DieterMeyrl/E+ via Getty Images

Range Resources Corporation (NYSE:RRC) is a well-placed Appalachian natural gas and natural gas liquids (NGLs) producer that has weathered considerable lows in the sector and region. It’s a top 10 US producer of natural gas and NGLs and the top independent exporter of NGLs.

Because Appalachia is still transport-limited and because Range’s first priority is debt repayment, I recommend the stock as a “hold.” Investors will likely want to check back in a quarter or so (being mindful of winter gas price spikes).

Counterbalancing this $8.1 billion company’s still-low dividend rate of 1% is its $500 million stock repurchase program. Moreover, the decline and now full cutoff of Russian natural gas exports to Europe has created an enormous draw for new gas sources given recent Dutch Title Transfer Facility (TTF) spot prices of up to $100/MMBTU, more than 10x the current US gas spot price.

Range Resources 2Q22 Results and Guidance

In the second quarter of 2022 Range Resources’ revenues were $1.23 billion and its net income was $453 million, or $1.77/share. This included a -$240 million mark-to-market derivative loss due to commodity price increases.

Net cash from operations for 2Q22 was $325 million.

Range produced 2.1 billion cubic feet-equivalent (BCFe)/day, about 70% of which was natural gas. This is divided as 1.45 BCF/day of natural gas, 96,500 barrels per day (BPD) of NGLs, and 7900 BPD of oil and condensate.

Quarterly costs per thousand cubic feet-equivalent (mcfe) were $2.68, including $0.46/mcfe for non-cash depletion, depreciation, and amortization. The total also included $1.70/mcfe for transportation, gathering, processing, and compression.

Range expects to hold production flat for the remainder of the year, with 2022 capital expenditures of $480 million. In the first half of 2022 it spent half that.

The company’s net debt is $2.4 billion; its target is $1.0 billion to $1.5 billion.

Macro

Due to economic sanctions for its invasion of Ukraine, Russia has now largely turned off all natural gas exports to northern Europe via Nord Stream. Europe had relied on Russian gas for 40% of its gas consumption, so this is a body blow, albeit one for which Europe has been preparing by stockpiling gas, conserving, seeking out other sources, and where possible, using other fuels. Natural gas also is a key industrial and chemical precursor, so the high price has and will shutter some operations.

Super-high European natural gas prices draw LNG from everywhere. However, Europe’s regasification and non-Russian-oriented pipeline infrastructure is capacity limited.

Russia could reverse course and send large supplies of cheap natural gas again to Europe, but that’s a non-trivial geopolitical bet. Instead, Russian president Vladimir Putin is likely to just taunt Europe.

To replace Russian gas, the process of transporting US natural gas via pipeline to Gulf Coast liquefaction facilities, liquefying it, tankering the resulting LNG across the ocean, re-gasifying the LNG in European facilities, and transporting gas to various countries in (insufficient) pipeline infrastructure requires large commitments of capital and long construction times that rely on long-term, big-volume contracts.

