Elena Bionysheva-Abramova/iStock via Getty Images

Introduction

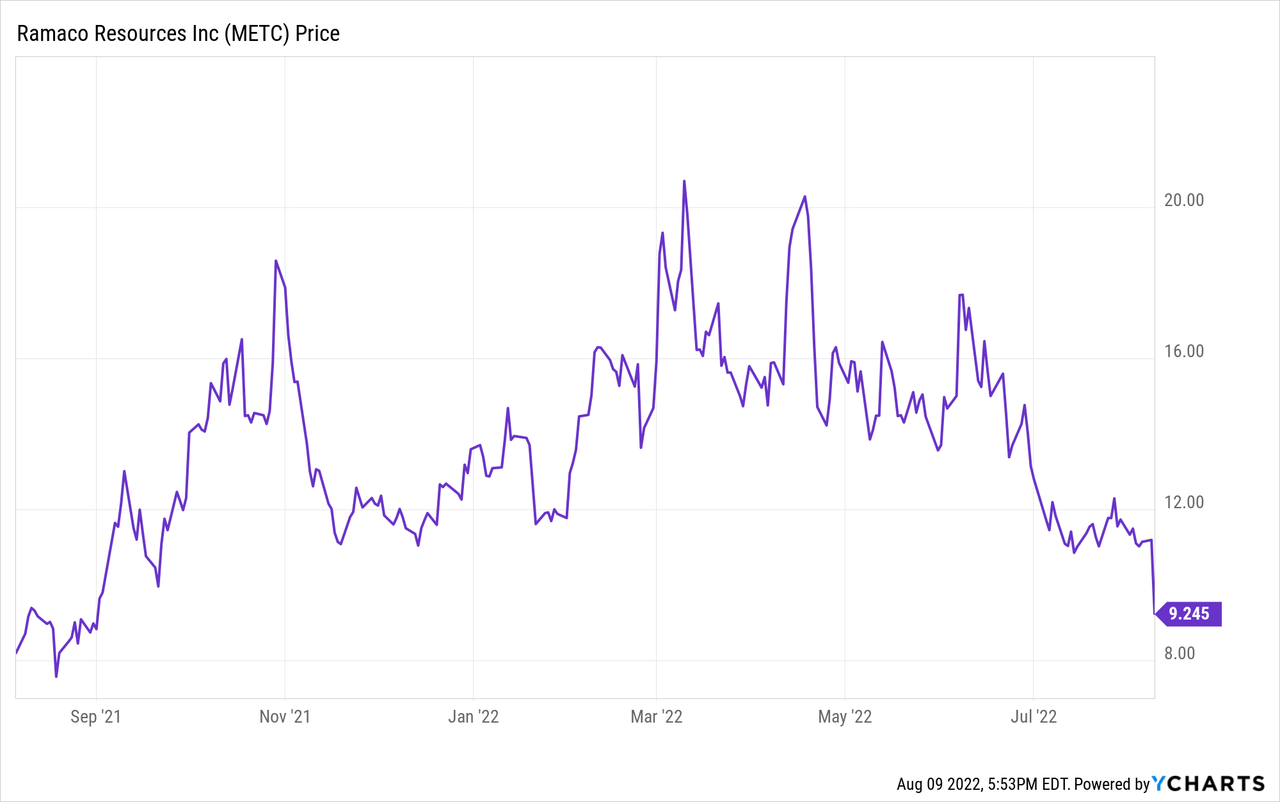

I have been keeping an eye on Ramaco Resources (NASDAQ:METC) (NASDAQ:METCL) for over a year now and I initially just purchased the 9% yielding senior notes. As the yield to call of those notes continued to decrease, I sold my entire position. Meanwhile I was still writing put options on Ramaco Resources’ common shares and it looks like I will end up with a long position after the most recent share price drop. I wanted to dig into the Q2 results to make sure that was the right decision and wanted to figure out if I should perhaps write more put options or cut my losses.

