AutumnSkyPhotography

Thesis

I am very bullish on QUALCOMM (NASDAQ:QCOM), as I believe the company is poised to benefit from metaverse-related structural trends. Notably, it is estimated that VR/AR technology could grow at a 40% CAGR through 2030. And QUALCOMM’s Snapdragon is the leading chipset in this industry.

QUALCOMM stock is down about 35% year to date, versus a loss of approximately 23% for the S&P 500 (SPX). This, in my opinion, is a secular dip-buying opportunity for long-term focused investors.

Personally, I see more than 30% upside for QUALCOMM stock. I anchor my thesis on a residual earnings model, which calculates a fair implied share price of $157.34/share.

About QUALCOMM

QUALCOMM is a US-based leading semiconductor company. The company researches, designs and commercializes chip technologies with a focus on the wireless industry. QUALCOMM operates three key segments: Qualcomm CDMA Technologies; Qualcomm Technology Licensing; and Qualcomm Strategic Initiatives.

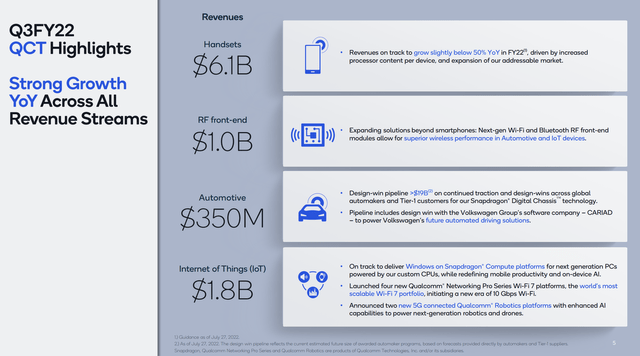

The Qualcomm CDMA Technologies segment provides technology for the wireless communication, networking, application processing and multimedia industry (reference 5G) and accounts for about 85% of the company’s revenues. The Qualcomm Technology Licensing segment sells licenses and other usage rights for QUALCOMM’s intellectual property portfolio and accounts for about 15% of sales. Finally, Qualcomm Strategic Initiatives segment is the company’s investment arm and provides funding to new technologies, including 5G, artificial intelligence, automotive, consumer, enterprise, cloud, and IoT.

QCOM June Quarter presentation

Leading Into The Metaverse

While QUALCOMM for a long time has been known primarily as a chip designer for the smartphone industry, the company is now rapidly diversifying into new high-potential verticals – most notably the metaverse. To put thing into perspective, McKinsey has estimated the annual market size of metaverse economy at $5 trillion by 2030. Citigroup (C) even said that $13 trillion by 2030 could be reasonable.

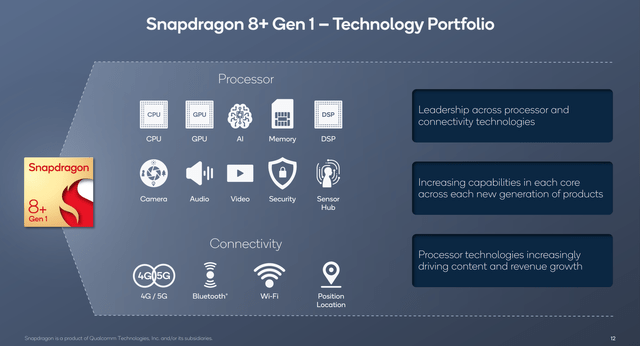

Without a doubt, low latency data communication will be a key cornerstone for the metaverse. And as of 2022, QUALCOMM’s CDMA Technologies segment is leading the wireless communication and networking chipset technology, which could be leveraged for broader metaverse experiences.

Moreover, QUALCOMM’s Snapdragon technology powers most, if not all, AR/VR devices, including Meta’s (META) Oculus Quest. A few weeks ago, QUALCOMM and Meta Platforms have announced a strategic partnership that will likely further strengthen QUALCOMM’s leading metaverse chip technology.

QUALCOMM expects that the Snapdragon technology will grow at a 15% CAGR through 2024. But instead of slowing down afterwards, revenues could accelerate, as XR device adoption finds broader acceptance in the global economy and society.

Exceptional Financials

With regards to financials, QUALCOMM can play in the same league as the US’s leading tech businesses, including the FAANGs, both with regard to revenue expansion and business profitability.

Notably, QUALCOMM’s revenues jumped from about $22.6 billion in 2018 to $42.1 billion in 2022 (TTM reference), which implies a topline CAGR of about 18%. Over the same period, operating income jumped from $3.8 to $15.1 billion, a compounded annual growth rate of 44% respectively.

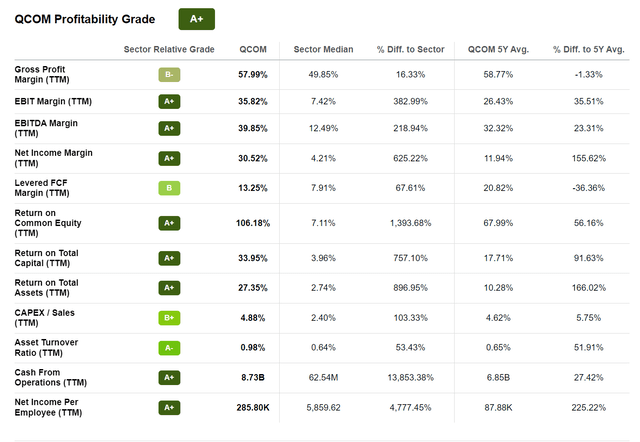

For the trailing twelve months, QUALCOMM has claimed a gross profit margin of 58%, which is about 16% above the sector median of 50%. QUALCOMM’s operating income margin (EBIT, TTM reference) is 45.8%, versus 7.4% for the sector median (382% premium).

Finally, I would like to highlight that QUALCOMM’s balance sheet is very strong. As of June 30, the company had $6.8 billion of cash and cash equivalents versus total debt of $15.5 billion.

Target Price Estimation

To estimate a stock’s fair implied share price, I am a great fan of applying the residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

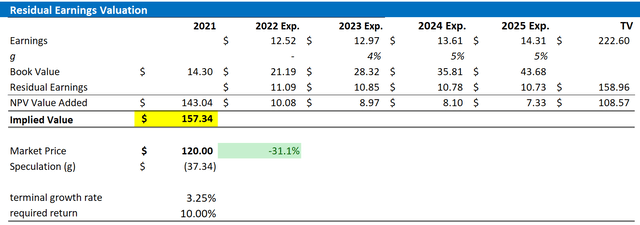

With regard to my QUALCOMM stock valuation, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise

- To estimate the capital charge, I anchor on QCOM’s cost of equity at 10%

- For the terminal growth rate after 2025, I apply 3.25%, which is arguably very conservative (about one percentage point higher than estimated nominal global GDP growth)

Given these assumptions, I calculate a base-case target price for QUALCOMM stock of $157.34/share (more than 30% upside).

Analyst Consensus EPS; Author’s Calculations

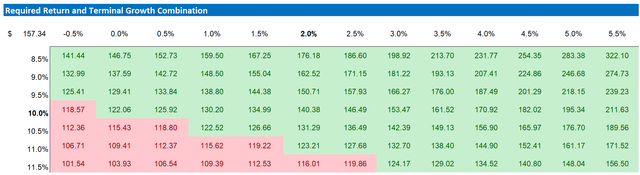

Notably, my bullish price target is not a reflection of a specific combination of growth and cost of capital. In fact, please find below a sensitivity analysis that supports different assumptions.

Analyst Consensus EPS; Author’s Calculations

Risks

Investing in QUALCOMM is not without risk. First, I would like to highlight that many of QUALCOMM’s growth verticals, including the metaverse, IoT expansion and AI-driving technology, are entrepreneurial bets. They can pay-off handsomely, but there is no guarantee. Secondly, QUALCOMM is hoping to expand in the data center server chip technology, but an important related verdict for the lawsuit with UK-based ARM is still pending. Finally, investors should consider that sentiment towards risk assets such as stocks remains strongly depressed. And given multiple macroeconomic headwinds, QCOM stock may suffer from share price volatility even though the company’s fundamentals remain unchanged.

Conclusion

If I had to pick one chipmaker to hold until 2030, it would be QUALCOMM. Investors should consider that QUALCOMM has similar growth rates and profit margins as NVIDIA (NVDA), while trading at multiples of Intel (INTC). As QUALCOMM should strongly benefit from metaverse-related technology trends, I believe QCOM stock should and could trade significantly higher. Personally, I calculate a target price of $157.34/share. And accordingly, I view the current share price weakness – which is mostly driven by general risk-aversion towards stocks – as a strong buying opportunity.

Be the first to comment