imagedepotpro

By Somya Sharma

Summary

We rate the First Trust Nasdaq Clean Edge Green Energy ETF (NASDAQ:QCLN) as a Hold. These days for us, that’s about as high a rating as we’ll give to most ETF. Our cautious near-term broad stock market outlook allows for a very small number of full-throated buy recommendations.

There is certainly plenty of political debate over climate change. But we believe the growth of renewable energy is a key to mitigating that long-term issue. It is an industry with strong growth prospects, and has been a boon for long-term investors in recent years. This year alone, global investments in this industry are expected to reach $2 trillion by December 31st. That is an 8% increase from last year. However, even this industry couldn’t hide from the risk of rising interest rates and recession fear in the market.

Strategy

QCLN was launched in August 2007 and is managed by First Trust. It tracks the performance of the Nasdaq Clean Edge Green Energy Index. The index comprises companies that primarily deal in manufacturing, developing, distributing, and installing clean energy technologies. To qualify for potential inclusion in the index, the companies should have a market cap of at least $150 million and an average trading volume of at least 100,000 shares. This allows QCLN to include companies of all market capitalization sizes.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Aggressive

-

Sub-Segment: Clean Energy

-

Correlation (vs. S&P 500): Low

-

Expected Volatility (vs. S&P 500): Very High

Holding Analysis

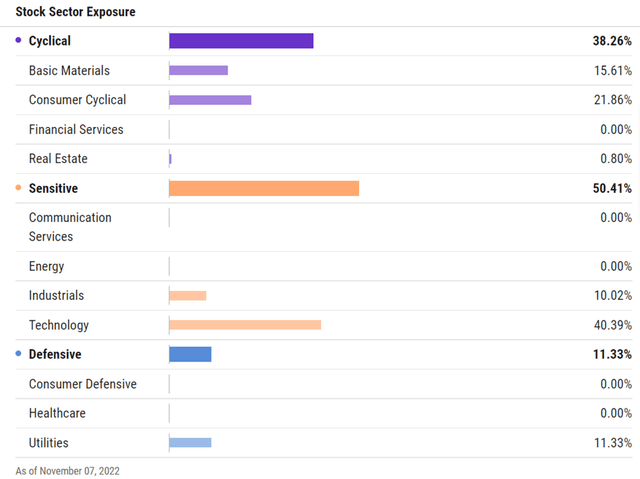

QCLN diversifies across 63 holdings as of the writing. From a sector standpoint, it is highly concentrated, with around a 40% allocation to the technology sector, followed by consumer cyclicals (22%) and basic materials (16%). Taken together, this makes QCLN more sensitive to changes in the economic cycle. Here is the complete sector and super-sector breakdown.

QCLN Sector Exposure (Ycharts)

More than 50% of the fund’s assets are invested in mid-cap stocks, while 27% are deployed into small-cap stocks. Together, these offer a higher potential for growth in QCLN than its large cap counterparts, and higher risk. Part of that risk is in how concentrated the ETF is. The ETF’s top 10 holdings make up about 62% of the total.

Strengths

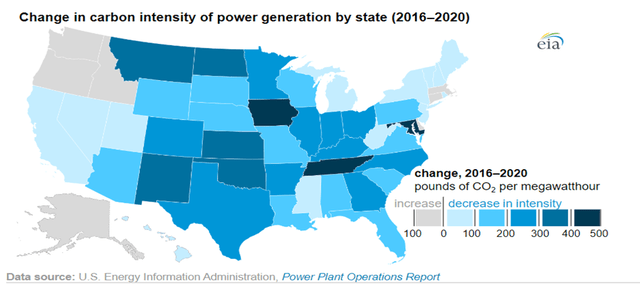

Net-Zero and Clean Energy Initiatives by companies and the government are leading to a New Era in the Energy Transition. The energy transition is a shift from fossil fuels to cleaner energy sources, representing a change in how we produce power. It’s all happening around us. As per the U.S. Energy Information Administration, from 2016 to 2020, the carbon intensity of U.S. power generation fell by 18% and is increasing significantly.

Carbon intensity on the decline (U.S. Energy Information Administration)

While risks are certainly involved, investing in renewable energy ETFs could be a positive choice for long-term investors. Over the past 5 years, QCLN has captured 162% of the S&P 500’s upside, while experiencing only 89% of its downside. That’s an excellent up/down ratio of 1.83. Not a bad history, if you are a risk taker.

Weaknesses

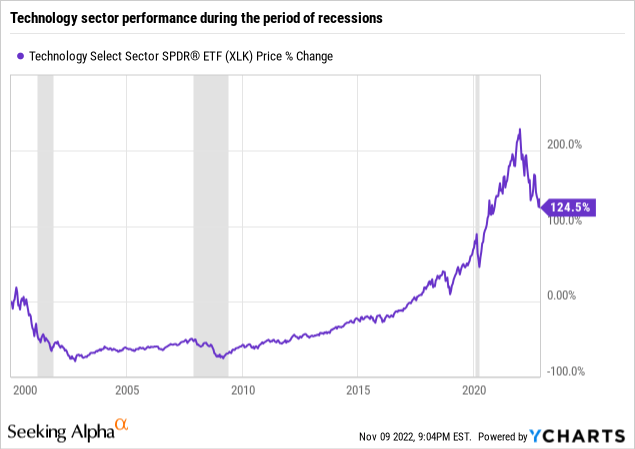

QCLN is heavily invested in the tech sector, which is more vulnerable to economic downturns than other sectors. This was clearly illustrated during the recession of 2008-2009. At that time, the value of tech stocks fell sharply, and many businesses cut back on their technology budgets. The grey areas in the chart below show U.S. recessions. While the tech industry has recovered since then, it remains susceptible to future economic shocks.

Technology sector performance during periods of recessions (Ycharts)

Opportunities

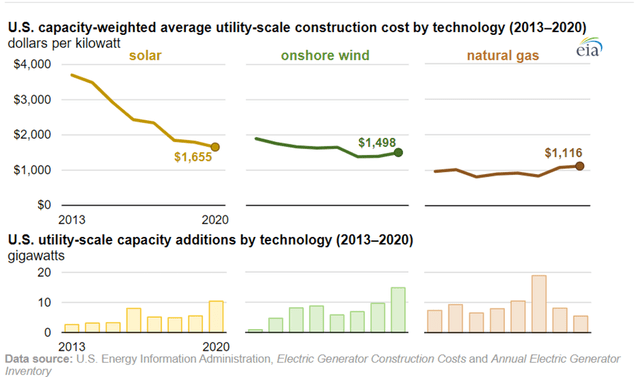

With the world’s economy in a constant state of flux, it can be challenging to say which industries will thrive in the coming years. However, one trend that appears to be gaining steam is an investment in renewable energy. Advanced economies such as the United States and the European Union are leading the charge, with both governments and private companies pouring money into research and development. Moreover, the cost of clean energy technologies has fallen sharply in recent years, making them more affordable and accessible. In the chart below, we can see the declining construction cost of energy generators for solar and wind energy.

Construction cost trends (Ycharts.com)

QCLN is not highly correlated with the S&P 500. That is a double-edged sword. QCLN’s performance after the pandemic bottom on March 23, 2020 was impressive. From that market low through October 5 of that year, QCLN gained more than 156%, while the S&P 500 gained 38%. While that high beta works both ways, QCLN has a history of jumping high when bull markets return.

Threats

The green energy industry is still in its infancy, and is more sensitive to changing market conditions than most industries. In particular, the renewable energy business relies on government subsidies, which can be reduced or eliminated if political support for that ideal wanes.

Also, exposure to the technology and cyclical consumer sectors in the green energy industry makes QCLN highly volatile ETF, and this is unlikely to change moving forward. The ETF has a beta of 1.5 over the past five years, which means, on average, it moves 1.5 times that of the S&P 500. QCLN’s 5-year standard deviation of roughly 40% put this ETF in the top 10% of ETFs we follow.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Hold

-

Long-Term Rating (next 12 months): Buy

Conclusions

ETF Quality Opinion

The renewable energy industry is a booming and exciting business for long-term investors. QCLN is a better fit for aggressive investors, while investors with a low-risk appetite should either keep their position size small, or avoid it altogether. There’s just too much price action here.

ETF Investment Opinion

The volatile nature of this industry can be difficult for renewal sector companies to manage. It can be a double-edged sword. On the one hand, they can benefit from economic growth. However, they are also more vulnerable to economic downturns. We like QCLN for those with long time horizons, and our technical analysis work confirms what we presented here fundamentally. However, in this market environment, we can’t deliver more than a Hold rating for the time being.

Be the first to comment