PBFloyd

Quest Diagnostics (NYSE:DGX) has been a longstanding position in my “Healthy Dividends” portfolio thanks to a safe dividend and long-term growth prospects. This position has grown in size and value thanks to Quest being a mainstay in the battle against COVID-19 with their molecular testing demand generating significant revenue growth during the peak of the pandemic. Now, that the worst of the pandemic is presumably in the rearview, we have to anticipate a drop in COVID-19 testing demand, which could lead to Quest reporting year-over-year decreases in earnings. Obviously, the market loves to promote tickers that report growth and will punish those who report decaying earnings. Therefore, investors should not be surprised by the market’s treatment of DGX, which is down roughly 25% from its January high. For me, I am focusing on the company’s impressive long-term growth trends and the ticker’s attractive valuation.

I intend to review the company’s long-term growth trends and their future growth prospects. In addition, I discuss the ticker’s attractive valuation. Finally, I reveal my plan to manage my DGX position over the next year.

Interpreting the Recent Trends

As I mentioned in my introduction, Quest is expected to be reporting year-over-year decreases in revenue and earnings as the COVID-19 pandemic continues to slow down and testing demand will likely go with it. Looking at the company’s Q2 earnings, we can see some evidence of the expected year-over-year regressions already.

In Q2, Quest recorded $2.5B in total revenues with earnings per share coming in at $1.96 compared to $4.96 in Q2 of last year. Quest’s adjusted EPS was $2.36 verse $3.18 last year. The company’s reported operating income in Q2 was $388M, which was 15.8% of their revenue. However, this is down from $533M in Q2 of last year, which was about 20.9% of their revenue. The company attributes these declines as a result of lower COVID-19 testing volume. In fact, the company reported that COVID-19 testing revenues were around $355M, down about 31% from Q2 2021 and 41% from Q1 of 2022.

I would argue that although the company is reporting a year-over-year decrease in earnings, the fact remains that Quest is still on an upward trajectory in comparison to their pre-pandemic performance. The market is reacting as if the year-over-year decreases are indicative of the company’s core business and long-term prospects. I will point to the company’s earnings history which shows that the company’s recent earnings are still better than pre-pandemic earnings.

Quest Earnings History (Seeking Alpha)

Looking at the figure above, we can see that Quest is reporting superior EPS and revenues than pre-COVID, yet, the market is looking to bring the share price down to April 2020 levels. I believe the market is taken this “COVID-Fade” too far on DGX. Indeed, the market is “forward-looking” and the demand for COVID-19 testing is overall slowing. However, the market is overlooking the reality that Quest is growing their base business year-over-year, so the company does not have to rely on COVID-19 testing to grow in the long term. Moreover, the spread of variants has sustained the demand for COVID-19 molecular testing, and Quest’s positivity rate was about 25% in the first 2 weeks of July. Quest is still running roughly 8% of COVID-19 molecular testing in the United States, which is up from around 4% in March. So, the COVID-19 revenues are not busted.

What’s My Point?

Quest’s base business is growing while the company is increasing their share of COVID-19 molecular testing. Essentially, Quest has the ability to grow regardless of COVID-19 testing, but they can also take advantage of being a leader in COVID-19 testing at a time when demand is still significant. I believe investors should consider focusing on the company’s “meat and potatoes” base business growth trends and see the COVID-19 revenue as “gravy” at this point.

Potential Growth Opportunities

Quest has several opportunities to unlock growth in the near term and in the coming years. Looking at Quest’s base business, the company mentioned that they are “in late-stage discussions with several hospital health systems on the purchase of their laboratory outreach business.” In addition, Quest has seen growth in health plan access as they renew contracts with price increases. Moreover, Quest is seeing growth in direct-to-consumer testing including testosterone, comprehensive metabolic panels, and Lyme disease tests.

Into the bargain, Quest has launched a molecular test for monkeypox that can “differentiate monkeypox from other orthopoxviruses.” Quest believes that will be able to perform approximately 30K tests a week and can increase capacity if needed. Monkeypox might not reach the same level of threat as COVID, however, the world is still going to need tests to help diagnose patients and manage the public health response.

Looking ahead, Quest is looking to debut their improved QuestDirect digital platform, which they believe will help them “acquire, convert and retain more customers.”

QuestDirect Steps (Quest Diagnostics)

As a result, Quest updated their full-year 2022 base business revenues to be between $8.35B and $8.45B.

On the COVID front, it looks as if the need for COVID-19 testing will most likely become a mainstay for managing the infection and for public health monitoring. Luckily, Quest’s COVID-19 strategy and execution have made them a leader in testing. What is more, the company has increased the number of their testing access points via retail relationships including CVS (CVS), Walmart (WMT), and Rite Aid (RAD) with plans to increase the number of access points. It is important to note, that the public health emergency has been extended into October, which will help maintain their reimbursement for testing. Considering these points above, one must concede that there is still a substantial opportunity in COVID-19 testing, and Quest is positioned to maximize it. As a result, Quest raised their COVID-19 revenue guidance for 2022 to be $1.15B to $1.30B.

Overall, Quest believes their full-year 2022 revenues will come in between $9.5B and $9.75B. Looking ahead, the Street expects Quest to report year-over-year decreases in revenue for 2022 and 2023 as COVID-19 revenues shrink.

DGX Annual Revenue Estimates (Seeking Alpha)

However, Street analysts expect the company to report single-digit growth for 2024, 2025, and will cross $10B in revenue in 2026.

So, it appears that the Street is expecting Quest to ultimately return to reporting growth as the company continues to grow their base business and capitalize on their COVID-19 testing leadership.

Picking a Valuation

Finding a reasonable valuation for an industry-leading healthcare company can be complicated, especially when there is a dividend involved. Luckily, I use a variety of valuation models in order to smooth out the results and come up with a solitary value.

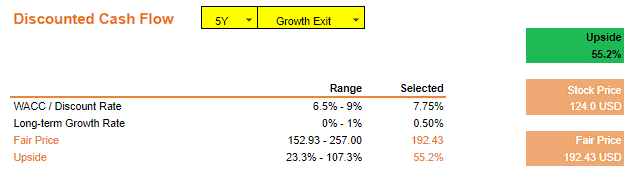

My discounted cash flow “DCF” 5-year growth exit is $192.43, and the 10-year at $216.77. My P/E Multiples model has DGX at roughly $300; the EV/EBITDA Multiples is $163.80; the Earnings Power Value is $142.04. Meanwhile, my Multi-Stage Dividend Discount Model “DDM” has DGX at $139.55. Considering DGX’s share price is trading at around $124 per share, we can say that the stock is trading at discount for valuation models. If I were to pick one, I would go with the DCF 5-year growth exit at $192.43 (up 55% from current levels) since we are concerned about the value of DGX for its future earnings.

DCF Model Using Value Investing (Value Investing)

My Plan

My plan for DGX is similar to my other Healthy Dividend tickers, which is to accumulate an oversized position over several years using a dollar-cost average “DCA” strategy. However, I will be particular with my buys in view of the current market environment. For that reason, I’m going to implement a buy threshold that will help me avoid overpaying. This threshold is intended to be a parameter to help make periodic investments as long as the share price is trading lower than my Buy Threshold of about $129 per share. I will also use a low sensitivity on the DDM model to get a discount price of ~$111 per share, which is another parameter where I will increase the size and frequency of my transactions.

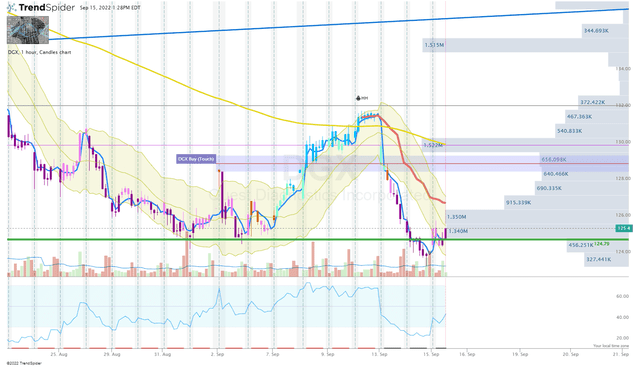

At the moment, DGX is trading just below my buy threshold, so I will wait to press the buy button until I see a high conviction reversal setup on the hourly chart.

Long term, I am looking to maintain a DGX position in my Compounding Healthcare Healthy Dividend portfolio for at least five more years.

Be the first to comment