zeynep boğoçlu/E+ via Getty Images

It has been almost six months since my last discussion of Pyxis Tankers or “Pyxis”(NASDAQ:PXS, NASDAQ:PXSAP, PXSAW), a small, Greece-based operator of product tankers.

Introducing Pyxis Tankers

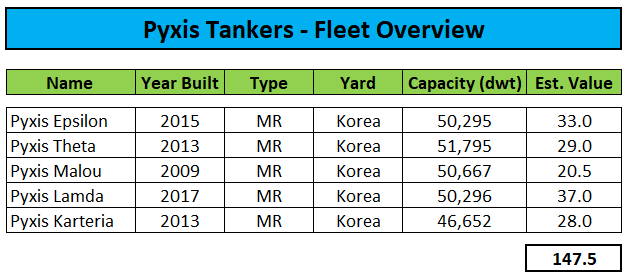

For those still unfamiliar with the company, Pyxis owns a fleet of five MR2 tankers with an average age of approximately 8.8 years and is controlled by its largest shareholder Valentios “Eddie” Valentis.

Company’s SEC-Filings / Compass Maritime

Pyxis Tankers gained its Nasdaq listing in late 2015 by a reverse merger with the shell of LookSmart, once a leading search engine back in the early days of the World Wide Web. After the remains of LookSmart were transferred into a privately held entity, Pyxis Tankers was merged into the empty shell.

The stock has been quite volatile ever since the company went public, mostly due to its small free float and generally unfavorable market dynamics in the product tanker segment over the past couple of years.

Occasionally, shares have been chased by momentum traders, mostly as a side-play to current or former momentum crowd favorites like Castor Maritime (CTRM), Performance Shipping (PSHG), Top Ships (TOPS), Globus Maritime (GLBS), and Seanergy Maritime (SHIP).

In the past, the company largely failed to capitalize on these mostly short-lived but often violent moves but last year, management seized the opportunity and sold 14.3 million new common shares in a private placement for gross proceeds of $25 million. The reverse stock split-adjusted purchase price of $7 per share represented an almost 200% premium to estimated net asset value per share (“NAV”) at that time.

Pyxis Tankers has used the funds to acquire two additional MR2 product tankers last year (Pyxis Lamda and Pyxis Karteria).

Earlier this year, the company sold its small tankers Northsea Alpha and Northsea Beta for an aggregate purchase price of $8.9 million. After the repayment of associated indebtedness and settlement of various transaction costs, net cash proceeds amounted to $2.7 million.

Improved Product Tanker Market Conditions

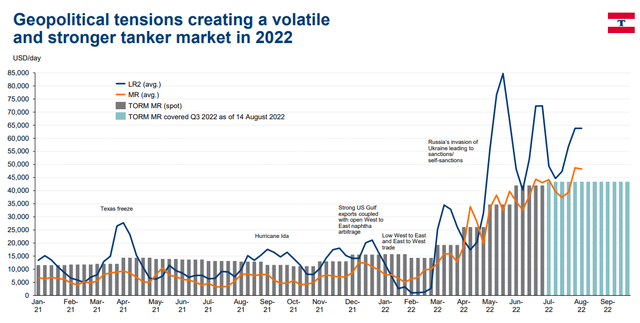

As very much visible in the slide from larger competitor Torm plc’s (TRMD) second quarter earnings presentation below, Russia’s assault on Ukraine has been a game changer for the product tanker market as sanctions on Russia have led to trade recalibration towards longer distances with refinery dislocation adding further to ton-miles.

While spot rates have given back some of their gains in recent weeks, the time charter market remains healthy with one-year rates sitting near all-time highs.

Second-Hand Vessel Prices Have Been Soaring

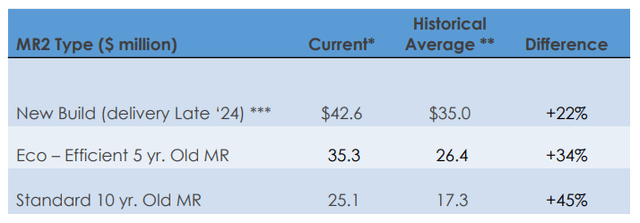

The robust chartering outlook in combination with vastly increased costs for newbuildings has resulted in strong appreciation of second-hand vessel values:

