G0d4ather

Thesis

The media slammed Qualcomm Incorporated’s (NASDAQ:QCOM) FQ3 earnings card as it focused on its weaker-than-expected Q4 guidance. Yet, QCOM held its June lows remarkably, as our analysis suggests that semi stocks have likely bottomed.

Therefore, we have adjusted our valuation parameters on QCOM, given June’s bear trap signal (indicating the market denied further selling downside decisively). Consequently, we believe the market had anticipated a solid Q2 performance and rallied markedly from its June lows.

Our analysis suggests that Qualcomm’s leadership in premium handsets was instrumental as its handsets business remains robust. As a result, we have observed a significant bifurcation between QCOM and MediaTek (OTCPK:MDTKF) stock recently. Therefore, we believe the market is increasingly confident about Qualcomm’s long-term partnership with Samsung (OTCPK:SSNLF) but more cautious about MediaTek’s low- to mid-tier positioning.

Coupled with Qualcomm’s solid QTL revenue base, we believe QCOM’s June bottom would likely hold robustly.

Notwithstanding, we urge investors to wait patiently for a meaningful pullback in QCOM, as we don’t think it’s undervalued. Our analysis suggests a level closer to its near-term support of $118 is appropriate to add more positions.

Accordingly, we reiterate our Hold rating on QCOM for now.

Qualcomm’s Premium Segment Is Critical To Its Success

Qualcomm highlighted that it extended its partnership with Samsung, highlighting the competitive moat of Qualcomm’s leadership. Therefore, Qualcomm has high multi-year visibility into its QTL portfolio, supporting its revenue base. Management articulated (edited):

Now we’re announcing a multiyear agreement to power the Samsung Galaxy smartphones globally. We see it as a very, very significant milestone event for the QTL licensing program. It really contributes a lot to the stability of the QTL program going forward. The silicon content of a Snapdragon 8 Series, is at least equal to or better than the revenue and earnings of 5 modems for another OEM [Apple]. So it expands beyond Galaxy smartphones to include Galaxy books, Windows PCs, Galaxy tablets, future extended reality devices, and other devices. (Qualcomm FQ3’22 earnings call)

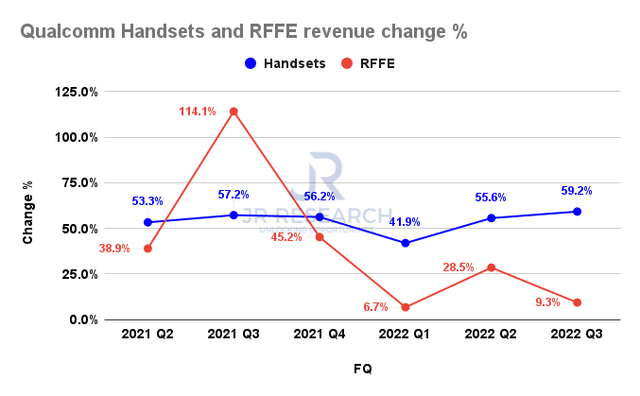

Qualcomm handsets and RFFE revenue change % (Company filings)

Therefore, we believe it’s remarkable that Qualcomm’s critical handsets segment (66% of Q3’s QCT revenue) has continued to drive growth, given the increased silicon content.

However, an analyst on the call was also concerned whether the significant slowdown in RFFE growth could impact its handsets revenue growth moving ahead. Management provided assurances that such a “bifurcation” is expected to persist. CFO Akash Palkhiwala accentuated (edited):

We’re going to continue to have a discrepancy. There’s a lot more demand for processor content, whether it’s CPU, GPU, camera, AI, security, audio, or video. We are increasing content across the board. And so we do expect that will drive stronger revenue growth on the handset side. (Qualcomm earnings)

But, The Street Is Still Fixated On Slowing Growth From FY23

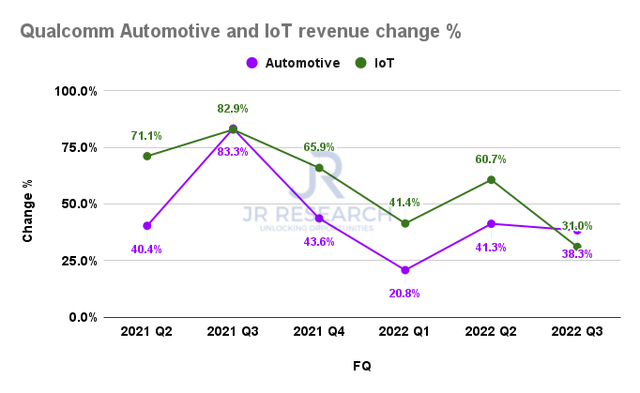

Qualcomm automotive and IoT revenue change % (Company filings)

Despite the robust performance of its newer growth areas (automotive and IoT), as seen above, we believe the Street remains concerned about the potential slowdown in its revenue growth trajectory from FY23.

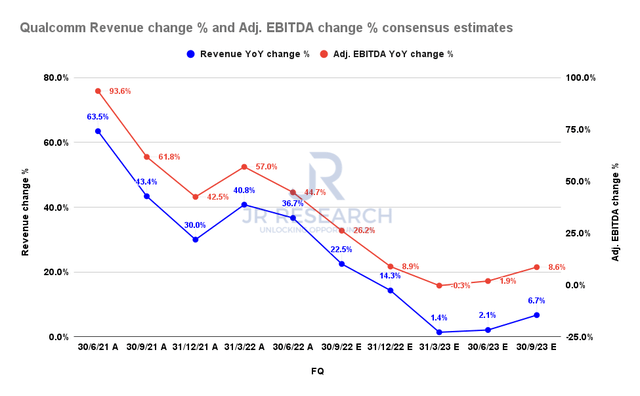

Qualcomm revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

The revised consensus estimates (bullish) indicate that Qualcomm’s revenue and profitability growth could continue to moderate significantly through FY23 before bottoming.

As a result, we believe the market has also de-rated QCOM at its January highs, despite still posting robust momentum. Therefore, we think it’s critical that investors continue monitoring how Qualcomm would guide for Q1’23 at its Q4 earnings card (for the calendar quarter ending September). If management can provide upside guidance surprises, a re-rating could be in store for QCOM.

Is QCOM Stock A Buy, Sell, Or Hold?

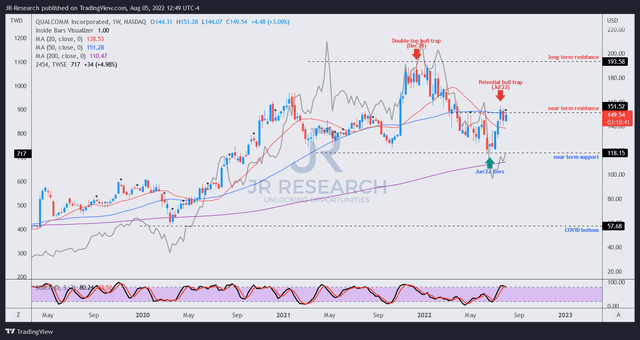

QCOM price chart (weekly) (TradingView)

As seen above, QCOM’s price trend has diverged from MDTKF (gray line overlay) since its June bottom, as the market re-rated QCOM pre-earnings.

As a result, it also formed a potent bear trap at its near-term support ($118), which is our suggested buy entry-level, based on the current price action dynamics. We are also confident that QCOM has likely formed a medium-term bottom in June, in line with its semi peers.

Notwithstanding, we urge investors to be patient and wait for a meaningful pullback in QCOM first, given its sharp run-up in July.

Therefore, we reiterate our Hold rating for now.

Be the first to comment