RoschetzkyIstockPhoto

There is constant talk about what will be the next “big thing” for Tesla (NASDAQ:NASDAQ:TSLA). The auto division will undoubtedly continue to grow its revenue for years to come. The stock price has factored in that revenue already though. So one needs to know what might next drive the stock price higher.

Some commentators have high hopes for FSD (full self-driving), for”Optimus” robots, for various AI avenues such as the DOJO super computer. Others see Tesla financials being tied in with other parts of the Musk empire such as SpaceX, neuro-science or the Boring Company. However at the Q3 analysts meeting Elon Musk said that particular development would be some way down the line, if at all.

However, as I detailed in an article in January this year, the answer is already staring observers in the face. Tesla have repeatedly stated that they expect energy storage and other energy items to become 50% of company revenue. Now the road map to the possibility of achieving that is becoming clear. The Q3 2022 results just released show this clearly. Energy storage growth year-on-year was 62% against cars delivered growth at 42%.

The move from ICE vehicles to EV’s is a secular growth area and unstoppable. The move from fossil fuels to renewables to a secular growth area and unstoppable. What they have in common is that Tesla is a leader in both.

Capacity

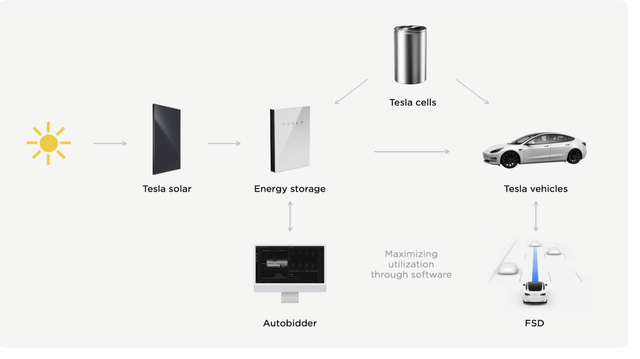

The big issue for Tesla has always been capacity, capacity, capacity. This was particularly felt when the Model 3 was launched. The company then had to put the soaring demand for the Model 3 at the head of the list of priorities. As per the Tesla Environmental Report, the company has always envisaged strong vertical integration over the long-term.

Tesla Inc

Now product shortage seems to have been largely resolved. At a recent briefing the company surprised with what they could now produce at the Nevada factory. At the end of 2021 the company was calculated to be the 3rd largest BESS (Battery Energy Storage Systems) systems integrator in the world. The production capacity of the largest commercial battery, the “Megapack”, is now at 42 units per week. Orders are backed up into late 2023. The production capacity of the residential battery, the “Powerwall” is now at 6,500 units per week. The company was reported recently to have orders backed up to the tune of 80,000 units, which has a value of about $920 million. In addition there is a smaller commercial battery the “Powerpack” (current production capacity for that was not stated). The contract price for the Megapack probably averages about $1.6 million. The sales price for the Powerwall averages about $11,500.

The potential at current capacity gives $138 million per week in revenue into the foreseeable future. The waiting list for both runs into mid 2023 and probably later. On that basis alone we can expect $7.1 billion per annum in revenue from this factor alone for the energy division. That would approximate to about 10% of company revenue at expected revenue of $67 billion per annum at current levels.

As the Nevada factory continues to gear up, the new dedicated facility at Lathrop in California is coming on stream. That is expected to produce over 40 GWh of batteries for storage next year. My article here detailed that. To understand the importance of this, that would be about ten times what Tesla produced in 2021. Unit costs are set to decrease quite substantially even while sales prices go up. This will lead to better margins for the company on its energy storage business. A recent listing on LinkedIn shows Tesla is now recruiting for a range of job openings at Lathrop.

In fact the annual dollar revenue potential should be far greater than current figures would indicate. With shorter lead-times and more management input, the demand should continue to rise rapidly. The main constraint may be company management time.

The company may now be able to offer Powerwall to individual home owners without the solar roof package. Otherwise such customers can buy from Tesla dealers. There is still some uncertainty on this. That could further drive demand. They can also now offer the product in many more markets around the world this year. That will help drive Tesla’s ambition to be authorised as a distributed global utility, such as it now is in the U.K, in Germany and in Texas. Last year the company sold 250,000 Powerwalls by targeting only a small portion of the addressable market.

