Adrian Vidal/iStock via Getty Images

Unless you went to cash or invested heavily across the oil patch, chances are your investments are stuck between a rock and a hard place. There have been limited places to hide as both the Nasdaq and S&P 500 have slid into bear markets, and bonds didn’t offer the type of protection conventional wisdom would have us believe. The 60/40 portfolio and even target-date funds are underwater in this economic environment. Many investors don’t move in and out of the markets as tops and bottoms aren’t known until well after their established, and missing entry and exit points becomes a huge gamble. All we can do is speculate on when the pain will end based on historical trends.

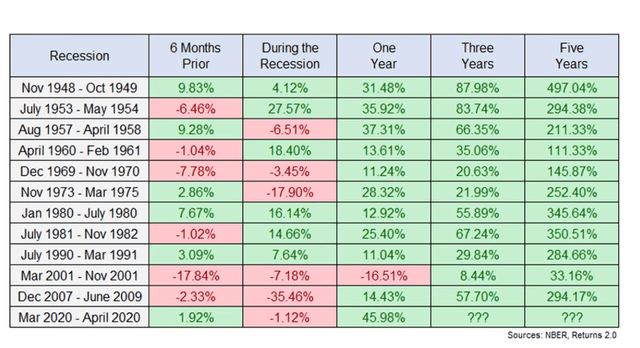

There have been 12 recessions since 1948. There were 3 occurrences where the market finished in the green 6 months prior, during, and 1 year after the recession ended. There were 6 occurrences where the markets finished in the green during the recession. There was only 1 occurrence where the market finished negative 1 year after a recession. To date, every recession which has ended has resulted in the markets being higher 3 years after and 5 years after 100% of the time. The big question that remains is how will the Fed’s quantitative tightening impact the markets? The Fed will take a phased approach to unwind its balance sheet, and as of June 1st, the Fed started with a 3-month period of unwinding $30 billion of treasuries and $17.5 billion in mortgage-backed securities. These amounts will increase to $60 billion and $35 billion in September.

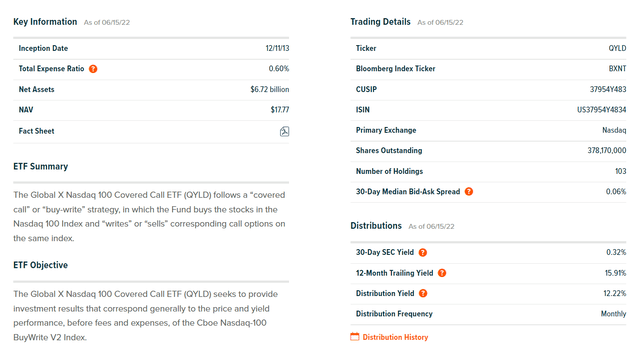

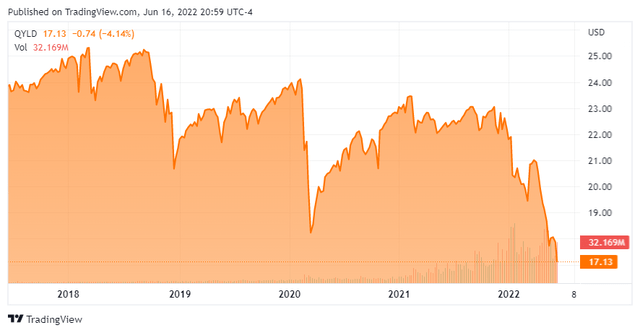

Only time will tell when a bottom is established and how the Fed’s quantitative tightening will impact the markets this summer. YTD, the Invesco QQQ ETF (QQQ) has declined by -31.73% as the Nasdaq has fallen deeper into a bear market. Some investors hate the Global X NASDAQ 100 Covered Call ETF (NASDAQ:QYLD), while others look to it to generate double-digit yields. One of the most common arguments which are used to discredit an investment in QYLD is that it won’t be stable in a bear market environment. Numbers don’t lie; right now, QYLD has declined by -23.15% in 2022, while QQQ has declined by -32.44%. This isn’t an investing environment with many positive outcomes but the idea that QYLD would fall further than the underlying index or see the level of income it generates severely impacted has been debunked. Please keep in mind that QYLD is not a vehicle for capital appreciation. Eventually, when a bottom is established, QYLD will start to appreciate and regain some of the lost capital appreciation, but due to its covered-call strategy, it won’t completely follow QQQ upward. Investors should understand exactly what they are signing up for with QYLD, as this is an income-first strategy that sacrifices capital appreciation to deliver yields that seem too good to be true.

More investors are piling into QYLD as its Net Assets continue to increase

I wrote my first article on QYLD almost 1 year ago, in August of 2021. When I wrote this article, QYLD had $3.81 billion in assets. As of June 15th, 2022, roughly 10 months since that article was published, QYLD has grown its net assets by $2.91 billion or 76.38%. QYLD now has $6.72 billion in net assets under management and could reach $7 billion on the 1-year anniversary of my first article. It’s clear that QYLD fills a void for many investors, and its strategy continues to deliver large amounts of income to its investors.

QYLD has been a continuous debate, but I believe there is nothing to debate in this investing environment. Everyone’s investment needs are different, and not every investor has a need for income distributions from their investments. If you are 25 with decades ahead of you, investing in an S&P 500 index fund would be a more viable solution as its prospects for capital appreciation exceed QYLD’s. On the other side of the coin are income investors who are less concerned with capital appreciation and more concerned with steady streams of income. The proof is in the numbers, and more investors who are focused on income are adding QYLD to their portfolios.

Covered-call strategies are looked down upon by some as your trading upside potential for immediate income, while others are more than willing to engage in this trade-off. QYLD invests at least 80% of its total assets in the securities that create the NASDAQ-100 index. Each month QYLD will write or sell one-month call options on the Nasdaq 100 index, which are covered since QYLD holds the securities underlying the options written. Each option is written and will generally have an exercise price at or above the prevailing market price of the Nasdaq 100 index from when it was written. QYLD’s distributions are predicated on the options premiums generated, which will fluctuate but will never be nonexistent. Investors are warming up to the mechanics of QYLD as covered-call strategies have gone mainstream.

Viewing QYLD through the eyes of an income investment

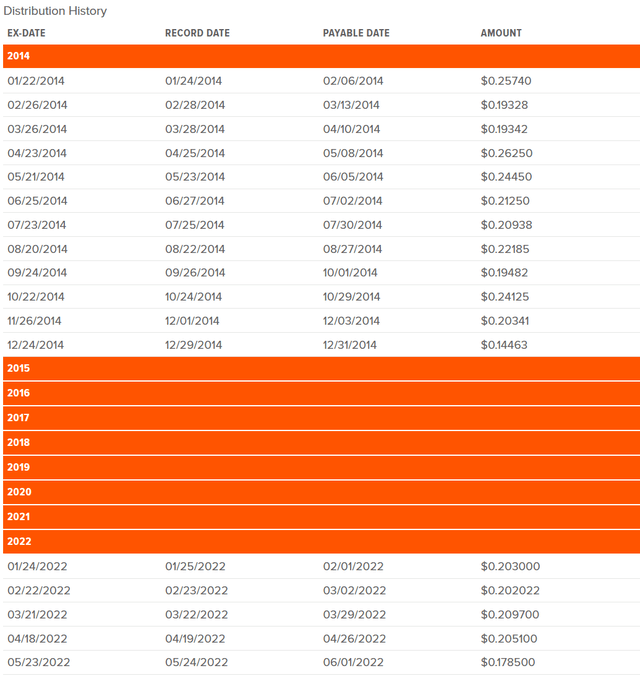

QYLD started 2022 trading at $22.29 per share and has declined by -$5.16 or -23.15%. In the same period, QQQ has declined by $130.29 (-32.44%) per share from $401.68 to $271.39. Neither scenario is ideal, but income investors look at things much differently than investors focused on capital appreciation. QYLD has already generated 5 distributions from January through May, amounting to $1 per share. Hypothetically, if you had purchased 100 shares at the beginning of 2022 for $2,229, you would have generated $100 in income, which is a 4.5% yield on investment. There is another distribution coming at the end of June and 6 more distributions throughout the remainder of the year. If you had taken the same capital ($2,229) and placed it in QQQ, you would have been able to purchase 5.55 shares. QQQ has paid 1 dividend in 2022 to date in the amount of $0.43 per share. Your investment in QQQ would have generated $2.39 in income or roughly 1/10th of a percent (0.11%) yield on your initial investment. Even with a 2nd dividend coming in the next several weeks, your yield on investment would be roughly 0.25%.

