greenbutterfly

A Quick Take On Rapid7

Rapid7, Inc. (NASDAQ:RPD) reported its Q2 2022 financial results on August 3, 2022, beating expected revenue and EPS estimates.

The company provides a range of cybersecurity technologies to organizations worldwide.

RPD faces a recessionary Europe, foreign exchange headwinds and more price-conscious customers, so I’m on Hold for RPD in the near term.

Rapid7 Overview

Boston, Massachusetts-based Rapid7 was founded in 2000 to provide a platform for various analytics-driven cybersecurity risk management functions.

The firm is headed by Chairman and Chief Executive Officer Corey Thomas, who was previously Group Product Manager at Microsoft and a consultant at Deloitte Consulting.

The company’s primary offerings include:

-

XDR and SIEM

-

Threat Intelligence

-

Vulnerability Management

-

App Security Testing

-

Orchestration & Automation

-

Cloud Security

The firm acquires customers through its direct sales and marketing efforts as well as through referrals and its partner ecosystem.

Rapid7’s Market & Competition

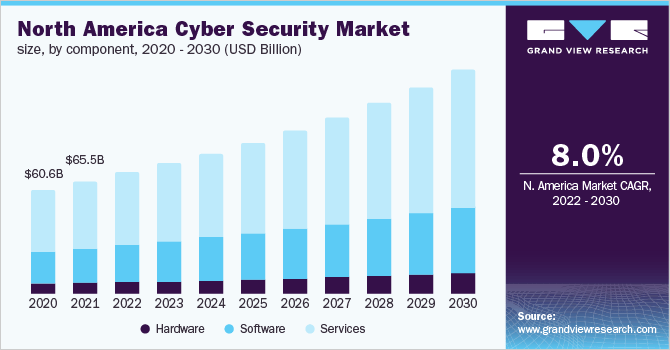

According to a recent market research report by Grand View Research, the global cyber security market size was valued at $185 billion in 2021 and is expected to reach $512 billion by 2030.

This represents a forecast CAGR of 12.0% from 2022 to 2030.

The main factor driving market growth is the rise in cybercrimes and malware attacks on governments, BFSI and healthcare organizations.

The chart below shows the historical and projected future growth of the North America cyber security market:

N. America Cyber Security Market (Grand View Research)

Major competitive vendors that offer cyber security solutions include:

