NicoElNino/iStock via Getty Images

“Perhaps home is not a place but simply an irrevocable condition.” ― James Baldwin, Giovanni’s Room

Recently, we posted an article on CloudFlare (NET), which provides an integrated cloud-based security solution to clients. Even after falling some 80%, the shares were still selling at 15 times forward revenues and insiders were still selling shares in mass.

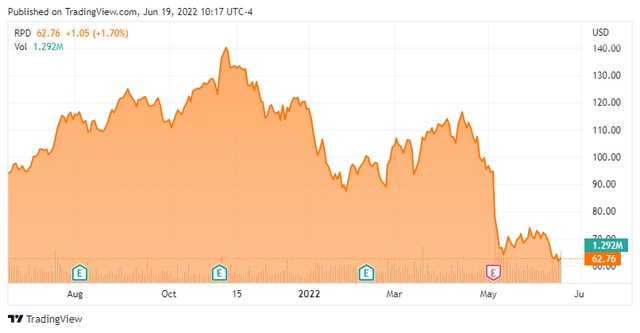

Today, we are going to take a look at internet security firm Rapid7, Inc. (NASDAQ:RPD) whose shares have also taken an approximate 45% hit in the market selloff in 2022. However, this stock seems more reasonably valued and actually saw some insider buying in the stock in May. An analysis follows below.

Company Overview:

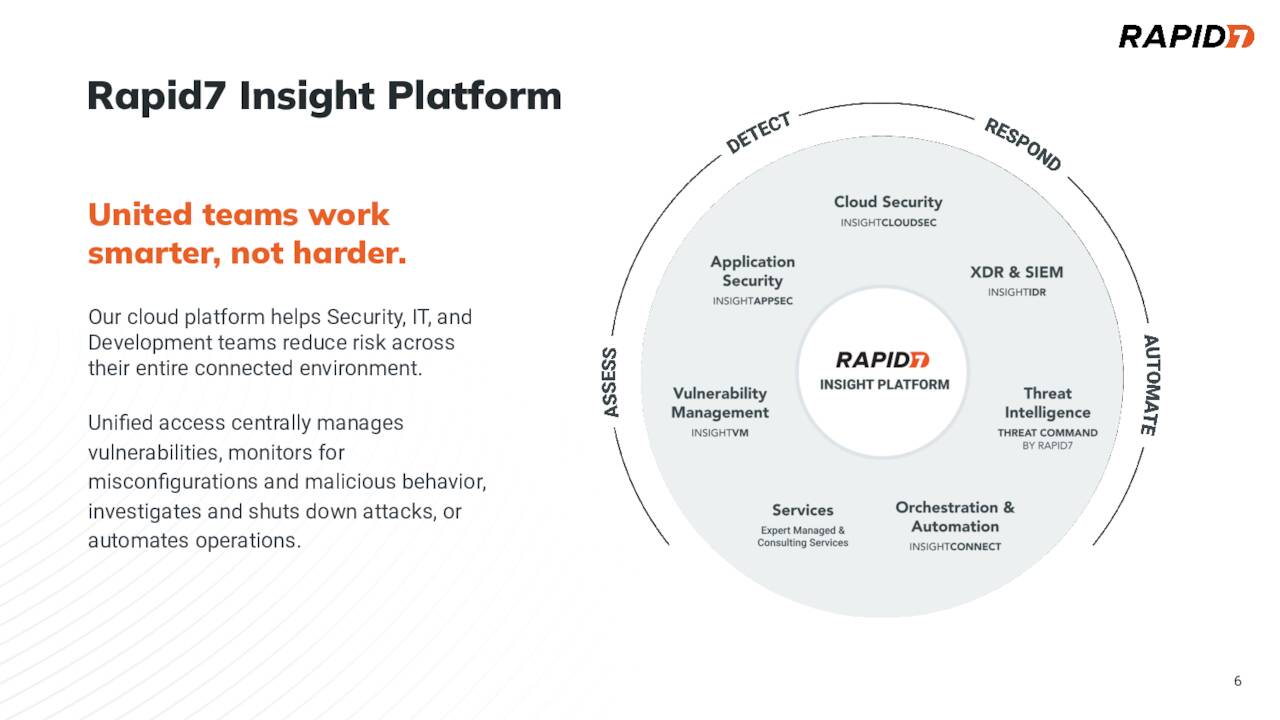

Rapid7 Inc. is a cyber-security concern that is headquartered in Boston. The company provides a cloud-native insight platform that enables customers to create and manage analytics-driven cybersecurity risk management programs.

May Company Presentation

The stock sells for just north of $62.00 a share and sports an approximate market capitalization of $4.8 billion.

May Company Presentation

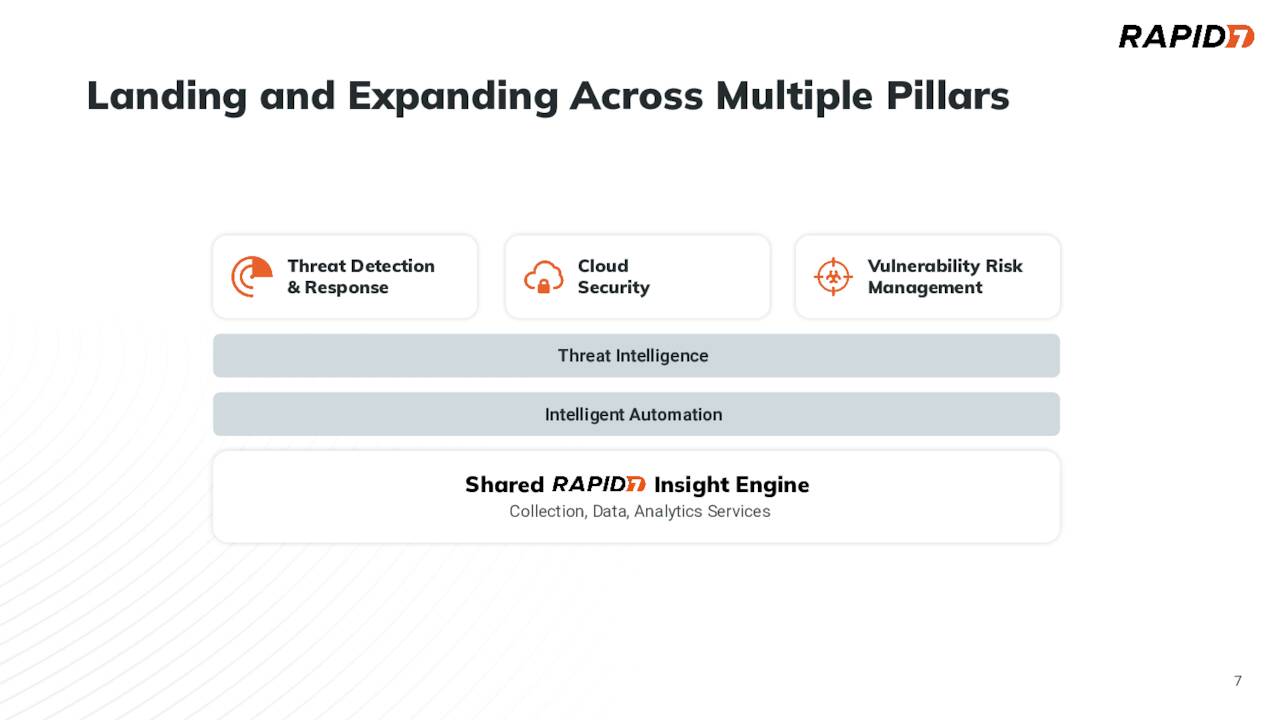

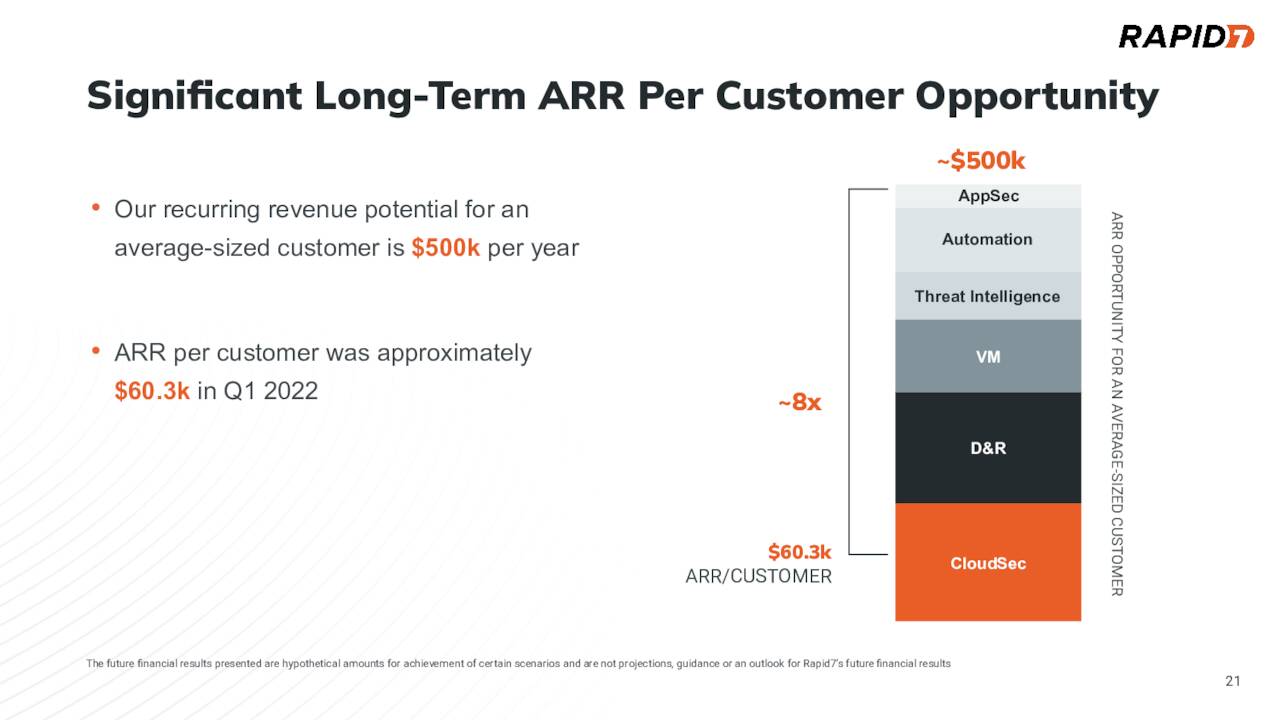

The company gets over 90% of its overall revenues from existing clients and the leadership believes ‘upselling‘ is a core driver of its long term growth and is in the early innings. Rapid7’s Insight Platform allows companies to manage corporate wide vulnerabilities via one centralized application.

May Company Presentation

First Quarter Results:

On May 4th, the company posted first quarter numbers. Rapid7 had a non-GAAP loss of 16 cents a share, which was in line with the consensus. Revenues rose 34% to just over $157 million, slightly better than expectations.