I look at an income investment the way I would look at a business. When you own a business, you don’t have the value of your business flashing on a screen. Regardless of the business’s size, the objective is to generate profits. The markets fluctuate, and every minute of every trading day, shares of QYLD fluctuate. From an income perspective, the most important aspect is that the dividends or distributions flow into your account. This is not a situation where QYLD is declining, where the market is appreciating, the entire market is giving back gains, and QYLD is falling alongside the market. The difference is that income investors are getting paid their monthly distributions on the way down from QYLD and experiencing less capital depreciation than its respective index, QQQ.

When you look back over the previous year, QYLD has paid $2.71 in distributions per share which is a 12-month trailing yield of 15.68%. If you want to assume that 100 shares were purchased on 6/1/21, the initial investment would have been $2,223. The forward yield would have been 12.19% on the original investment. Commutatively, QYLD has paid out $20.04 across 101 distributions since its inception. QYLD started trading at $25 per share and has experienced peaks and valleys since the end of 2013. If you had purchased 100 shares at its inception, your initial investment would have been $2,500, and you would have generated $2,004 in distributions which is an 80.16% yield on investment.

Many companies that were held on pedestals have significantly declined during the current downturn. This is part of investing, bull markets don’t last forever, and the good thing is, neither do bear markets. When I purchase QYLD, I am looking at a long-term vehicle for income generation, and the day-to-day share price doesn’t concern me. If you had purchased 100 shares at inception for $2,500, your initial capital would have declined by -$787 (-31.48%) since the end of 2013. While being in the red never feels good, QYLD would have generated $2,004 in distributions over the years. I would look at this as my initial investment of $2,500 should eventually regain some if not all the capital it lost some time in the future while putting $2,004 in my pocket. I still have $1,713 invested, which could very well be over $2,000 by the end of 2022, and I will still have monthly distributions being generated with an installment coming in the next 2 weeks. If QYLD was to pay $2.50 in distributions per share, then in the next 2 years, each share would have generated $25 in distributions since its inception at the end of 2013, placing the income generated at the equivalent level of the initial investment. If you had held the shares as an income investment, 100% of your capital would have been returned to you through distributions in less than 10 years while still having those 100 shares generating future income.

My plans for QYLD and why I remain very bullish on QYLD as an income investment

On 2/10/20, right before the pandemic sent the world into a tailspin, QYLD traded at $24.11 per share. Just over 1 month later, on 3/16/20, shares of QYLD had declined to $18.23, losing -24.39% of their value. Almost 11 months later, on 2/8/21, QYLD trades at $23.46, regaining almost all the value they had lost during the Covid Crash. Going back further, on 9/10/18, QYLD traded at $25.24, and just over 4 months later, on 12/17/18, shares traded at $20.50, losing -18.78% of their value. Over the next 2 years, shares regained almost all their value before Covid occurred. The -23.15% that QYLD has lost in 2022 isn’t its first major decline, and it won’t be the last. The silver lining is that QYLD has paid its distribution every month over the past 111 months and throughout every decline its faced. In 2018 QYLD paid $2.66 per share in distributions; in 2020, when companies were cutting and reducing their dividends paid, QYLD produced $2.54 in annual distributions per share.

Regardless of what transpired in the markets, uptrends and downtrends alike, QYLD has always generated large amounts of income. Eventually, the markets will recover, and QYLD will recover, the question that remains is when? As an income investment, I am not concerned with QYLD’s share price and am looking at the current volatility as an opportunity. I plan to continue adding to QYLD monthly and increase its distribution stream. I don’t need the income today, so I have elected to reinvest the monthly distributions. I believe QYLD will grow its net assets and continue to generate monthly distributes for decades into the future. With several decades on my investment horizon, I plan on adding and compounding my way into a large monthly income position with QYLD.

Investors should read through QYLD’s investment documents and understand the mechanics behind the investment. This isn’t a typical index fund and isn’t designed to keep up with an index fund during periods of appreciation. QYLD is an income-focused investment, and investors should be very clear about their investment expectations before jumping into QYLD. Based on how much I am allocating, the power of compounding, QYLD’s history, and several decades of time, after crunching the numbers, QYLD fits in my income investment thesis. Just because it works for me doesn’t mean it will work for you, and I can’t stress enough to go through the numbers. In the end, QYLD has proven to be less volatile than QQQ, and the main criticisms against QYLD have been debunked. If you’re an income investor, I believe QYLD is a buy.

Be the first to comment