-

Qualys

-

IBM

-

Tanium

-

CrowdStrike

-

Symantec

-

Cisco Systems

-

Checkpoint Software Technologies

-

Fortinet

-

Trend Micro

Rapid7’s Recent Financial Performance

-

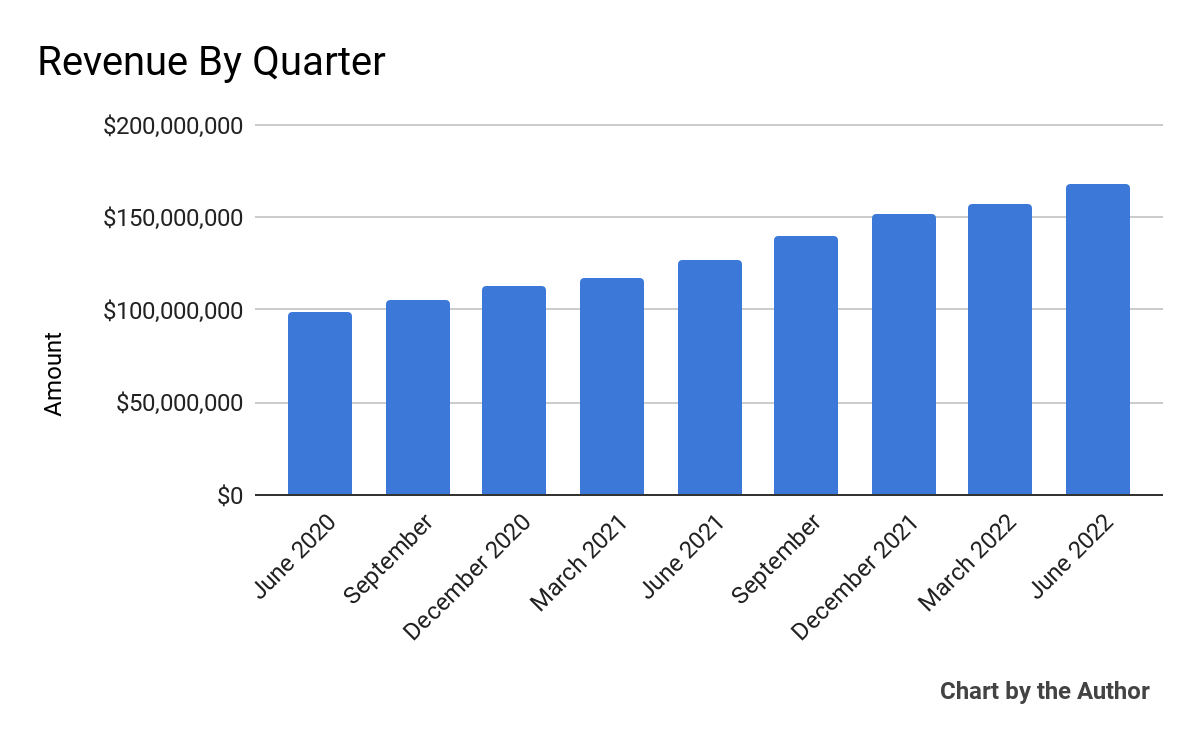

Total revenue by quarter has risen per the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

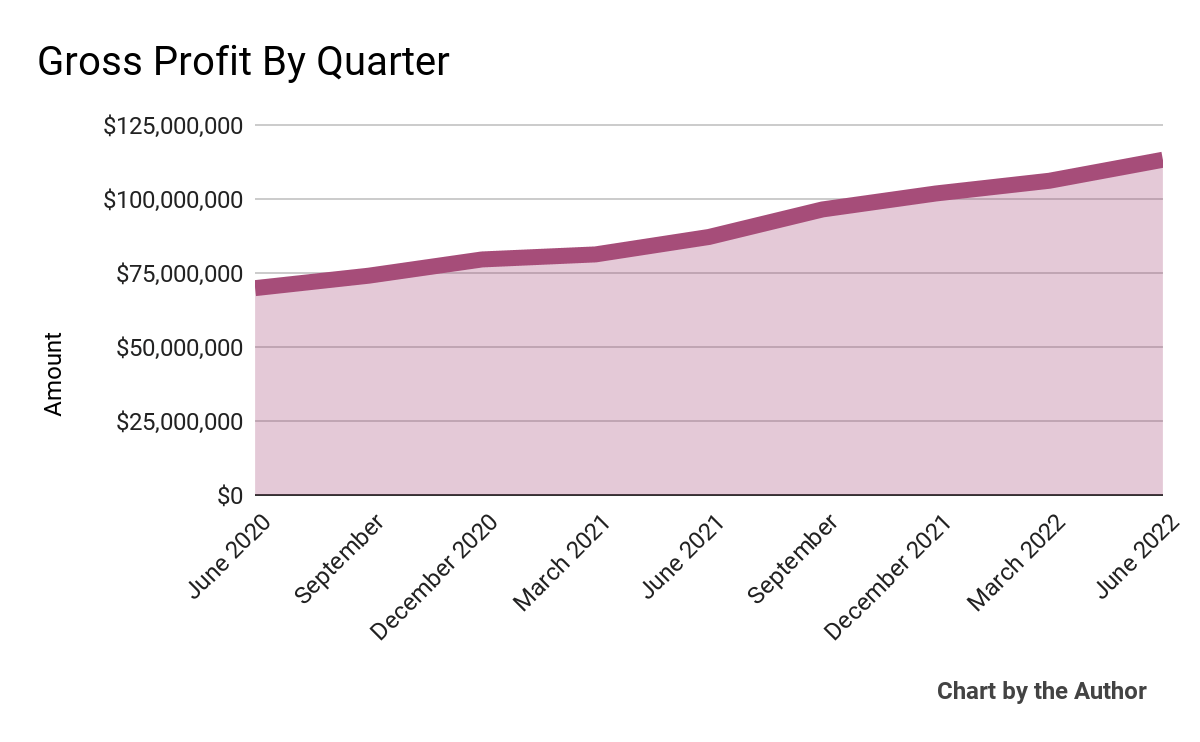

Gross profit by quarter has followed a similar trajectory as total revenue:

9 Quarter Gross Profit (Seeking Alpha)

-

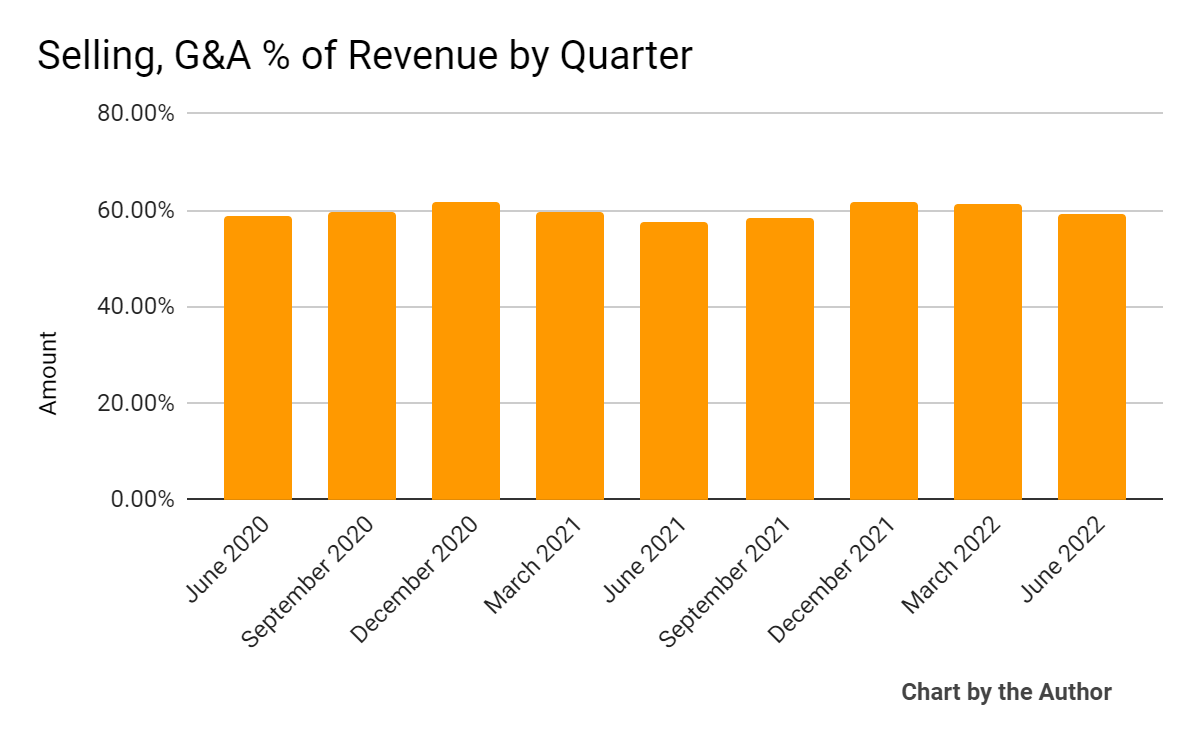

Selling, G&A expenses as a percentage of total revenue by quarter have remained within a relatively narrow range:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