The financial results weren’t bad at all, the late shipment is just a minor nuisance

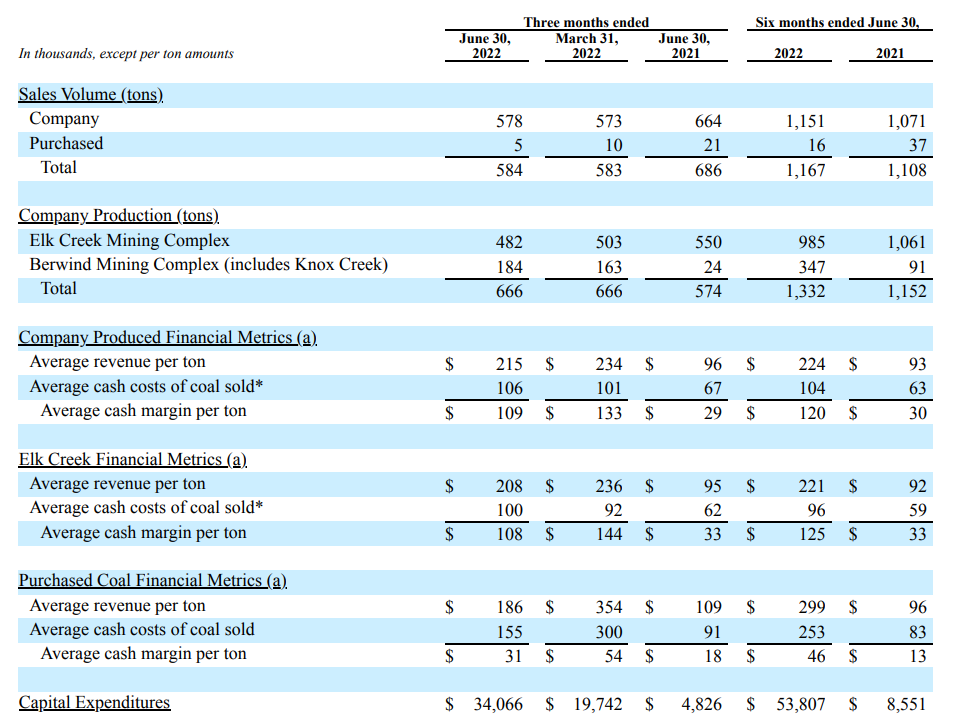

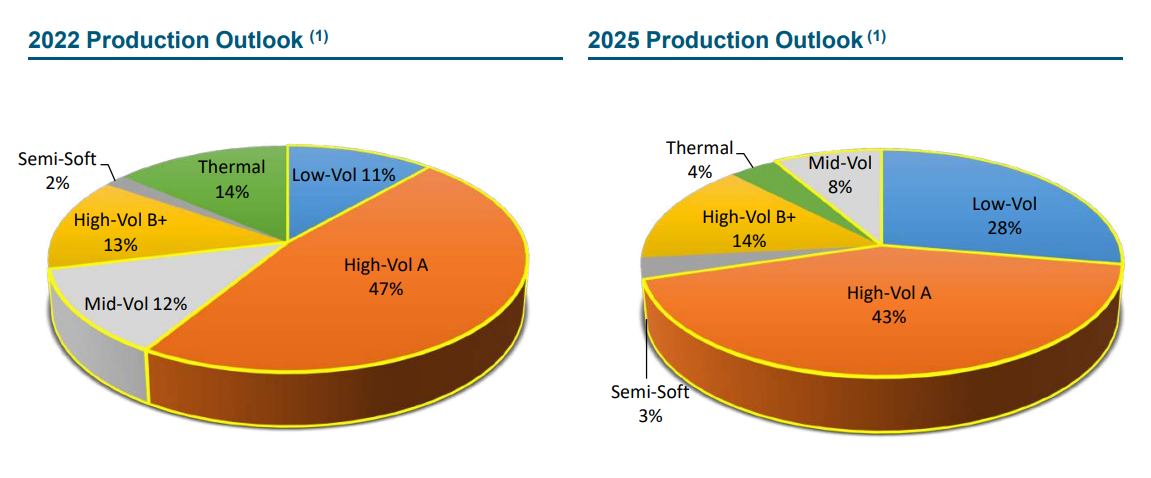

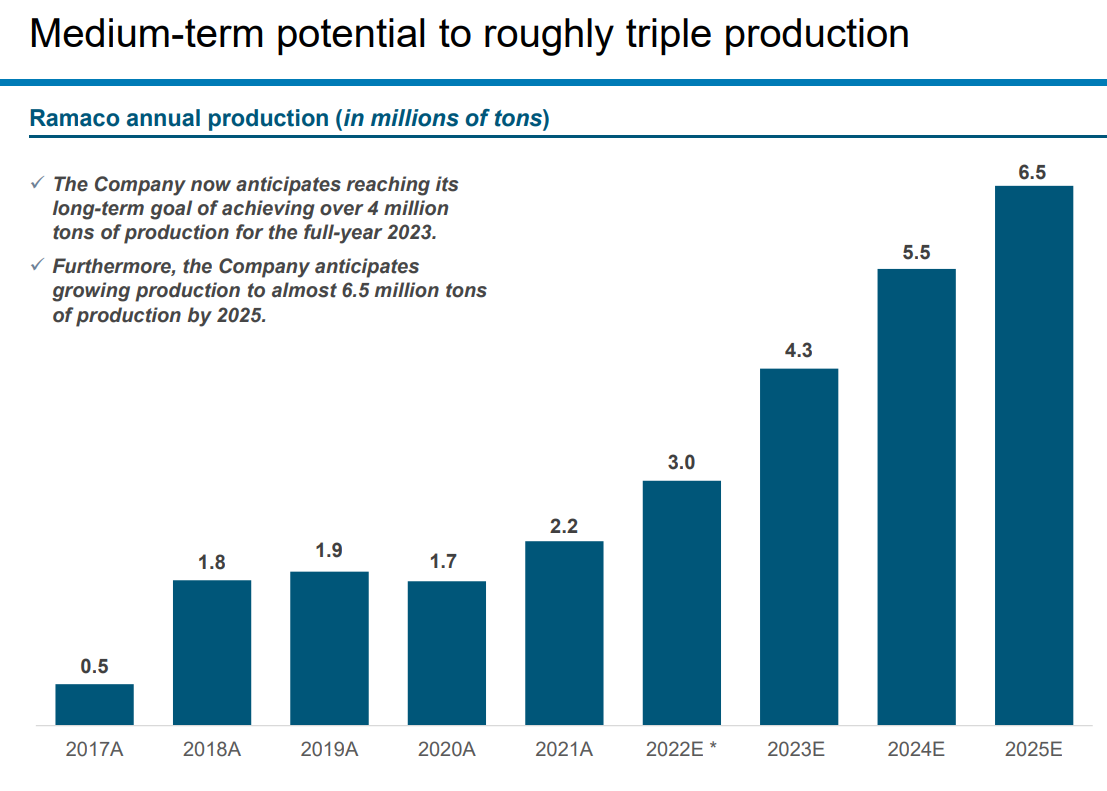

During the second quarter, the company produced just under 670,000 tonnes of coal but was only able to sell approximately 578,000 tonnes of coal. This means Q2 was the second quarter wherein Ramaco sold less coal than it produced. In the first half of the year, Ramaco produced 1.33 million tonnes of coal but only sold 1.17 million tonnes. The remaining coal is held in inventory and will obviously be sold over the next few months.