May Company Presentation

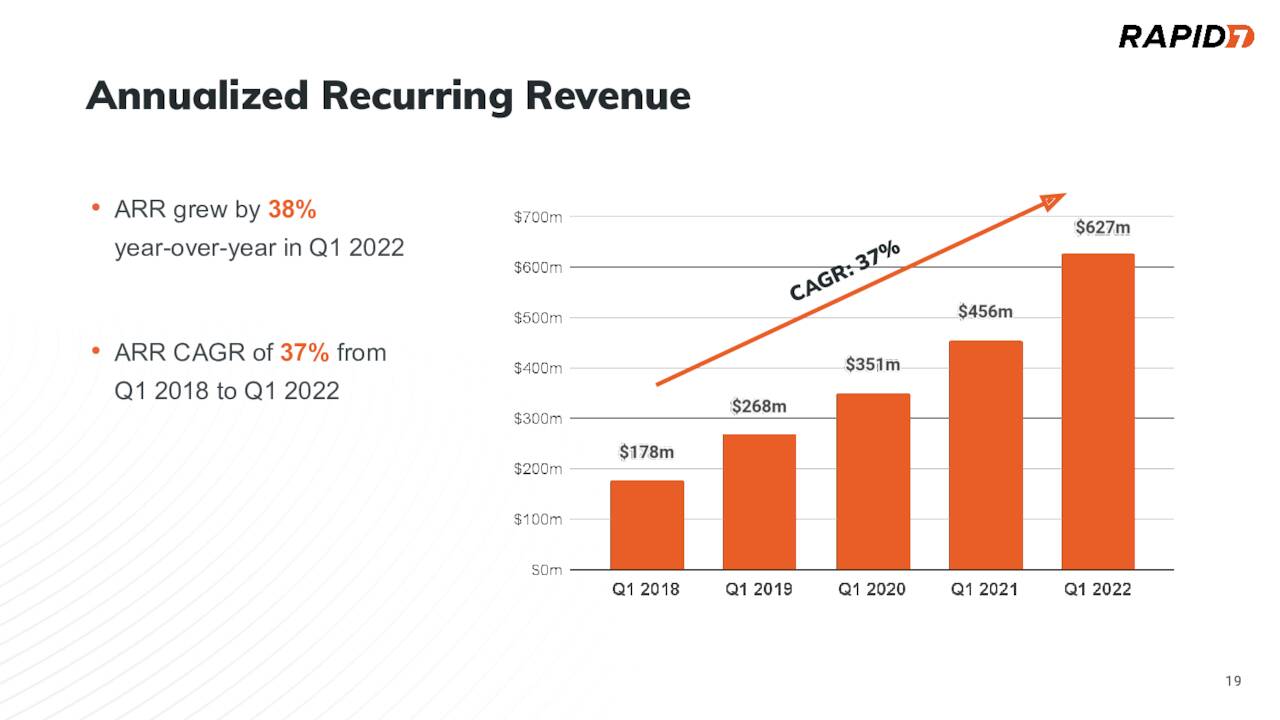

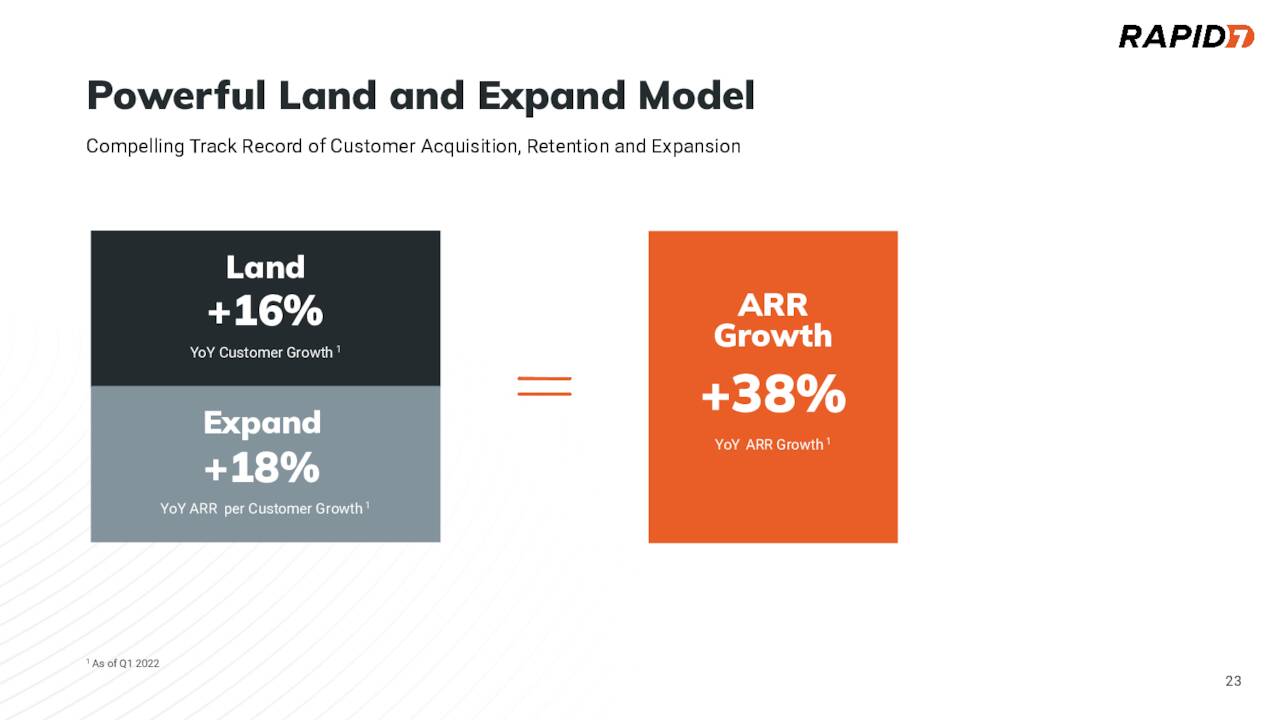

Digging into the report, Annualized recurring revenue or ARR rose 38% on a year-over-year to $627 million, while customer count grew by 16% from the same period a year ago. The total ARR from existing customers was up by 18%.

May Company Presentation

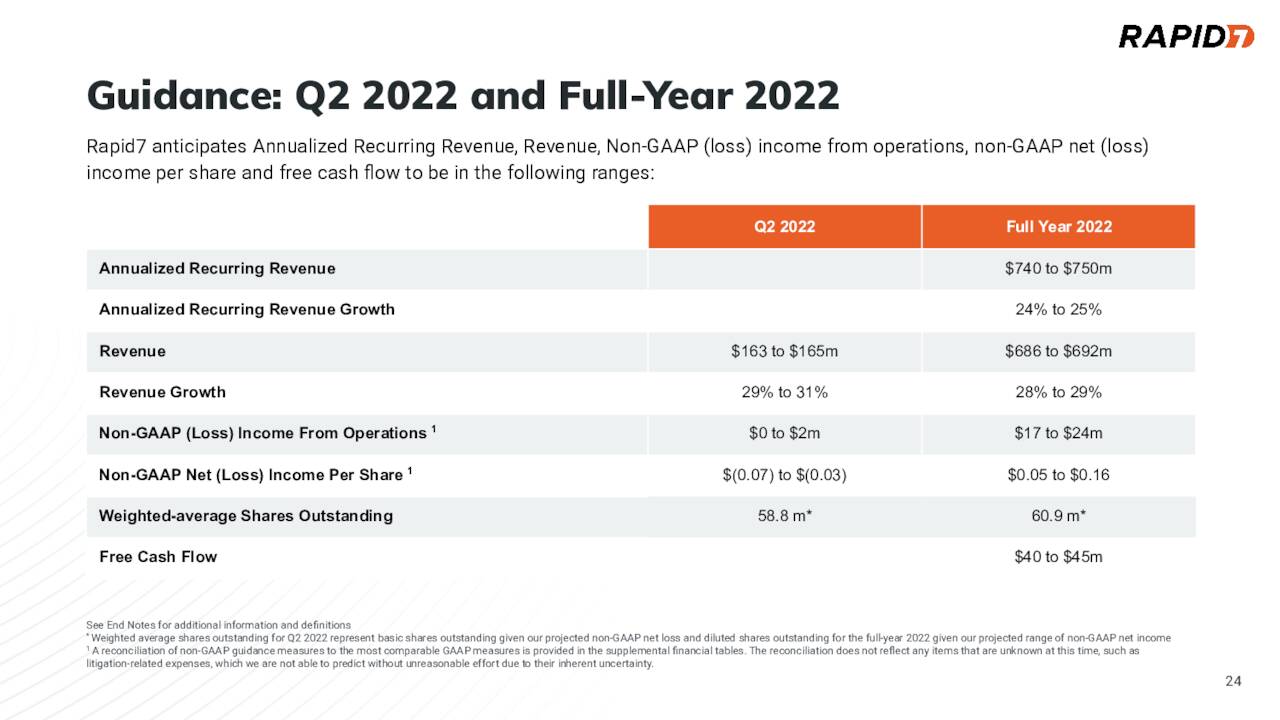

Leadership provided the following guidance for FY2022. The company expects total revenues to come in between $686 million to $692 million as annual ARR grows 24% to 25% to $740 million to $750 million for the year.

May Company Presentation

Analyst Commentary & Balance Sheet:

Over the past two months, analysts have mostly kept the faith in this firm. 10 analyst firms, including RBC Capital and Barclays, have reiterated Buy or Outperform ratings on the stock, albeit almost half of these had downward price target revisions. Price targets proffered range from $105 to $155 a share. Morgan Stanley reiterated its Hold rating and took its price target down to $95 from $103 previously. Goldman Sachs downgraded Rapid7 to a Neutral on April 12th while maintaining its $130 price target. Here is the commentary at the time from Goldman’s analyst.

The analyst expects strong performance ahead and sees a “meaningful opportunity” for the company to take share in its markets. However, the analyst is moving to a Neutral rating saying Rapid7’s better performance appears to be fairly reflected in the stock price at current levels. Further, he expects elevated costs associated with its platform investments ahead as the company continues to invest for growth. The analyst sees greater risk/reward within other areas of his coverage.

It should be noted that RPD was trading just above $110.00 a share at the time of Goldman’s downgrade.

Just over seven percent of the outstanding float in the stock is current held short. On May 9th, the company’s CFO bought just over $325,000 worth of stock. This is the first insider buying I can find in the shares since the company came public in 2015. Insiders have been frequent and consistent sellers of the stock for many years. However, insider selling has been absent for ten weeks now, which is rare in the history of this stock.

