technotr/E+ via Getty Images

Investment Thesis

One of the reasons given for the biotech industry’s surprising fall from grace in 2021 – its flagship XBI index is down by 45% over the past 12 months – is the record-breaking number of IPOs completed last year and the year before.

According to Biopharmadive there were 78 biotech IPOs in 2021, 71 in 2020, 39 in 2019, and 44 in 2018. In 2021 and 2020, respectively 14 and 13 companies raised sums of $250m or more, whilst in 2019 and 2018, the numbers were 3 and 2.

Atreca Inc (NASDAQ:BCEL) IPOd in June 2019, raising ~$114m at $17 per share, but its share price has sunk to just $2 at the time of writing. In a press release around the time of its IPO, Atreca describes its business as follows:

Atreca is a biopharmaceutical company utilizing its differentiated platform to discover and develop novel antibody-based immunotherapeutics to treat a range of solid tumor types.

While more traditional oncology drug discovery approaches attempt to generate antibodies against known targets, Atreca’s approach relies on the human immune system to direct it to unique antibody-target pairs from patients experiencing a clinically meaningful, active immune response against their tumors.

Since then, Atreca has put together a pipeline of drugs targeting both oncology, with one asset – ATRC-101 – entering the clinic and being evaluated for a range of solid tumor cancers, including ovarian, lung, colorectal and breast, and infectious diseases, mainly focused on SARS-Cov-2, and, in partnership with the Bill and Melinda Gates foundation – malaria.

Atreca may not have made spectacular progress but its loss of market cap valuation – which has fallen from close to $1bn, to just $71m in not much longer than 18 months – seems a little harsh, although the company appears to have run into some problems.

Atreca raised $125m last July via a share offering which will have been dilutive to existing shareholders. The company has a high cash burn, however, making a net loss of $80m in the first nine months of 2021, and $63m in the prior year equivalent period.

Management says existing funds of $153m ought to be sufficient until H123, but with only 1 asset in the clinic, meaning there’s scant prospect of near-term commercial revenues, Atreca will have to find a development partner prepared to make an upfront payment soon, or dilute shareholders further, likely before the end of this year.

In April last year, Atreca also announced the departure of its Chief Scientific Officer, Norman Michael Greenberg, before releasing data from its Phase 1b trial of ATRC-101 at the end of July that disappointed the market and sent its already rapidly declining share price tumbling even further toward its current low.

Eight – or 33% percent of participants – had at least one grade ≥ 3 adverse event (“AE”), whilst 8 of the 20 participants (40%) evaluable prior to the data cut-off experienced stable disease (“SD”) as their best RECIST response, and 4 patients experienced tumor reduction.

Whether the data prompted the departure of the CSO is unclear, but the key figures at Atreca – co-founders Dr. Tito Serafini, who was CEO of the company between 2010 and 2018 and John Orwin, who formerly founded Relypsa, a biotech that commercialized its lead candidate, Patiromer (US brand name Veltassa), and was acquired by Galenica (Vifor Pharma) in a $1.5bn deal – still remain. John Orwin also is a board member of SeaGen (NASDAQ:SGEN), the $23bn biotech with 4 FDA approved cancer drugs and >$1bn in annual revenues.

The sheer number of newly IPOd biotechs competing for financial resources to fund drug discovery efforts has probably overwhelmed a sector that was growing fast, but not fast enough to support multi-billion dollar valuations for a freshly listed biotech with no prospect of delivering a commercial product for five years or more.

That helps to explain why Atreca’s shares have performed as badly as they have since IPO, but could they now be undervalued relative to the opportunities that Atreca and an experienced management team have in front of them?

Another issue (I believe) dogging the biotech industry is the sheer volume of cash this goes into R&D, without there being much in the way of end product – it’s well known that the drug discovery, development, and commercialization process costs billions to complete, but investors’ patience with cash consuming biotechs appears to have worn out.

That’s not necessarily great news for Atreca but where the company is on stronger ground is perhaps with providing more data from its trials of ATRC-101 – a drug with a mechanism of action that shouldn’t be discounted at this stage – and initiating further trials as a combo therapy either with an immune checkpoint inhibitor (“ICI”) which looks like it will be Merck’s highly successful (>$11bn per annum selling) Keytruda, or alongside chemotherapy.

Atreca is also promising Investigational New Drug (“IND”) applications for new drug candidates both this year and in 2023, has an ongoing partnership with Xencor (NASDAQ:XNCR) – a $2bn market cap biotech working with engineered monoclonal antibody therapeutics – to develop up to two antibodies against novel targets from which Xencor will engineer XmAb bispecific antibodies that bind to the CD3 receptor on T cells.