Ramaco Resources Investor Relations

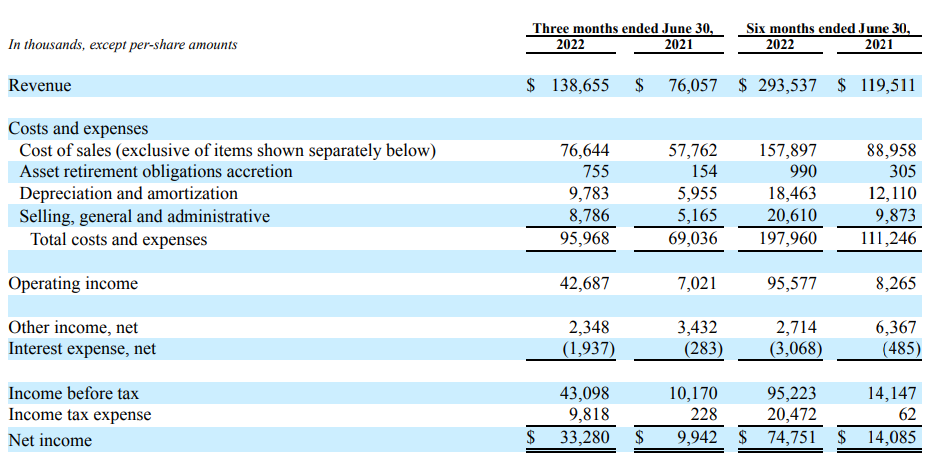

The total revenue in the second quarter was approximately $137M, and after deducting all expenses, the operating income came in at just under $43M. That’s lower than in the first quarter of the year as Ramaco generated a higher average sales price (fewer tonnes were sold domestically) at a slightly lower operating cost. Despite this, the net income of $33.3M still represented an EPS of $0.75 which is hardly anything to sneeze about.

