Vertigo3d/E+ via Getty Images

Investment Thesis

Range Resources (NYSE:RRC) has seen its share price sell-off together with its natural gas peers. However, I believe that the market is overreacting.

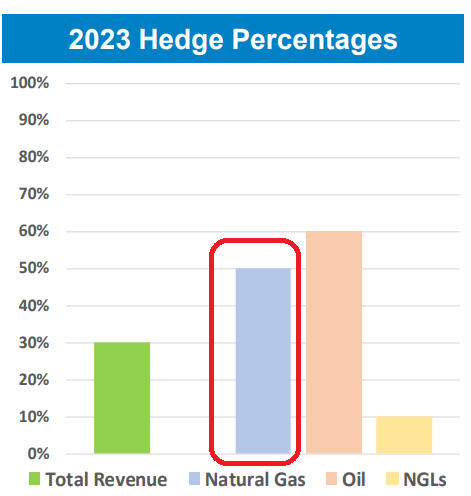

Why? Because for better or worse, Range Resources is nearly 50% hedged for its 2023 natural gas production.

If we assume that natural gas prices stay higher than $4.75 into 2023, this company is priced at just 5x free cash flows.

That’s a very attractive valuation.

Interpreting Range Resources’ Recent Performance

Range Resources is a leading natural gas and NGL producer. For Q1 2022, approximately 94% of its revenues come from either natural gas or NGL sales, with the remainder coming from oil sales, an immaterial portion.

Consequently, whatever happens in the natural gas market will have a substantial implication for Range’s business performance.

Now, let’s provide some background. As you know, nearly all areas of the market are down from their highs, with the exception of energy.

Depending on the exact sector one considers, the retracement from former highs ranges from 30% to 50% to as much as 75% down from previous highs. And in some cases, the sell-offs have been even higher.

Yet, as noted, the one clear exception had been energy stocks. This space has been up, until now.

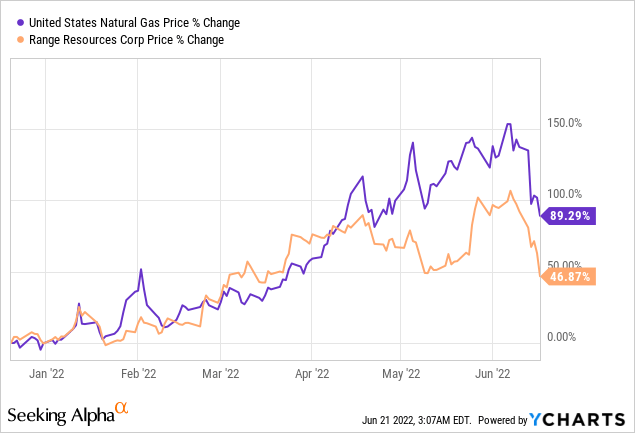

On 7 June, Range Resources marked a 5-year-high. The high coincided with the high prices of natural gas on the spot market.

Then, the widely reported news of the Freeport LNG facility catching fire caught investors’ imagination, and this led to the natural gas price sell-off.

However, Range Resource’s share price had already lagged substantially from the natural gas price, see above. Even though the two are not direct proxies for each other, they are nevertheless closely linked.

But given investors’ fear in the market right now, investors looked to pull back from energy stocks. After all, as noted already, this had been the only space left in the market that investors had been able to cling onto gains.

Consequently, not only are investors jittery, but they absolutely do not want to give up any gains in their portfolio, so they are very much de-risking their portfolios and taking profits off the table, wherever they can find them. Most likely, the only place left is energy.

Accordingly, I declare that investors are not taking profits off the table because the bull case is broken. Indeed, I contend that the recent selling has more to do with the fact that stocks don’t trade in a vacuum.

However, just because investors are being forced sellers of Range Resources doesn’t mean that the bull case is over.

Range Resources Capital Allocation

Range Resources has taken a cue from some of its peers that are getting rewarded with strong share price performances of late. More specifically, Range Resource has sought to return capital to shareholders alongside paying down its debt.

Rather than solely focusing on paying down its debt, as Southwestern Energy (SWN) has opted to do, Range Resources has looked to reward shareholders together with its creditors.

And this makes sense. If the equity is being priced at somewhere near 15% free cash flow yields, paying down debt early doesn’t make a lot of sense.

