Justin Sullivan/Getty Images News

Qualcomm (NASDAQ:QCOM) has fallen from the recent highs due to fears on slowdowns from smartphone sales. The global wireless company is in the middle of shifting the business model away from a pure wireless focus, but the business is still dominated by global handset sales. My investment thesis remains Bullish on the stock as Qualcomm shifts to a higher earnings stream while the market doesn’t fundamentally recognize the higher earnings potential.

5G Boom

An investor in Qualcomm has to recognize that the 5G boom boosted FY21 numbers and the current strong guidance for FY22. The company definitely benefits from the cycles for new wireless technology with growth rates eventually slowing down after an initial surge.

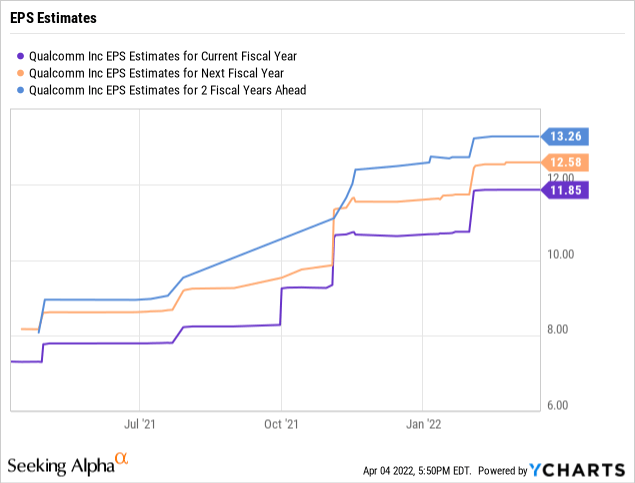

While the stock had surged to new highs in late 2021, the market appears to not recognize that Qualcomm has finally taken the earnings stream to a much higher level. After years of struggles hitting a forecast for a $7+ EPS once solving the licensing deals with Apple (AAPL) and Chinese firms, analysts now forecast FY22 EPS of ~$12.

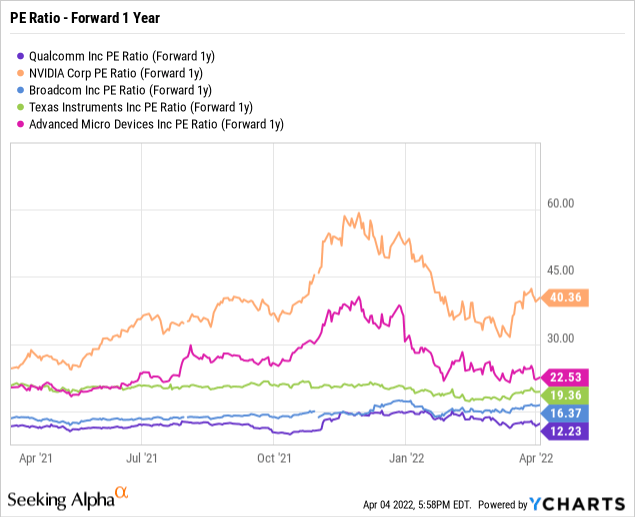

So just from the start, the stock is ridiculously valued at only 12x FY22 EPS targets while the iShares Semi. ETF (SOXX) index leaders all generally trade at higher PE ratios. Only struggling Intel (INTC) trades at the same multiple while the likes of Nvidia (NVDA) and AMD (AMD) trade at vastly higher multiples topping 20x forward EPS estimates.

A base case would seem to support Qualcomm trading at a 16x forward multiple similar to Broadcom (AVGO) or even closer to 19x like slow-growing Texas Instruments (TXN). The case probably doesn’t exist for a Nvidia or AMD PE multiple, but a 16x multiple on a $12 EPS target equates to a $192 stock for Qualcomm.

Qualcomm has a massive opportunity in the auto sector and just closed a deal to acquire Arriver to advance aspirations in autonomous driving. The Automotive sector has struggled recently with FQ1’22 sales only up 21% to $256 million due to general auto sales sluggishness with chip shortages.

Combined with IoT, Qualcomm now gathers $1.76 billion in quarterly sales from areas outside the Handsets and RF front-end sales from smartphones. Unfortunately, the company still obtains the vast majority of profits from the various revenues related to handsets including the $1.9 billion in high margin license revenues. Over time though, the automotive sector promises to rival the revenues from handsets.

Bumpy Demand Period

The recent fears on slowing smartphone sales are somewhat overblown because the shift is occurring from 4G to 5G where Qualcomm obtains far higher content. Flat smartphone sales still equate to much higher revenues for the wireless giant forecasting 5G device sales jump from 535 million last year to 750 million this year.

The comments from the likes of Micron Tech. (MU) and TSMC (TSM) have roiled some of the markets involved in consumer electronics. Even influential analyst Ming-Chi Kuo suggested what amounts to ~51 million less handset units using Qualcomm chips from Chinese Android phones.

Though, Micron posted strong guidance due to this shift towards 5G which drives higher content for the storage company similar to Qualcomm with RF-front end. On the recent FQ2’22 earnings call, CEO Sanjay Mehrotra was clear weakness in China was being overcome by the transition to higher content 5G demand:

Fiscal Q2 mobile revenue grew slightly year-over-year as the 5G transition continues in smartphones. We see some weakness in the China market as the local economy slows, smartphone market share shifts and some customers take a more prudent approach to inventory management. Mobile memory and storage demand continues to be supported by content-hungry applications and the ongoing transition from 4G to 5G, which is driving 50% higher DRAM content and the doubling of NAND content. 5G smartphone sales are expected to grow to 700 million units in calendar year ’22.

Takeaway

The key investor takeaway is that the current period will definitely be bumpy for the semiconductor companies due to strong demand for advanced chips while demand slumps in areas like education because Covid pulled forward purchases in 2020 and 2021. Qualcomm remains too cheap at just 12x strong earnings while the company was clear FQ2’22 and beyond forecasts included demand still exceeding supply. The equation could quickly shift, but the stock is already priced for this worst-case scenario of where demand falls while a strong environment for 5G handsets will warrant a much higher stock price for Qualcomm.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market during early 2022, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

Be the first to comment