Kimberly White

Given that cracks are only just beginning to appear in the key automobile and real estate sectors as the Federal Reserve continues to aggressively raise interest rates, we agree with Ray Dalio’s thesis that conditions for the economy will likely worsen meaningfully in the coming years. Given that these sectors make up a meaningful percentage of the S&P 500 (NYSEARCA:SPY) in and of themselves and are generally reflective of the broader economy, a tumble in one or both of them in the coming months and years would likely spell trouble for the SPY. In this article, we will examine these risks in more depth while also offering our approach to the current economic conditions.

Ray Dalio’s Macroeconomic Outlook

Yesterday billionaire Ray Dalio said we “are starting to see all the classic early signs” of a recession. In the wake of another substantial (75 basis point) interest rate hike by the Federal Reserve and a very hawkish outlook on continued interest rate increases that made clear the Federal Reserve’s number one priority is fighting inflation, Ray Dalio made it clear in an interview that there will be economic pain coming as a result:

We are right now very close to a 0% growth year. I think it’s going to get worse into 2023 and then 2024, which has implications for elections…

What [the Federal Reserve] will do will balance it. They will tighten monetary policy and take away credit until the economic pain is greater than the inflation pain.

In particular, he highlighted the housing and automotive sectors as the ones that are beginning to face stiff headwinds from rising interest rates. This is primarily due to the fact that many homes and cars are purchased with debt under fairly generous financing terms. The reason why the financing is generally pretty easy to get is because these loans are secured by the underlying asset (i.e., the home or automobile involved) which are fairly easy to resell by the lender at near market value in the event that the borrower defaults on their loan.

Our Macroeconomic Outlook

In the immediate aftermath of the COVID-19 outbreak, interest rates plummeted to all-time lows as the Federal Reserve strove to stimulate economic activity and ward off a recession. On top of that, the Federal Government doled out thousands of dollars to each American taxpayer in order to further stimulate the economy and help to alleviate the economic hardships suffered by many in the wake of the COVID-19 lockdowns and reduced consumer activity out of health concerns. This combination of extremely cheap financing and extra cash in consumer’s pockets resulted in very strong demand for both vehicles and homes.

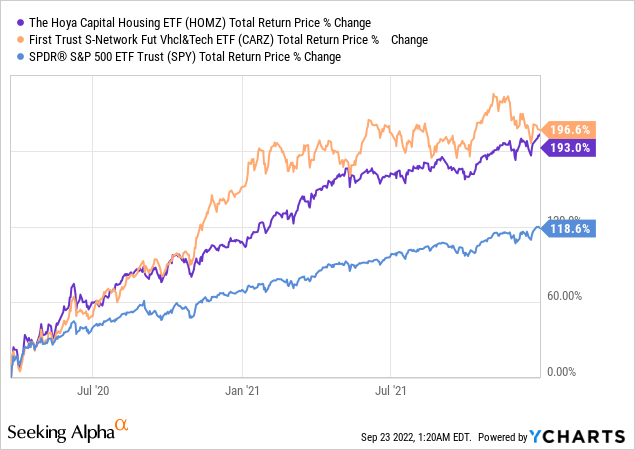

As a result, housing (HOMZ) and automotive (CARZ) stocks significantly outperformed the SPY coming out of the COVID-19 crash:

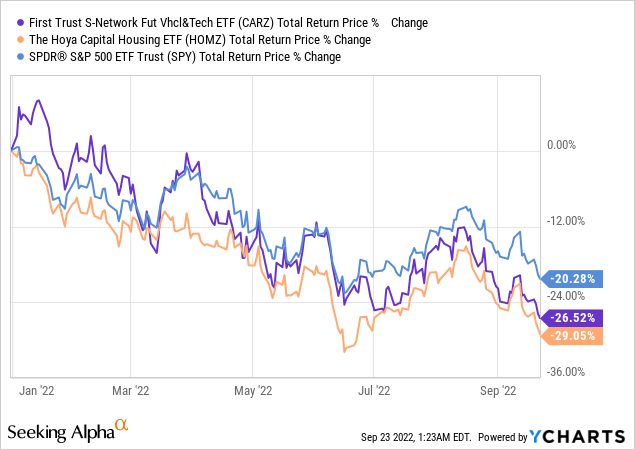

However, now with interest rates soaring and economic growth grinding to a halt in 2022, these sectors are seeing a sharp reversal, underperforming the SPY year-to-date:

Real estate (not counting engineering and construction businesses nor mortgage lenders) makes up 2.84% of the index at the moment, while automotive stocks – led by mega cap Tesla (TSLA) as well as Detroit titans like General Motors (GM) and Ford (F) – along with several other automotive parts manufacturers and automobile dealers make up 3.84% of the index. This does not even include the chip manufacturers like NVIDIA (NVDA), which would add considerably more to this percentage if they were included as well. With nearly 7% of the index consisting of just automotive and real estate stocks, their future outlook is not inconsequential on the overall performance of the index.

