AutumnSkyPhotography

QUALCOMM Incorporated (NASDAQ:QCOM) has just declared its Q4 earnings as covered by Seeking Alpha here. EPS were in-line while revenue beat by $40 Million. But Q1 guidance was lower than expected, and this has sent the stock sharply lower, down about 7% in addition to the 4% it lost during regular trading on Wednesday.

We have a history of analyzing dividend coverage based on free cash flow after earnings, as can be seen here.

Why cash flow over EPS

When evaluating dividend coverage, most investors and analysts tend to look at earnings per share (EPS). We prefer free cash flow (“FCF”) as a better indicator of financial health for these reasons:

- Earnings tend to be up and down depending on rare events and write-offs.

- Earnings are more prone to GAAP-related fluctuations.

- Cash flow is king.

Let us see how Qualcomm’s dividend coverage looks after this recent quarterly result.

- Total shares outstanding: 1.12 Billion

- Current quarterly dividend per share: $0.75

- Quarterly FCF required to cover dividends: $0.84 Billion

- FCF in Q4: $0.812 Billion

- Payout ratio using FCF: 103% ($0.84 billion divided by $0.812 billion)

- EPS reported: $3.13

- Payout ratio using EPS: 24% ($0.75 divided by $3.13).

Based on this quarter’s report, it appears like Qualcomm’s payout ratio using FCF is a bit of a concern, but it appears much healthier based on EPS. But one quarter may not present the full picture, as one-off occurrences may have benefitted or impacted the company. Let us run the same numbers above based on full year, FY 2022.

- Total shares outstanding: 1.12 Billion

- Current annual dividend per share: $3.00

- Annual FCF required to cover dividends: $3.36 Billion

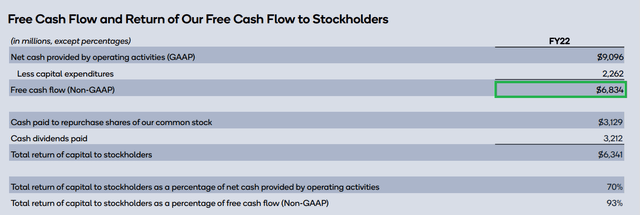

- FCF for 2022: $6.8 Billion, as shown in the investor presentation below.

- Payout ratio using annual FCF: 49% ($3.36 Billion divided by $6.8 billion)

- Annual EPS for 2022: $12.53

- Payout ratio using EPS: 26% ($3.36 divided by $12.53).

The annual numbers look a lot better, but investors need to be mindful of the following:

1. Qualcomm’s 65% reduction in free cash flow Quarter-on-Quarter is a little worrying. Although Qualcomm is not as capital investment heavy as Telecom companies, it is surprising that EPS was much more impressive than FCF in this quarter.

2. That said, short-term fluctuations are normal even for established businesses. Even more so for cyclicals like Qualcomm that see heavy demand fluctuations depending on the quarter.

3. To summarize, Qualcomm’s dividend coverage after this quarterly result and FY 2022 is sound based on both FCF and EPS, with EPS projecting a more rosy picture about the company’s ability to raise dividends through the years.

Forward-Looking Thoughts and Conclusion

- Qualcomm recorded its best revenue in Handsets, Automotive, and Internet of Things (IoT). With Meta Platforms’ (META) recent announcement that it will invest heavily in data centers, chipmakers like Qualcomm stand to benefit heavily from this trend. Qualcomm is a key player in Meta’s raid into Virtual Reality, as the two companies have signed a multi-year agreement.

- With its early mover advantage, Qualcomm is well positioned to reap in the rewards from the Automotive market, which is expected to be $100B in size by 2030. To quote the CEO:

“Qualcomm is a leader in essential technologies for the Connected IntelligentEdge. Our One Technology Roadmap scales across virtually every industry, including automotive. The Snapdragon Digital Chassis, combined with our relationships with automakers, has resulted in a $30 billion design-win pipeline. We are winning the digital future of automotive.”

- Qualcomm is not averse to the macroeconomic challenges. But investors can take confidence from the fact that the company is also cutting down on its expenses, with a targeted 3% to 5% reduction in operating expenses in Q1 2023.

- In a market that severely punishes unprofitable tech companies, Qualcomm is a moderate bet. There are risks associated with reduced demand and export regulations. However, at the current pre-market price of $104, Qualcomm is trading at a forward multiple of 8 if forward estimates hold. That is very attractive, even more so considering the near-3% yield.

- Speaking of yield, Qualcomm has increased dividends for 18 consecutive years. With the room shown in both EPS and FCF based payout ratios, it is fair to expect a dividend increase in 2023. Given the macro conditions, we expect Qualcomm to be a bit circumspect and offer a 5% increase. That will place the new the new quarterly dividend between 78 and 79 cents per share.

- Qualcomm is a rare bread tech stock that offers current dividend, capital appreciation potential, and dividend growth potential at a very reasonable price.

- Lastly, investing becomes a manageable game when you know what you are playing. Qualcomm is a cyclical company and should be treated as such in your portfolio. We continue being invested in Qualcomm and will look at adding to our portfolio below $100 in the upcoming days.

Be the first to comment