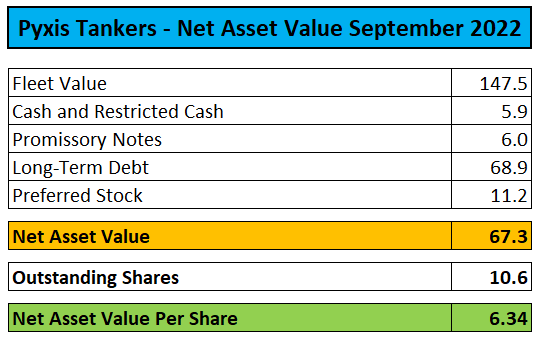

Since my last update on Pyxis in early May, fleet value has increased by approximately 30% thus almost doubling the company’s estimated net asset value (“NAV”) on a reverse stock split-adjusted basis:

Company Press Release / Compass Maritime

Strong Q2 Results and Outlook

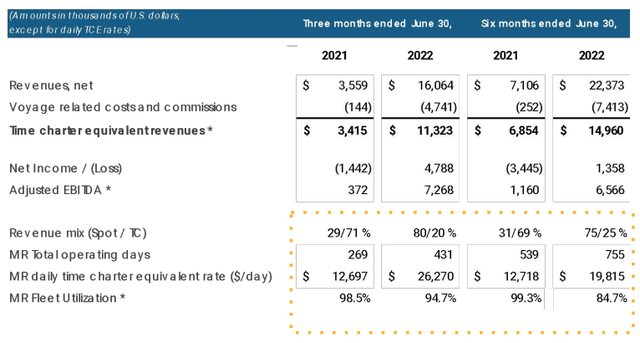

The company recently reported record second quarter results with the average time charter equivalent (“TCE”) rate more than doubling sequentially with further improvement expected for the current quarter.

Starting this spring, historically low inventories of petroleum products coincided with the war in the Ukraine and expanding global demand, especially for transportation fuels, resulted in market dislocation, including arbitrage opportunities, ton-mile expansion of cargoes and substantially higher charter rates for product tankers. We have taken advantage of improving market conditions by continuing to employ our five Eco- MR’s under a mixed chartering strategy of short-term time charters and spot voyages. During the three months ended June 30, 2022, our daily TCE rate more than doubled to $26,270 compared to the same period in 2021. As of August 5th, 56.7% of the available days in Q3, 2022 for our MR’s were booked at an estimated average TCE of $30,500 per vessel, including three vessels contracted under short-term time charter at an average rate of $25,000 and two MR’s employed in the spot market at an average rate of $43,900.

Risks

While management remained optimistic on market fundamentals, CEO Valentis warned of potential oil demand destruction caused by elevated inflation and resulting higher interest rates followed by slower economic growth or even an outright recession in certain parts of the world.

Bargain Valuation and Healthy Market Fundamentals

That said, with one-year time charter rates sitting near all-time highs and the company’s common shares trading at a 50% discount to NAV, speculative investors should consider building a position in Pyxis Tankers.

Earlier this week, Jefferies issued a very bullish note on both the crude and product tanker markets.

Convertible Preferred Shares – Less Risky With Decent Optionality

Readers looking for a somewhat less risky investment in Pyxis Tankers should consider taking a position in the company’s Series A Convertible Preferred Shares (PXSAP) which are ranking senior to common stock and paying a rather juicy 9.5% annualized cash dividend at current levels.

In addition, the preferred shares are convertible into new common shares at a price of $5.60 at any time. Should product tanker charter rates remain strong going into 2023, the embedded call option might very well move into the money at some point going forward.

Moreover, starting in October 2023, the company will have the option to redeem the Preferred Shares at a price of $25 per share.

Bottom Line

Despite some broad-based economic concerns and a recent setback in spot charter rates, product tanker market fundamentals remain sound as also evidenced by very healthy one-year time charter rates.

While Pyxis Tankers remains a small player, the company should start to generate meaningful cash flow from operations this quarter.

That said, investors should not expect the company to start paying dividends anytime soon even as management intends to “use excess cash flow to further improve our financial position” unless accretive acquisition opportunities present themselves.

But unlike most of its much larger peers like Ardmore Shipping (ASC), Scorpio Tankers (STNG) and Torm plc, Pyxis trades at a very substantial discount to NAV thus offering some decent near-term upside.

Investors looking for a somewhat less risky investment in Pyxis Tankers should consider taking a position in the company’s Series A Convertible Preferred Shares (PXSAP).

Be the first to comment