. No room for an alternative perspective. In those moments, admitting to being wrong can be a challenging proposition.

Imagine if you retired in January of this year and planned on taking your first withdrawal from your retirement savings. You diligently saved and followed the advice of your financial planner or those genius columnists you read diligently online for years. You look at your account and it’s down.

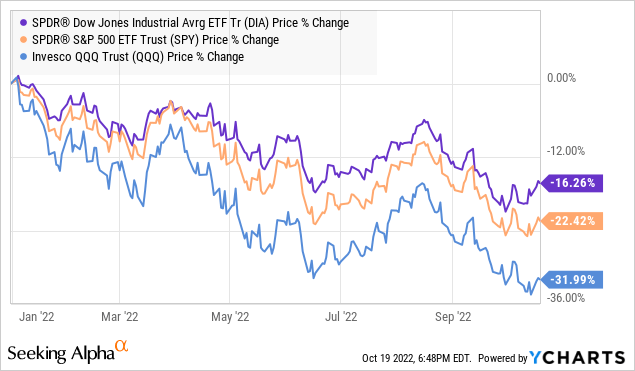

Your $1 million in savings is now down between 16 and 32%! You’re left looking at a balance of $680,000 to $840,000. If you planned to take out 4% annually, that’s the equivalent of 4-8 years’ worth of income erased in 10 months!

Your spouse asks how the retirement account looks and you have to be honest but you also need to lay that blame somewhere… right? So you could own it and try to explain what has happened to your balance and the hopes it will recover in a year or two, but everyone keeps beating the drum of a recession and things could get worse. Worse than losing a third of your retirement?!

Okay. Okay. You know whose fault it is:

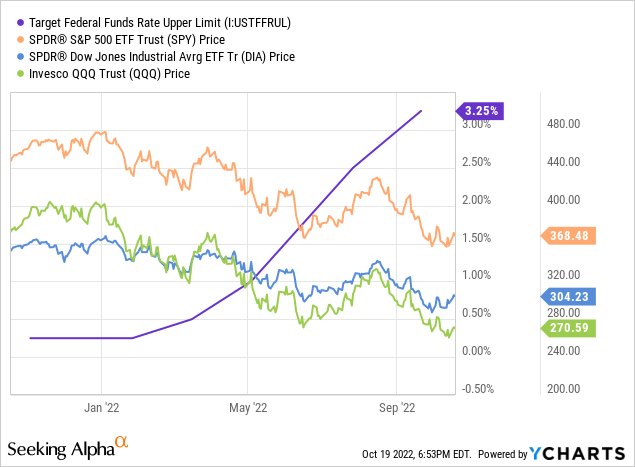

Honey, the Fed shrank our retirement savings.

It has to be their fault right?

It sure looks like it when you consider that every time the Fed hikes rates, it negatively impacts the market so far this year. Plus if they drive us into a recession, then the market will have further to dip.

Time For a Family Meeting

Now you and your spouse are concerned. Darn, that Fed! What should we do, you ponder.

You can hold the course. You’ve followed this path through the COVID drop and it turned out okay, but you weren’t planning on making withdrawals back then. You delayed retiring to ensure your savings recovered. Everything seemed great so you decided to make the leap into retirement now, and now things have gone down in a seemingly never-ending spiral!

You’ve heard of the sequence of return risk – if you withdraw money on this low, it’ll reduce your returns on the recovery and be a costly choice, but you need money to pay your bills! The cost of living has climbed and you want to maintain your lifestyle.

So what can you do? Holding the course seems to be a great idea for those with the time to do it, but if things get worse and prices keep rising, you fear you might run out of money. You worked this hard to save this amount, and the market is just wiping it away without any regard for you!

They said it was the best way to generate wealth, but now it’s taken nearly one-third of it back from you.

If only there was another option, something that didn’t require you to constantly sell shares to pay your bills. Seems crazy right? So you start to seek out other options.

Hello Dividends, My Old Friend

You rediscover dividend investing. Wait, the market can pay you for owning shares? Oh right, I used to get dividends from my index funds but my advisor largely told me they were secondary and the same as the rising value of my shares.

A dollar is a dollar, right? That made sense when the market was constantly climbing. Now that it’s fallen, those dollars have vanished. If you sell when 20-30% down, you have less money when the market climbs 50% again. It’s simple math.

“Those dividends were cash, weren’t they?” You think ”Cash that came in and I reinvested, but it was cash I got without having to sell shares”

So you start to dig deeper and a startling fact jumps out at you.

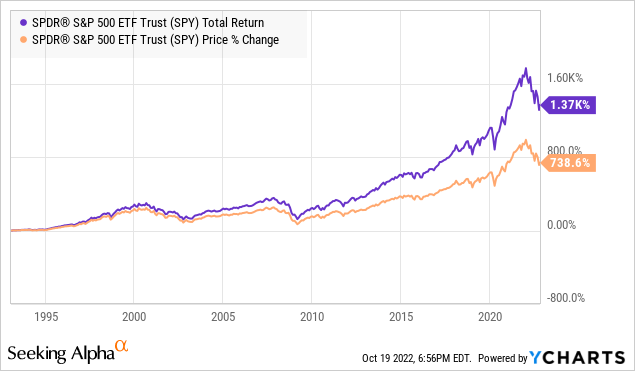

“What?! Dividends have provided almost 50% of the S&P 500’s (SPY) total return?! My advisor shrugged them off as inconsequential! How did they not know this? Or did they?”

They likely did. They also know that the market averages about 7% returns per year since its inception – including the Dot com bubble burst, the Great Financial Crisis, the COVID drop, and the Depression. If you keep holding, your returns will continue to climb, even if there are drops along the way.

