AutumnSkyPhotography

Thesis

Qualcomm (NASDAQ:QCOM) fell approximately 10% after the company reported a disappointing guidance. But this sell-off might provide investors with an excellent dip-buying opportunity, as long-term favorable tailwinds meet temporary macro challenges. Moreover, the valuation set-up remains very attractive – priced at a one year forward EV/EBIT of about x8.

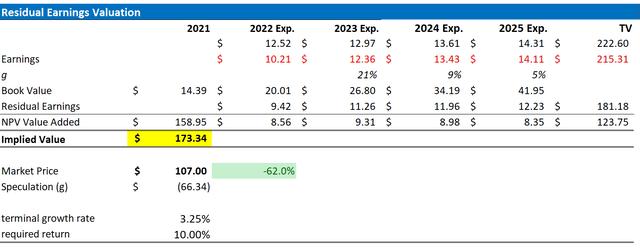

Personally, I continue to believe that QCOM stock is deeply undervalued. Although I update my residual earnings valuation framework to account for lower EPS in 2023 and 2024 on the backdrop of consensus adjustments, I still see more than 30% upside. I remain ‘Buy’ rated.

Qualcomm’s Q4 2022 Results

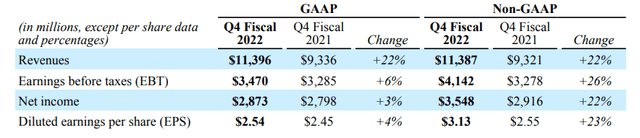

Qualcomm’s September quarter was actually better than expected, but the company disappointed on guidance.

From July to end of September, Qualcomm generated total revenues of $11.4 billion, which reflects an increase of 22% year over year versus the same period in 2021. Net-income on a Non-GAAP basis increase by 22% respectively, to $3.55 billion ($3.13/share).

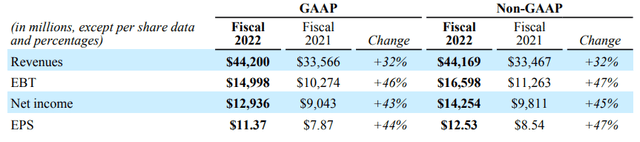

From a FY 2022 perspective, revenues increase 32% versus FY 2021, to $44.2 billion. And Non-GAAP net income jumped 45%, to $14.25 billion ($12.53/share).

Looking at the above numbers, an investor could argue that Qualcomm’s Q4 and FY 2022 were excellent (record year in terms of revenue and EPS). Cristiano Amon, CEO of Qualcomm, commented:

We are pleased to report another strong year, despite the macroeconomic challenges, as we continue to execute our strategy of transforming Qualcomm from a wireless communications company for the mobile industry to a connected processor company for the intelligent edge.

But the problem was with regards to the company’s guidance, as the CEO also added: (emphasis added)

While our financial outlook is being temporarily impacted by elevated channel inventory, our diversification strategy and long-term opportunities remain unchanged

Disappointing Guidance

After almost all major semiconductor companies acknowledge the rapidly deteriorating demand environment for chips, following supply chain easing, Qualcomm predicted that Q1 2023 revenues would likely fall between $9.2 billion to $10 billion – versus analyst expectations having anchored around $12 billion.

Qualcomm also commented on EPS expectations, which were preliminarily estimated at about $2.25 to $2.45 per share, more than one third below analyst consensus of approximately $3.42/share.

Given the uncertainty caused by the macroeconomic environment, we are updating our guidance for calendar year 2022 3G/4G/5G handset volumes from a year-over-year mid-single-digit percentage decline, to a low double-digit percentage decline.

The rapid deterioration in demand and easing of supply constraints across the semiconductor industry have resulted in elevated channel inventory. Due to these elevated levels, our largest customers are now drawing down on their inventory, negatively impacting the mid-point of our EPS guidance for the first quarter of fiscal 2023 by approximately ($0.80). This is the primary driver of the variance relative to our prior expectations.

However, Qualcomm’s challenges were termed ‘temporary’, and long term the company continues to see strong tailwinds in automotive, IoT and VR.

Valuation: Still Very Attractive

Following Qualcomm’s Q4, I upgrade my residual earnings model for QCOM to account for preliminary consensus EPS upgrades. However, I continue to anchor on an 10% cost of equity and a 3.25%, terminal growth rate (one percentage point higher than estimated nominal global GDP growth).

Given these updated assumptions, I now calculate a base-case target price for QCOM stock of $146.77/share, versus $157.34 prior.

Analyst Consensus Estimates; Author’s Calculations

Here is the updated sensitivity table.

Analyst Consensus Estimates; Author’s Calculation Analyst Consensus Estimates; Author’s Calculations

Risks

As I see it, (except for temporary macro challenges) there has been no major risk-updated since I have last covered QCOM stock. Thus, I would like to highlight what I have written before:

Investing in QUALCOMM is not without risk. First, I would like to highlight that many of QUALCOMM’s growth verticals, including the metaverse, IoT expansion and AI-driving technology, are entrepreneurial bets. They can pay-off handsomely, but there is no guarantee. Secondly, QUALCOMM is hoping to expand in the data center server chip technology, but an important related verdict for the lawsuit with UK-based ARM is still pending. Finally, investors should consider that sentiment towards risk assets such as stocks remains strongly depressed. And given multiple macroeconomic headwinds, QCOM stock may suffer from share price volatility even though the company’s fundamentals remain unchanged.

Conclusion

I remain very bullish on QCOM stock, given that the company’s valuation is now even more attractive in relation to the company’s fundamentals – after the sell-off. Moreover, reading QCOM’s earnings release and analyst call transcript, I see no reason to expect that the company’s long-term outlook darkens, and/or the company’s diversification strategy to push into exciting secular growth verticals should be impacted by temporary macro-conditions.

That said, although I update my residual earnings model with lower EPS expectations until 2025, I still see more than 30% upside. Reiterate ‘Buy’ rating with a downward-adjusted $146.77/share target price.

Be the first to comment