ThamKC

Where Food Comes From (NASDAQ:WFCF) is one of the more unique companies you’ll come across on the Nasdaq. The firm’s name should give a hint that the business model is intriguing.

In the company’s own words, here is its mission:

“[Where Food Comes From] is one of the nation’s largest independent, third-party traceability and verification providers.

We use rigorous verification processes on food production processes to ensure that claims made by food producers and processors are accurate. We care about food and other agricultural products, how it is grown and raised, the quality of what we eat, what farmers and ranchers do, and authentically telling that story to the consumer. Our team visits farms and ranches and looks at their plants, animals, and records, and compares the information we collect to specific standards or claims that farms and ranches want to make about how they are producing food. Our customers include top-tier players in the food and wine space.”

WFCF has been in the verification business for more than 25 years and now supports more than 15,000 farmers, ranchers, vineyards, and other such food and beverage enterprises.

The company aims to create a more sustainable food supply chain. And it has had some success and earned accolades; for example, it won a Whole Foods quality supplier award in multiple years. While the average grocery shopper may not care too much about the provenance of their produce, meats, and beverages, a growing number of customers do care about how their food is cultivated.

There are multiple reasons for this. There is more focus on sustainability and the ethical treatment of animals and the earth in general. There are more rigid food safety and quality standards, particularly for export markets. And as people are aging and chronic disease has risen, many folks are willing to spend more on their food in an effort to improve health outcomes.

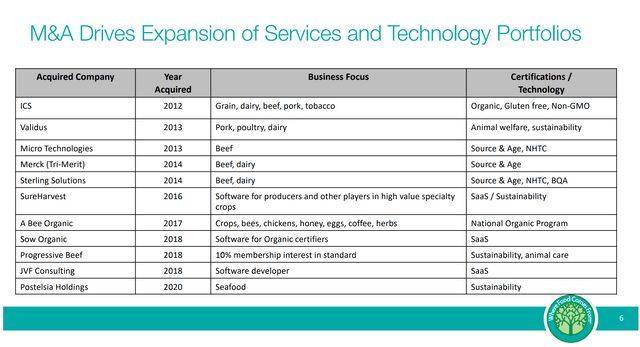

There’s another seemingly compelling piece to the story as well. Where Food Comes From has been an M&A machine, tacking on new products, certifications, and so on at great speed. Just look at this line-up of new and expanded offerings that have come from the acqusition pipeline:

WFCF M&A targets (Corporate Presentation)

There are multiple animal sourcing, safety, and welfare acquisitions in there. We’ve got multiple software buys. A Bee Organic brought in a great number of organic product certifications. And in 2020, the company bought Postelsia, which moved it into seafood sustainability as well. Overfishing of the oceans is a huge problem, and there should be a great market opportunity there in helping consumers and governments understand and track seafood production.

From a glance, Where Food Comes From looks like an ideal under-the-radar sort of business with a unique purpose. It seems to check all sorts of boxes including appealing to a growing consumer base, generating recurring high-margin revenues (particularly on the software) and being something that appeals to ESG-focused consumers and investors.

The Numbers Are Much Less Exciting Than The Story

And yet, the moment you move from the story into the financial analysis, things really lose their luster.

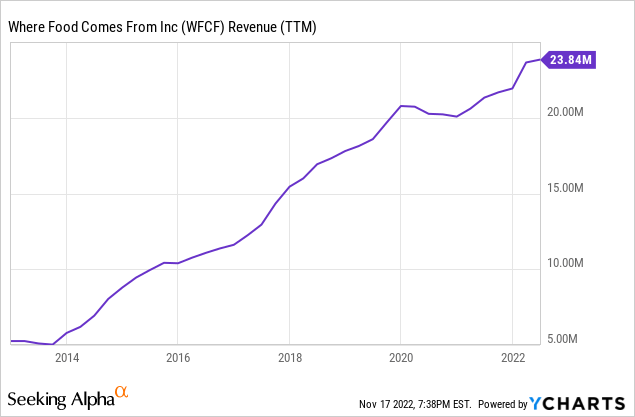

It starts with revenues. You’d think a business that has been around for more than a quarter-of-a-century and which has had thousands of customers would already have obtained a significant size. And yet, revenues are clocking in at just $24 million annually. Here is the past decade of growth:

To be fair to the company, this is a large increase in percentage terms. However, this is a tiny business on a standalone basis. And, I’d argue, what makes this even less encouraging is the huge number of acquistions that the company has made to get to this point.

WFCF has made 11 purchases in recent years and still only gotten to $24 million in annualized revenues. There doesn’t appear to be much organic growth or natural adoption of the company’s services if this is the result to-date.

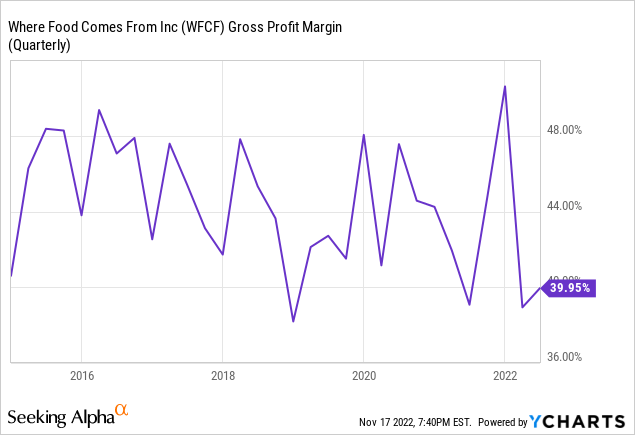

Another issue is with gross margins. Here is the past decade of those:

WFCF has earned around a 44% gross margin on average, and that has dipped to the lower end of the historical range this year.