The issue – so many advisors and authors overlook – is that once you retire, those drops hurt exponentially harder because you’re not holding or building your portfolio – you’re liquidating it.

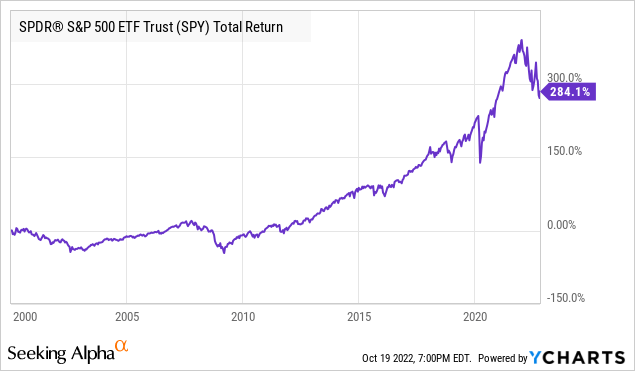

Consider this from 2000 till now, SPY has returned 284.1%:

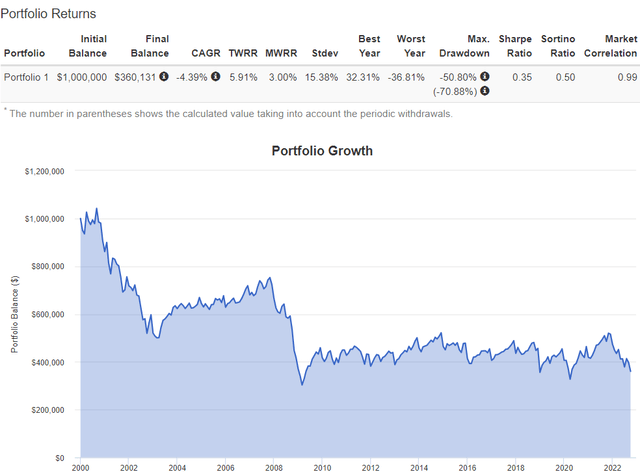

However, if a retiree has been drawing 4% annually, adjusting with inflation, from their portfolio, it has shrunk considerably:

There is a great divergence in performance. Why? The continual drawdowns have caused a 284% return to disappear into negative returns. When you sell shares to fund your retirement, you erode the gains otherwise possible.

The need for income can greatly impact your returns. So dividends become your best friend in retirement and for many of you. This drop in the market can be your wake-up call.

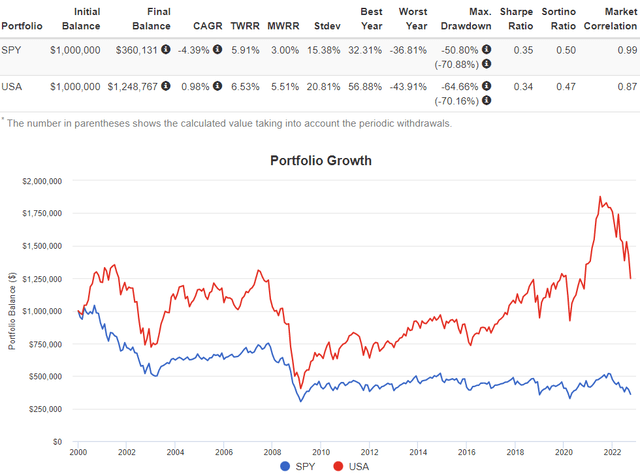

I’ll take one example from the High Dividend Opportunities portfolio to illustrate this, using Liberty All-Star Equity Fund (USA), and run the same 4% withdrawal simulation:

Portfolio 1 (blue) is 100% SPY – same results as the previous graph – whereas Portfolio 2 (red) is 100% USA. We can see that USA’s distributions cover the $40,000 annual drawdowns and enable reinvestment. Do they match the 284% return of the SPY without any money being taken out? No not at all, but they leave you with a higher retirement balance in the end – even with the large drop in value in 2022 in the picture.

You may have followed the common logic of 4% withdrawals and passive ETF investing for decades to grow your portfolio, but when it comes to retirement, you need income and a passive ETF will not cut it. You can see over a 22-year period your retirement savings would erode to a measly $360,000 of what you started with and the downswings in the market only make those withdrawals more impactful.

This is why our Income Method is so effective. It outearns your needs and allows your original shares to go untouched, able to recover in value over time and increase in value. When you sell shares, you start off the real-world risk of running out of money before your retirement is over.

Taking time to properly evaluate your income needs and finding dividend-paying securities which can meet them with as little risk as possible is my advice to every retiree. I have spent my life helping retirees all around the world.

Conclusion

You and your spouse have had a hard talk about the losses your retirement account has faced.

You always dreamed of a stress-free financially independent retirement. The market seems to have other plans for you. You’ve learned about the big secret of the market – dividends matter way more than anyone let you know. You’re frustrated, worried, and rightfully scared.

Now is an excellent time to get your portfolio into strong dividend-paying securities. Fixed income yields are up to 6% from major banks, common shares have yields in the 7-9% range with low-risk.

It can be hard to realize the mainstream mindset isn’t a good fit for retirement. Sure, when the bull market party was raging on, it masked the reality that for many, a passive ETF wasn’t the best choice for income in retirement to pay your bills. The truth above is undeniable.

The choice is yours and my team and I, along with countless Seeking Alpha authors and readers are here to support you if you decide to take the dive into income investing.

It’s a wonderful place to be. We don’t have the shrinking retirement talk because the next question is “How is our income doing?” which is followed up with “Growing faster than ever!”

Be the first to comment