remco86/iStock via Getty Images

Options are one of the best ways to enhance returns. More importantly, options are also one of the best ways to enhance returns relative to risk. By embracing volatility and selling insurance (read cash secured puts) or lottery tickets (covered calls) to other investors, one can enhance returns while reducing risk. Funds have rushed into this space in the last few years, no doubt influenced by low yields everywhere else. The Nuveen Nasdaq 100 Dynamic Overwrite Fund (NASDAQ:QQQX) is one of the most popular funds in this space and uses covered calls as the primary strategy to enhance returns.

The Fund

QQQX was founded near the last major market peak in January 2007, so it has a longer history than many other funds in this space. It was created with the aim of offering regular distributions, through a strategy that seeks to reduce volatility. The fund invests in an equity portfolio that was almost identical to the Invesco QQQ ETF (NASDAQ:QQQ). The fund also aims to sell call options on 35-75% of the notional value of its total portfolio with a longer-term average of 55%. This allows the fund to use some timing alongside a passive strategy. It can sell more calls when the markets are ebullient and less when it is depressed.

Holdings

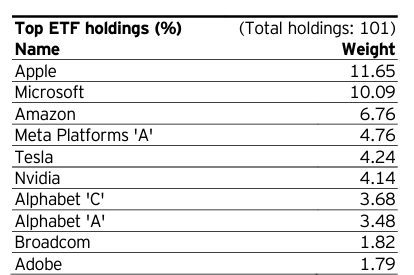

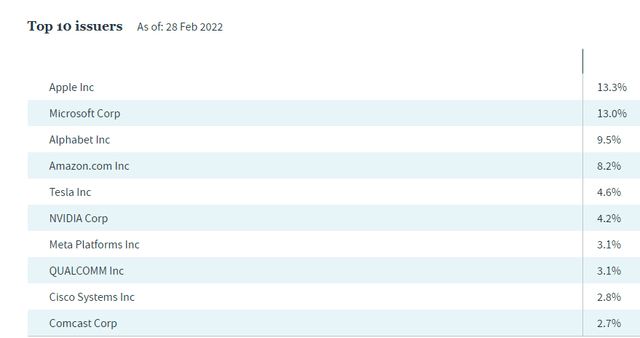

The fund sticks close to its desired benchmark and the top holdings are very similar, though nowhere near identical to that of QQQ.

QQQX is more top-heavy compared to QQQ below.

QQQ Top Holdings (Invesco)

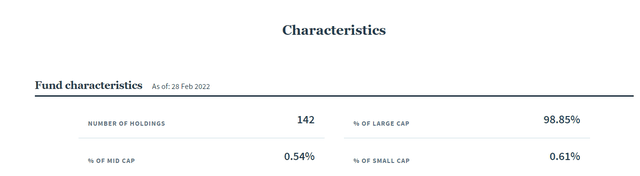

What accounts for these differences? There are likely components here from trying to achieve tax-efficiency (one of the fund’s stated goals) as well trying to underweight more expensive components. We will also note here that QQQX holds far more stocks than the 101 in QQQ.

Covered Calls

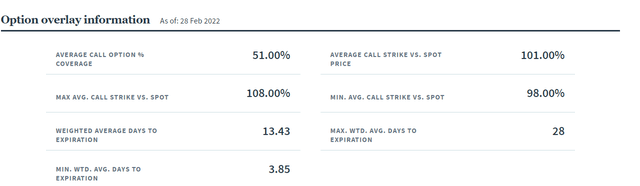

Unlike our own strategy where we favor longer duration option selling, QQQX’s options are extremely short dated.

QQQX Option Information (Nuveen)

The fund is likely writing weekly options and alongside the regular monthly ones. As anyone who has traded options knows, this strategy has perks as well as drawbacks. The perk is that theta decay is maximum near option expiration, so you capture that rapidly. The drawback is that there is very little premium received and downside protection is minimal. In fact, QQQX heavily underperformed during the COVID-19 drawdown.

