BraunS/E+ via Getty Images

Among C-suite and financial executives at both for-profit and nonprofit organizations, 99% are committed to helping employees save for retirement and 84% believe they have made significant progress toward achieving their organization’s diversity, equity, and inclusion (DEI) goals. That’s according to a December 2021 PNC Survey on institutional social responsibility.

Despite these commitments, many employees remain underprepared for retirement. Specifically, low-income workers, women, and people of color tend to have significantly less access to retirement plans, and when these groups do have access, they accumulate fewer retirement plan assets relative to other demographics. Thus, building a more equitable retirement program is essential to creating better retirement outcomes for employees and helping organizations achieve DEI-related goals.

So, what does the current retirement landscape look like and how can we address these disparities? We propose three primary methods: automatic plan design features, creative matching contribution formulas, and innovative education strategies.

The Current Retirement Landscape

Workplace retirement savings vehicles, such as defined contribution (DC) plans, are one of the most common ways that US workers save for retirement. DC plan programs in the United States totaled $11 trillion in assets as of Q4 2021 and provide over 80 million participants with tax-deferred retirement accounts. As defined benefit plans — pensions — continue to decrease in number and with Social Security facing numerous funding-related headwinds, we believe DC plans will grow ever more critical to retirement outcomes.

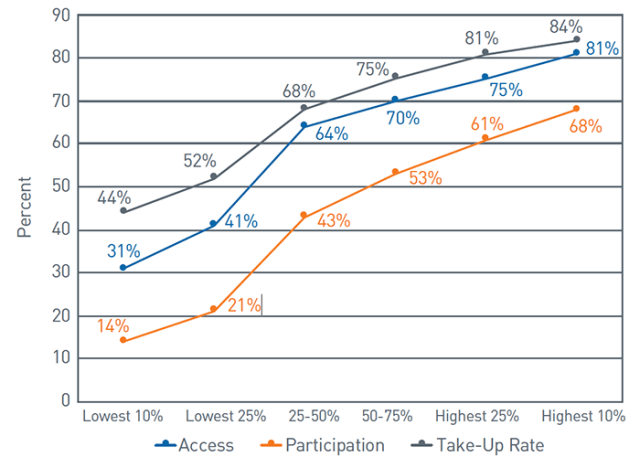

Yet statistics show that DC plans are not benefitting all demographic groups equally. Income level is a key first determinant of retirement readiness, and employees in lower wage groups struggle across the board, with lower access to, participation in, and take-up rates for DC plans.

Defined Contribution Plan Access, Participation, and Take-Up Rate by Wage Percentile

Source: US Department of Labor

In terms of gender, a slightly greater percentage of women work for employers that offer retirement plans (69% vs. 65%), according to a 2020 National Institute on Retirement Security study, but a slightly greater percentage of men are eligible to participate in these plans (89% vs. 85%) and choose to do so (81% vs. 79%). This means men and women participate in DC plans at equal rates (47%). However, there is a significant gender gap in retirement income: Women aged 65 and older have a median household income of $47,244, or 83% of the $57,144 median household income of men aged 65 and over.

What explains this retirement wealth gap? The gender pay gap and employment gaps for pregnancy, child care, and caregiving for elders or spouses all may play a role. Also, divorce can lead to worse financial outcomes for women than men. These and a host of other reasons may negatively impact women’s retirement outcomes.

Household Retirement Plan Access, Participation, and Take-Up Rate by Race and Ethnicity

| Households with Access to Retirement Plans | Households Participating in Retirement Plans | Household Take-Up Rate | Average Household Retirement Account Balance | |

| White | 68% | 60% | 88% | $50,000 |

| Black | 56% | 45% | 80% | $20,000 |

| Hispanic | 44% | 34% | 77% | $20,000 |

| Other* | 61% | 54% | 88% | $34,000 |

The numbers are even worse across race and ethnicity lines. The preceding table demonstrates the lower levels of access, participation, and average balances for households of color. The average account balance disparity is especially alarming.

While plan sponsors strive to design plans that improve retirement outcomes, these statistics show that quite a lot more needs to be done. To address this, three strategies are worth considering.

1. Automatic Plan Design Features

Automatic enrollment is a tried-and-true method to increase retirement assets. A company’s new hires automatically start contributing to the firm’s DC plan at a pre-set deferral rate. The contributions are invested in the plan’s qualified default investment alternative — often a target-date fund (TDF) — until the employees re-direct their investments.

Auto-enrolled employees tend to remain enrolled — and at the deferral rate set by the plan’s automatic enrollment feature. Default enrollment helps overcome two key retirement savings challenges: lack of knowledge and inertia.

