image

Quanta Services (NYSE:PWR), a leading provider of specialty contracting services for the electric and gas utility, renewable energy, communications, and energy industries, is at the forefront to modernize America’s electric grid. Modernizing the grid refers to the upgrades needed in the power grid to accommodate the technological changes happening in the generation, transmission and distribution of electric power as a result of the increase in the capacity of renewable energy, specifically wind, solar, geothermal and hydroelectric.

Renewable Energy is the Future

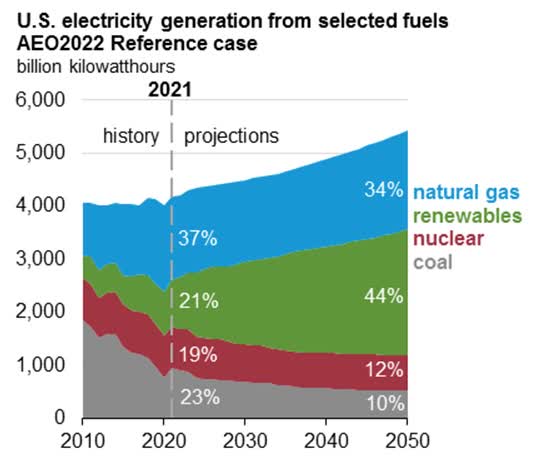

According to the US Energy Information Administration (‘EIA’), over the next thirty years renewables (primarily wind and solar) will become the leading source of energy in the United States.

US Energy Information Administration

With this in mind, in 2021 Quanta acquired Blattner Holding Company, one of the largest and leading utility-scale renewable energy infrastructure solutions provider in North America, significantly expanding its services to the renewable generation industry. Through the first half of 2022, Quanta’s Renewable Energy segment rose to 22% of total revenues from 13% in 2021. It is now the fastest growing division for the company with its segment revenues growing 151% in the last year. For fiscal year end 2022, the company is estimating total revenues growing 29% to $16.8 billion. In the latest quarterly report, Duke Austin, Quanta’s CEO commented:

Our solid financial performance in the first half of 2022, coupled with our record twelve-month backlog, ongoing active customer discussions and robust end market dynamics, reaffirms our confidence in our full-year 2022 consolidated financial expectations.

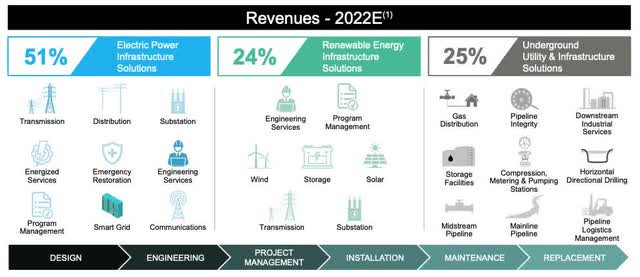

Even with the rise of the renewable energy segment to 24% of revenues by year end 2022, the Electric Power Infrastructure Solutions division, which services the electric utility companies, remains the majority source of revenue as the company helps utility companies upgrade their capabilities.

This demand for energy is largely driven by 5G, electric vehicles, cloud/data centers, Internet of Things and connected objects, and smart cities. The company sees this demand lasting years and have incorporated it into their multi-year financial targets:

Our customers’ multi-year programs to modernize and harden utility infrastructure, along with their initiatives to move towards a reduced-carbon economy continue to drive demand for our services and present incremental growth opportunities. Notably, we are seeing growing demand for our renewable generation and infrastructure solutions in 2023 and beyond, giving us continued confidence in our multi-year financial targets.

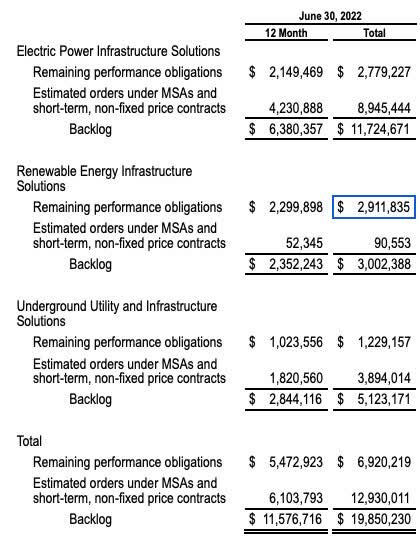

Some of this demand can be seen in the company’s backlog for its services.

Quanta Services

As you can see from the table above, Renewable Energy has the largest backlog under remaining performance obligations showing the strength of this division. It also has the smallest estimated orders reflecting the infancy of this segment for the company.

Opportunities Abound

One of the main drivers in upgrading the national grid are electric vehicle (‘EV’) charging stations. Due to the expected rise in EV sales over the next decade, electricity demand to charge EVs will follow suit. This has led to opportunities for Quanta’s services:

In July 2022, Quanta signed a master services agreement to provide turnkey engineering, construction and program management solutions in support of the deployment of a national EV direct current (‘DC’) fast charging network. This program brings together one of the world’s largest auto manufacturers, North America’s largest operator of travel centers and the nation’s largest public fast charging network for EVs. These companies are collaborating on the fast charging network, which is expected to include as many as 2,000 DC charging stalls at hundreds of travel locations across the United States. Quanta expects to begin engineering work on this program this year, with construction to begin in 2023.

Another opportunity the company sees is in the aging of utilities’ employee base. The utility industry today is experiencing a shortage of journeyman linemen and specialty craft labor. Quanta’s customers need specialized labor resources to address their aging utility workforce.

To address this need, Quanta made a strategic acquisition of Northwest Lineman College (‘NLC’) in 2018, a postsecondary educational institution that provides training programs for the electric power infrastructure, communications and underground utility industries. The institution specializes in utility task training for electric workers. The company owns and operates NLC as a way to source skilled labor to provide outsourced infrastructure services to utility companies.

Quanta believes this trend will continue potentially to a degree that demand for labor resources will outpace supply. As the largest employer of craft skilled labor in the industry, and with the acquisition of NLC, Quanta is uniquely positioned to provide critical infrastructure services related to connectivity and electric power.

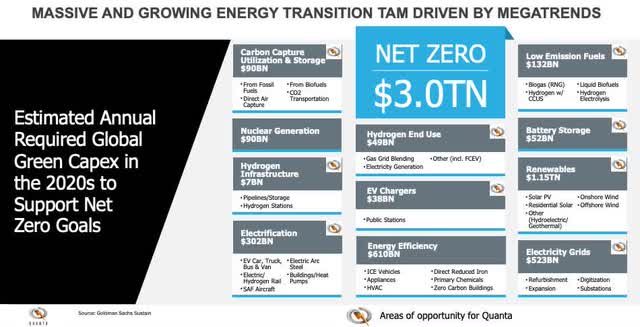

According to Goldman Sachs (GS), underlying these opportunities is a total addressable market of $3 trillion driven by megatrends from renewables and electrification to battery storage and EV chargers.

Risks Remain

Despite the opportunities presented by the demand for renewables and upgrading the electric grid, risks remain. One is Quanta’s reliance on craft skilled labor personnel and experienced operators to successfully manage its day-to-day business. Other than the continuous need for skilled labor, compensation and working conditions are always potential labor issues that could impact cost and/or delay delivery of services.

Second, is the highly regulatory environment of the utility industry. Quanta serves clients such as Duke Energy (DUK), PG&E (PCG) and Southern Company (SO) that are regulated at the federal, state and municipal levels. One specific risk is potential changes in environmental laws. Another are changes in regulatory requirements that could adversely affect the company’s ability to serve these markets.

Quanta attempts to mitigate these risks by having strong relationships with its unions and its customer base.

Analysis

Buy Rating: I have a Buy rating for Quanta Services’ stock with a three-year target price of $237 per share.

With the continued rise in demand for electricity over the next decade, I estimate that Quanta can grow revenues by 20% over the next 3 years driven by growth in their Renewable Energy segment. This would bring Quanta’s revenues to $28 billion by 2025 from a projected $16.8 billion this current fiscal year, and up from $12 billion in 2021.

As infrastructure services to renewable energy companies grow, I expect the company to be able to raise their net margin to 4% over time since these services tend to be more specialized and technology based generating higher margins for the company.

With regards to the stock’s valuation, the growth in the company’s earnings will actually lead to its price-to-earnings ratio (P/E) to contract during this period making the stock more attractive to investors.

Below is a table contrasting Quanta’s current metrics and stock price to the 3-year estimate:

| Quanta Services |

Current* (as of 9/19/22) |

3-Year Estimate |

|

Revenue (in millions) |

$15,474 |

$28,685 |

|

Net Margin (%) |

2.92% |

4.0% |

|

Net Income (in millions) |

$451.82 |

$1,147 |

|

# Outstanding Shares |

146,695,000 |

145,190,000 |

|

Net Income per Share |

$3.08 |

$7.90 |

|

Price/Earnings (P/E) Ratio |

45.9 |

30 |

|

Stock Price |

$141.28 |

$237 |

Source of company metrics: Morningstar, Quanta Services

*Current metrics based on TTM 2022 2nd quarter results.

Electricity Demand Will Drive the Stock

As demand for electricity continues to increase, utility companies will need to make significant investments to meet that demand. It is estimated that new power generation of 70-200 gigawatts (‘GW’) by 2030 will be required, and an additional 200-800 GW from 2030 to 2050. Currently, power generation capacity in the United States stands at 1.2 million megawatts or 1,200 GW (1 GW = 1,000 megawatts). The majority of this new power generation is projected to come from renewable energy. This translates to approximately $30-$90 billion of additional investment by 2030 and $200-$600 billion by 2050.

As a leader in utility infrastructure services, Quanta will play a critical role in meeting these needs. As a result, Quanta’s stock will see participation on the upside as these secular trends play out over the next several decades.

Be the first to comment