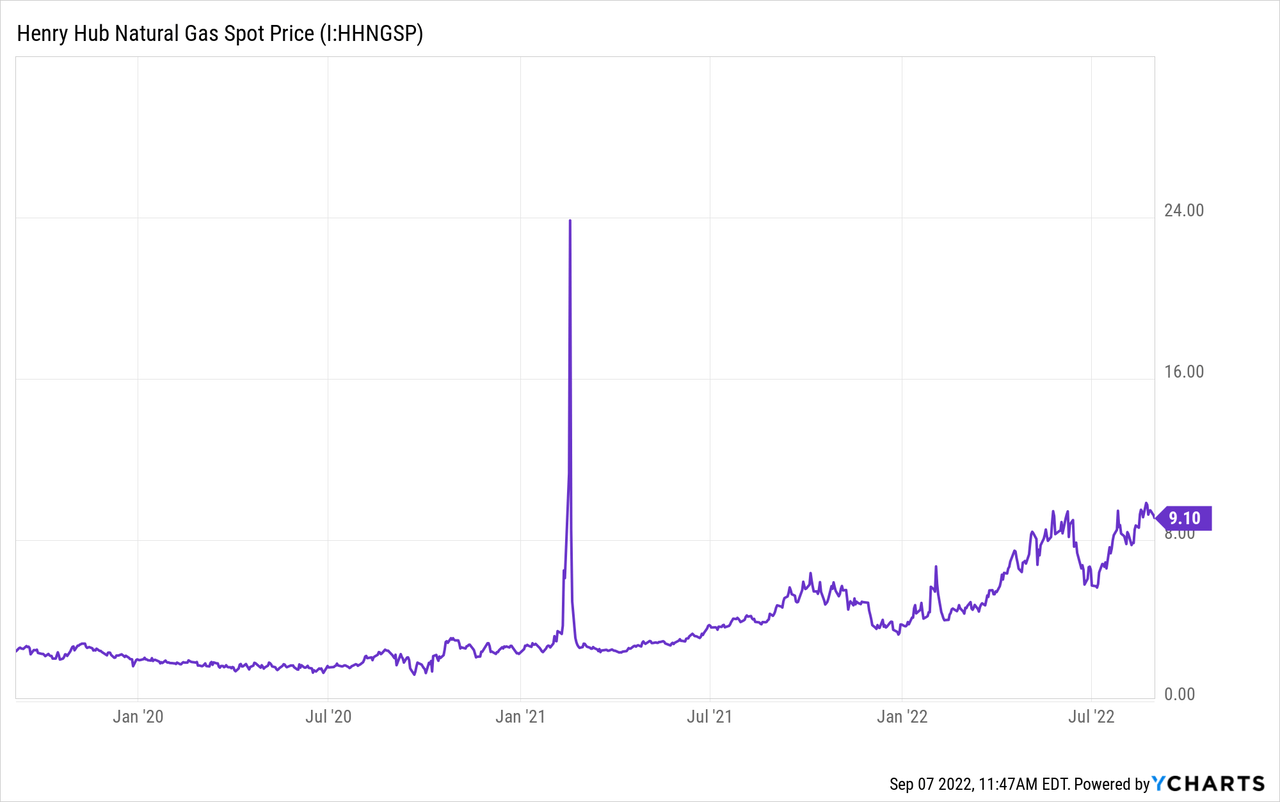

For now, Dutch TTF LNG prices last week averaged $83.62/MMBTU but went as high as $100/MMBTU. The JKM (Japan Korea Marker) reference price for LNG in Asia was only somewhat lower at $64.02/MMBTU. These are both several times the level of a year ago and of the corresponding US gas futures price of $8.95/MMBTU on Aug. 31, 2022.

Short-term demand is inelastic, hence the sky-high natural gas prices. Longer-term demand is more elastic, allowing solutions like coal and nuclear as substitute fuels, conservation, and alternate supplies brought in through new LNG infrastructure.

Some Russian LNG is apparently brought in via sale to China and Chinese resale to Europe.

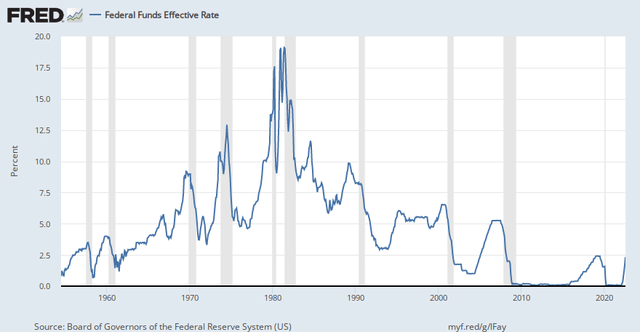

The Federal Reserve is trying to tame inflation, which affects Range’s labor and material costs, with gradual interest rate increases, which could affect Range’s borrowing cost. Recall that to bring down inflation in the 1980s, the Fed raised the Fed funds rate to 18%.

St. Louis Federal Reserve

Finally, there’s also the Biden administration’s and several states’ war on US hydrocarbon production.

LNG Exports

Building LNG export facilities requires long-term contracts and substantial capital. The US Energy Information Administration’s (EIA) summary graph shows expected progress of LNG export capacity. Total projected capacity of 20 BCF/D would represent about 20% of US gas production.

