jimfeng

Right now, the housing market is in a very interesting state. While there is a housing shortage, the very real chance of a recession, combined with the impacts caused by rising interest rates, should help to offset some of the demand for housing. Exactly how this situation will work out remains to be seen. But more likely than not, it will result in a temporary lull in housebuilding that will then be made up for once the difficult times have passed. This lull could be painful for the companies involved. But by buying into a high-quality player that is trading on the cheap on both an absolute basis and relative to similar firms, investors could be positioning themselves well for the long haul. One great prospect to consider that fits this description is M/I Homes (MHO). In recent years, the company has done extraordinarily well for itself. We are seeing some weakness in demand at this point in time, but the overall picture for the company looks robust. As such, I’ve decided to rate the company a solid ‘buy’, reflecting my belief that it will likely outperform the broader market for the foreseeable future.

M/I Homes is a specialty homebuilder

According to the management team at M/I Homes, the company operates as one of the leading builders of single-family homes in the US. From its founding in 1976 through the end of its latest completed fiscal year, the company has sold over 136,700 homes. It largely operates in two key regions. One of these is the Northern region, which consists of states like Ohio, Indiana, Illinois, Minnesota, and Michigan. The other is the Southern region. This involves operations in Florida, North Carolina, Texas, and Tennessee.

The homes that M/I Homes builds are largely constructed in planned development communities and mixed-use communities. As I mentioned already, they are single-family homes letter dedicated largely to first-time, move-up, empty nester, and even luxury buyers. The company acquires much of the land that it builds on and then ultimately sells both as a completed product to the home buyer. Generally speaking, the homes that it sells range in price between $210,000 and $788,000. The company also provides various financial services associated with the home buying process. For the most part, activities in this category involve the origination and selling of mortgages, as well as the collecting fees for title insurance and closing services. But this particular portion of the enterprise is fairly small, accounting for just three percent of sales in any given year.

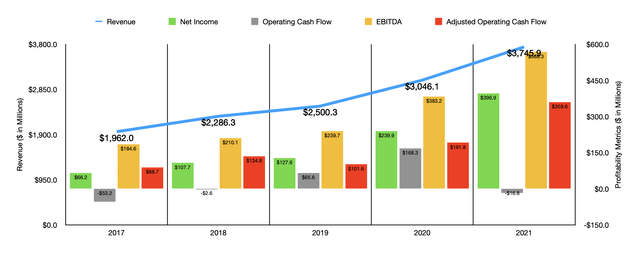

Author – SEC EDGAR Data

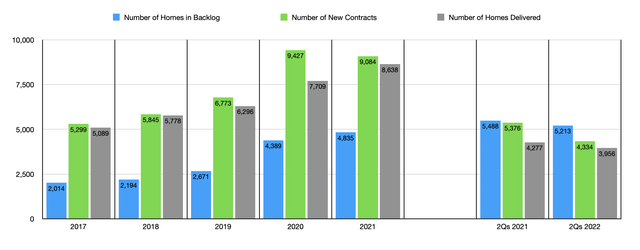

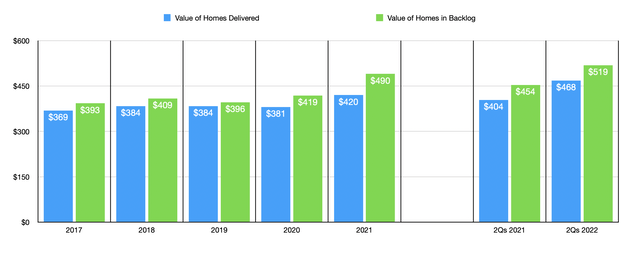

Over the past few years, the management team at M/I Homes it’s done a remarkable job growing the company’s top line. Revenue has risen consistently, climbing from $1.96 billion in 2017 to $3.75 billion in 2021. This increase in sales was driven by a couple of factors. The largest, by far, was an increase in the number of homes delivered. This number ultimately jumped from 5,089 in 2017 to 8,638 in 2021. Another contributor has been an increase in pricing for an average home that the company has sold. For homes delivered, the average price has increased from $369,000 to $420,000. What’s also exciting is that this trend, at least near term, looks to be positive. The average sales price of the homes in its backlog have risen over that same timeframe from $393,000 to $490,000.

Author – SEC EDGAR Data

As revenue has risen, profitability has followed suit. Net income grew from $66.2 million in 2017 to $396.9 million in 2021. Cash flow has been a bit more volatile but has still trended higher. This metric went from negative $53.2 million in 2017 to $168.3 million in 2020. In 2021, this metric came in negative to the tune of $16.8 million. If we adjust for changes in working capital, however, the trend has been consistently positive. The metric ultimately would have increased from $88.7 million in 2017 to $359.6 million last year. Meanwhile, EBITDA has risen from $184.6 million to $568.3 million during the same five-year window.

