Black_Kira

Investment Thesis

Radware Ltd. (NASDAQ:RDWR) mainly focuses on providing cyber security and application delivery solutions. The company has recently announced the launch of a new cloud center in Italy which can accelerate the company’s growth in terms of sales and further expand its profit margins as it can help the company to cater to the rising demand in the market.

About RDWR

RDWR deals in providing cyber security and application delivery solutions. The company provides these solutions to cloud, physical, and software-defined call centers. It offers a wide array of physical products, software products, cloud-based subscriptions, and product subscriptions. The products and services of the company are sold through distributors and sellers in multiple locations such as North, Central, and South America, Asia, Africa, Europe, and Australia. It also offers customer services such as professional services, technical support, and training & certifications. It mainly carries out direct sales in the United States, supported by sales and marketing managers. The company generates 45% of its total revenue from North, Central, and South America, 34% from Europe, the Middle East & Africa, and 21% from Asia-Pacific. Product sales accounted for 58% of the total revenue, whereas 42% of revenue was derived from service sales. Even in the global pandemic situation, the company has performed well hence signaling the excellent position of the company. The company has also invested in research and development activities at its facilities in Israel, Canada, Vancouver, India, North Carolina, and the United States.

New Cloud Security Center

As I have explained in the previous section, the company has confirmed a dramatic increase in cyberattacks globally in the First Half of the 2022 Global Threat Analysis Report. This dramatic rise reflects the increased customer need for cyber security, which might be a potential opportunity for the company to acquire customers. I believe the company can attract many customers as it is one of the leading companies in the industry with the competitive advantage of automation, which helps them offer automated attack detection and mitigation solutions to enterprises. This competitive advantage enables the company to mitigate such threats at lower costs. As the need for cyber security is rising, the company has also recently expanded its relationship with a Fortune 500 financial services provider in a multi-million dollar deal. As the demand increases in the markets, it will be crucial for the company to expand its attack detection and mitigation capacity to maintain its competitiveness. Identifying this need for expansion, the company has recently announced the launch of a new cloud security center in Italy. This center will protect the customers from volumetric DDoS and application-level DDoS attacks. It will also protect them from OWASP Top 10 Web Application Security risks 2021, OWASP Top 21 Automated Threats to Web applications, and OWASP API Security Top 10. The company currently has a mitigation capacity network of over 10 Tbps. Among these, the most recent facilities were launched in Chile, Taiwan, and the United Arab Emirates. I believe the new launch of the cloud center in Italy can significantly improve the company’s ability to address rising demand and increase the number of customers they serve. I think the customer base might rise due to this new cloud center which can boost the company’s sales volume and further expand its profit margins by enhancing its competitive advantage of automation.

Financial Trend

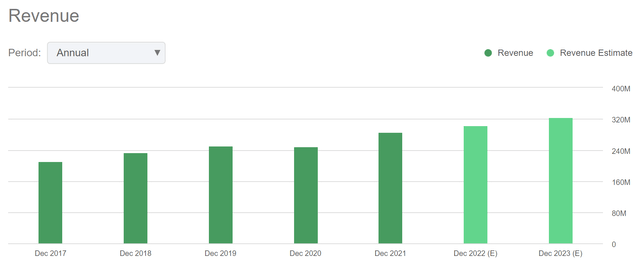

The company has experienced stable revenue growth in the last five years. The revenue has grown from $211.37 million in FY2017 to $286.5 million in FY2022 resulting in a 5-year CAGR of 6.27%. In FY2020, the company managed to perform well despite the pandemic and economic slowdown. According to the seeking alpha estimates in the coming years, the company can earn revenue of $303.33 million and $323.05 million in FY2022 and FY2023, respectively, resulting in a 3-year CAGR of 4.08%. I think these estimates are conservative; let me explain why. According to the company, the cybersecurity solution demand is correlated to the level of threats and attacks. The company provides a solution to block the attacks such as distributed denial-of-service attacks ((DDoS)), web applications attacks, and bad bot attacks. Recently, the number of all of these attacks has significantly increased. The DDoS attacks have increased by 203%, while Web application attacks have increased by 38% compared to the last year. In Q2FY2022, the bad bot attacks have risen by 148% compared to the same period of last year. I think the number of cyberattacks might continue to increase with the rising digitalization of the economy. To cater to this demand, the company has opened a new cloud security center in Italy. The company is also targeting midsize customers who have similar cyber threats & security requirements, like the large enterprise peers. Generally, midsize customers cannot afford high-end solutions as they have limited funds for cybersecurity. The company provides cheap cloud security service with a high-end level of protection, which can significantly increase the company’s customer base. Also, the company plans to expand its global footprint in various geographies and presence in Taiwan, which can boost its customer base and earnings. After considering all these factors, according to my analysis, the accurate revenue estimations for FY2022 and FY2023 are $321.6 million and $345.8 million, respectively, resulting in a 3-year CAGR of 6.47%.

Also, the company has shown strong EPS growth in the last five years. The EPS has grown from $0.17 in FY2017 to $0.81 in FY2022 resulting in a 5-year CAGR of 36.65%. Recently the company has completed the integration of the Security-Dam, which has expanded its gross margin by 100bps. After considering the projected revenue and gross margin expansion, my EPS projections for FY2022 and FY2023 are $0.82 and $1.00.

What is the Main Risk Faced by RDWR?

Low Entry Barrier

The market in which the company deals has very few barriers to entry which makes it highly competitive. If new participants enter the market with emerging and advanced technologies, the competition can highly intensify, and further, the company can lose its market share if it fails to compete effectively. The competitors in the market compete based on advanced technologies and new solutions. They also compete on finances, personnel, and other resources. If the company is unable to keep up, it can result in reduced demand for its solutions which can affect its sales volume, further putting pressure on its profit margins.

Valuation

The rising demand for cybersecurity solutions and expansion in various geographies can increase the customer base and drive growth for the company in the coming years. After considering these factors, I project the EPS for FY2023 to be $1.00, which gives the forward P/E ratio of 21.4x. The company is trading above its sector median of 16.76x. However, RDWR has always shown a tendency to trade significantly above its sector median, as its 5-year average P/E ratio is 45.77x, which is 173% higher than its sector median. I believe the company is well positioned to tackle the new entrants as it has the competitive advantage of automation, which helps them to offer automated attack detection and mitigation solutions. Hence, I think the company can trade at its 5-year average P/E ratio of 45.77x. The EPS of $1.00 and P/E ratio of 45.77x gives the target price of $45.77, representing a potential upside of 114% from the current share price.

Conclusion

RDWR has recently announced the launch of a new cloud center in Italy which I believe can significantly help the company to serve more customers as the cyber-attacks have seen a dramatic rise in the first half of 2022. The company deals in a competitive market where entry barriers are low. RDWR always tends to trade significantly above its sector median, as its 5-year average P/E ratio is 45.77x, which is 173% higher than its sector median. After analyzing all these factors, I assign a buy rating to RDWR.

Be the first to comment