EIA

US Gas Production, Demand, and Prices

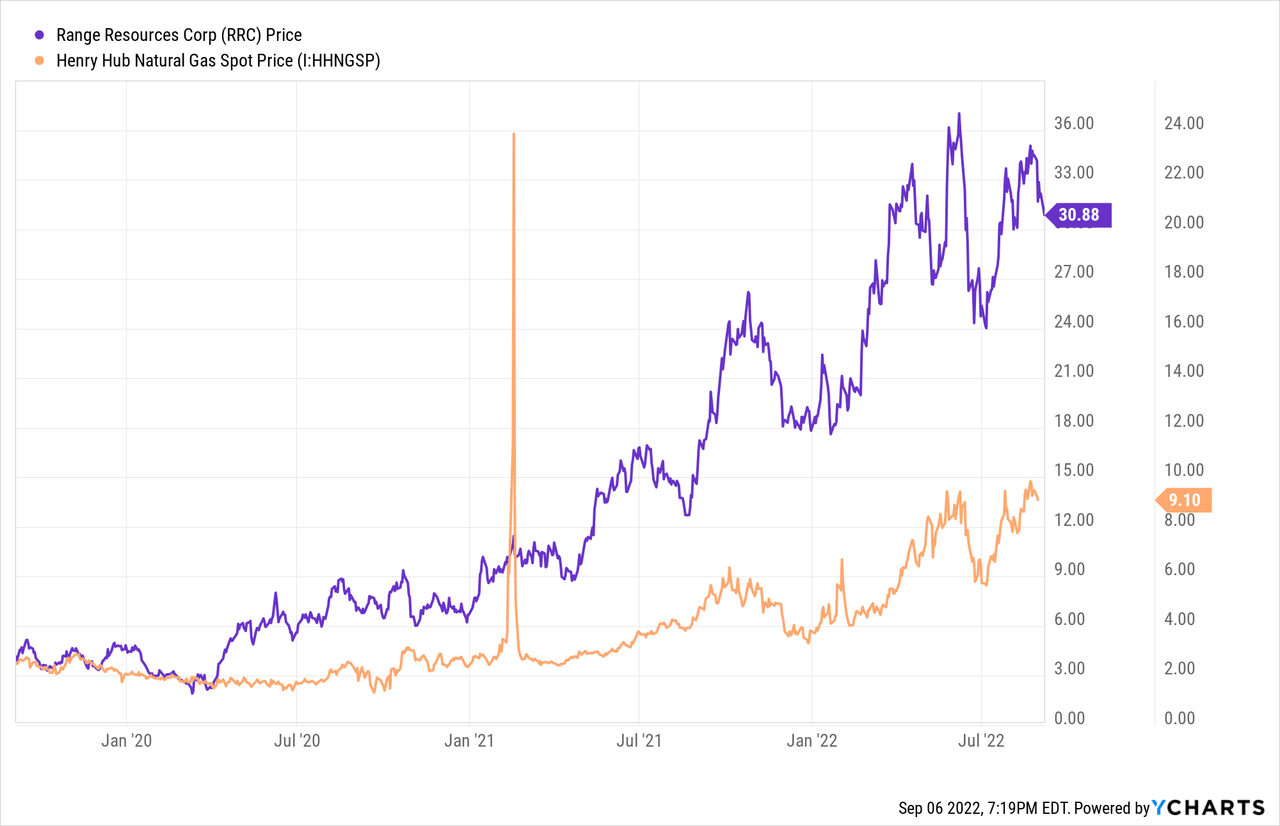

The Sept. 7, 2022 natural gas futures price for October 2022 delivery was $8.15/MMBTU at Henry Hub, Louisiana. The EIA projects $9+/MMBTU gas through 4Q22 falling to $6/MMBTU gas in 2023.

Meanwhile, last week the Marcellus natural gas price at Tennessee Zone 4—a representative Appalachian price on August 31, 2022, was $8.12/MMBTU; the corresponding Henry Hub price was $8.95/MMBTU.

Total US natural gas production in July 2022 was 96.4 BCF/D and the EIA estimates a ramp up to 100.3 BCF/D by year-end 2023. As the EIA projects US natural gas demand of 84.5 BCF/D in 2023 and LNG export capacity in 2023 of 14 BCF/D, the market could become slightly oversupplied.