Finally there’s the company’s COVID program which uses its proprietary Immune Repertoire Capture (“IRC”) technology to generate antibodies from patients infected with the original SARS-CoV-2 virus, and a licensing agreement with the Bill and Melinda Gates Foundation, which will see Atreca develop MAM01/ATRC-501 – an engineered version of a human monoclonal antibody generated following vaccination with Mosquirix.

For me, Atreca’s relatively rare approach to developing drugs, committed and experienced management team, 12 – 18 months’ worth of financing, and depressed share price all mean that the company is worth a second look as a potential investment opportunity.

Its fall in value has been staggering, and at a time when even positive clinical data readouts appear to causing biotech valuations to crash, perhaps in future the data from early trials of ATRC-101 will be viewed more favorably.

In the remainder of this post I will explore the technology and the opportunity in a little more detail. Investors should do their own due diligence of course, but in a biotech market where valuations seem to fall further each day, Atreca at least is a company that can shed much more value, being valued at ~0.5x its current cash position.

Atreca Attempts to “Invert the Drug Discovery Paradigm”

There has been a real buzz around AI-driven drug discovery at the beginning of this year, with the likes of Merck (NYSE:MRK), Pfizer (NYSE:PFE), and Sanofi (NASDAQ:SNY) announcing partnerships respectively with Absci (NASDAQ:ABSI), Codex DNA (NASDAQ:DNAY) and Exscientia (NASDAQ:EXAI), that could be worth billions if all milestones are met.

The hope is that AI can find new druggable targets faster than humans can, and given that just 10 targets, including the likes of PD-1, CD20, TNF, HER2, VEGF, IL6, EGFR, and CD19 account for roughly half of FDA new drug approvals.

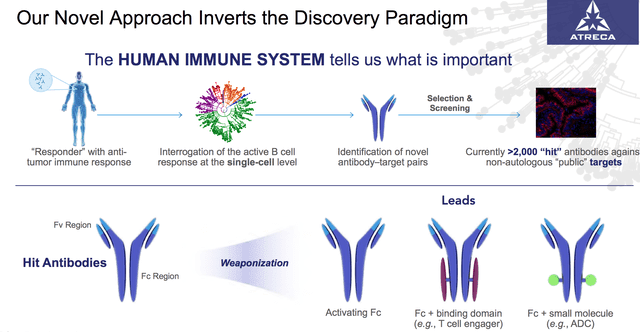

Atreca’s approach is a little different – as shown below:

Atreca’s approach to identifying drug targets

Many biotechs attempt to work in tandem with patient’s immune systems, and although I’m not a biophysicist, it seems as though Atreca studies patient “responders” who product anti-tumor responses “interrogating” their B and T cells, to see if the antigens can be cloned and used to treat other patients.

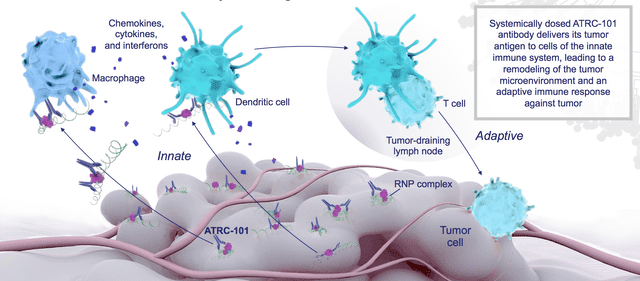

ATRC-101 was designed in this way, and according to Atreca it targets a ribonucleoprotein complex which contains multiple RNA-binding proteins and RNA, and which can be induced by stress, passing its tumor antigen to the innate immune system, which is subsequently able to influence the tumor microenvironment.

ATRC-101 targeting the tumor microenvironment

Atreca believes a drug such as ARTC-101 could target autoimmune diseases and infectious diseases as well as cancers, although the drug has primarily shown promise in mouse models in cancer, as well as facilitating the activity of checkpoint inhibitors and other T-cell focused therapeutics in an animal model.”

For my money, given that ARTC-101 appears to need to create a stressful environment in the cell target cell in order to find its target, which can be created using chemotherapy, and has shown to have a catalytic effect on checkpoint inhibitors, the real area of interest will be the combo trials – the anti-PD1 trial has already begun, with the chemo trial expected to initiate this year.

It ought to be easier – and likely more lucrative – if ARTC-101 could work in a combo with either a chemotherapy, or a drug such as Keytruda. There are dozens of biotechs designing drugs to work in combo with these successful (as they come) treatments and drugs however, and so far Atreca’s data has not suggested it has anything special with ARTC-101. That could change overnight – although the safety profile looks a little troubling, perhaps a larger number of patients studied over a longer period will benefit the drug and Atreca.

