Maksim Labkouski

Purple Innovation, Inc. (NASDAQ:PRPL) recently signed a merger agreement with Intellibed, and also received a bid to be acquired by Coliseum Capital Management. There is certainly a lot of demand for the stock at the current price. In my view, the company’s patents and proprietary manufacturing process are worth a significant amount. Economies of scale and more customer base after the merger with Intellibed could be very valuable. Besides, future free cash flow could justify a higher valuation than the current market price. Under beneficial conditions, the stock could be worth $11.80 per share.

Purple Innovation

Purple runs a vertical brand for designing and manufacturing comfort products like mattresses, pillows, or frames. The company has know-how accumulated over 30 years of innovation.

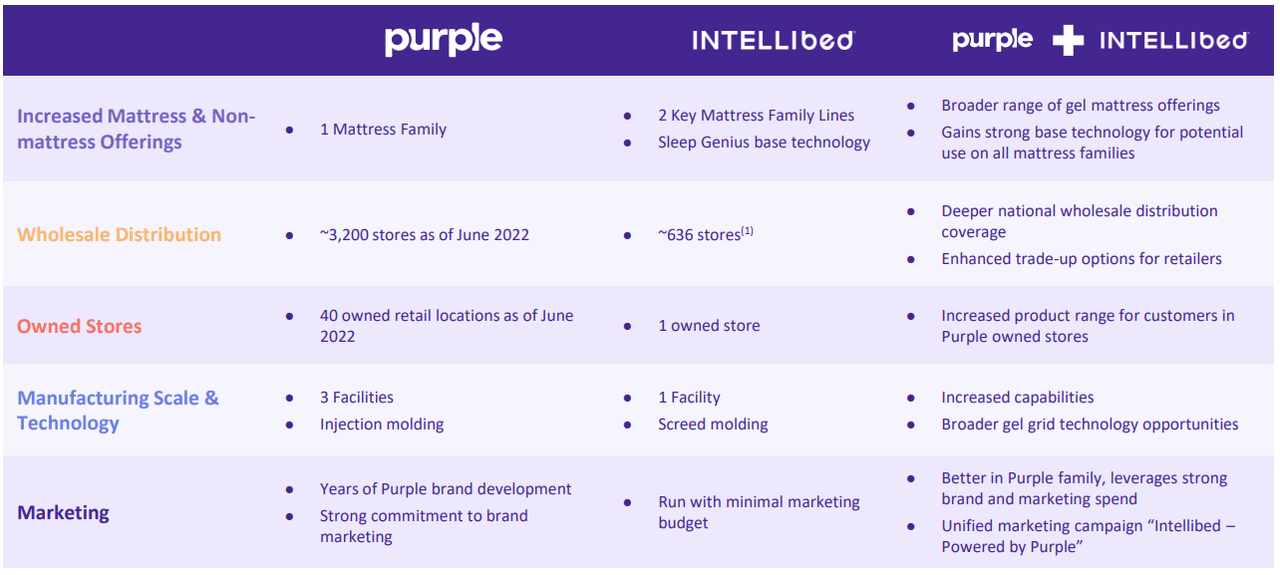

I believe that it is an exciting time to review the company’s business prospects. First, Purple Innovation signed an agreement to merge with Intellibed, which will bring 636 more stores and 2 additional mattress family lines:

Source: Presentation

Among all the information that I found about the transaction, the most interesting were the words of the CEO. He expects to obtain a more diversified wholesale distribution network, a larger customer base. Under these conditions, I would say that future free cash flow could be larger than expected.

This merger provides Intellibed with a great opportunity to reach a much broader consumer audience through Purple’s larger, more diversified wholesale distribution network and growing footprint of company-owned showrooms. Additionally, we look forward to benefiting from the marketing prowess that has made Purple the fastest-growing premium sleep brand. We’re so pleased to align with a company that shares our vision for delivering the health benefits that our proven better-sleep products provide. Colin House, CEO of Intellibed

I believe that economies of scale from the merger and potential synergies would justify a position in the stock. I did run a discounted cash flow model, and obtained a larger valuation than the current stock price.