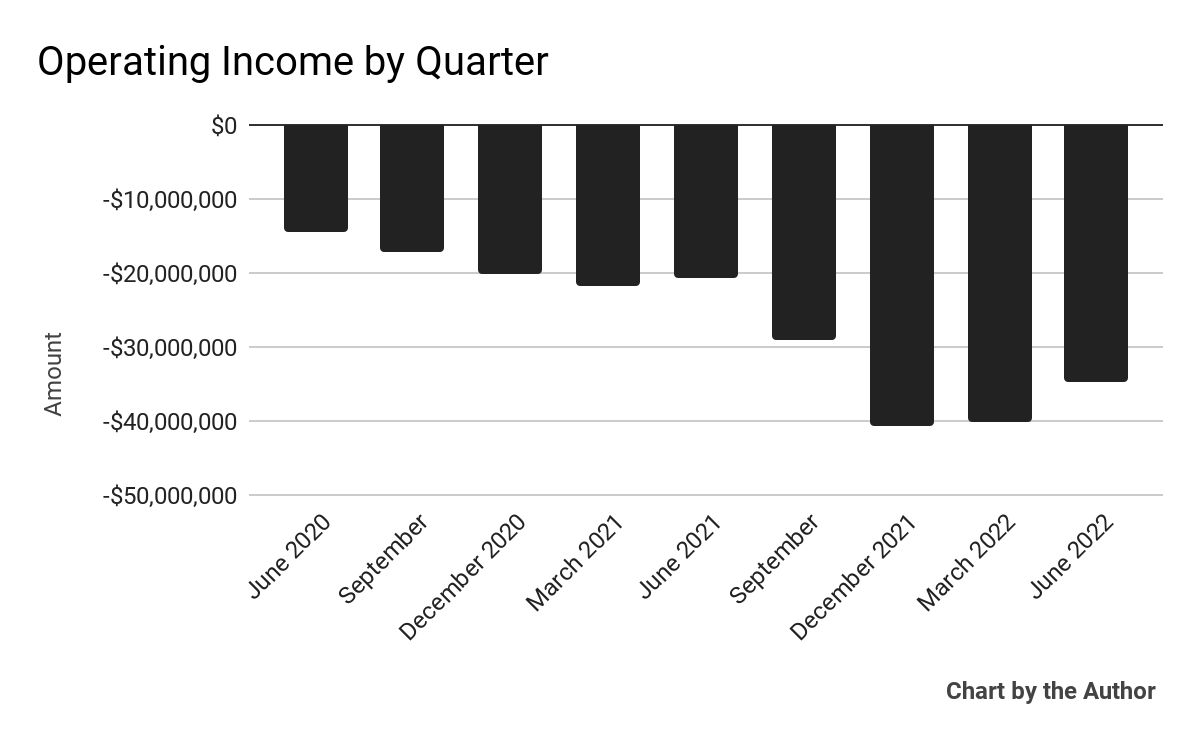

Operating losses by quarter have worsened in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

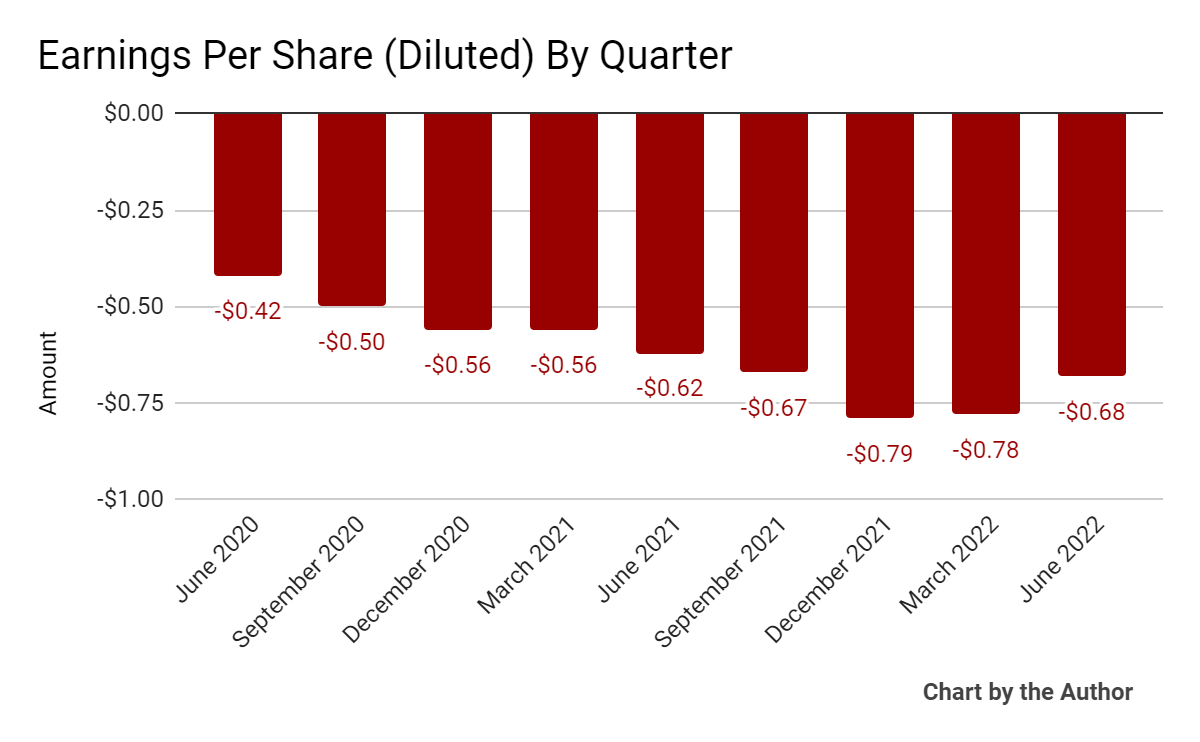

Earnings per share (Diluted) have also generated greater negative results in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP.)

