JHVEPhoto

Technical Analysis

We wrote about OPKO Health, Inc. (NASDAQ:OPK) back in June of this year when we stated that elevated short interest in the stock would most likely lead to sustained volatility in shares over time. Although short interest has come down from approximately 14% to 9% over the past three months, shares are down just over 15% in this timeframe. Whether we continue to see lower lows remains to be seen, but investors should not dismiss Opko’s short interest ratio especially if it were to rise once more.

The reason being is that short sellers (due to the unlimited risk to the upside) invariably take far more risk than their long counterparts. Suffice it to say, the higher the ratio, the more confident these sophisticated investors are that a significant decline will indeed take place.

Despite the fact that short interest remains close to the 10% mark, Opko’s CEO mainly continues to buy shares with his most recent transaction being 100,000 shares on the 2nd of this month. Insider buying is encouraging as it demonstrates management’s confidence in that the ModeX acquisition for example can be a real game-changer for the company.

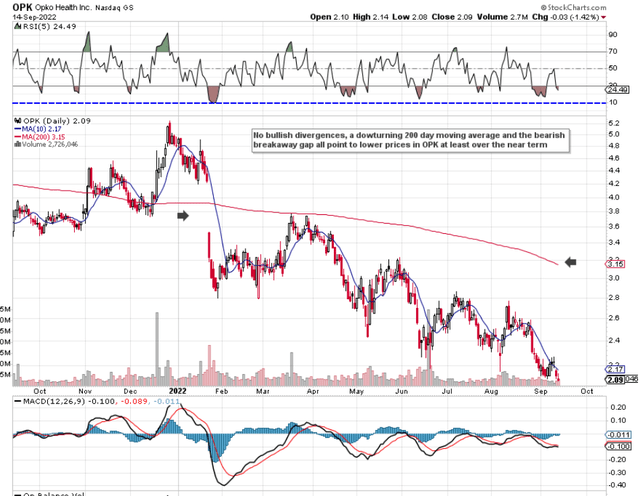

However, as stated, the market remains unconvinced. As we can see from the technical chart below, shares continue to make lower lows with no end in sight at this stage. In fact, if this trend persists, a decline to the stock’s 2020 lows is a real possibility here before a firm bottom may be confirmed. In saying this, let’s delve into how the company has been changing which may very well lead to shares bottoming out here in the not-too-distant future.

Opko Continues To Make Lower Lows (Stockcharts.com)

Company Progress

Every known fundamental which could potentially affect Opko´s share price has already been reflected in the share-price action we see on the technical chart. This means the market believes the stock deserves to be making 52-week lows. Insiders though as alluded to above believe otherwise due to the ongoing transformation of Opko which was seen once more in the second quarter.

The reasons from management’s point of view are self-explanatory. The ModeX deal is expected to be a game-changer for Opko not just with respect to its oncology & infectious diseases pipeline and technologies but also concerning the vast experience (people) who are now working at Opko. Suffice it to say, the goodwill which Opko has taken on board as well as the share dilution to complete the deal ($300 million in common stock) is expected to be a fantastic investment for Opko in the long run.

Then you have the Pfizer (PFE) partnership with NGENLA which continues to be rolled out in multiple jurisdictions. These rollouts result in milestone payments for OPKO; something the market is fully aware of. The question, though, is how successful this drug will be going forward. We state this because the more momentum this product gains, the more launches we will see in further countries. Remember, not only sales of NGENLA will move the needle from a gross profit sharing perspective, but also the number of markets where the drug is launched will also bring money into OPKO´s coffers through ongoing royalty payments.

In our commentary to date on Opko, we have always stated that sustained profits were needed from the diagnostic segment to buy the pharmaceutical segment time to come good. Due to a significant fall-off in Covid-19 testing in recent months, diagnostics continue to suffer not only because of the drop in volume but also because of how point-of-care testing delivers lower margins overall for the company. Opko needs to continue to deleverage this area of the business due to the significant drop in both sales and earnings. Given that management has not assumed a surge in Covid-19 testing going forward, there might be a possibility of much better sales and earnings from diagnostics in the winter months. Although as noted, this section of the business is totally dependent on external conditions and can not be relied on, better numbers here can buy the likes of ModeX to come good and also keep creditors at bay.

Conclusion

Despite the significant fall (which was earmarked) in the diagnostics segment in Q2, product revenues from the pharmaceutical segment grew to almost $36 million in the second quarter. It has to be said that the ModeX deal and everything it brings with it could significantly change the trajectory of Opko. Some green shoots will be needed to reverse market sentiment. We look forward to continued coverage.

Be the first to comment