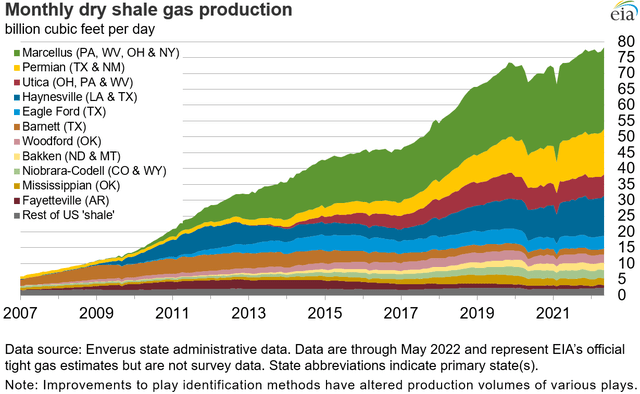

Appalachian gas volumes (the green-colored Marcellus and rust-colored Utica) are estimated to be 35.5 BCF/day in September 2022, more than 35% of US production.

EIA

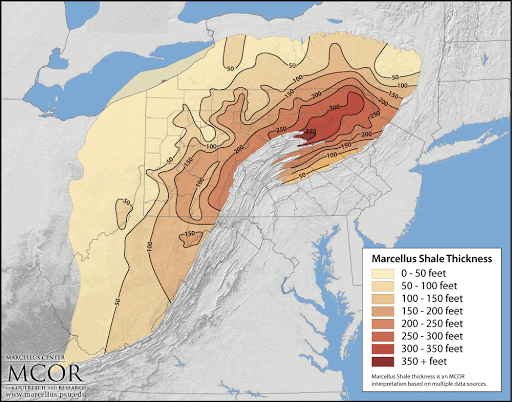

The map illustrates the Marcellus gas formation.

Penn State Marcellus Center for Outreach and Research

Natural Gas Liquids

NGLs (ethane, propane, and butane) are used to make ethylene, a critical petrochemical building block, and for heating and drying. Range also gets price uplift from its NGL production.

Reserves

Range Resources’ year-end 2021 total year-end proved reserves were 17.8 trillion cubic feet-equivalent that divide as 11.5 TCF of natural gas, 1.0 billion barrels of natural gas liquids, and 53 million barrels of crude oil and condensate.

Proved developed reserves were 10.4 TCFe, or about 58% of the total.

Because 2021 prices were higher than in 2020, the PV-10 value of the reserves increased by 4.5x, from $2.8 billion to $12.5 billion.

Hedges

As of July 15, 2022, Range’s oil and gas hedges are slated to roll off by 2024.

|

Total |

Total |

|||||

|

Gas Hedged |

Gas |

% Current |

Oil Hedged |

Oil |

% Current |

|

|

(MCF)* |

MCF/D** |

Production |

(Bbl)* |

BPD |

Production |

|

|

4Q22 |

83,860,000 |

931,778 |

64% |

598,000 |

6,644 |

84% |

|

2023 |

281,290,000 |

781,361 |

54% |

1,870,000 |

5,194 |

66% |

|

2024 |

117,740,000 |

327,056 |

23% |

228,000 |

633 |

8% |

|

*Assumes 1000 BTU/CF |

||||||

|

**90 days/quarter; 360 days/year |

||||||

Competitors

Range Resources is headquartered in Fort Worth, Texas. Although poor gas price economics inhibited the Appalachian natural gas sector for years, several other companies also toughed it out, including Antero Resources (AR), Chesapeake (CHK), CNX (CNX), Coterra (CTRA), EQT (EQT), National Fuel Gas (NFG), Ovintiv (OVV), and Southwestern Energy (SWN).

Appalachian natural gas is at a disadvantage due to pipeline constraints to natural gas in Louisiana, Texas, and Oklahoma for meeting Gulf Coast industrial, power, Mexican export, and LNG export demand.

Governance

At Aug. 28, 2022, Institutional Shareholder Services ranks Range Resources’ overall governance as an excellent 1, with sub-scores of audit (9), board (2), shareholder rights (1), and compensation (2). On the ISS scale, 1 represents lower governance risk and 10 represents higher governance risk.

As of August 2022, Range’s ESG ratings from Sustainalytics were high (not good) with a total risk score of 33 (73rd percentile).

Controversy level is 2, or “low,” on a scale of 0-5, with 5 as the worst.

Insiders own 2.7% of the stock. Shorted stock as a percentage of float is 7.0%.

Range Resources’ beta is 2.15. While much more volatile than the overall market, this is in line for an independent gas producer.

On June 29, 2022, the five largest institutional stockholders, some of which represent index fund investments that match the overall market, were Fidelity/FMR (15.4%), Vanguard (9.5%), Blackrock (9.5), State Street (4.2%), and Dimensional Fund Advisors (3.3%).

Vanguard, Blackrock, and State Street are signatories to the Glasgow Financial Alliance for Net Zero, a group that, as of May 31, 2022, manages $61.3 trillion in assets worldwide and which (despite less energy supply due to reduced Russian exports to Europe) limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner.

Other Range Resources Financial and Stock Highlights

With Range’s Sept. 6, 2022, closing stock price of $30.86/share, market capitalization is $8.1 billion.

Given a 52-week price range of $16.56-$37.44/share, the closing price is 82% of the 52-week high and 76% of the one-year target price of $40.86/share.

Range’s trailing twelve months’ returns on assets and equity are strong at 8.5% and 30.7%, respectively. Trailing twelve months’ EPS is $2.05 for a current price/earnings ratio of 15.

Trailing twelve months’ operating cash flow was $1.24 billion and levered free cash flow was $723 million.

At June 30, 2022, the company had $4.64 billion in liabilities and $6.615 billion in assets giving Range a high liability-to-asset ratio of 70%.

Of the liabilities, current liabilities are $844 million, derivative liabilities are another $647 million, and senior notes are $1.83 billion. (Current maturities of long-term debt are $531 million.)

The ratio of debt to EBITDA is 1.9.

Analysts’ average estimates of 2022 and 2023 EPS are $5.10 and $5.40, respectively, giving a forward P/E range of 6.1-5.7.

After a tumultuous several years, Range Resources pays a small dividend, $0.32/share, for a dividend yield of 1.0%. Share repurchase authorization is $500 million: It had bought back about $150 million in the first six months of 2022.

The company’s mean analyst rating is a 2.1, or “buy,” from 34 analysts.

Notes on Valuation

The company’s book value per share of $8.25, about a fourth of its market price, suggests positive investor sentiment.

With an enterprise value (EV) of $10.8 billion, Range’s EV/EBITDA ratio is 8.7, less than the preferred maximum of 10 or less and so in bargain territory.

So overall, Range Resources has

*a market capitalization of $8.1 billion,

*an enterprise value of $10.8 billion,

*reserves with a PV-10 value of $12.5 billion, and

*a balance sheet asset value of $6.6 billion.

Positive and Negative Risks

Investors should consider their natural gas price and demand expectations – especially in Appalachia with its limited takeaway capacity – as the factors most likely to affect Range.

The major factor is the loss of Russian pipeline gas exports to Europe creating a vacuum and much higher prices that draw and raise the price of all natural gas, but especially LNG that can be delivered to Europe.

Inflation is at a decades-high and is expected to stay so. This will affect Range’s costs, including financing.

Other risks are political and regulatory – particularly with the Biden administration, bankers including three of Range’s largest institutional investors, and several states on the East Coast – Range’s natural market–taking a race-to-zero-hydrocarbons posture.

Recommendations for Range Resources

Range Resources has an uphill battle with regulators fighting both pipelines and hydrocarbons generally. Moreover, gas supply can come on quickly, depressing prices.

Due to the small dividend yield, I do not recommend Range to dividend-seeking investors.

With 30% upside to the one-year target price, PV-10 reserve value above enterprise value, forward price-earnings range of 5.7-6.1, significant cash flow generating ability especially given the strong global macro for natural gas, some risk-seekers may find Range of interest.

Yet with inflation a concern, Appalachia’s limited gas takeaway capacity, and Range’s considerable debt, many will want to wait for more proof of concept.

Range Resources

Be the first to comment