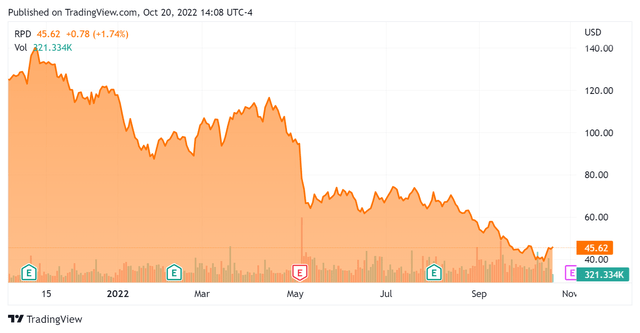

In the past 12 months, RPD’s stock price has fallen 63.7% vs. the U.S. S&P 500 index’ drop of around 19.2%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Rapid7

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

5.42 |

|

Revenue Growth Rate |

33.4% |

|

Net Income Margin |

-27.1% |

|

GAAP EBITDA % |

-17.3% |

|

Market Capitalization |

$2,670,000,000 |

|

Enterprise Value |

$3,340,000,000 |

|

Operating Cash Flow |

$41,990,000 |

|

Earnings Per Share (Fully Diluted) |

-$2.92 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

RPD’s most recent GAAP Rule of 40 calculation was 16.1% as of Q2 2022, so the firm needs significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

33.4% |

|

GAAP EBITDA % |

-17.3% |

|

Total |

16.1% |

(Source – Seeking Alpha)

Commentary On Rapid7

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted 35% growth in the company’s ARR (Annual Recurring Revenue) and exceeding its previous revenue and operating guidance.

However, management is beginning to notice customer budgets coming “under greater scrutiny,” likely leading to increased discounting or longer sales cycles.

Most of the firm’s international business is concentrated in Europe, which is seeing rampant inflation, dropping consumer confidence and strong foreign exchange headwinds against the U.S. dollar.

As to its financial results, total revenue rose 32% year-over-year, while total gross margin was 72%, in line with expectations.

Management did not disclose the company’s net dollar retention rate, which is a critical metric for investors to determine customer satisfaction with its product/market fit and its sales & marketing efficiency.

RPD’s Rule of 40 results have been lackluster and in need of significant improvement.

Sales and marketing expenses as a percentage of revenue rose slightly, as did R&D costs.

However, operating losses remained heavy for the quarter, as did negative earnings.

For the balance sheet, the firm ended the quarter with cash equivalents and investments of $254 million and debt of $814 million.

Over the trailing twelve months, free cash flow was $28.4 million.

Regarding valuation, the market is valuing RPD at an EV/Sales multiple of around 5.4x.

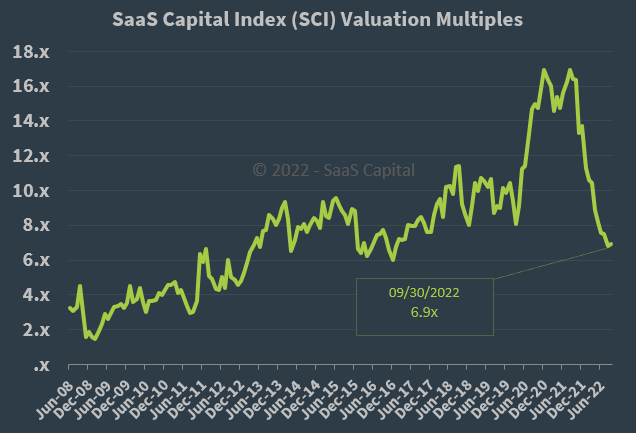

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.9x at September 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital Index)

So, by comparison, RPD is currently valued by the market at a discount to the broader SaaS Capital Index, at least as of September 30, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, and a deeper recession in Europe, which may accelerate new customer discounting, slow sales cycles and reduce its revenue growth trajectory.

With a gloomy outlook in Europe and increasing operating losses, I don’t see a significant catalyst in the near term.

I’m therefore on Hold for RPD at this time.

Be the first to comment