DNY59

The Invesco Nasdaq 100 ETF (NASDAQ:QQQM) bounced back sharply after losing significant value in the first half of 2022. It is highly likely that the recent rebound in tech stocks and the broader market index won’t last long, and that the uptrend could turn out to be a bear market rally, which might be followed by a gigantic selloff. The rally looks unsustainable as investors’ sentiments may be affected by several factors, including weakening global economic growth, high valuations, interest rate hikes, and earnings revisions. In addition, historical stock market trends show that the market has only entered the second phase of this selloff and it has yet to face the capitulation phase where all companies will fall, and the trend will last longer than the first two phases. In light of this, I recommend waiting a little longer rather than chasing a current rally and buying a high beta ETF like QQQM.

Lower Projections Could Weigh on Sentiments

Several large-cap technology stocks, including Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN), rose sharply in recent weeks due to stronger-than-expected June quarter earnings. Apple’s June quarter earnings beat expectations by $0.04 per share, while Microsoft’s revenue grew at a double-digit rate from the past year’s quarter. A narrow revenue and earnings miss by Alphabet (GOOG) (GOOGL) and Meta Platforms (META) also soothed investors’ fears. Despite positive earnings, investors have been ignoring lower forecasts for the second half of 2022 as well as for the next year. According to Bloomberg Intelligence data, analysts’ profit estimates for tech companies listed on the S&P 500 have plunged two percentage points since second-quarter earnings began in July. For instance, Apple’s September quarter earnings expectations were lowered by 27 analysts in the last 90 days while only two analysts raised them.

The growth of online platforms has also slowed down dramatically due to a number of factors, including fierce competition, a global economic downturn, and rising inflation. Consequently, revenue and earnings expectations for Meta Platforms saw a steep decline in the last 90 days. Seeking Alpha data shows that 34 analysts have cut their annual earnings forecasts for the company, while just one analyst increased his earnings forecast. The situation is not different for Alphabet, the parent company of Google, which received a negative C grade on earnings revision based on the Seeking Alpha quant grading system.

Lofty Valuations Limits Upside

A rebound in stock prices coupled with lower earnings forecasts led to a significant increase in P/E ratios from recent lows. The price-to-earnings ratio of NASDAQ is currently hovering at around 27 compared to 22 in June, while the forward P/E has jumped over 23. Apple, the largest component of the NASDAQ index, is trading around 27 times forward earnings, which is higher than its 5-year average of 22 times and sector median of 22.77 times. Due to revenue and earnings revisions for 2022, as well as prospects for slower growth in the coming year, the rise in stock prices and valuations is concerning.

According to Seeking Alpha’s quant grading system, most of the NASDAQ 100’s top 10 stocks received poor valuation scores. Apple, Tesla (TSLA), Amazon, Nvidia (NVDA), and Costco (COST) all received F grades, while Microsoft, PepsiCo (PEP), and Alphabet received negative D grades. Overall, it appears to be risky to pay a significant premium on tech stocks in recessionary economic conditions, rising inflation, slowing tech hiring, and rising valuations.

Trends Echoes Early 2000 Dynamics

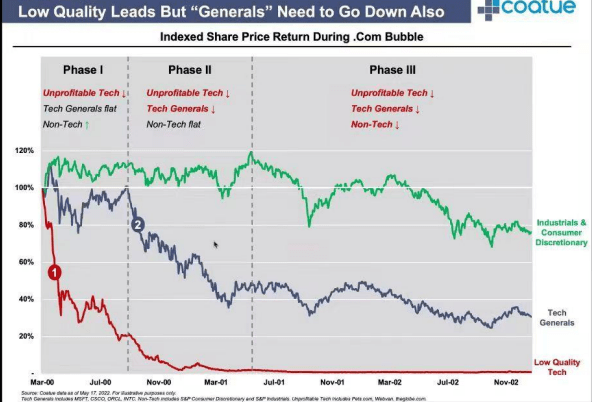

Investors should be aware of the bear market rally because historical trends indicate stocks haven’t hit bottom. Current market trends appear to have a lot in common with the dot-com burst of 2000. Between 2000 and 2001, stock prices collapsed in three phases. Those phases are very similar to market trends that began in 2021 and continued into 2022.

Coatue Management Investor Presentation (assets.empirefinancialresearch.com)

In early 2000, low-quality and unprofitable tech stocks lost investors’ confidence and started falling fast. Meanwhile, high-quality and profitable tech stocks remained strong along with the rest of the sectors. The second phase, which began in the second half of 2000 and lasted for 9 months, was characterized by slowing earnings growth for the entire technology sector. Lastly, the capitulation phase, which began after the earnings revisions, affected the performance of the entire public sector. The third phase lasted longer than the first two and erased significant value from the broader market index.

Considering historical trends, we are just in the middle of the bear market. In the first phase, which began in 2021, there was a huge dispersion between returns from non-profitable tech companies and high-quality profitable tech companies. After a huge rally in 2020, non-profitable and early-stage tech stocks fell sharply in 2021 due to lofty valuations and concerns over their performance in post-pandemic conditions. Meanwhile, large caps like Apple, Microsoft, and many others continued their upside momentum and traded around their all-time high at the end of the year.

However, in 2022, a threat of recession, rising interest rates, concerns over slowing earnings growth, and high valuations led to a change in the trend for all tech stocks. In the first half of 2022, stocks of both low-quality and high-quality companies lost significant value, pushing the tech-heavy NASDAQ index into a bear for several months. As of right now, it appears we are closer to the final phase of capitulation, where tech and non-tech companies might see steep and prolonged declines. The term capitulation describes a situation in which investors lose faith in stock prices amid slowing economic growth and declining corporate earnings. In 2022, the US GDP contracted for the second consecutive quarter, completing one of the standard criteria for a technical recession. Moreover, the forecasts hint that GDP would experience further contraction in the following quarters of 2022 due to the Fed’s strategy of curbing inflation through a series of rate hikes.

In Conclusion

QQQM’s low expense ratio of 0.15% and portfolio concentration of 100 large cap NASDAQ stocks make it a great long-term investment. However, when chasing value, buying ETFs at the right time matters a lot. I believe it’s not the right time to buy QQQM ahead of the economic slowdown and rising rates. A combination of high valuations, lower earnings forecasts, and economic difficulties would not only limit the upside but also help in building the capitulation phase in the days to come. Therefore, it’s prudent to wait for a better buying opportunity.

Be the first to comment