The company ended the first quarter with just over $800 million of long term debt. A good portion of this debt came from a $525 million aggregate principal amount of 0.25% convertible senior notes due 2027 in a private placement from March 2021. The initial conversion price of this debt was $103.38 a share.

Verdict:

The current analyst firm consensus has the company earning a dime a share in FY2022 as revenues increase just under 30% to some $690 million. Analysts project sales will rise in the low 20s in FY2023 and Rapid7 will deliver a half a buck a share in profit.

May Company Presentation

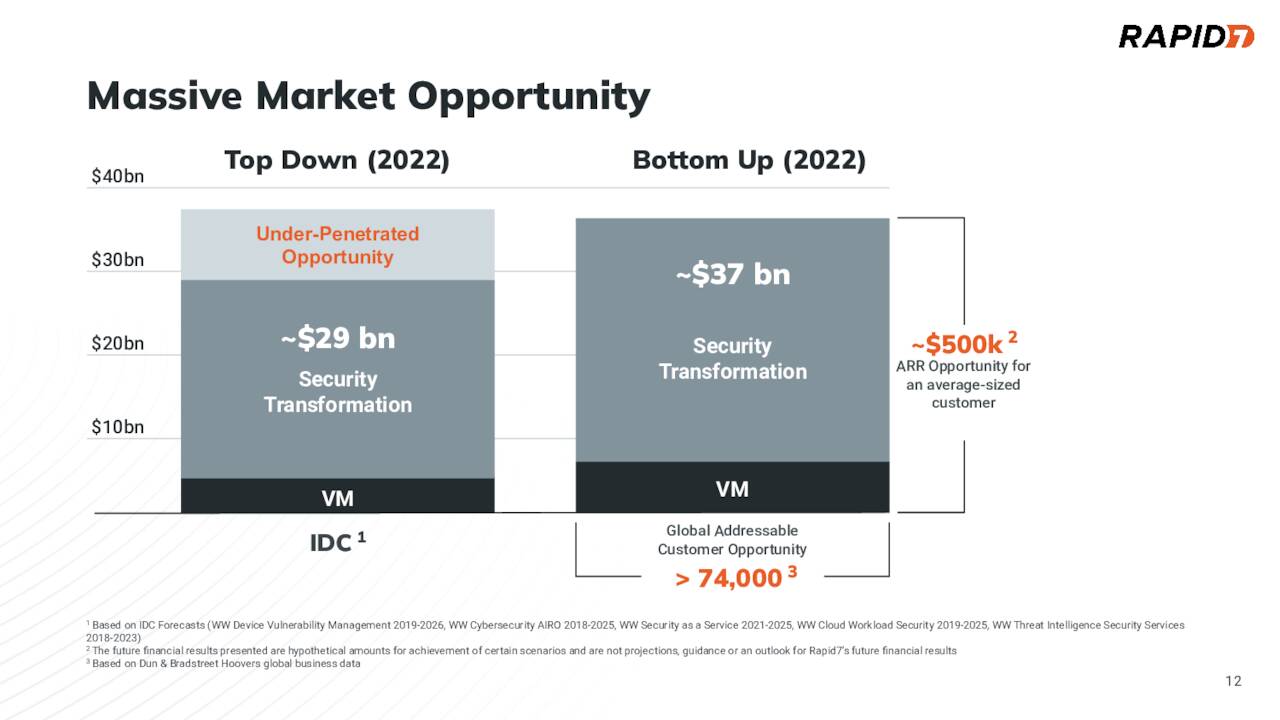

The company is no doubt targeting a large and growing market. Obviously, the valuation on a P/E basis is astronomical at the moment as only small profits are expected in FY2022 and FY2023. RPD is selling for approximately seven times forward sales. This is less than half that of Cloudflare, which has slightly higher projected growth and also a much stronger balance sheet.

For investors wanting more exposure to this part of the market, Rapid7 is not the worst way to do. Personally, I don’t think selling in the overall market has climaxed, and growth stocks will likely to continue to be pummeled until that happens. If RPD trades down further to the mid or low $50s and some more insider buying emerges, I will probably take a small ‘watch item‘ holding in the stock via some covered call orders.

“If you want total security, go to prison. There you’re fed, clothed, given medical care and so on. The only thing lacking… is freedom.” ― Dwight D. Eisenhower

Be the first to comment