Gary Ell/iStock Editorial via Getty Images

Northrop Grumman (NYSE:NOC) provided its first quarter in April, which I will analyze in this report where I will be paying attention to the quarterly results as well as the outlook going forward. Those who have been following my defense coverage know that I previously have been bullish on Northrop Grumman as the company meets demands as military capabilities around the world are developing against which the US and its allies should be able to respond. Since I published that report, shares of Northrop Grumman have gained 51% compared to a 4.6% decline for the broader market. With significant changes in the defense and geopolitical landscape, it’s interesting to see how Northrop Grumman envisions the future.

Pandemic pressures in Q1

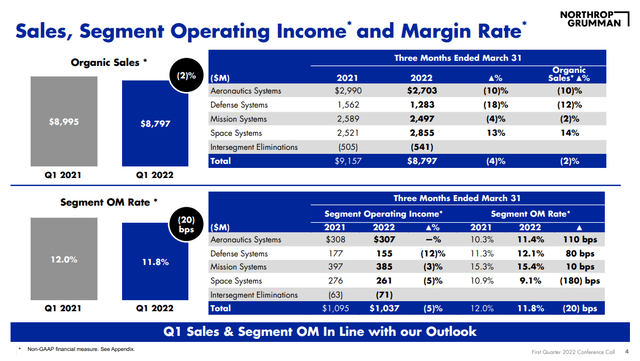

Northrop Grumman Q1 2022 results (Northrop Grumman)

How focused Northrop Grumman is on the future became clear in the discussion about the first quarter reports or better said the lack thereof. Revenue decreased by 4% and 2% organically. Interesting was that between the segments there was significant difference in year-over-year change in revenue. Space was the positive outlier with a revenue growth of 13% while Aeronautics and Defense systems showed significant declines of 10% and 18%. Mission Systems revenue decline matched the overall quarterly revenue decline for the entire company.

Interesting is that the margins showed the opposite. While Aeronautics and Defense Systems revenues dropped, their margins improved, which led to stable operating income for Aeronautics Systems while the profit for Defense Systems declined by 12% on a 18% reduction in revenues. Mission systems margins remained more or less stable producing a 3% decline in profits. The strong surge in Space Systems revenues did not translate into higher profits as a 180 points reduction in margin more than offset the topline performance. Overall, income was 5% lower on 4% lower revenues.

As an investor, you would like to see top- and bottom-line growth but Northrop Grumman did not produce a year-over-year growth on either metric and when listening to the call and going through the call I found that the company provided extremely little color to what caused the declines. I had to go through the 75-page 10-Q to find the cause of the reduction in revenues and profits, which not surprisingly was attributed to COVID-19, employee leave and supply chain challenges:

The company’s first quarter 2022 revenue and operating income were modestly reduced by the impact of the COVID-19 pandemic on the company earlier in the quarter, including through elevated levels of employee leave and supply chain challenges.

Northrop Grumman provides color on the future

While I would like to have seen Northrop Grumman provide more color on the margin and revenue pressures, I was pleased with the detail the Defense company provided for 2022 and the upcoming years.

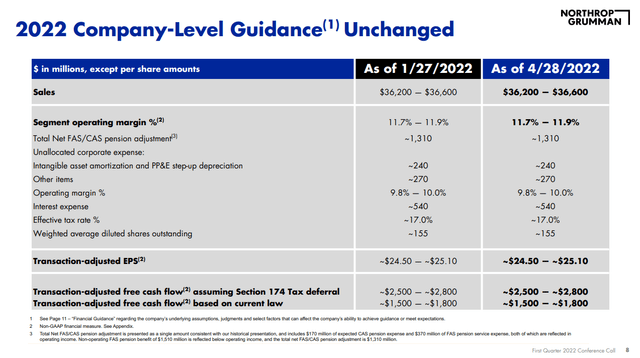

Northrop Grumman guidance for 2022 (Northrop Grumman)

For 2022, Northrop Grumman maintained its guidance with $36.2 billion to $36.6 billion in sales and 11.7%-11.9% operating margin resulting in a $24.50-$25.10 adjusted earnings per share. On sector guidance, Northrop Grumman maintained a mid to high $10 billion revenue and 10% sales margin while Defense Systems guidance slightly dropped from high $5 billion to mid to high $5 billion on high 11% margins. Mission systems guidance for the full year remained ant mid $10 billion at low 15% margins. Space Systems guidance was upped from mid $11 billion guidance to mid to high $11 billion on margins in the low tens. Eliminations will be roughly $100 million lower at $2 billion with a maintained mid to high 12% margins.

Overall, Northrop Grumman is guiding for 1.4% to 2.5% increase in revenues and $4.2 billion to $4.36 billion in profits. That provides a 3% uptick in profits unadjusted for inflation. I would say that the outlook for 2022 is not spectacular and neither is the 24% to 25% of full-year revenues that’s expected in the second quarter. More useful is the color provided beyond 2022.

Northrop Grumman’s expectations beyond 2022 are supported by a 4 to 5 percent increase on the budget plus supplemental funding. Additionally, there are indications that there is support to increase that budget further to offset inflation as the threat landscape is evolving. Key items are a 9% increase in R&D and a 30% increase in budget for space while modernization programs in the deterrent portfolio are also well funded. Northrop Grumman is positioned particularly well in that area with the B-21 bomber which provides part of the air based nuclear capability and contracts in support of the current land based nuclear capability as well as its replacement, the Ground Based Strategic Deterrent. Northrop Grumman also is competing with Lockheed Martin for a contract for the Next Generation Interceptor aimed to intercept incoming warheads.

With the current threat and budget environment as well as Northrop Grumman’s defense platforms, the company expects acceleration of revenue growth in the second half of the year as reflected in the guidance and that momentum to carry into 2023. In 2023, the aeronautics revenues will be more or less flat with growth returning in 2024 supported by the B-21 strategic bomber. In 2023-2024, Northrop Grumman sees the earliest opportunities for meaningful impact on contracts awards as international customers increase defense budgets while margins will tick up to 12%.

Conclusion

While I have been somewhat disappointed by the lack of comment on the first quarter results, it also does make a lot of sense for aerospace defense companies not to stay overly focused on quarterly earnings. Readers that have followed my work know that I often point out the long-term nature of this industry and with that in mind providing more color and comment on the future than on current results does make sense.

Overall, Northrop Grumman saw its top and bottom-line decline year-over-year, but the Defense specialist still was able to beat earnings per share estimates by $0.12 while missing revenue estimates by $90 million. The declines are a result of COVID-19 and supply chain challenges. Zooming out, we see that Northrop Grumman expects revenue growth accelerating in the second half of the year and continue into next year where key platforms such as the B-21 Raider and Ground Based Strategic Deterrent are providing solid support. The Ground Based Strategic Deterrent will provide $1.9 billion of revenues in 2022 and the B-21 revenues will start layering in for growth in 2024 while the Next Generation Interceptor is a future growth opportunity. On top of that there are additional contract awards to be expected as the evolving threat level pushes Defense budgets higher.

Northrop Grumman increased its dividend by 10% earlier this year and I believe that while its yields is not the most attractive, the combination of revenue growth, share repurchases and dividend hikes provide a solid investment opportunity in a market that is currently plagued by inflation but has seen demand for defense equipment rising. As a defense company, Northrop Grumman should be able to benefit from the increasing threat level while it is in part shielded from inflation as it does business with governments and national security interests are high regardless of inflation numbers. A threat to any stock at this point are the recession fears and Northrop Grumman is no exception, even though Defense names usually work with long-term contracts.

Be the first to comment