- Knowledge describes the various lifetime experiences and formal and informal education that leads an employee to employment with a particular company. While some people benefit from a background in which financial literacy was prominent, many do not. For example, low-to-moderate income communities are less likely to know or be solicited by financial advisers due largely to a perceived mismatch between the community’s expected need and the financial adviser’s expected opportunity. This may reduce the likelihood that members of such communities will be familiar with or prioritize saving for retirement.

- Inertia is a broad category, but our focus here is on two major types. Due to personal financial reasons — budget constraints, debt, etc. — many employees don’t believe they can set aside money for retirement. Other employees simply do not take the time to set up their retirement plan. They see it as “something to get to later” or otherwise delay enrolling in the retirement plan. What starts as “I’ll get to it tomorrow, next week, well definitely next month” can lead to months, years, or even a working lifetime of delayed retirement savings.

While automatic enrollment doesn’t affect access, it can increase participation among eligible employees, according to a 2021 study. Indeed, 84% of workers cited the feature as a primary reason for earlier saving. This tracks with the significant rise in plan sponsor adoption over the past decade. In 2011, only 45.9% of plans featured automatic enrollment, according to the Plan Sponsor Council of America. In 2020, 62% of plans did. Automatic enrollment helps employees overcome knowledge and time-related barriers, so we expect more plans will adopt the feature.

For plan sponsors that want to add or augment an automatic enrollment feature, these additional considerations may help maximize the impact:

- Setting the default automatic enrollment deferral rate to a higher starting number. We believe the higher the default deferral percentage, the more likely automatic enrollment will improve employee retirement outcomes. The table below illustrates the default deferral percentages for plans with automatic enrollment. Six percent is the most often-used rate.

- Adding automatic escalation, whereby the employee contribution amount increases, up to a pre-specified amount in percentage increments, each year unless the employee opts out.

- Conducting automatic re-enrollment: Each year, employees who have opted out of enrollment in the DC plan must re-opt out.

- Examining whether the qualified default investment alternative (QDIA) is available to all employees and if it will improve retirement readiness for employees who do not otherwise change their investment selection.

Implicit in all these strategies is the idea that convincing an employee to not opt-out, or take no action, is easier than convincing them to opt-in, or require action. By making participation the easiest option for employees through automatic enrollment, more are likely to remain enrolled in the plan compared with the number of employees who would participate if they had to take personal action to opt-in.

Default Deferral Percentage in Plans with Automatic Enrollment

| 1% | 2% | 3% | 4% | 5% | 6% | >6% | |

| Percent of Plans | 1.0% | 5.2% | 29.0% | 12.9% | 16.1% | 32.9% | 2.9% |

2. Creative Matching Contribution Formulas

An employer matching contribution is a primary incentive to participate in DC plans. Put simply, employer matching contributions feel like “free money” to employees.

Despite this, two major challenges have emerged. First, different studies have estimated billions of dollars in unrealized available “matching” that eligible employees don’t access. Second, for low-to-moderate income employees, a matching contribution made as a fixed percentage of their salary might not be enough to improve their retirement outcome. As an example, if an employee only saves $100 in a given year and the employer matches that $100, the absolute dollar value of $200 in retirement contributions is unlikely in aggregate to meaningfully improve the employee’s retirement readiness.

With this in mind, two strategies can improve retirement outcomes: minimum employer contribution levels and stretch-matching.

A. Minimum Contribution Levels

As the name implies, minimum contribution levels are dollar thresholds set to describe a minimum amount that an employer will contribute to an employee’s account, often only if the employee takes set actions related to their own contributions. An example might be, “Employer will contribute the greater of 100% on the first 4% of an employee’s deferrals or $1000.” In this case, if the employee defers 4% of compensation to the DC plan and that amount is less than $1,000, the employer typically makes a “true-up” at the end of the year to bring the employer match in dollar terms to $1,000. This way, the minimum employer contribution would never be less than $1,000 per employee. (Changing your plan’s matching contribution formula may require an amendment to your plan document. Please consult your ERISA counsel or plan document preparer for more information.)

As an example, PNC will contribute a minimum of $2,000 in matching contributions each year if an employee contributes at least 4% of their eligible compensation every pay period during the year and is employed by PNC on the last business day of that year. This minimum match helps ensure that eligible employees earning less than $50,000 annually get an extra boost to their retirement savings. (The minimum match is prorated for hourly employees and those who are eligible for less than a full year.)

Minimum contribution levels can provide additional financial support to help increase potential retirement income for employees with lower pay. Of course, this method is not without cost — for example, the minimum contribution amount per employee relative to what the match would have been otherwise. With that in mind, provisions that encourage positive employee behavior, such as PNC’s requirement that they contribute at least 4% to receive the minimum match, can sharpen the impact toward improving employee retirement outcomes of this additional cost to employers.

B. Stretch-Matching

This second option encourages the employee to contribute more. Often, to simply maximize the incentive benefit, participants will only defer up to the maximum match rate — for example, electing a deferral rate of 4% with an employer match formula of 100% on the first 4% of contributions. In behavioral finance terms, this resembles anchoring bias: The first number employees see — an employer match formula of 100% on the first 4% of contributions — becomes an arbitrary benchmark. They assign meaning to the 4% number and often come to associate it with “enough to achieve retirement readiness.”

To combat this bias, stretch-matching requires the employee to contribute above the maximum employer match rate to receive the full match. As an example, an employer might reengineer the above formula to match 50% on the first 8% of contributions. In this scenario, the employee’s “anchor” is set at an 8% contribution rate, which encourages higher net contributions without changing the dollar cost of the employer match.

To be sure, this method is not perfect. For example, lower-income employees might be unable or unwilling to contribute a higher percentage — above 4%, for example — thus leaving the employer match on the table and potentially reducing their aggregate, employee-and-employer, contribution rates in dollar terms. In this way, a stretch match might actually hurt lower-income employees rather than help. That’s why it is important to monitor participant behavior closely and adjust as needed following any changes to a plan’s matching formula.

3. Innovative Education Strategies

Automatic features, matching strategies, and other plan design changes can only go so far in driving participation in the plan. Employees must be aware of why and how they should contribute to their DC plan and be given the tools to achieve the financial ability to do so. Comprehensive financial education and enhanced employee communications are crucial to this equation.

A. Comprehensive Financial Education

Good financial education starts with data. Quantitative plan data can help identify if certain groups are under-engaged or unengaged in the plan. Are they not participating at all? Do they have low balances or a low deferral rate? Are they not receiving the full match? Surveys can bolster quantitative data with qualitative employee feedback. Then employers can design targeted education strategies based on both data and direct employee response. Once employers have the data, they can work with financial providers to customize holistic financial wellness programs for their workforce. These can range from on-site education sessions where an educator visits the office, factory, etc. to live or on-demand webinars, to points-based learning portals that incentivize employee participation, among other potential offerings.

There are plenty of jokes about all that we learned in school as children instead of basic financial concepts — “square dancing,” for example. Financial education strategies give employees the tools to make up for those lost learning opportunities and to help them build the requisite knowledge base to achieve financial wellness and retirement readiness. The PNC survey of C-suite and financial executives found that while only 57% of employers offer financial education today, 29% are planning to offer it in the future. We expect this trend to continue in the coming years.

B. Enhanced Employee Communications

The best education strategy is a failure if it never reaches employees. That’s why communication may be the most important part of employee education. There are several components to an effective communication strategy:

- Various Media at Various Times: Different employees respond to different communication sources differently. Some prefer articles to read, some prefer live classes, some prefer on-demand videos, and others prefer other things. An effective communication strategy includes as many different data sources as possible, within reason, so that employees can pick what works best for them.

- Clear and Concise: Financial and retirement topics can be complicated, and industry jargon can be confusing. Education should be simple and use clear and concise language. The more understandable the information, the more effective the education strategies are likely to be.

- Accessibility: Employee communications, educational materials, websites, and videos must be designed for use by the entire workforce, including employees with varying accessibility or non-English language needs. An important consideration is whether the employee education provider offers training with features that are compliant with the Americans with Disabilities Act (ADA), such as closed captioning, etc.

- Inclusive Language: Inclusive language acknowledges diversity and conveys respect to all people. When plan sponsors feature inclusive language in their vernacular, including retirement documents and communications, they can help employees to feel heard and understood and potentially increase participant engagement. As more organizations increase their focus on DEI in hiring, retention, training, and beyond, ensuring employee benefit communications reflect this priority may be critical.

Slightly over half of respondents (55%) to the December 2021 PNC Survey say that less than 50% of their employees take advantage of financial wellness programs. Through an approach that starts with data, customizes the experience based on employee demographics and requests, and effectively communicates the resulting education program, employers can meet employees where they are and increase their engagement.

This perhaps more than anything else has the greatest potential to boost employee financial wellness and retirement outcomes.

Conclusion

Employers feel responsible for helping employees prepare for retirement. Beyond the productivity declines and other statistics that a lack of financial wellness is associated with, employers are starting to see their retirement plans as a pillar of an institutional social responsibility strategy. Implicit in this is the notion that companies can do well by doing good and especially by helping employees who might need it the most. With time and continued effort, we hope this will result in more equitable retirement outcomes for all.

Disclaimer: Please note that the content of this site should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment