Justin Sullivan

Shares of NVIDIA Corporation (NASDAQ:NVDA) have significantly underperformed the iShares Semiconductor ETF (SOXX), with a year-to-date (“YTD”) return of -58%. The revenue outlook is looking increasingly bleak in the current macro backdrop. Like many tech hardware players facing headwinds, Nvidia is not immune to disappointing results, as peers such as Advanced Micro Devices, Inc. (AMD) recently pre-announced that PC-related revenue will decline by 40% in Q3 (analysis here). Markets are nervous, the semiconductor sector is selling off as of writing, and Nvidia investors should brace for another 1-2 quarters of underwhelming results.

Expectation vs. Reality

In 1Q22, Nvidia guided Q2 total revenue of $8.1 billion at the midpoint where Gaming sales were expected to “decline sequentially.” This was initially good news to the market, as investors were somewhat relieved that management finally acknowledged weakness in the gaming business following a very strong 2021 when demand for its top-notch GPUs skyrocketed. As a result, shares rallied 5% the day after earnings.

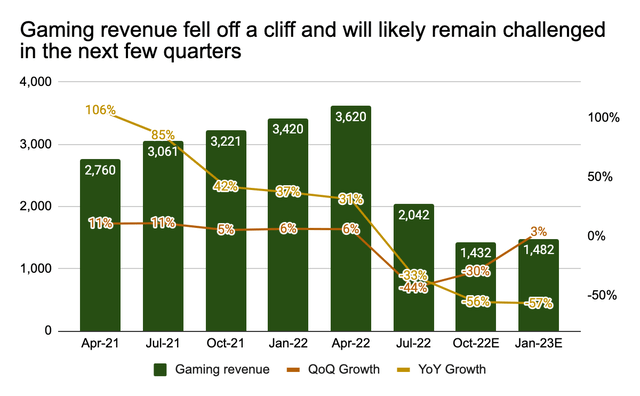

The question then was how much Gaming would fall going forward. Looking back at my previous article on 5/31, the sentiment I felt was that Gaming would certainly slow in Q2. Anywhere between negative 10-15% QoQ would seem appropriate due to management’s comment about a sequential decline and the market’s understanding of “normalization”. Unfortunately, what Nvidia subsequently delivered was quite underwhelming (but also weirdly unsurprising): 2Q22 Gaming revenue fell 44% QoQ / 33% YoY to $2 billion.

The decline in Gaming GPU revenue was sharper than anticipated, driven by both lower units and lower ASPs. Macroeconomic headwinds across the world drove a sudden slowdown in consumer demand. – Nvidia FY2Q23 earnings call.

Too many GPUs

In brief, there are too many GPUs in the economy. Demand is clearly not on the same page as supply. Consumers may now prefer a trip to Thailand over a GPU upgrade. It’s quite astonishing how fast the supply-demand dynamics can change in the graphics card market. Nvidia responded positively to an analyst’s question on whether a 30%+ QoQ decline in Gaming sales was the right context for 3Q22 (Q2 earnings transcript).

Company data, consensus estimates. Albert Lin

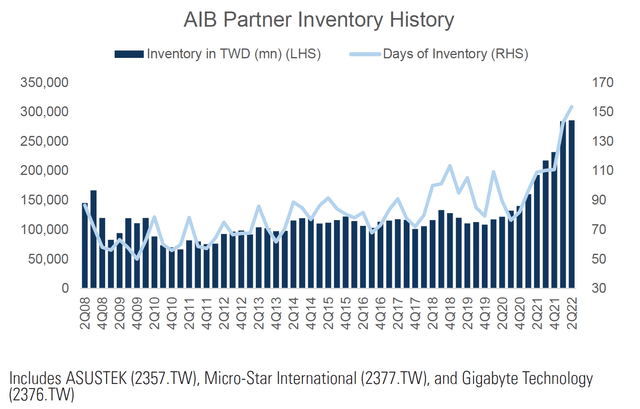

We can see from consensus estimates that investors are frankly not expecting much despite the fact that Nvidia will soon be launching (10/12) its top-end RTX 4090 GPU, which uses the 4nm Ada Lovelace architecture and will have an MSRP of $1,599 ($100 above RTX 3090). The RTX 40 series will have upgraded DLSS 3.0 technology and will boost performance by 2-4x vs. the best RTX 30’s GPUs. The problem, however, is that there are currently too many cards in the market, as illustrated by the inventory levels at Nvidia’s AIB (Add-In-Board) partners below.

Goldman Sachs, FactSet, Company data

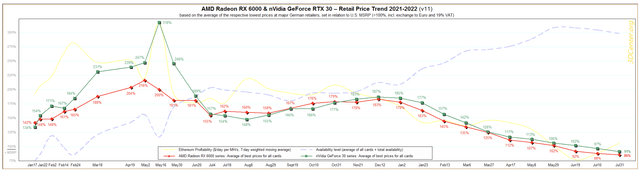

With inventory at unsustainably high levels in a post-Covid environment, and with depressed crypto prices, GPU prices can only drop as channel partners get rid of excess stock. Per this price tracker by 3D Center, average prices of the RTX 30 series at major German retailers have fallen from 185% of MSRP in January to 91% in July.

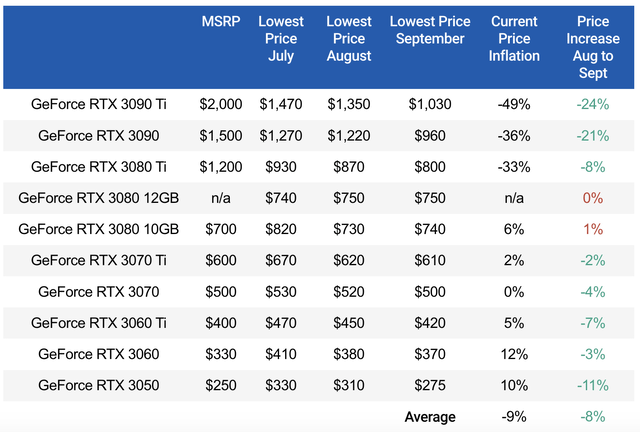

A recent GPU pricing update by TechSpot also indicates that Nvidia’s high-end GPUs are currently selling at a significant discount to their respective MSRPs. For example, the RTX 3090 GPU is now selling at just below $1,000 vs. $1,500 MSRP. It has seen continuous price declines over the past 3 months. AMD is more or less the same story, albeit suffering less impact from miners.

Understandably, prices of the RTX 30 series will have to be reduced in order to make way for the new RTX 40 series. However, there are two main reasons why MSRPs of the 40 series may not hold for long:

- GPU mining is dead. On 9/15, Ethereum officially completed the shift from PoW (proof-of-work) to PoS (proof-of-stake). The PoS mechanism eliminates the need for mining blocks of transactions as coin owners can now “stake” their coins (minimum 32 ETH) to become validators. This makes the whole network more efficient with 99.9% less energy consumption. As a result, GPU demand from miners will drop, availability will rise, and prices will fall as more cards hit the second-hand market.

- RTX 30 oversupply. Elevated RTX 30 inventory levels inevitably lead to lower prices, which will also impact demand for the RTX 40 series. While RTX 40 GPUs offer significantly better performance, not everyone will want to pay full price for a 4090 when a 3090 is now priced at below $1,000 while everything else including food, rent and gas is more expensive. For many serious gamers, high-end RTX 30 GPUs can already get the job done.

Muted outlook

Given the weakness in Gaming revenue, Nvidia expects 3Q22 revenue of $5.9 billion at the midpoint, implying a YoY decline of 17%. The Street consensus is currently slightly lower at $5.8 billion, as analysts expect Gaming revenue to be just $1.43 billion (25% of revenue), down 30% QoQ / 56% YoY. During the Covid days, Gaming was a major growth driver (as well as Data Center), accounting for 45-50% of revenue.

While excess GPU inventory will likely take a few quarters to work through, it’s difficult to imagine Gaming returning to its glory days of $3 billion plus in quarterly revenue even if there’s another widespread lockdown. Perhaps recovering crypto prices may help, but a new consensus mechanism for widely mined coins like ETH will require significantly less GPU investment.

As Gaming becomes a smaller percentage of revenue, investor attention will begin to shift towards Nvidia’s Data Center business, which posted a robust 61% growth in 2Q22 and 83% in 1Q22. However, such growth rates are obviously unsustainable, which explains why current estimates imply YoY growth will moderate to 32% in Q3 and 24% in Q4. While Automotive is an exciting story, with increasing design wins across automakers and robotaxis, the size of the business (~3% of 2022E revenue) is too small to make a difference in the near term.

Final thoughts

As of writing, shares of Nvidia currently trade at 35x CY2022 EPS and 26x CY2023 EPS, a premium to the S&P 500 (SPY) (15x) and the Philadelphia Semiconductor Index (13x). During the last crypto down cycle, where Bitcoin (BTC-USD) prices tanked 80%, Nvidia saw its multiple contract to 18x forward earnings as Gaming revenue experienced a sharp decline.

Although Nvidia is a much more different story this time, as Data Center is now a bigger revenue contributor, multiples are still at risk of further compression. Gaming weakness cannot be completely offset by DC strength, and higher interest rates will continue to put investors in an uncomfortable position on the valuation side of things. This means more negative news flow and price volatility, at least in the short term. For this reason, I rate Nvidia shares a Hold and would recommend investors to remain on the sidelines until we have better clarity.

Be the first to comment