LaSalle-Photo/iStock via Getty Images

Introduction

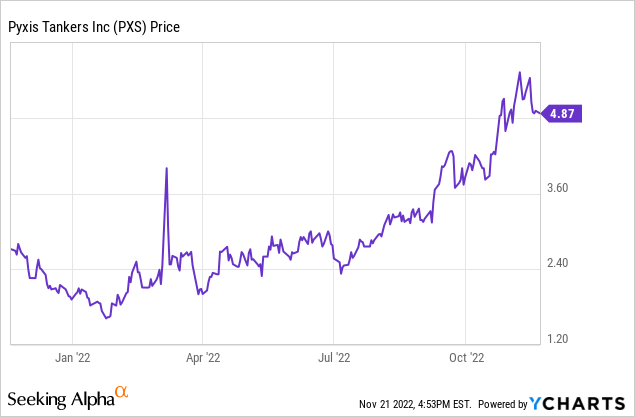

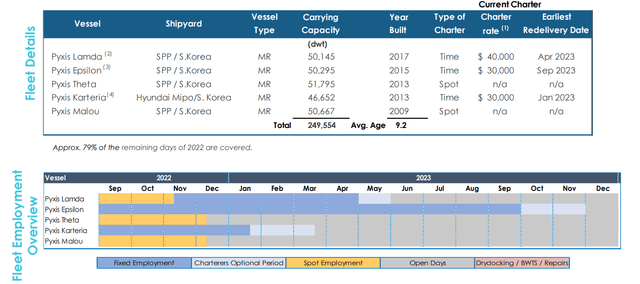

Back in August, I argued the preferred shares of Pyxis Tankers (NASDAQ:PXS), a small product tanker company with five operating vessels, were becoming safer day after day as the surge in charter rates suddenly improved the profitability of the company. An additional attractive feature was/is the conversion feature of the preferred shares: preferred shareholders can convert the preferred shares into common shares at a fixed conversion ratio which means that they can tag along in the slipstream of the common shares should the share price increase.

A look at the third quarter results

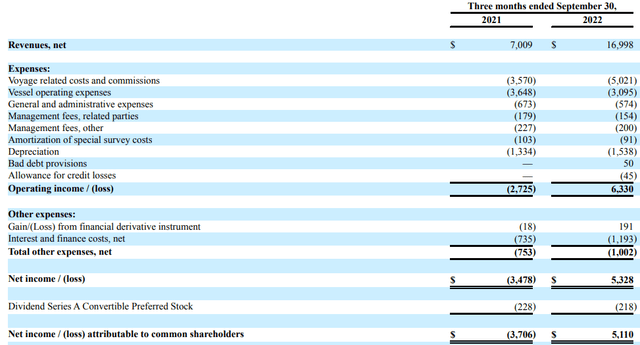

The higher charter rates are clearly visible in the income statement and cash flow statement. In the third quarter of this year, Pyxis saw its total revenue come in at $17M which is more than twice the revenue generated in the third quarter of last year. Operating costs and commissions also increased, but the $2.7M operating loss was easily converted into a $6.3M operating gain. This means that of the $10M in incremental revenue, $9M hit the operating income level.

The interest and finance expenses increased as well, but the company obviously remained very profitable. The reported net income was $5.3M and after deducting the $0.2M in preferred dividend payments, the net income attributable to the shareholders of Pyxis was approximately $5.1M for an EPS of $0.48 based on the average share count of 10.6M shares outstanding.

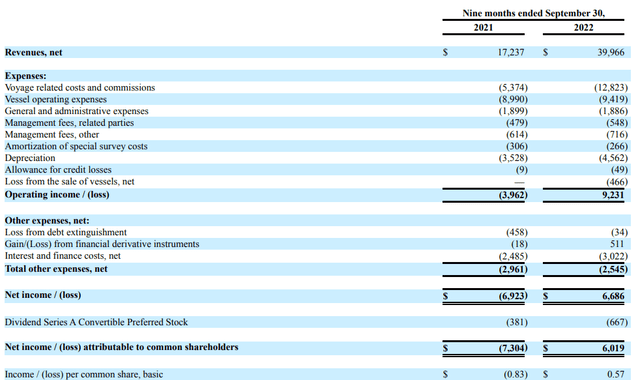

The strong third quarter obviously also boosted the 9M 2022 results of Pyxis. The reported net income in the first nine months of the year was $0.57.

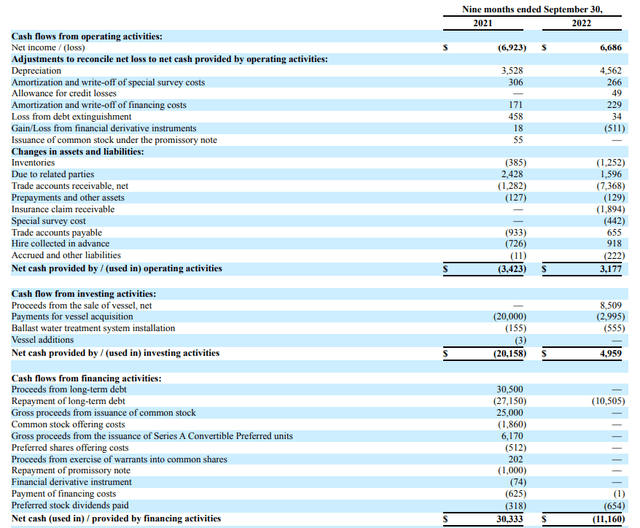

Even more important than the net income are the cash flows. After all, these are the months and quarters Pyxis needs to rake in the cash to protect its balance sheet against another downturn. I’m not saying a down-cycle is imminent but I’m just saying this is an excellent and easy way to beef up the balance sheet.

Unfortunately Pyxis did not disclose the Q3 cash flow result, so I’ll have to distillate the Q3 cash flows by comparing the 9M 2022 cash flow statement with the 6M 2022 cash flow result.

In the first nine months of 2022, Pyxis reported an operating cash flow of $3.2M. But as you can see below, this includes a substantial cash outflow related to changes in the working capital position. The underlying operating cash flow adjusted for changes in the working capital was approximately $11.3M. The total capex was just $0.6M resulting in an adjusted free cash flow of $10.7M (excluding the sale and acquisition of new vessels).

We know the adjusted operating cash flow was $4.1M in the first semester, which means the adjusted operating cash flow in the third quarter was approximately $7.2M. That’s approximately 10% higher than the operating cash flow generated in the second quarter.

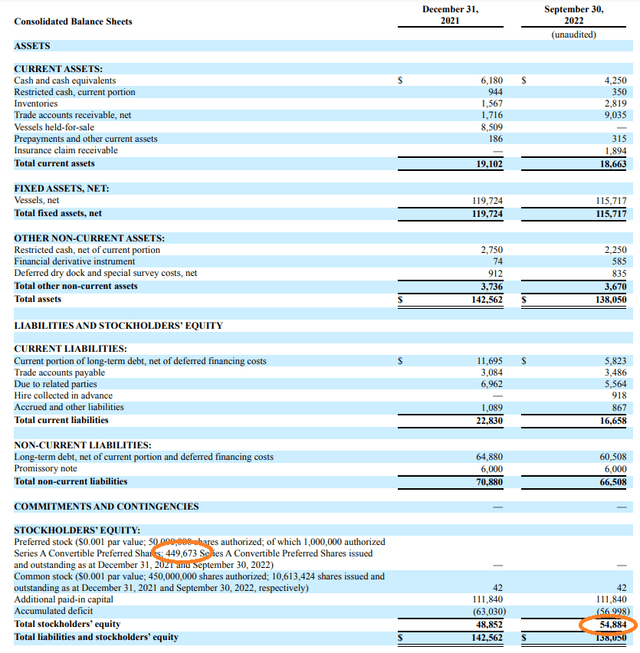

This should mean the balance sheet is getting safer but unfortunately the net debt level hasn’t decreased by as much as I would have wanted, mainly due to those investments in the working capital position (the negative working capital position of $3.7M as of the end of last year was converted into a positive working capital of approximately $2M as of the end of the third quarter, so you can clearly see the impact of the good results, just not in the net debt level). As of the end of September, Pyxis had $4.7M in cash and restricted cash while it had $5.8M in short term debt $66.5M in long-term debt resulting in a net debt position of just under $68M (excluding the amounts due to related parties).

Q2 was good, Q3 was even better, and Q4 is also shaping up to be very strong with MR charter rates still exceeding $40,000 per day. It will be interesting to see what the daily rates will be once the Pyxis Karteria will conclude its current engagement. Given the current spot rates are exceeding $40,000 per day, I have little doubt the option period for two additional months of employment at $30,000/day will be executed.

What does this mean for the preferred shares?

As you know, I have mainly looked at Pyxis from the perspective of a preferred shareholder. While I did own the common shares for a while for trading purposes, I currently just own the preferred shares which are trading with (NASDAQ:PXSAP) as ticker symbol. Mainly because I can actually benefit from the share price increase of the common shares. The preferred shares have a conversion feature allowing a conversion into common shares at the fixed price of $5.60 per share. So for every preferred share with a par value of $25, I would receive 4.464 common shares. This means that the moment the common share price exceeds $5.60 per share, the preferred share should move in tandem. If Pyxis’ common shares would trade at $6.25, the preferred shares would theoretically trade at $6.25 * 4.464 = $27.90. So I’m totally fine with my preferred share position as the common share price gets closer to the $5.60 level.

Also keep in mind Pyxis can only force me to convert my preferred shares if the share price exceeds 170% of the conversion price (1.7 * $5.60 = $9.52) and at that point the preferred share would be trading at just over $42 and I may very well abandon my position before that.

The strong charter rates obviously make the preferred shares safer. As we saw in the Q3 income statement, the net income was $5.3M and only $0.2M was needed to cover the preferred dividends, which means the preferred dividend coverage ratio exceeded 2,500%. Sounds great, but keep in mind it used to be different when Pyxis was loss-making.

Secondly, as the company is profitable again and doesn’t pay a dividend on the common shares, the balance sheet is getting much safer. As you can see below, the total equity value increased to almost $55M. As the total amount of preferred shares remained stable at just 450,000, the preferred equity accounts for just $11.25M of the equity. Which means in excess of $43M in common equity ranks junior to the preferred shares.

Also keep in mind the equity value is based on the $116M book value of the vessels. As the market has been heating up, the vessel valuations have increased as well. Looking at the age of the fleet, and the current market value of second hand vessels, I think the $116M book value of the vessels can be reached by the four oldest vessels combined. The market value of the five vessels may be 30-35% higher than the book value considering a 5 year old MR tanker sells for $39M and even 10 year old vessels are being sold for $28M these days.

Investment thesis

While I understand owning the preferred shares doesn’t provide the same torque as owning the common shares has, I’m perfectly fine with my preferred share position. I receive a monthly income and if the common share price increases substantially, the preferred shares should increase alongside due to the conversion feature.

The preferred shares are currently still yielding in excess of 8% and I think the risk/reward ratio is very attractive.

Be the first to comment