Author – SEC EDGAR Data

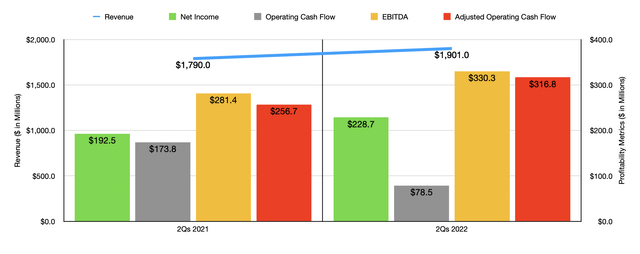

When it comes to the 2022 fiscal year, the picture is looking somewhat mixed. From a purely revenue and profitability perspective, the picture is mostly positive. For instance, revenue of $1.90 billion in the first half of the year came in above the $1.79 billion generated the same time one year earlier. Net income rose from $192.5 million to $228.7 million. Operating cash flow did fall, declining from $173.8 million to $78.5 million. But if we adjust for changes in working capital, it would have risen from $256.7 million to $316.8 million. And over that same time, EBITDA increased from $281.4 million to $330.3 million.

Author – SEC EDGAR Data

This strength for the company comes largely thanks to an increase in average selling prices for its homes. For homes delivered, pricing increased from $404,000 in the first half of last year to $468,000 the same time this year. Meanwhile, the average price in the company’s backlog rose from $454,000 to $519,000. There was, unfortunately, some weakness the company experienced. The total number of homes delivered, for starters, declined from 4,277 to 3,956, while the company’s backlog contracted from 5,488 to 5,213. The number of new contracts the company had on a net basis also worsened, falling from 5,376 to 4,334. Clearly, this is a sign of weakness in the market that is largely as a result of higher interest rates and recessionary fears. Higher costs associated with housing in general are almost certainly a problem in this.

Author – SEC EDGAR Data

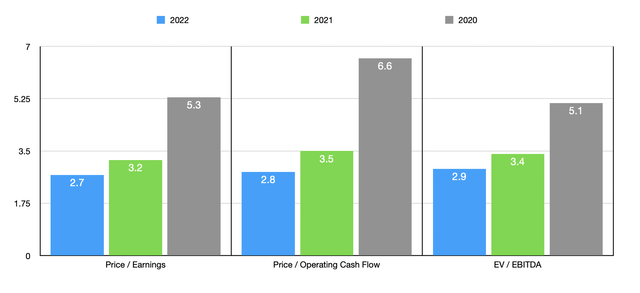

Even though M/I Homes may be hitting an inflection point, shares look almost too cheap to pass up. For the 2022 fiscal year, there’s no telling what the picture will look like. But if we annualize results experienced in the first half of the year, we should anticipate net income of $471.5 million, adjusted operating cash flow of $443.8 million, and EBITDA of $667.1 million. This gives us a price-to-earnings multiple of 2.7, a price to adjusted operating cash flow multiple of 2.8, and an EV to EBITDA multiple of 2.9, respectively. Even if we assume that the company reverts back to 2021 levels, these multiples are still low at 3.2, 3.5, and 3.4, respectively. And a return to 2020 levels would change these multiples to 5.3, 6.6, and 5.1, respectively. To put the pricing of the company into perspective, I compared its 2021 calculations to the performance of five similar firms. On a price-to-earnings basis, these companies ranged from a low of 2.6 to a high of 7. Only two of the five companies were cheaper than our prospect. Using the price to operating cash flow approach, only three of the five companies had positive results, with their multiples ranging between 11.8 and 16.7. And using the EV to EBITDA approach, the range for the five firms was between 3.7 and 8.5. In both of these cases, M/I Homes was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| M/I Homes (MHO) | 3.2 | 3.5 | 5.3 |

| Green Brick Partners (GRBK) | 5.1 | 16.7 | 5.0 |

| Dream Finders Homes (DFH) | 7.0 | 16.7 | 8.5 |

| Century Communities (CCS) | 2.9 | N/A | 3.7 |

| Tri Pointe Homes (TPH) | 3.8 | 11.8 | 3.7 |

| Beazer Homes USA (BZH) | 2.6 | N/A | 6.6 |

Takeaway

Based on all the data provided, I will say that M/I Homes looks cheap on both an absolute basis and relative to similar firms. I have no problem admitting that the company and the industry itself is likely to face some weakness moving forward. That weakness could last a while. At the same time, however, even a return to prior profitability levels experienced during the pandemic would lead to shares looking very cheap on an absolute basis. Plus it helps that shares already look cheap compared to similar firms. All of this, combined, has led me to rate the enterprise a ‘buy’ for now.

Be the first to comment