Silver (XAG/USD) outlook:

- Silver price action falls following weak NFP report

- CCI suggests that Silver may be harboring overbought conditions

- Short-term selling pressure may still prevail

Silver Advances as Dollar Takes Strain

Silver prices continue to move lower, as the Dollar takes back some of its previous losses. Despite increasing prospects of additional US Fiscal stimulus following the US Senate runoffs in Georgia, higher bond yields and optimism regarding the distribution of the Covid-19 vaccine overshadowed concerns, boosting the demand for riskier assets.

Visit the DailyFX Educational Center to discover why news events are Key to Forex Fundamental Analysis

Recommended by Tammy Da Costa

How news can impact your trades?

Silver (XAG/USD) Technical Analysis

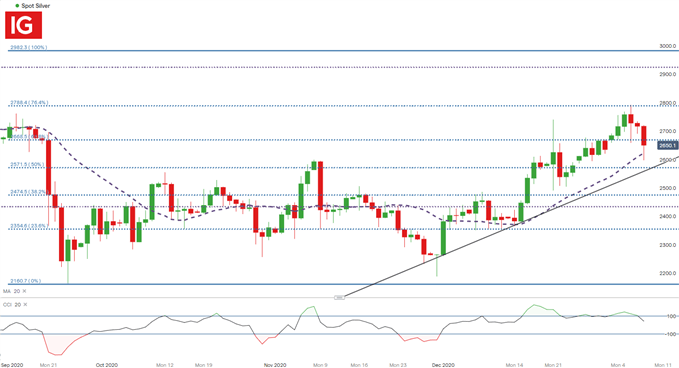

Silver faces its third consecutive day of losses against the greenback, after bulls failed to break above the wall of resistance formed by the 76.4% Fibonacci retracement level at 2788.4 earlier this week. A decrease in demand for Silver, Gold and other safe-haven assets resulted in bearish dominance, despite an increase in the industrial demand for the precious metal.

Meanwhile, the 20-Day Moving Average has formed an additional layer of support for price action, with a break below this level providing a potential indication that selling pressure may hold. The Commodity Channel Index (CCI) remains confined towards the upper bounds of the Index, lingering just below overbought territory.

Recommended by Tammy Da Costa

Building Confidence in Trading

Silver (XAG/USD) Daily Chart

Chart prepared by Tammy Da Costa, IG

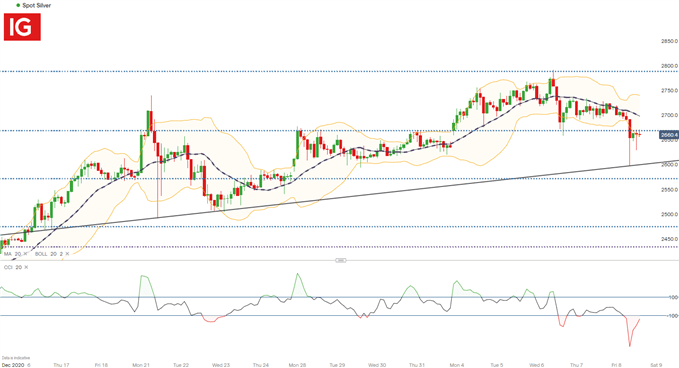

After breaking below the Bollinger Band, the release of dismal Non-Farm Payroll (NFP) brought some additional bearish price action into the mix. However, prices remain below the 20 period Moving Average and the Commodity Channel Index (CCI) remains below -100, a potential indication that XAG/USD may be nearing oversold in the short-term.

Silver (XAG/USD)2 Hour Chart

Chart prepared by Tammy Da Costa, IG

For now, support potential remains around the key psychological level of 2600 with the 50% Fibonacci retracement level providing additional support at 2571.5

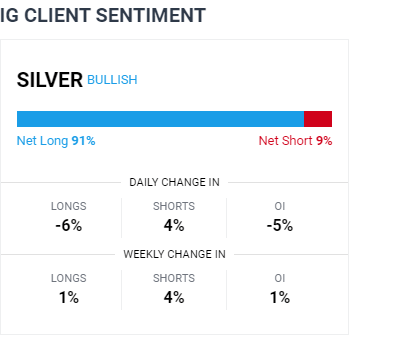

Silver Sentiment Remains in Favor of the Bulls

At the time of writing, retail trader data shows 91.68% of traders are net-long with the ratio of traders long to short at 11.01 to 1. The number of traders net-long is 3.59% higher than yesterday and 5.42% higher from last week, while the number of traders net-short is 12.40% lower than yesterday and 3.64% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Silver prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Silver price trend may soon reverse higher despite the fact traders remain net-long.

— Written by Tammy Da Costa, Market Writer for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

https://www.dailyfx.com/education?ref-author=dacosta

Be the first to comment