COVID and Malaria – Not Too Late To Make A Difference

Atreca was presenting data on its COVID antibodies earlier this month, suggesting that it had found four pan-neutralizing antibodies from different donors that exhibited “favorable developability properties, including high melting temperatures and low polyreactivity.“

It may be too late for Atreca in COVID, given the success of mass vaccination and Pfizer’s (PFE) development of Paxlovid, its antiviral treatment for that can reduce risk of hospitalisation by >90%, apparently, but although I’m usually quite critical of biotechs pivoting to COVID, I find Atreca’s approach quite interesting and would hope to hear more about this program, possibly in the context of developing vaccines against future viruses and pandemics.

The partnership with the Bill and Melinda Gates Foundation is also intriguing, and has recently seen a slight uptick in Atreca’s share price, although the terms look weighted in favor of the Foundation.

In its investor presentation, Atreca suggests that revenues could be generated by sharing IP rights – a patent application is pending – or developing the therapy – named ATRC-501 for the prevention of malaria in travelers.

Companies such as Dynavax (NASDAQ:DVAX) – whose shares are up 88% across the past 12 months – have done extremely well working on vaccine development with agencies such as the Coalition for Economic Preparedness (CEPI”) and biotechs developing vaccines as partners, so it isn’t inconceivable that something will come from Atreca’s infectious disease pipeline that adds genuine value and be produced for partners.

Xencor and Latest Asset Help to Diversify Atreca’s Pipeline

The Xencor deal is another encouraging sign for Atreca, in my view – Xencor is a larger company with more experience and its pipeline is larger and more advanced, but perhaps most importantly, the biotech was involved in the development of two recently-commercialized drugs – MorphoSys’ (NASDAQ:MOR) Monjuvi, targeting Diffuse large B-Cell Lymphoma (“DLBCL”), and GlaxoSmithKline’s Sotrovimab, a COVID therapy.

Otherwise, I also think that Atreca’s next candidate, APN-122597, is at least worth a second look. Atreca says it was:

discovered via “a lung adenocarcinoma patient with an active anti-tumor immune response after treatment with nivolumab

Nivolumab is marketed and sold by Bristol Myers Squibb (NYSE:BMY) as Opdivo, and it is Keytruda’s major rival across a range of different solid tumor types, making sales of ~$7bn per annum. The target is EPAH2, which is expressed in the cells of many different types of cancers, although it is also associated with high levels of toxicity and is difficult to target.

Conclusion – A Biotech Is Never Derisked By A Low Share Price, But In The Current Bear Market Atreca May Be An Unlikely, Rare, Buy Opportunity

In the course of writing for Seeking Alpha I have reviewed hundreds of investor presentations, data readouts, mechanisms of action, and followed the progress of many different drugs.

The statistics tell us that most drugs do not make it on the shelves of pharmacies, but also that those that do make it usually generate triple-digit-million, or even billion-dollar annual revenues.

Despite the research I have done I would still say that it can be incredibly hard to “follow the science,” or evaluate the significance of a new data set from a clinical trial, or even evaluate a biotech’s response to that data (spoiler alert – biotechs tend to tell you all of the good news and don’t mention the bad unless they have to).

That is certainly the case with Atreca – I can’t claim to have an insider’s knowledge of the company’s scientific approach or that I’m certain it will work – but I can compare and contrast the biotech with others I have followed, and come to the conclusion that a valuation as low as $78m, and an 86.5% decline in Atreca’s share price in the past 12 months does not quite seem right.

It seems difficult to argue that the cash position, clinical stage asset, partnerships with Xencor and the Bill and Melinda Gates Foundation, and preclinical pipeline is worth less than $100m in its entirety – and especially so when you have a co-founder who has successfully commercialized a drug at a previous company and secured a $1.5bn buyout on the back of it.

We will know more when the next set of data arrives (there ought to be several updates this year) and a major fear is that it is simply not good enough, with safety concerns around e.g. Cytokine Release Syndrome (“CRS”) and an overall lack of efficacy – if the project is discontinued, what happens to Atreca then?

In theory, it ought to be able to survive as a smaller, preclinical company for a while yet, but the pressure on the MoA and approach of its pipeline and tech platform would become intense, and investors even more unforgiving.

Still, I think the anti-PDL1 and chemo trial data may be worth waiting for, and perhaps a potential APN-122597 / nivolumab combo trial also. It’s a tough call – management could keep stringing investors along with the promise of a new drug or trial initiation – but what you are buying with Atreca stock is a “moon shot” type company that believes it can unlock new medicines by studying patients who have shown an immune response.

Atreca’s approach sounds a little similar to the attempted use of convalescent plasma to treat COVID patients – a thesis that was ultimately disproved, with several biotechs losing out badly – e.g. Liminal (NASDAQ:LMNL) (my note here) – but personally I think Atreca may have already hit rock bottom, and its technology platform and pipeline looks cheap to gain access to at $2 per share.

That doesn’t guarantee success by any means, but makes the risk / reward much more appetizing.

Be the first to comment