Justin Sullivan

Last week, chip giant Nvidia (NASDAQ:NVDA) surprised the markets by pre-announcing fiscal Q2 revenues that were well below street expectations. The reported top line number showed barely any year over year growth, and it left many wondering how the next few quarters will turn out. For the stock to truly bottom, it is possible that we may need to see another warning from the company, perhaps even at next week’s earnings report.

For the July quarter, Nvidia generated $6.7 billion in revenue, down 19% from fiscal Q1 and up just about 3% year over year. This top line number was dramatically short of Street expectations for $8.1 billion. The main culprit was the gaming business, which saw a 33% drop from the year ago period. While data center revenues surged more than 60% year over year to a record, they seemingly fell a little short of company expectations. The following quote came from the company’s leader:

“Our gaming product sell-through projections declined significantly as the quarter progressed,” said Jensen Huang, founder and CEO of NVIDIA. “As we expect the macroeconomic conditions affecting sell-through to continue, we took actions with our Gaming partners to adjust channel prices and inventory.

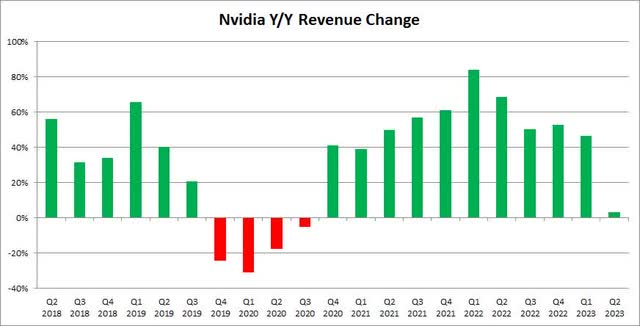

Fiscal Q2 was supposed to see a bit of a growth pullback anyway after multiple years of very strong results. Analysts were looking for a little more than 24% growth in revenues after the previous 10 quarters showed growth of more than 38% in each period. As the chart below shows, we likely are just in the midst of another downturn in this cyclical industry.

Nvidia Y/Y Revenue Growth (Seeking Alpha)

The obvious question is where do we go from here, as Nvidia is set to report full Q2 results on August 24th. One analyst from Bank of America, who has a Buy rating and $200 price target, thinks there is still one more shoe left to drop here. He believes that another guide down could help clear the decks and meaningfully reset expectations for next year. He noted that total third-quarter sales could be between $6 billion and $6.5 billion, which would fall quite a bit short of the current Street average estimate for $7.08 billion.

Looking back at Nvidia’s history suggests this analyst may not be too far off in his thoughts. When we saw the last drop off, total sales fell by $1 billion from peak to bottom, a fall of more than 31%. If we apply the same percentage this time around to the recent record of nearly $8.3 billion from fiscal Q1, it would mean that revenues could drop to around $5.7 billion. I’m sure bulls will think the company is a bit stronger this time around, but that low to mid $6 billion range the analyst mentioned doesn’t seem that outrageous in this respect.

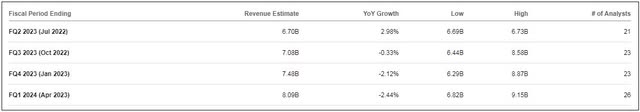

When we saw that drop into the red in fiscal Q4 2019, Nvidia reported a 24.25% drop in the top line. In the following sequential quarter, the percentage drop increased to 30.78%, a more than 650 basis point increase. Estimates for the current quarter only call for a 331 basis point worsening in the year over year growth rate, although they do increase a bit more to the downside as we look at the two quarters after that as seen below.

Nvidia Current Revenue Estimates (Seeking Alpha)

Another way to look at things is in pure dollar terms. When we saw that big drop a few years ago, the company reported fiscal Q4 revenues of $2.21 billion. Things ticked up ever so slightly the following quarter to $2.22 billion. However, as the graphic above showed, analysts are looking for almost $400 million in sequential growth for the current October period. That makes me think next week’s guidance is likely to disappoint, especially if some of those seemingly unrealistic over $8 billion high estimates don’t come down rather quickly.

So what does this all mean for Nvidia shares? Well, the stock lost more than half of its value from its $346 peak as the chart below shows. A pullback in the market combined with perhaps some thoughts about a slowing business sent the stock much lower, although we’ve rallied nicely from the recent low of $140. The average price target of nearly $225 represents solid upside from here, although I wonder if some targets will come down after next week’s report, especially if we get weak guidance. I personally wouldn’t be a buyer in the short term unless we trade down to the 50-day moving average (purple line below), which likely would be the meaningful reset of expectations this name needs.

Nvidia Last 12 Months (Yahoo! Finance)

In the end, investors in Nvidia might want to brace for some more bad news from the company. While the company’s Q2 revenue pre-announcement sent Street estimates sharply lower, history suggests that current numbers may still be a little optimistic. We’ve seen downturns like this before, and the company has come out of them stronger than ever. It wouldn’t be a bad thing to see expectations and the stock reset a bit, and then we can look forward to a better year in calendar 2023.

Be the first to comment