A possible delaying factor now is with semiconductors. The Q2 results call had discussed semiconductor shortages as having been a brake on growth as well as batteries.

Tesla’s own #4680 battery cell production is ramping up fast. Its production tripled in Q3 over Q2, it was revealed at the analyst meeting. The company is aiming at 1000GWh annual production in the USA. At the meeting Musk forecast that the world will need 300,000 to 400,000 GWh in the future for autos and storage.

The #4680 is mainly used for autos. It is not used for the Semi. If Semi production ramps up as expected, its need for batteries could possibly compete with the energy storage’s division need for batteries. Tesla’s long-term contracts with CATL and BYD Auto (OTCPK:OTCPK:BYDDF) should however be sufficient. What gets supplied to what product from which supplier is still not entirely clear.

Projects.

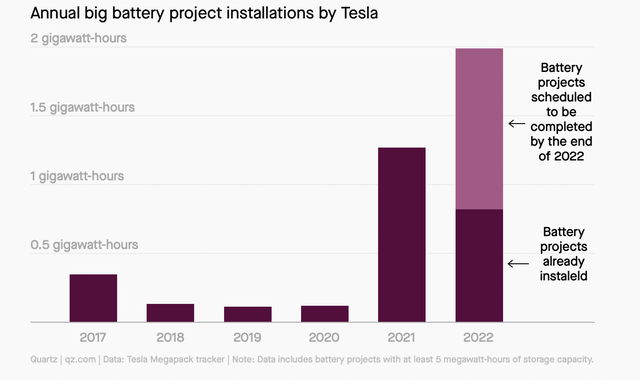

As my previous articles in January and July detailed, the projects are of many differing types and in many different areas of the world. An idea of the geographic spread can be sighted here. As per the Tesla Megapack Tracker and quoted by Quartz, 2022 will be a vibrant year:

Tesla Megapack Tracker

The Q3 numbers suggest the above may be an under-estimate. A small sample of recent projects illustrates the breadth of the business.

* Watertown Renewables Project in New York. Using 10 Megapacks this provides 31 MWh for expansion of a sub-station.

* TFG chain of stores in South Africa. They have so far bought 307 Powerwall units to combat the effects of common load shedding amongst its 3000 nationwide stores.

*3 large U.S. projects coming on stream. These comprise their 3 biggest projects. The largest is the Elkhart Battery Storage plant for PG & E (NYSE:PCG) in California. For this Tesla is supplying 256 Megapacks (value about $410 million). There was in fact an incident recently when one Megapack caught fire during installion. The product’s fire protection safeguards to prevent spreading seem to have worked well. The second biggest project is in Hawaii and the 3rd biggest in New Mexico. A great virtue of these three projects is that they are directly replacing heavily polluting coal-fired peaker plants.

* Riverina & Darlington Point Energy Storage Systems in New South Wales. This is a 150 MW/300 MWh project worth about $125 million to Tesla. It is contracted with Edify Energy with whom Tesla has previously worked using Powerpacks. It is another example of the relationship with energy providers. Once they use Tesla’s software suites such as the “Autobidder” AI revenue optimisation software platform, they want to work with Tesla on future projects. Added value shows that the energy storage business is not a commodity business as some observers have incorrectly observed.

Australia has been a big market for Tesla since the start with the much touted “world’s largest battery” project at Hornsdale. Early projects were mostly done with State governments. This was often against the opposition of the Liberal Party government, which was well-known for its links with the fossil fuel sector. Now with the new Labour government under PM Anthony Albannese, there is strong support from central government. This will undoubtedly give a strong impetus to such projects.

* Kogan Creek, Queensland project for C.S. Energy. This is a $113 million project for Megapacks to be supplied next year as part of a replacement programme for an old coal fired peaker plant.

