Andrea DiCenzo/Getty Images News

Elevator Pitch

I rate Raytheon Technologies’ (NYSE:RTX) shares as a Buy.

RTX’s attractiveness as an investment is validated by the company’s good medium-term outlook. By 2025, Raytheon’s net margin is expected to increase to as high as 14.5%, while maintaining a steady topline CAGR in the 6%-7% range. Considering that defense budgets are less likely to be cut and the company’s substantial backlog, Raytheon has a higher chance of meeting the company’s mid-term growth targets compared to other non-defense companies, all else being equal.

The resilience of RTX’s revenue in a weak economic environment and the growth opportunities potentially emerging from greater geopolitical tensions in the future make the stock a Buy.

RTX Stock Key Metrics

RTX’s key metrics relate to the company’s financial guidance for fiscal 2022.

Raytheon expected the company to deliver a top line of $68.25 billion and a non-GAAP adjusted earnings per share or EPS of $4.70 in FY 2022 based on the mid-point of its guidance released in tandem with its Q1 2022 financial results announcement on April 26, 2022. This translates into revenue and EPS growth rates of +6% and +10%, respectively for RTX in the current year.

It is encouraging that RTX has a high probability of realizing the decent top line and bottom line growth that the company has guided for previously, based on the sell-side analysts’ consensus financial forecasts and management’s recent comments.

Wall Street analysts have kept their FY 2022 financial estimates for Raytheon largely unchanged in recent months, which suggests that RTX’s outlook has remained stable. In the past three months, the consensus fiscal 2022 EPS forecast for RTX has been reduced by a very marginal -0.8%. Furthermore, there were no changes to the consensus FY 2022 EPS projection for Raytheon in the last month. Analysts see RTX generating an EPS of $4.77 for the current fiscal year, which is +1.5% higher than the company’s guidance.

Separately, Raytheon assured investors at the company’s recent UBS (UBS) 2022 Global Industrials and Transportation Conference on June 8, 2022 that “we’re on track to meet our 2022 commitments, as well as our longer-term 2025 commitments.” In other words, earnings misses in the subsequent quarters of 2022 appear to be less likely. This also brings us to the subject of the next section of the article, RTX’s 2025 financial goals.

Where Will Raytheon Be By 2025?

As highlighted in the preceding section, RTX has expressed confidence in meeting both the company’s fiscal 2022 management guidance and its FY 2025 targets outlined at its May 18, 2021 Investor Day.

As per its 2021 Investor Day presentation slides, Raytheon guided for its top line to grow at a CAGR of 6%-7% for the FY 2020-2025 period, with its non-GAAP adjusted net profit margin expanding from 7.9% to 13.4%-14.4% over the same period. RTX also saw the company increasing its yearly free cash flow from $2.3 billion in 2020 to $10 billion by FY 2025 with $20 billion of excess cash flow distributed to shareholders during this period.

In my view, RTX’s intermediate-term goals are realistic.

A high single-digit revenue CAGR seems achievable. Raytheon has a $154 billion backlog (roughly equivalent to two and half years of revenue) as of March 31, 2022, with its defense and commercial aerospace businesses contributing $92 billion and $62 billion of the backlog, respectively. More importantly, rising geopolitical tensions and the eventual recovery of the commercial aviation market are expected to be key drivers of Raytheon’s future top line expansion.

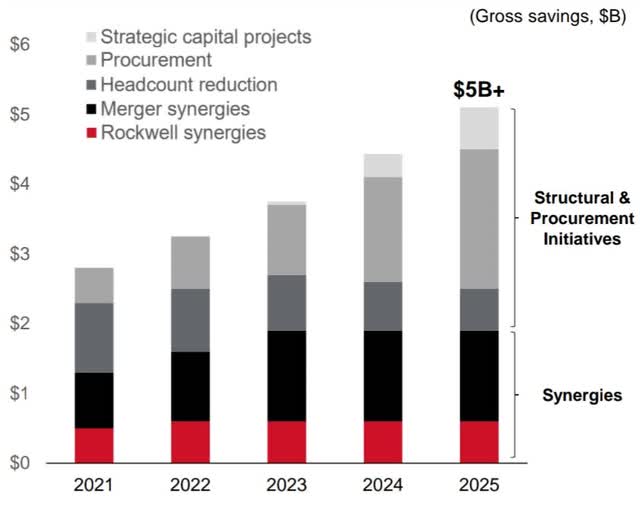

With regards to margin improvement, the cut in expenses relating to both higher productivity and synergies associated with past mergers & acquisitions should support better profitability for RTX, on top of greater economies of scale.

Raytheon’s Mid-Term Cost Savings Target

RTX’s 2021 Investor Day Presentation

Separately, Raytheon’s free cash flow should also grow in line with sales expansion and the improvement in profitability. This should in turn help to sustain RTX’s consensus forward FY 2022-2024 dividend yields in the 2.3%-2.7% range.

In summary, RTX will be a steady and consistent revenue grower in the next few years with rising profit margins over this same period. This will translate into decent earnings and free cash flow going forward which will help to fund its future dividends.

Is Raytheon Stock A Good Value Now?

I think that Raytheon is a good value now.

RTX is valued by the market at a consensus forward next twelve months’ normalized forward P/E multiple of 19.6 times as per S&P Capital IQ, which is only slightly above its five-year average P/E multiple of 18.5 times.

In absolute terms, a forward P/E multiple of below 20 times and an earnings yield (inversion of the P/E) of above 5% are appealing for a stock like Raytheon which possesses both defensive and growth characteristics as discussed in the next section.

Is Raytheon A Good Long-Term Stock?

There are two key risks that investors are currently concerned about, namely a recession and more geopolitical conflicts. Raytheon acts a good hedge against both types of risks.

Assuming that a recession really happens, many listed companies will see revenues shrink due to consumers tightening their purse strings and corporations reducing their spending. But RTX’s top line will be relatively less impacted by a weak economy, as the company has a sizeable defense backlog, and governments might be less keen to cut defense spending which will pose a threat to national interest.

Separately, events in Ukraine have brought geopolitical tensions and conflicts into the spotlight. It is reasonable to assume that most countries will place a greater emphasis on defense, and the proportion of the respective nations’ budgets allocated to spending on defense should increase going forward. This will be positive for Raytheon, which is among the largest defence contractors.

Is RTX Stock A Buy, Sell, or Hold?

I rate RTX stock as a Buy. Raytheon is a good investment taking into account the company’s 2025 outlook, the stock’s valuations, and its ability to act as a hedge against macroeconomic and geopolitical risks.

Be the first to comment