Ramaco Resources Investor Relations

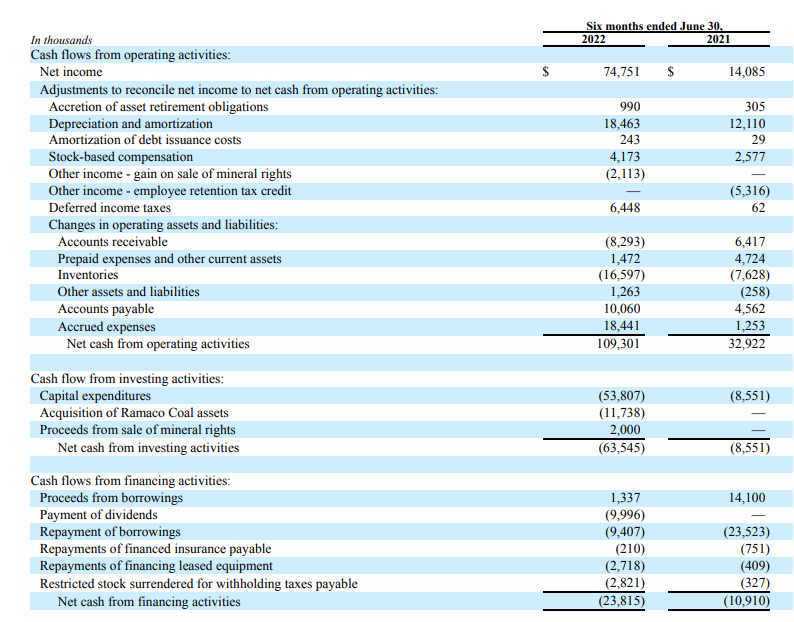

In the first semester, the reported operating cash flow came in at $109.3M. That includes some changes in the working capital position (including an inventory build-up which I will discuss below). Adjusted for these working capital changes, Ramaco’s operating cash flow was $102.9M and roughly $100M after deducting the lease payments. As a reminder, this is based on selling 1.15 million tonnes of coal at an average price of $224/t.

Ramaco Resources Investor Relations

The total capex in the first semester was $54M resulting in an underlying free cash flow of $46M or just over $1/share for the semester. The capex is high (and will be even higher in the second half of the year) as Ramaco is expanding its operations as it aims to produce 4.3 million tonnes of coal in 2023. The sustaining capex is likely just around $8-12M per quarter considering $70M of the current $105-125M capex guidance consists of growth capex.

Ramaco Resources Investor Relations

This means the Q2 results were OK. Not spectacular, but also not bad. One element that has likely contributed to the underwhelming market reaction is the inventory build-up due to rail delays. Ramaco confirmed it produced approximately 90,000 tonnes of coal that were originally anticipated to be shipped into the higher price export markets but those tonnes will now only be shipped in Q3 and as such recorded as Q3 revenue and cash flow. This will likely result in a stronger than anticipated cash flow in the second half of the year as the volumes have just shifted: The coal isn’t just suddenly “gone.”