Unfortunately, the outlook is not great. As already stated, both sectors appear to be in a Fed-fueled bubble which is now being popped by a sharp reversal in the very policies that inflated it in the first place. However, there is potential for significant additional economic carnage beyond a deflation of the bubble itself. This is because the rapid decline and then dramatic rise of interest rates over such a short period of time miscommunicated the true conditions of the economy to entrepreneurs and business executives, causing them to misallocate capital – quite possibly on a grand scale – into higher risk, longer-term investments (i.e., speculative high-growth and unprofitable technology companies as epitomized by the ARK Innovation ETF (ARKK) mania). It also incentivized individuals to buy homes and vehicles with cheap debt that they are no longer able to afford under current interest rates. This will likely lead to a massive and sudden decline in demand and – should unemployment rise – a rise in auto loan and even mortgage defaults. This will all combine to increase inventory and quite possibly drive prices sharply lower.

We are already seeing single family home prices peak and even begin to decline across the United States. Demand has evaporated and home inventory is beginning to increase as homes remain on the market for longer. This effect has carried over to the mortgage industry, which is also grappling with vanishing demand after booming in 2021.

Even more terrifying moving forward is the fact that the Federal Reserve seems bent on reducing housing prices with Chairman Jerome Powell stating:

For the longer term, what we need is supply and demand to get better aligned, so that housing prices go up at a reasonable level, at a reasonable pace, and that people can afford houses again. And I think we – so we probably in the housing market have to go through a correction to get back to that place.

The Federal Reserve has the firepower to do this, too. As the Mises Institute reported earlier this year:

Runaway house price inflation continues to characterize the U.S. market. House prices across the country rose 15.8% on average in October 2021 from the year before. U.S. house prices are far over their 2006 Bubble peak, and remain over the Bubble peak even after adjustment for consumer price inflation…Unbelievably, in this situation the Federal Reserve keeps on buying mortgages. It buys a lot of them and continues to be the price-setting marginal buyer or Big Bid in the mortgage market, expanding its mortgage portfolio with one hand, and printing money with the other…The Federal Reserve now owns on its balance sheet $2.6 trillion in mortgages. That means about 24% of all outstanding residential mortgages in this whole big country reside in the central bank, which has thereby earned the remarkable status of becoming by far the largest savings and loan institution in the world.

Given that the Federal Reserve owns nearly a quarter of all mortgages in the United States, it can – by selling them or even just letting them roll off naturally – push mortgage rates significantly higher still. Meanwhile, rising interest rates will likely hurt vehicle demand as well, particularly new vehicle demand, given that the high prices that new cars command typically require buyer financing.

Investor Takeaway

While these headwinds do not bode well for the economy, a separate question is whether or not the SPY is cheap enough to buy right now. Well, based on data compiled by Current Market Valuation, the stock market overall appears fairly valued right now. The Yield Curve, Buffett Indicator, and P/E Ratio models all imply that the market is overvalued, while the Interest Rates, Margin Debt, and S&P 500 Mean Reversion models all imply that the market is fairly valued.

However, given the bearish macroeconomic outlook, it seems like wisdom would side with caution at current levels and wait for some margin of safety before buying the SPY right now.

Moreover, as Ray Dalio reasserted in his latest interview: “cash is still a trash investment” given that the real interest rate (the nominal interest rate minus the inflation rate) remains negative.

Bonds of course are likely the worst investment of all in a rising rate environment, as their value is directly and virtually entirely correlated with interest rates.

Where to invest then? Floating rate securities – if they can be bought at a good value – are not a bad place to be. However – again – the interest rate often trails the inflation rate in the current environment unless a decent bit of risk is taken on. There are some BDCs that have investment grade balance sheets and fairly conservatively positioned investment portfolios allocated almost entirely to floating rate debt along with excellent underwriting performance and are remarkably trading at significant discounts to NAV. However, their loans are still more risky, so they may struggle during an economic downturn.

Another approach is to bet that a recession will force the Federal Reserve to reverse course and slash interest rates before too long, making regulated utilities (XLU) and other recession-resistant high yield businesses like triple net lease REITs (VNQ) and MLPs (AMLP) attractive buys, especially while their share prices are suppressed. This is the approach that we favor at High Yield Investor, though we are also buying some investments with exposure to floating interest rates as well as other niche deep value investments.

Ultimately, we believe that SPY is not yet cheap enough to warrant a direct investment, but we do believe there are pockets of opportunity in the market today. As a result, we think it is prudent for investors to be honest with themselves about their risk tolerance, stomach for volatility, and time horizon and pick their spots accordingly.

Be the first to comment