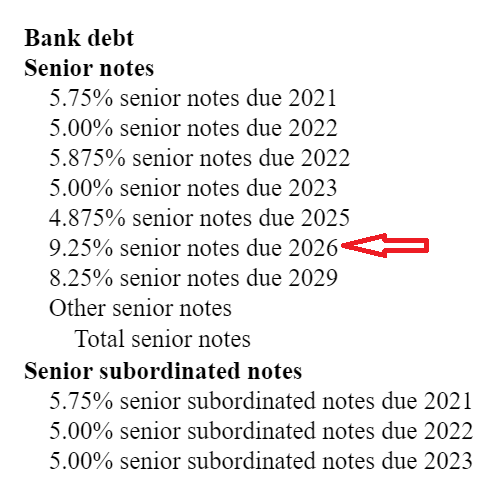

Range 10-K

Particularly given that senior notes 9.25% have already been paid down. And now, the remainder of Range’s senior notes nearly all carry less than 6% coupons, as you see above.

On the other hand, Range’s capital return, if fully deployed over the next twelve months is going to be around 8%. Shareholders will get approximately 6.8% via capital returns, and approximately 1.2% yield via dividends on an annualized basis.

That’s a fair return, and relative to some of its peers it’s right in the middle of the range other natural companies are offering.

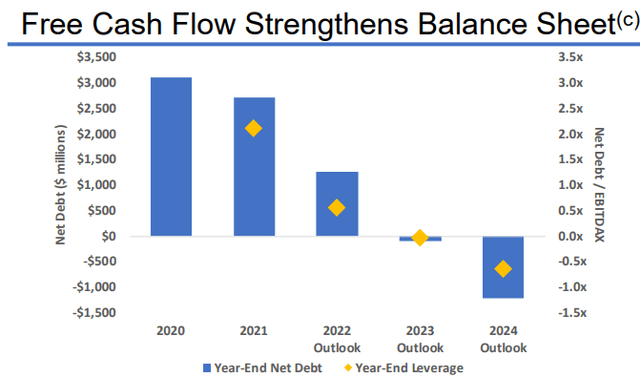

By my estimates, when Range reports its Q2 2022 results, its balance sheet will probably be around 1.1x to 1.3x net debt to EBITDAX leveraged. However, as we look out to the back end of 2022, Range believes that its net debt to EBITDAX could drop to near 0.5x, see below.

That being said, keep in mind that this figure of net debt balances already assumes some level of capital returns. Hence, it’s possible that as we get close to the end of 2022, Range Resources may at that point look for options to increase its capital returns to shareholders.

Moving on, now we get into what’s arguably the divisive part of the investment thesis. Range’s meaningfully hedged book.

Range’s Q1 2022 presentation

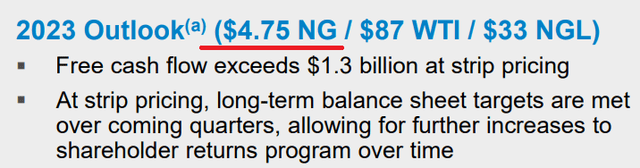

As you can see above, looking out to 2023, approximately 50% of Range’s natural gas production is hedged.

Hence, if one is particularly bullish on natural gas prices, Range Resources may not be the most compelling investment to get behind.

On the other hand, there are obviously some notable advantages to having a hedged book, which I’ll discuss next.

RRC Stock Valuation – Priced at 5x 2023 Free Cash Flow

The massive advantage Range Resources has over some of its peers could ironically come from its meaningfully hedged book.

Succinctly, Range Resources’ substantial hedged book can provide investors with something that its peers can not, and that is visibility in its free cash flow potential well into 2023.

If we assume that natural gas prices stay higher than $4.75 in 2023, which I firmly believe that to be a likely scenario, then Range Resources is going to make more than $1.3 billion of free cash flow.

And that’s a very compelling investment opportunity. Why? Because you are getting meaningful exposure to higher natural gas prices, but you are doing so without having to pay a high multiple.

Put another way, one could argue that paying a 5x multiple to free cash flow means that after 5 years at current strip rates, an investment in Range Resources pays for itself. And then, whatever happens starting from year-6 up until terminal value, is all free upside to shareholders.

The Bottom Line

Depending on how much you crave visibility Range Resources could be a terrific investment opportunity. If you want to have a strong degree of confidence over the amount of free cash flow your natural gas company is going to make, then, Range Resources could be an attractive opportunity.

If you want full exposure to natural gas prices because you believe that prices will remain high for a sustained period, then Range Resources may not the best investment opportunity for you.

That being said, at 5x free cash flow I believe that this is nothing to sneer at and investors are not likely to go substantially wrong on this investment.

Be the first to comment