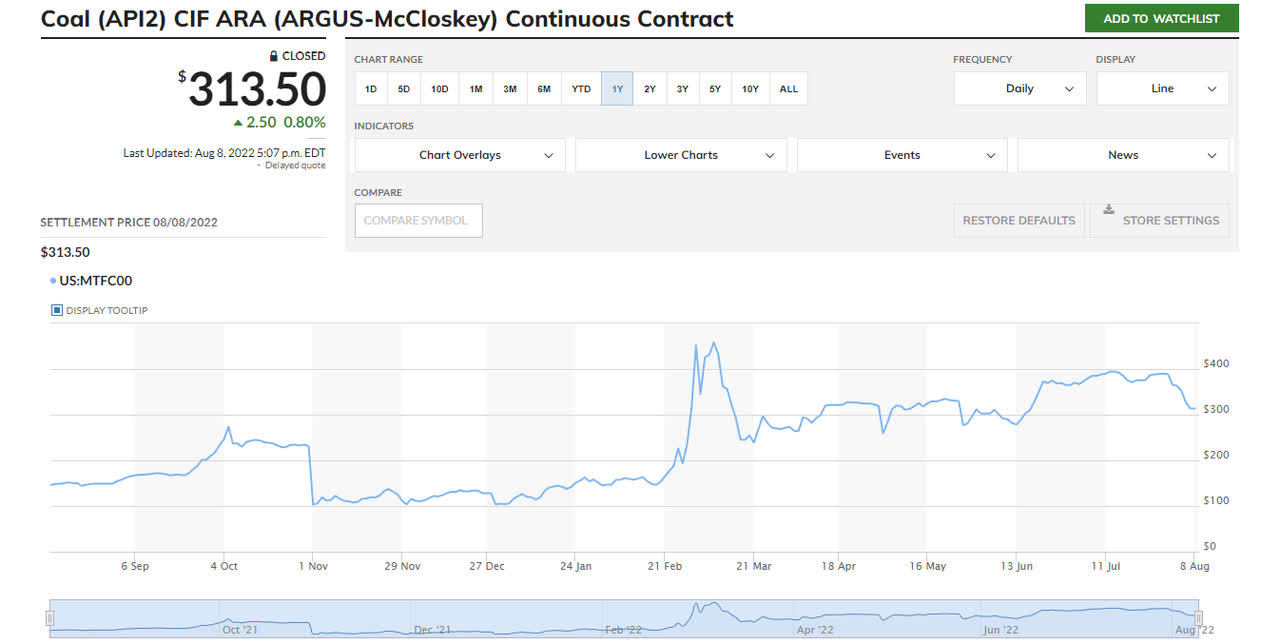

The company even calls it a blessing in disguise as some of the newer contracts for delivery in the second half of the year are now generating higher margins than anticipated. Ramaco mentions it signed a contract in July for the delivery of 250,000 tonnes of lower-grade metallurgical coal later this semester at a thermal coal index linked price. At the time the contract was signed, Ramaco anticipated a netback of $250/t so this batch of 250,000 tonnes will generate in excess of $60M in cash flow. This depends on the coal price and looking at the API2 coal price index, the index is now trading about $60/t lower than in July so perhaps we should adjust the expectations accordingly.

Ramaco Resources Investor Relations

The acquisition of Maben

So while Q2 (and H1) was a bit lighter than expected, the situation isn’t nearly as dramatic as what the 18% share price drop makes you think. Perhaps the market was also caught off-guard with the announcement Ramaco is spending $30M on a new acquisitions. It’s purchasing Maben Coal from Appleton Coal LLC for $9M in cash payable to the seller and an additional $21M payable from the proceeds of a secured note payable to Investec Bank.

The Maben Coal reserves total 33 million tonnes of coal of which 1.5 million tonnes will be mined immediately. The production is anticipated to start in Q4 2022 which means the total output in the current financial year will be negligible (25,000 tonnes) but Ramaco anticipates to produce 250,000 tonnes in 2023 at a cash cost of around $80/t. Add in the trucking costs to the Knox Creek preparation plant and a few additional expenses, and one could argue the all-in cost per tonne will be around $105-110/t, in line with the existing assets of the company. Based on the spot price of API2 as of August 4 (which was approximately $330/t) Ramaco anticipates a payback period of less than two years.

The longer-term production plans at Maben were not disclosed, and it feels a bit like this acquisition was accelerated by the methane ignition at one of the mines which resulted in a production guidance reduction for 2022.

Ramaco Resources Investor Relations

Investment thesis

The market is acting as if all of Ramaco’s mines have collapsed and no coal is being mined. The methane ignition was unfortunate and it’s understandable the production and sales volumes will be a bit lower than expected this year. However, looking forward to 2023, Ramaco is now guiding for an output of 4.3 million tonnes. That’s a 50% increase compared to the lower end of the updated 2022 production guidance and about 85% higher than the average production rate in the first half of this year. This means that at a margin of $100/t (lower than the current margins) Ramaco Resources should do very well considering its market capitalization has now dropped below $450M and its enterprise value is still less than $500M thanks to the low net debt position.

I currently have no position in Ramaco Resources but I have written put options (strike prices 10 and 12.5) and those will now likely end up being “in the money” and I intend to take delivery of the stock. I have sold my entire position in METCL as the after-tax yield to call was getting too low for my liking so at this moment I have no equity in position in any of the Ramaco securities but I expect to have a long position soon.

Be the first to comment