Stephan Behnes

By Antoine Bouvet, Padhraic Garvey, CFA, Benjamin Schroeder

ECB reduces its peripheral bond overweight

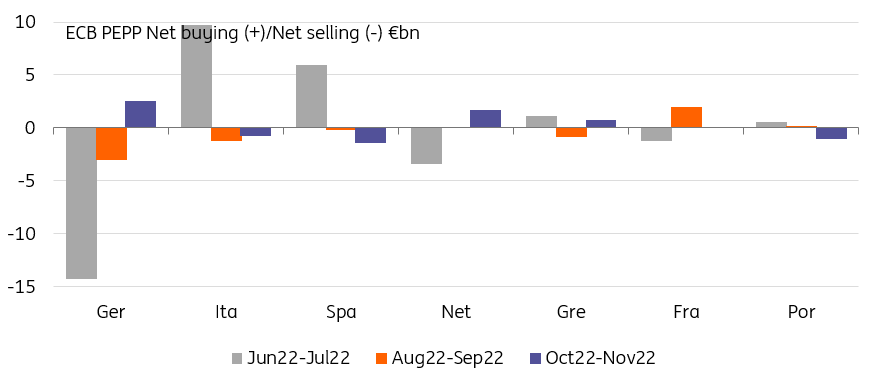

The ECB didn’t use the flexibility offered by the PEPP’s redemption to lean against wide sovereign spreads in the months of October and November. On the contrary, data show that it increased its holding of core (eg., Netherlands and Germany) and reduced its holding of periphery (eg., Spain, Portugal and Italy). The changes may be explained in part by different timing between redemption and reinvestment of the proceeds, but there seems to be a trend here: the overweight in peripheral countries is at least being partially unwound.

Looking at market moves of late, this is understandable. Spreads have been on a tightening spree, suggesting the higher-beta sovereign bond markets require less of the ECB’s support. This is good news, until it isn’t anymore. As long as the ECB retains the flexibility to lean against volatility in the sovereign bond markets, all should be well. The looming QT announcement is one key risk to this. So far, spreads have tightened alongside the improvement in global risk sentiment. That tightening cannot be entirely explained by the rally in core rates, and suggests instead genuine risk appetite for high-beta fixed income.

The ECB Has Partially Unwound Its Summer Intervention In Peripheral Markets (Refinitiv, ING)

No sign of re-steepening yet

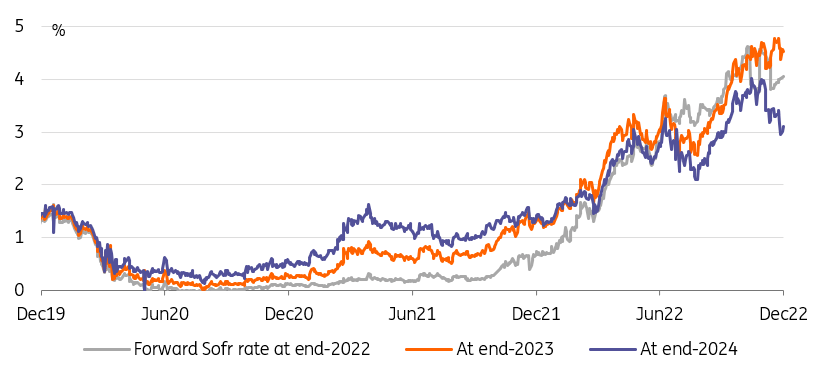

If the bond rally has stalled, which itself is still unsure, there is no sign yet of curve re-steepening. In the US in particular, where the Fed has presumably the most room to cut rates, the curve remains as inverted as ever. Dis-inversion can occur for two reasons. Firstly, front-end rates can drop on expectations of imminent Fed easing. In our view, this is only realistic once inflation is clearly on a path towards reaching the Fed’s target and the economy is near a recession. We think these conditions will only be met by mid-2023.

The other reason for a curve dis-inversion is if long-end rates reverse some of their November rally. This looks a more realistic scenario in the near term. Risk appetite, from stock to credit, has received a boost once it became clear that the Fed was easing off on the pace of hikes. This has also boosted demand for duration on the Treasury curve as investors look more kindly to any kind of investment risk. The problem is that it is not yet clear that the Fed is near the end of its cycle. Fed Funds forwards are steeply inverted from late-2023, implying the odds of a rate cut are rising. We think this is right, but that pricing may be reversed soon if data doesn’t worsen quickly.

The Rally In Long-End Bonds Has Come With Fed Funds Forwards Pricing Rate Cuts In 2024 (Refinitiv, ING)

Today’s events and market view

The headline Q3 eurozone is less liable to surprise markets, this being the third and final release, but the details of the report, including employment, will be of interest.

The EU has mandated banks for the sale of a new 15Y bond for €6.5 billion. The same deal will also features a smaller tap of a 30Y bond. The deal may weigh on bonds, but supply this week is otherwise light.

Today is the last day before the start of the pre-ECB meeting quiet period. Fabio Panetta and Philip Lane, both doves, are scheduled to speak. Any hawkish comment would catch the market off guards and push yields higher.

The US Q3 unit labour cost publication is also a final release, but as it is key to the Fed’s decision-making, any revision will be of importance.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment