bernardbodo/iStock via Getty Images

Investment Thesis

RCI Hospitality Holdings, Inc. (NASDAQ: RICK) is a prime consolidator of nightclubs in the U.S. due to its favorable capital structure and the management’s deep industry know-how about operating nightclubs. Bombshells, its sports-bar restaurant business, has an industry-leading operating margin compared to some of the well-established publicly traded restaurant companies. Bombshells continue to expand by building more units and franchising. Both businesses are extremely cash-rich, and this is best represented by the company’s high and growing free cash flow. With over 500 clubs in the U.S., RICK has a long runway. The valuation continues to be attractive.

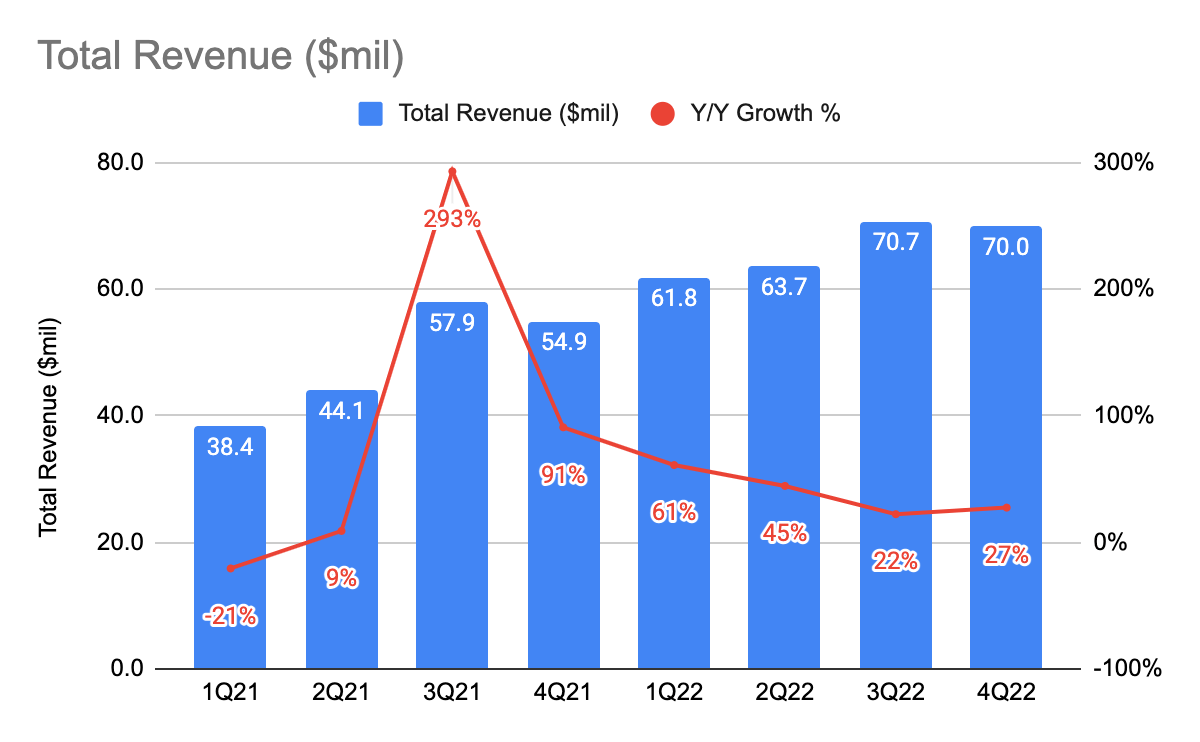

RICK recently reported its 4Q22 revenue of $70 million, which is in line with my internal forecast. And I view the recent share price as positive news for the company, as it is an important currency when it comes to speeding up acquisitions. Also, a quick glance at CEO Eric Langan’s Twitter shows that Nightclub is a fairly resilient business, as traffic in Tootsies Cabaret and Scarlett Cabaret is strong. Based on my validation model, RICK remains undervalued, and I believe it is a compelling investment for investors to consider.