In any case, WFCF is not achieving higher gross margins even as its revenues have increased dramatically. This is especially uninspiring because the company has made several software-as-a-service “SaaS” acquisitions during that time. All else being equal, you’d expect a company’s profitability to go up as more of their revenue mix moves to recurring revenue software sales. Instead, if anything, WFCF’s margins appear to be ticking down a bit.

Bitcoin Investment Is A Head-Scratcher

This summer, WFCF made a surprising disclosure. It had invested in Bitcoin. From the relevant 10-Q, we find:

“In June 2022, we [WFCF] purchased an aggregate of $178,000 in Bitcoin (a “cryptocurrency” or “digital asset”) and currently account for all digital assets held as indefinite-lived intangible assets in accordance with ASC 350, Intangibles-Goodwill and Other. We have ownership of and control over our digital assets and may use a third-party custodial service to secure it.”

I’ll give them this; at least they didn’t buy at a $70,000 price per coin last year. Still, this is a bizarre use of capital for a publicly traded company which is not an industry that has anything to do with cryptocurrency. I’d also note that the 10-Q says that the company “may use a third-party custodial service” to handle its Bitcoin. Given the rash of insolvencies we’ve seen among crypto exchanges recently, that is something worth monitoring going forward.

While $178,000 is a drop in the bucket, even for a small company like WFCF, it still sends a poor signal, in my opinion. The company only generates a couple million dollars a year in net income. Surely they must have good uses for every dollar that is available. More M&A? More firepower for their share buyback program? Or why not start a small dividend to reward patient shareholders? No, instead, the company decided to take a venture into cryptocurrency. This isn’t a dealbreaker for the company’s valuation or balance sheet, but I really don’t like the signal it sends to shareholders.

WFCF Stock Verdict

Management and the board, combined, own more than half of the company’s outstanding stock. That’s a great vote of assurance in a small firm like this. The people running the company are eating their own cooking, so to speak.

That said, I’m still not sold on this, particularly with the unfortunate decision to invest in Bitcoin. That sort of puzzling decision makes one question if there are enough opportunities to continue profitably growing within the company’s core business. The firm is generating just $24 million a year in revenues. Surely there must be something better to do with funds in their industry rather than speculating on digital tokens?

Furthermore, I’m not sure when customers will show up in greater quantity. WFCF has been in business for more than 25 years now. Stores like Whole Foods have been prevalent in America for a long time. If this trend were really going to break through and have folks clamoring for organic labeling everywhere, you would think that it might have happened already.

I inherently like the idea of what the company is trying to do. I get why investors are drawn to the appeal of the firm’s vision. However, the financial results simply aren’t there. Growth has been lackluster, particularly once you back out acquisitions. Margins aren’t going up despite more software and greater operating scale. And, at the end of the day, overhead costs eat up so much of any potential profit when you have just $24 million of annual revenues to work with.

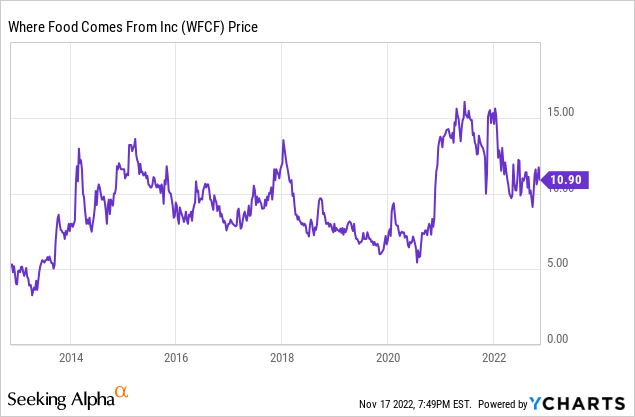

WFCF stock has been flat since 2014. The company is trading around 30x earnings, and I don’t expect earnings to grow particularly quickly. As such, there’s no real reason to own shares today. The stock is expensive, the business model and market demand is still somewhat unproven, and the Bitcoin investment is a point of concern.

What would change my mind? Simply put, show me an inflection point in either revenues or profit margins. WFCF has a large customer base. If it can charge them a higher price for their value-added services, that would make for a better financial picture.

The other catalyst could be the emergence of greater demand. Something like a major fast-food chain making a splashy deal with WFCF to certify its meat quality could be a big deal. Or perhaps we’ll see more government regulation which forces industry suppliers to comply with more stringent product-testing standards.

Those sorts of concrete positive developments could change my view. Until then, however, don’t be surprised if the company keeps muddling along. Revenues might grow to, say, $30 million in a few years and profits tick up by a few cents a share, but that probably wouldn’t be enough to do much for the stock price.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment