gorodenkoff/iStock via Getty Images

Summary

I believe Amplitude (NASDAQ:AMPL) is slightly undervalued today, and investors can look to gain 27% over a 1-year period.

Businesses that want to thrive in the future will need to digitize their operations. AMPL’s Digital Optimization System streamlines operations and allows for the direct correlation of digital outputs with tangible business results. The company provides superior service by combining in-depth customer data with lightning-fast response times. In sum, AMPL’s platform facilitates collaborative business analysis and quick decision making by bringing together dispersed teams.

Company overview

When it comes to cutting-edge software, nobody does it better than AMPL. Business operations are centralized within their Digital Optimization System, facilitating the mapping of digital outputs to business outcomes. They developed the first Digital Optimization System, which combines advanced knowledge of customers with rapid response for better service. AMPL paves the way for digital innovation and growth for organizations of all sizes and in all sectors, at all levels of digital maturity. Their platform brings together the product, marketing, data, and executive teams for a consolidated view of the business, allowing them to confidently and quickly make decisions that affect the company’s bottom line.

Digitization is not a choice, it’s a necessity in today’s world

The fact is we can’t go about our days without encountering some form of digital product. From holding a morning meeting on Slack to using Smartsheet (SMAR) to manage projects to watching a favorite show on Netflix (NFLX), digital products have become the primary means by which businesses interact with their customers . It is now crucial for businesses to be able to offer compelling digital products and services or they will perish.

Digital disruption is becoming increasingly feasible due to the proliferation of mobile and cloud computing. For instance, fintech startups catering directly to consumers now provide an array of products that can be purchased and utilized with a few taps of a smartphone screen. Therefore, traditional consumer banks can no longer depend on their extensive branching infrastructure to give them an edge in the market. If they want to stay relevant, they’ll need to move their operations online and into mobile apps. Those who are slow to adopt digital technologies face a challenging new environment. I believe that in the near future, many cutting-edge digital apps and services will be deployed utilizing cloud-native techniques to meet the rising bar of consumer demand for convenience and accessibility.

Moreover, I think digital is now the business itself, rather than merely a tool for doing business. It is impossible to overstate the significance of a company’s digital growth efforts to their future success. With many businesses racing to adopt digital tools to allow, for instance, work-from-home opportunities, the COVID pandemic has hastened the digitization trend. Every business must undergo a digital transformation and actively pursue digital expansion if it does not want to be left behind as the digital sector continues to grow as a proportion of the economy.

Companies need to realize, and I have faith that they will, that digital makes it simpler to maintain relationships with customers over time, which allows them to redirect resources from one-time transactions to increasing customers’ lifetime value. This shift in strategy has led to more effective use of marketing and sales resources and increased long-term growth prospects due to the lower costs associated with growing relationships with existing customers.

On the new front of digital innovation, there will be no gray areas. Businesses are increasingly focusing on digital products as a means to rebrand themselves and develop new ways to add value for customers. Those companies that don’t rise to the challenge and adjust to the new circumstances will soon find themselves in an existential crisis.

Turnkey solution reduces the psychological barrier to adoption

I believe the ability to reduce or remove customers’ psychological barrier to adoption is half the battle won.

In order to help teams make better decisions based on data, AMPL has developed a digital Optimization System. It’s flexible and easy to implement, making it ideal for a wide range of teams focused on improving digital products and marketing initiatives. Integrating with AMPL’s Analytics, Recommend, and Experiment products, the platform offers users a one-stop shop for all their digital optimization requirements. In turn, this facilitates better, faster, and more efficient solution development as teams are able to better communicate and collaborate with one another.

A turn-key solution is easier to implement than five separate point solutions, so it’s important to keep that in mind during the request for proposal [RFP] and sales pitch. The best example is Microsoft (MSFT); adopting MSFT360 is simpler than buying 50 separate point solutions to create another MSFT.

AMPL proprietary technology sets it apart from other peers

In order to quickly provide useful insights from intricate user data, AMPL has developed a proprietary behavioral database called the Amplitude Behavioral Graph. Modern columnar storage methods are used to construct the data model, which is then used to focus on behavioral data and facilitate the exploration and iterative development of questions by teams. AMPL is able to provide the required speed and depth of insight to its customers thanks to this method. AMPL’s entire product line is driven by the Behavioral Graph, which provides users with real-time visibility into data about their entire user experience across all of their devices, channels, and AMPL offerings. The Behavioral Graph serves as the backbone of AMPL’s infrastructure and the inspiration for the company’s groundbreaking work.

AMPL’s Behavioral Graph stands out from the crowd because it can process hundreds of billions of behavioral data points per month (source: S-1) with ease, providing the kind of comprehensive insights necessary for effective digital optimization.

Strong virtuous cycle of growth and enhancement

AMPL’s system has a powerful self-reinforcing loop that promotes ongoing improvement through reinforcement learning and optimization and increased usage as it continues to delight its user base. Due to this, AMPL becomes increasingly distinct from its competitors as it grows larger.

The AMPL system is typically implemented by customers in stages, with initial deployments focusing on a single use case before being expanded as customers realize the system’s value. When these useful discoveries are disseminated to other departments, they often lead to extensions of the original use case as well as the creation of entirely new use cases. To support these applications, more data is being instrumented on AMPL’s platform, boosting the worth of the information already there. The more data AMPL collects, the more it can refine its recommendation engine to improve the digital product experience for end users, who are then more likely to use the product, and so on. Since AMPL’s platform acts as the digital product command center, monitoring KPIs across the board and producing analytics used to manage and evaluate the business, it becomes extremely ingrained in the daily operations of the company and thus difficult to replace.

Valuation

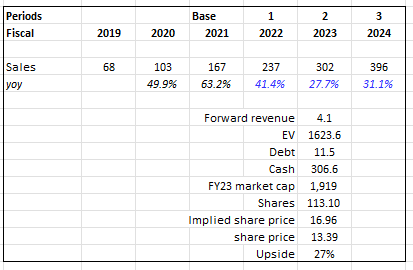

My model suggests that AMPL is undervalued. At this valuation, investors are probably looking at a 27% return over a 1-year period.

Looking at the consensus estimates, they are projecting a high growth rate, in the range of ~30%, which I think is fairly reasonable given this is a new industry and there are plenty of opportunities to capture. As I mentioned below (with regards to growth slowing), in the event AMPL misses, it could lead to really bad share price action as the market is valuing this as a high growth software company.

Anyway, at 4.1x forward revenue (where it is trading today), AMPL is worth $1.9 billion in FY23, or $16.96.

Own calculations

Risk

Adoption may be slower than expected

AMPL, as was previously mentioned, is at the forefront of a brand-new market. AMPL may have been able to acquire the low-hanging fruits, which may explain why growth has been so robust so far. If industry adoption is slower than expected, AMPL could be hurt by the story that the TAM is saturated, and the stock would be revalued as if AMPL were a mature software company rather than a high-growth software stock.

Expect more competition in the future

As long as AMPL maintains that this industry is viable with profitable unit economics, more competitors will enter to capture a portion of the profit pool. If AMPL is still on a small scale by then, it may not be able to grow as quickly or as profitably as it would like.

Conclusion

I believe AMPL is undervalued today. AMPL is a company that offers software solutions for digital optimization and innovation. Their Digital Optimization System helps businesses centralize operations and facilitates the mapping of digital outputs to business outcomes. More importantly, the platform is flexible and easy to implement, and offers a one-stop shop for all digital optimization needs, including analytics, recommendations, and experiments.

Be the first to comment