4Q22 Results and Valuation

RICK 10-Q

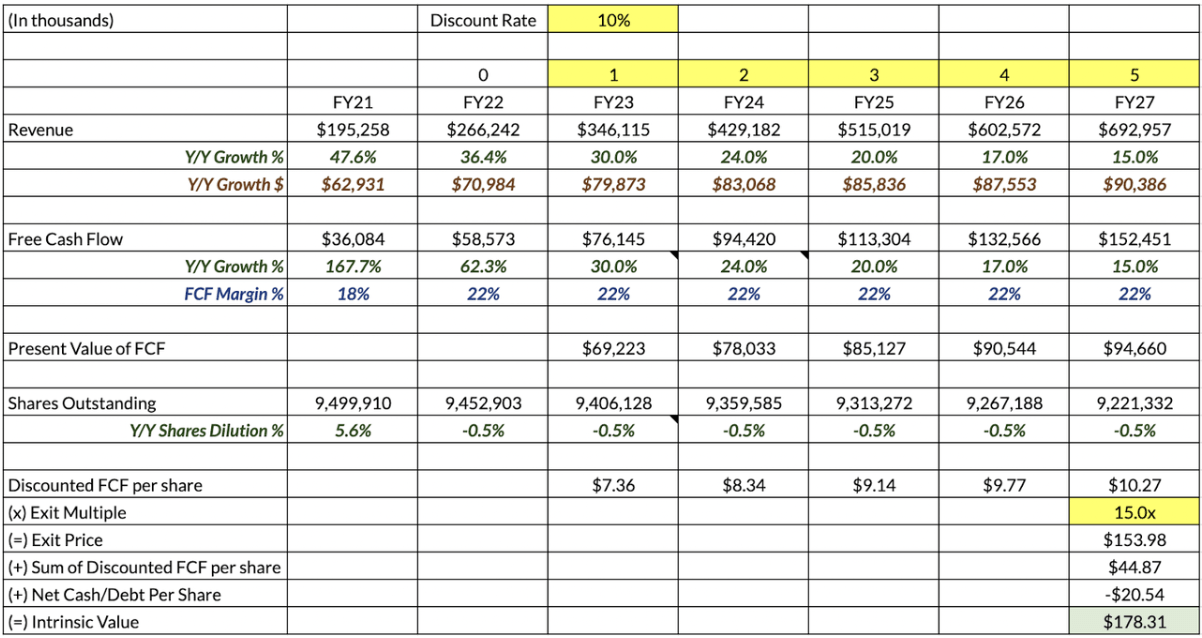

Author’s Estimates

RICK’s total 4Q22 sales came in at $70 million, growing at 27% Y/Y. Nightclub revenue grew 39% Y/Y to $56.1 million and Bombshell revenue grew 3.5% Y/Y to $13.9 million. This brings the total FY22 revenue to $266 million, which is in line with my internal forecast. Unless there is a change, such as quicker than expected growth decline in Bombshells, I will continue to hold on to this forecast. Recall that in 3Q22, the management is expecting a 30% Y/Y growth in free cash flow (“FCF”) by FY23, and by forecast is largely based on the management’s guidance.

Before the upcoming 4Q22 earnings results, I browsed through CEO Eric Langan’s Twitter to get a sense of the club’s foot traffic. For instance, 2 of RICK’s biggest clubs, Tootsies Cabaret and Scarlett Cabaret, saw relatively high traffic volumes. With recession concerns lingering around, this does seem to gauge that RICK is not seeing any impact from inflation. There was also a recent conference held in August by CEO Eric Langan on how they attract younger audiences to nightclubs. If you have not already watched it, I do highly encouraged you to do so.

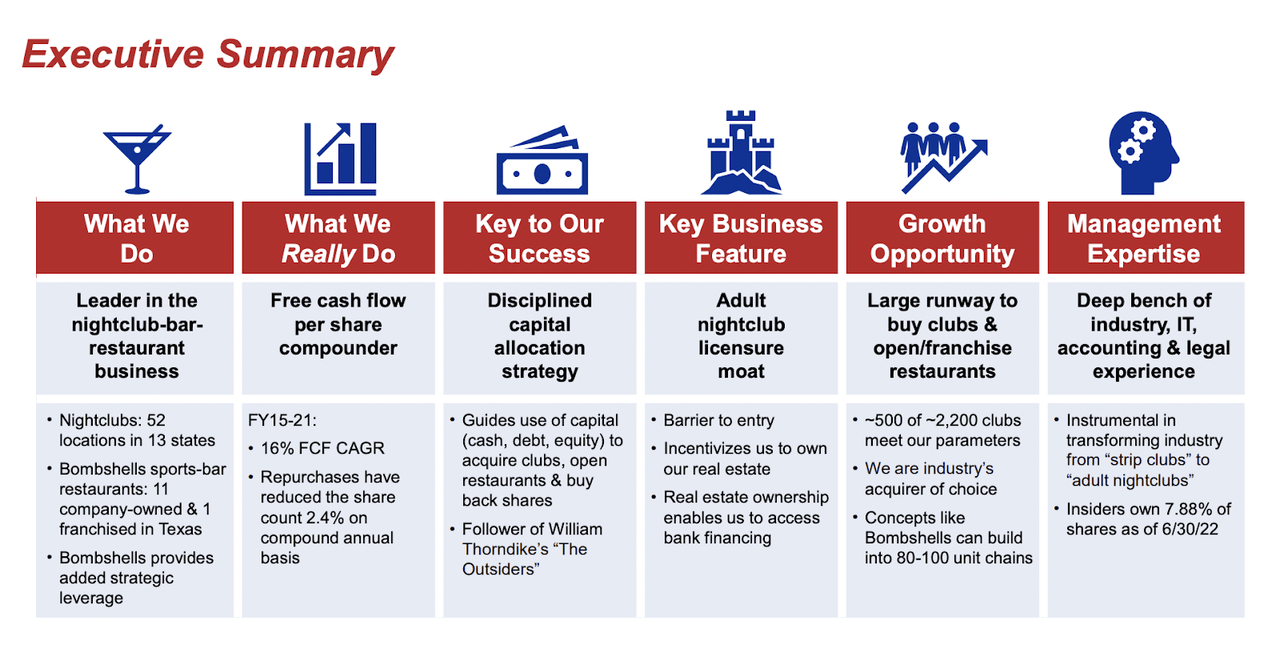

RICK Investor Presentation

On top of that, RICK also recently did a presentation, and I thought this slide best summarizes the overview of what the company does and why it is worth looking into. As a new investor, I’ll definitely appreciate this slide.

Share Price is an Important Currency

Since my first coverage of RICK in August, the share price has risen 13% to $78.77 at the point of this writing. With a higher share price, the management can accelerate the roll-up strategy by financing large acquisitions with a mix of debt and equity, such as the purchase of Lowrie. Otherwise, the management has always refrained from issuing equity to avoid diluting shareholders.

Here is also a past commentary by Adam Wyden back in the 2Q22 earnings call on why share price and multiple matters:

“I think a lot of the diehard value investors are like you know, the stock should – let the stock trade at some crazy low level and you can buy it all back and blah blah blah. That’s all good in theory. But I mean I think it might be important to explain to folks that part of the outsiders is yes being able to buy back stock when it’s cheap but also being able to create a multiple arbitrage. I mean what we saw with Lowrie is that you were able to do a transaction I think choice of 500,000 shares at $60, $30 million. I mean you would not have been able to execute on that transaction if the stock did not trade at a multiple higher than what you’re acquiring.”

Therefore, it’s definitely great to see the share price increase, although, I’d still argue that the stock is still undervalued.

Conclusion

RICK recently reported its 4Q22 sales and there were no surprises as it came in line with my expectations. A little digging on CEO Eric Langan’s Twitter would also show that foot traffic in RICK’s nightclubs is still relatively strong, which further validates that they have not seen an impact from inflation. Most recently, investors have also seen an increase in RICK’s share price, which is critical as it enables the management to accelerate acquisitions using a mix of equity and debt. As the share price and multiples get more attractive, I do think we could see a similar deal like Lowrie, which is RICK’s largest acquisition to date. As of today, RICK remains undervalued and I believe it is a compelling investment for investors to consider.

Do you agree with my analysis? Let me know in the comment section below!

Be the first to comment