* Townsite Solar & Storage Facility Project by Arevon Energy Inc at Boulder City in Nevada. This is a 360 MWh project using Megapacks which will cover 60,000 homes. Tesla and Arevon had previously signed up an intention to work together on a mammoth 2GW/6GWh worth of projects. That one commitment would be worth a sum of about the last two years of all projects for Tesla.

* Dunamenty Power Plant in Hungary. The MET Group’s Megapack order was delivered in September and is the first such project in the country. Further orders in Eastern Europe are planned.

* Amber Infrastructure Group project at Skelmersdale in England. This 50MW/100 MWh project is currently being installed with Megapacks. Amber and Tesla have stated they are working on future projects which could be announced quite soon.

* Chapel Farm and Jamesfield Farm in the United Kingdom. These two large projects are being developed in conjunction with the joint venture between two groups, Balance Power and TagEnergy. Both are using Megapacks and Autobidder. They have further projects in the final planning stage. As has been seen in Australia, once a group works with Tesla once, they tend to come back with future projects together. In many instances, individual energy storage projects are not just one-off items. They are part of a long-term revenue stream for Tesla.

My article in July supplied further details of projects recently gained or supplied. What is notable is the geographic range of projects and the range of different applications. With the ramping up of production now under way, the future prospects seems almost limitless.

The Numbers.

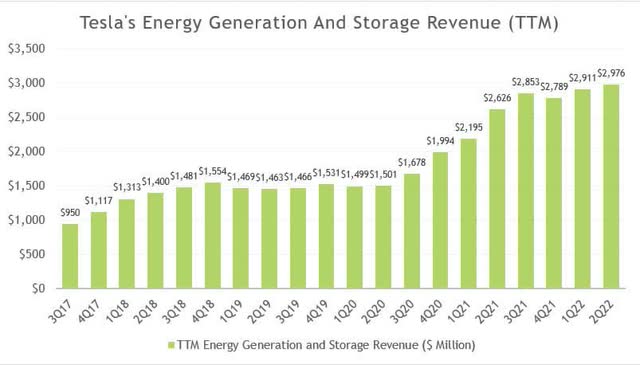

In fiscal Q2 2022, energy revenue represented only 4% of total sales. This is despite achieving year-on-year growth rates of 34% since 2017. The proportion indicates how rapidly the auto division has been growing. It does not take into account the usefulness of the great synergies that the company enjoys between the two divisions.

As per SA Quant ratings, the estimated revenue for Tesla this year will be about $67 billion. At the analyst call CFO Zachary Kirkhorn revealed that Q3 saw the best gross profit number they have hit so far.

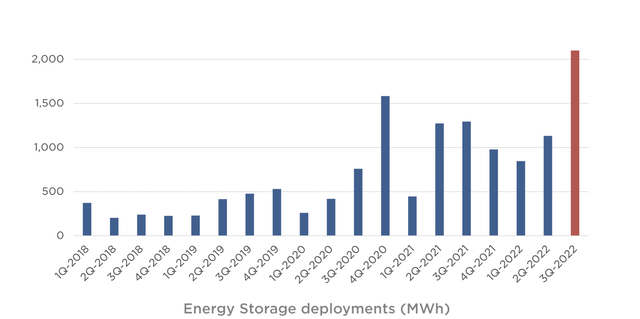

Energy storage revenue based on a Q3 number would suggest it will be running at a rate of 10% of company revenue by the end of the year. At the start of the year it was about 4%. In Q3 auto production increased at 54% while energy store deployed increased at 62%. Energy storage growing more rapidly than autos will I believe be an increasing and intensifying trend.

Q3 has seen a ramping up of growth in energy storage. Even the troubled solar panel division managed to show a 13% increase year-over-year, although that was far behind the 62% increase for storage. The Tesla press release particularly mentions semiconductor shortages as still not totally resolved. That has handicapped meeting the product growth potential.

Total energy deployment has been healthy for the past several years but has now shot up this year. This is shown from the Q3 numbers:

Tesla

Revenue of the division has been steady if not spectacular as per the graph below from from Stock Dividend Screener:

stock dividend screener

Profitability of the division has been adversely affected by the continuing problems with the solar roof installation operation. This is further affected by the continuing large capex, especially in the construction of the new factory at Lathrop.

The Big Picture.

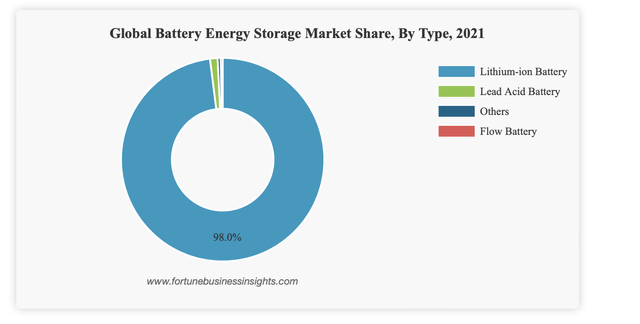

A recent report saw energy storage as having unprecedented growth over the next few decades. It predicted an 80% cost reduction in lithium-ion batteries by 2050. It foresaw also an increasing future role for other forms of storage. They cited flow batteries, compressed air and gravity based technologies. These all however look certain to be some way off into the future.

Another report highlighted how the declining costs of lithium-ion batteries will be a driving force of energy storage growth. The main driver will of course the obvious one of the unstoppable rise of renewable energy. It predicted an annual 27.9% CAGR over the next few years for lithium-ion storage.

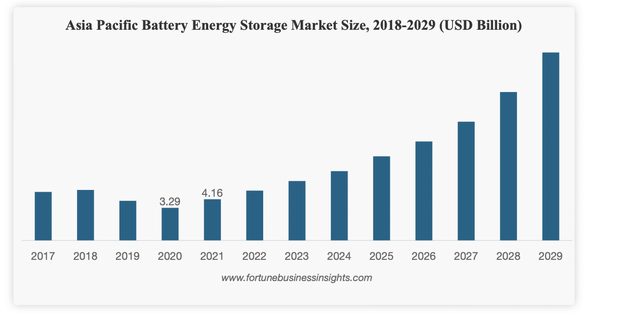

A comprehensive Fortune Business Insights report predicted similar expansion of the market. In particular it foresaw strong growth in the less remarked Asia-Pacific market as follows:

fortune business insights

Much of the Asia-Pac growth has come from a succession of mega-projects in Australia. Many of these are supplied by Tesla.

The report also saw the continuing dominance of lithium-ion battery storage for the present time. The current market is divided as follows;

fortune business insights

In an article I wrote in July this year, I identified the vast addressable markets we are talking about here. General estimates suggest the renewable energy market will be worth $2 trillion by 2030. The energy storage market should be worth $43 billion by then.

When I have written previously about the great potential of this business, I have come in for a lot of criticism from Tesla skeptics on SA. However it seems that other auto companies agree with my thesis. Readers can make up their own minds on who is right. GM (NYSE:GM) are joining the party. As reported recently by Reuters, GM have set up an energy unit for storage batteries and solar panels. Imitation is indeed the sincerest form of flattery. They see the current addressable market as being $150 billion. GM executive Travis Hester was quoted as saying:

Our competition in this space on the auto side is really only Tesla, which is a strong energy management company. There are a lot of analogies you can draw with Tesla.”

The promise GM see in this new division was backed up by a speech made by CEO Mary Barra the following week. A major advantage for Tesla and GM and probably others in the auto industry in the future is the nascent V2G (vehicle to grid) technology. This will only increase the vertical integration advantages.

Conclusion

The positive picture for Tesla’s energy store business was evidenced by the Q3 results. It was the first time that energy storage deployed increased more rapidly than autos delivered.

As detailed in this article, orders in hand for energy storage could bring energy storage up to 10% of total revenue, up from previous levels of 4%. Already energy store is growing more quickly than auto. I expect this percentage to increase quarter by quarter as we go forward.

Tesla is a leader in a huge secular growth industry and is successfully ramping up its manufacturing capacity. One can assume its capacity will continue to increase. The size of the market then shows a clear runway to a very substantial increase in revenues in coming quarters and years. This revenue will be on arguably a more solid footing than that of cars. Most importantly this revenue is here and now, unlike other potential revenue areas of the company.

Be the first to comment