metamorworks/iStock via Getty Images

After we initiated coverage of Leonardo (OTCPK:FINMF), today we are focusing on Leonardo DRS and RADA Electronic Industries (NASDAQ:RADA). Leonardo DRS was formerly known as DRS Technologies Inc. and it was a publicly-traded company before being acquired by the Italian group in 2008. Whereas, RADA is a leading provider of advanced military tactical radars, including critical infrastructure protection, border surveillance, active military protection, and applications against drones. The RADA group was founded in 1970 and is based in Israel.

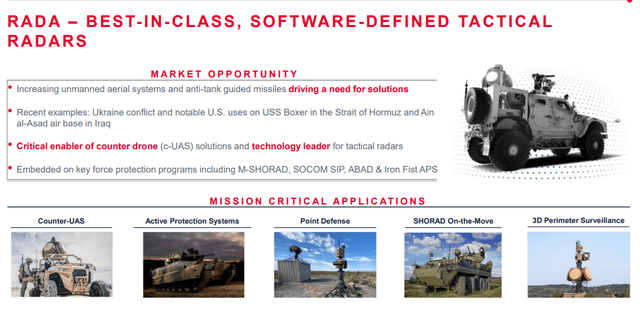

Rada at a Glance

Source: Leonardo DRS Combination with RADA

On Tuesday 21 June, in the pre-trading session, Leonardo announced a binding agreement for the merger between RADA into DRS with an automatic listing of the latter that is expected by the year-end. Thus, Leonardo found a solution to list DRS after having failed the IPO twice in 2021 for unfavorable market conditions and also for a non-compelling valuation.

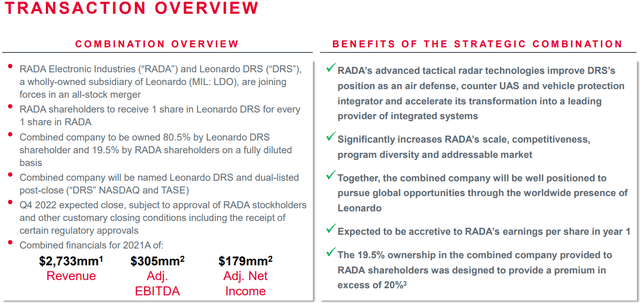

As a result of the merger, Leonardo DRS will acquire 100% of the share capital of RADA. The combined entity will be owned by Leonardo for 80.5% and the remaining 19.5% by the current RADA shareholders. More details are in the snap below. Among other things, the transaction is subject to RADA shareholders’ approval and also to regulatory requirements. RADA is listed not only on Nasdaq but also on the Tel Aviv stock exchange, where it will also be listed on DRS as a result of the merger.

Transaction Overview

Source: Leonardo DRS Combination with RADA

“The combination of RADA’s tactical radar capabilities and Leonardo DRS’ strength as a premier mid-tier defense provider make the Combined Company a leader in the rapidly growing force protection market, increases our addressable market, expands international opportunities, and ultimately unlocks value for shareholders” explained William J. Lynn III, CEO of Leonardo DRS. This transaction makes sense also at a commercial level. More in detail, RADA has a strong complementarity with the rest of the Leonardo group. Its advanced tactical radars complement Leonardo’s sensor portfolio, allowing it to obtain a stronger position in the emerging sectors of the tactical operating segment. The transaction also adds a domestic presence in Israel and supports the development of the international market for Leonardo, while allowing RADA to access opportunities in the markets and European and export programs, leveraging on Leonardo’s global presence.

In recent years, Leonardo has strengthened Leonardo Drs’ competitive positioning with a particular focus on its core business thanks to GES and AAC sales. Through the combination with RADA, the combined merger will be a leader in the defense solutions business.

Conclusion

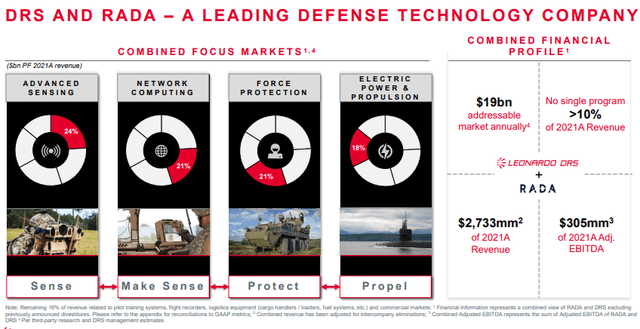

All other things being equal, if we consider that RADA’s enterprise is around $530 million and it trades with a 22x EBITDA multiple, the deal would lead to a combined new entity with an enterprise value of approximately $2.6 billion. Considering that 19.5% of the new entity will be attributed to RADA, the implicit valuation of DRS should be around $2.1 billion versus our valuation of around $2.8 billion. This is justifiable only by the possible operational synergies that the operation is expected to generate in the coming years and from the control acquired over the company. The transaction implies a premium of about 20% on RADA, which takes into account the majority premium and is higher than the average growth rates of the sector. We favor the transaction.

Leading defense player

Source: Leonardo DRS Combination with RADA

Previous coverage of defense companies:

- Leonardo: Back To Profitable Growth

- Leonardo: Still On Hold

Be the first to comment