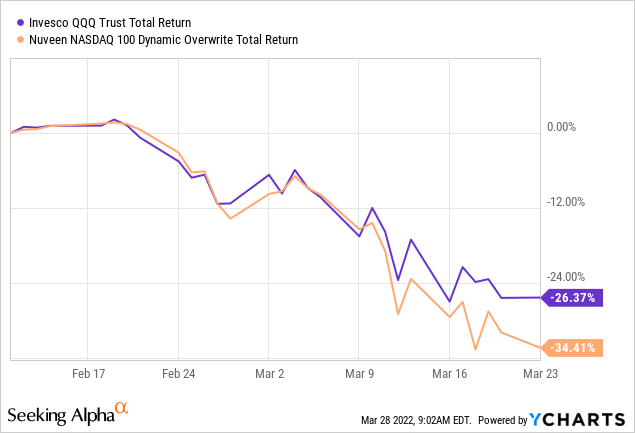

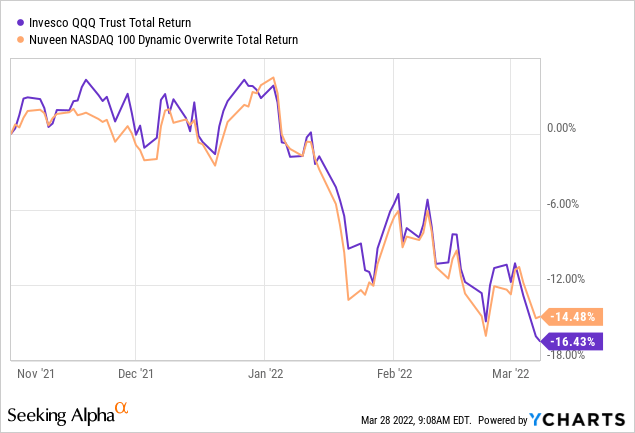

Why did QQQX fair so badly? We are not certain, but the underperformance likely came from the larger drops in its mid-cap and small cap holdings where QQQ did not venture. While we would not criticize QQQX for the relative underperformance during that timeframe, we would want investors to understand that the shorter term call-selling offers almost no downside protection. We saw the same pattern during the most recent selloff down to the day the indices bottomed.

Outlook & Verdict

We are fans of the covered call strategy and have used it successfully to outperform the indices during drawdowns. There are two problems with using QQQX for income with that hope though. The first being that the underlying holdings are coming off a busted bubble. We believe the recent NASDAQ peak marked the end of the “growth” bubble. Hence if we had to use a covered call strategy fund, we would gravitate towards stocks that have better fundamentals. The second issue we have is that the calls are just too short dated to provide any reasonable protection. As the two drawdown examples show, this is something you have to accept if you want this fund. We can illustrate both with a single example.

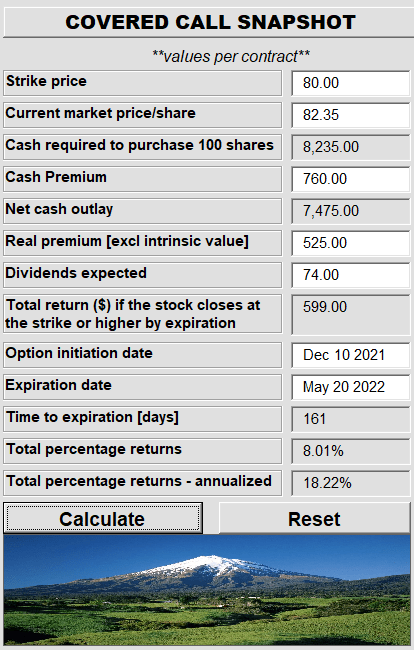

Science Applications International Corporation (SAIC), an S&P 500 information technology component, was trading at a relatively attractive valuation in late December. At $82.35, it was close to 12X earnings. It was also reasonably priced based on the whole host of other valuation metrics we ran on it. We decided to do the $80.00 covered call on it. The covered call was relatively long-dated but offered a very solid yield.

Trade 222 (Conservative Income Portfolio)

That yield beats QQQX’s 7% by a good mile. It also offered downside protection till $74.75 or about 9% below the market price. Of course, no strategy is foolproof and as it stands it would have been better to just go long SAIC, than play it in a defensive manner. But this strategy definitely reduces drawdowns.

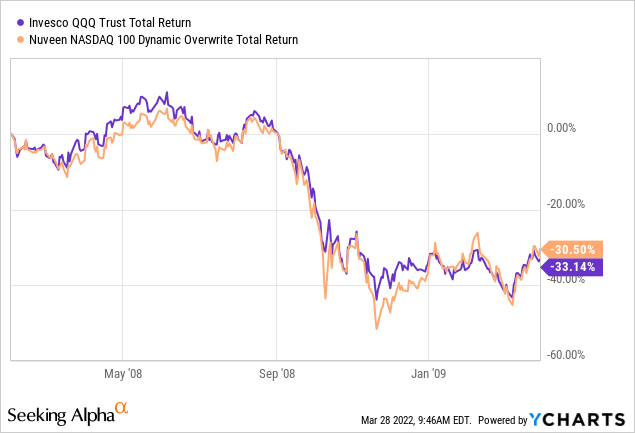

Getting back to QQQX, one might think that it is better than QQQ. That likely turns out to be correct and we think the strategy will outperform QQQ if the NASDAQ moves 30-50% lower from here. That too is not guaranteed as bear markets have huge rallies which can often force a covered call fund to buy back stocks at higher prices. It did win in 2008-2009, but it was a whisker.

We rate the fund a sell at current valuations of the underlying holdings.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment