Oleg Elkov

By Antoine Bouvet, Benjamin Schroeder, Padhraic Garvey, CFA

Sovereign spreads no longer fear the ECB

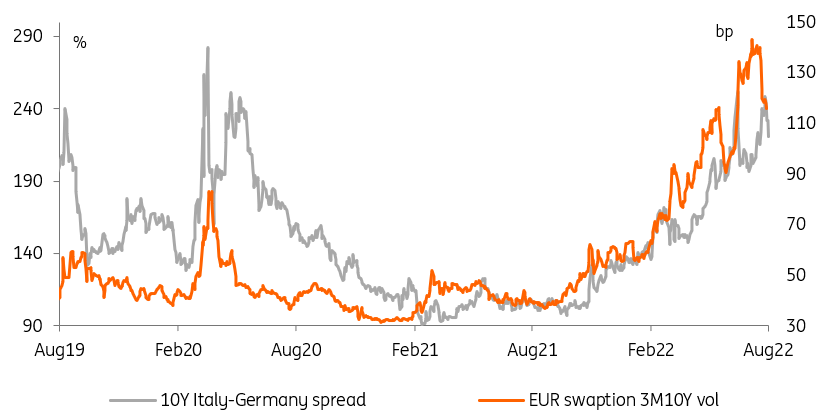

As the plunge in government bond yields continues in the face of numerous headwinds, including hawkish central banks (we list them here), risk appetite is improving fast in other corners of financial markets. Within the realm of interest rates, this is most visible in the fall in implied interest volatility and commensurate tightening of euro sovereign spreads.

Lower Rates Have Led Spreads Tighter And Implied Volatility Lower (Refinitiv, ING)

Whilst Italian politics rightly get a lot of airplay, the genesis of the recent jump upwards in sovereign spreads starts with central banks scrambling to tighten policy in the face of higher inflation. As an era characterised by not only ever-lower interest rates but also abundant liquidity injections in order to depress the cost of credit in financial markets comes to an end, it is understandable that sovereign spreads would widen.

The European Central Bank’s fragmentation-fighting apparatus unveiled at its July meeting was meant to counter just that and, to a large extent, is a credible response to this specific problem. Italian politics has thrown a spanner in the works in that it poses the sort of widening risk that the ECB is not able, or willing, to address. The good news is, however, that the original reason for spread widening – monetary tightening triggered by higher inflation – is quickly vanishing.

Two assumptions and a lot of time to disprove them

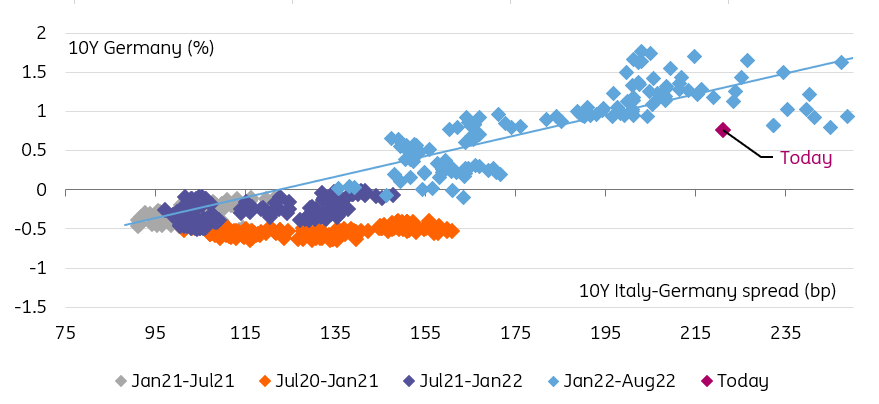

It is only natural for sovereign spreads to tighten on the back of the spectacular repricing of ECB and, to a lesser extent Fed, hike expectations. We’ve highlighted in the past the near-mechanical relationship between Italian spreads and core yields, such as Germany’s 10Y Bund. Arguably, given current sub-1% Bund yield levels, Italian spreads should be tighter than they are currently, but politics are keeping investors up at night.

Italian Politics Has Prevented Spreads From Tightening Faster (Refinitiv, ING)

Thus, the recent spread tightening is precarious for two reasons. Firstly, hopes of the Italian front-runners skirting the sensitive issues of NGeu-mandated reforms and fiscal consolidation may well prove too optimistic, although we are sympathetic with the view that it may not be in their interest to alarm markets and voters in the run-up to the elections. Secondly, markets (and our) assumption of a fall in inflation, and so of a shallower policy rates path, may be challenged.

The line in the sand for 10Y Italian-German spreads is 250bp. They have managed to stay beneath that level, but the next two months should prove tricky to navigate.

Today’s events and market view

The main economic release on today’s calendar is US job openings. The number of vacancies is running at around twice the number of job seekers, highlighting the tightness of the labour market. However, a further decline would probably be seen as a sign that the job market is cooling and that the Fed tightening is bearing fruit. So will a slowdown in the quit rate from 2.8% the month prior.

Three Fed speakers are scheduled today: Charles Evans, Loretta Mester, and James Bullard. On balance, it is probable that even if they acknowledge worsening economic prospects, they will be unhappy with the dovish reaction to last week’s FOMC. All they may be able to achieve in this environment, however, is a further flattening of the curve.

Bond direction is given a helping hand by rising geopolitical tensions in Asia. The visit of US House speaker Nancy Pelosi had market sentiment deteriorate in Asia hours. The Reserve Bank of Australia delivering on expectations of a 50bp hike resulted in a bull-flattening of the curve. All point to another strong session for bonds, with 10Y Treasuries now knocking on the door of 2.5% and 10Y Bund on 0.75%.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Be the first to comment