The other exciting reason to review the company’s expectations is the recent bid from Coliseum Capital Management, LLC to acquire the company at $4.35. In my view, $4.35 is not close to the fair value of Purple Innovation. I don’t know whether the bidder will offer more, but it is always great getting to know that there is demand for the shares.

Purple Innovation, Inc. a comfort innovation company known for creating the “World’s First No Pressure Mattress,” today announced that its Board of Directors, in response to an unsolicited and non-binding proposal from Coliseum Capital Management, LLC on September 17, 2022, to acquire all of the outstanding capital stock of the Company it does not already own for $4.35 per share in cash. Source: Purple Innovation Announces Formation.

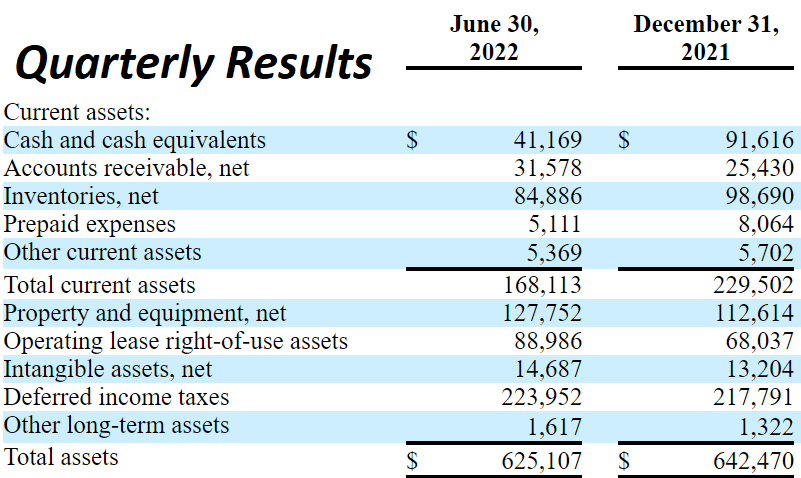

Balance Sheet

The company’s financial shape appears solid. Quarterly results for June 30, 2022, showed cash and cash equivalents of $41 million. In addition to account receivables worth $31 million, the company mentioned prepaid expenses of $5 million and total current assets worth $168 million. Finally, with property and equipment of $127 million, operating lease rights of use assets of $89 million, and intangible assets of $14 million, total assets stand at $625 million. With an asset/liability ratio larger than one, I don’t believe that the company’s financial shape is worrying.

10-Q

Liabilities include accounts payable of $39 million, in addition to an accrued sales returns of $5 million and an accrued compensation of $9 million. The company also mentioned total current liabilities close to $89 million and the debt, net of current portion of $37 million. Operating lease obligations stand at $103 million, with a tax receivable agreement liability of $161 million. Finally, total liabilities stand at $405 million. I don’t see a significant amount of debt, so I wouldn’t say that shareholders need a financial sponsor or a large transaction.

10-Q

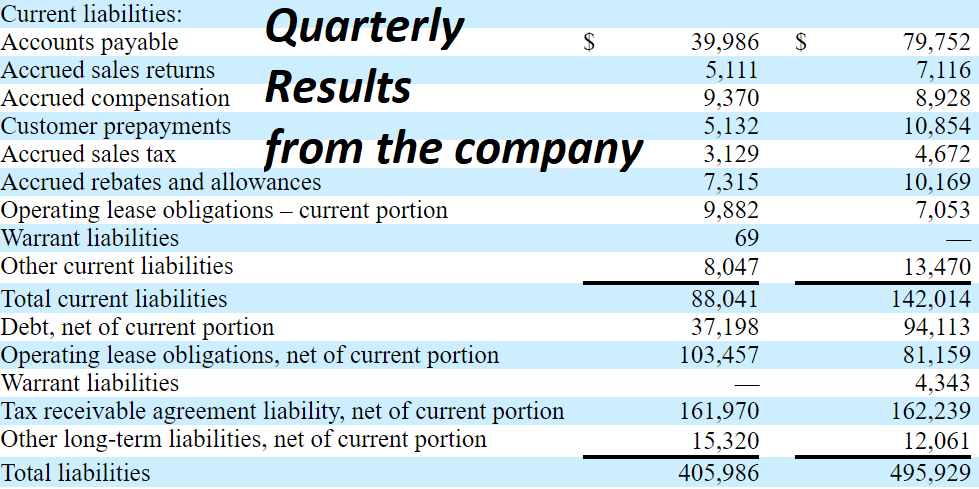

Analysts Expect Net Sales Growth Of 10% In 2023 And Free Cash Flow Expansion

By 2024, analysts expect the company to have net sales of $764 million and net sales growth of 19.56%, in addition to 2024 EBITDA of $25.6 million and an EBITDA margin of 3.35%. Operating profit would stand at $6.45 million.

Source: Seeking Alpha

In my view, the new acquisition would most likely push the company’s FCF/Sales north. Keep in mind that investors are expecting that the FCF/Sales margin would increase from -16% in 2022 to around -0.27%.

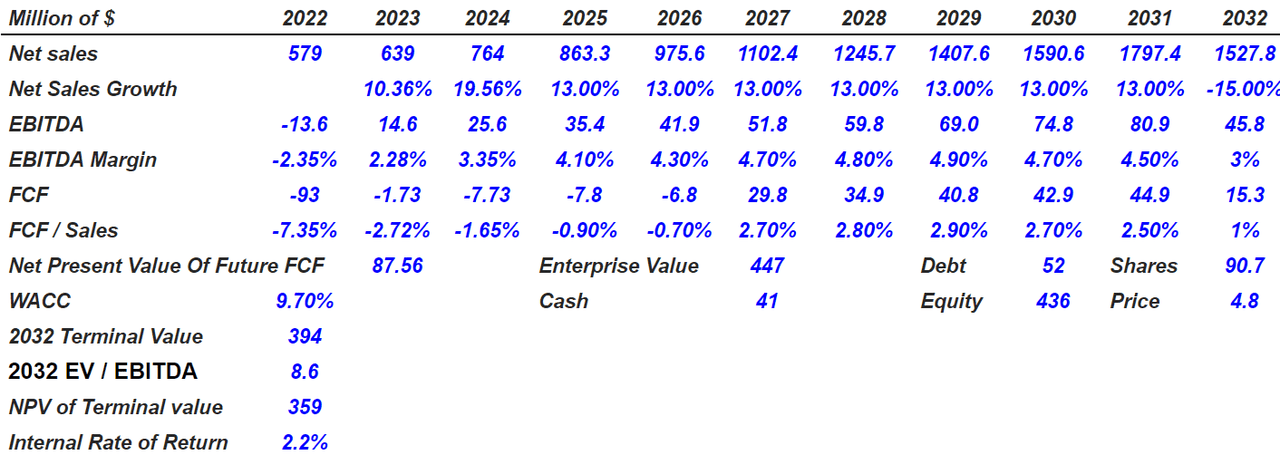

Under Bearish Conditions, I Believe That The Company Is Worth $4.80

Under quite detrimental economic conditions, I would say that the company’s sales growth would grow less than expected. Clients may decide to reduce their expenditures. In sum, future free cash flow may not grow as much as in previous years.

Because two of our currently operating manufacturing plants are located within the same geographic region, regional economic downturns or other issues could potentially disrupt a significant portion of our manufacturing and other operating activities, which could adversely affect our business. Source: 10-k

Purple Innovation makes most of its revenue through e-commerce platforms. The company recently announced that it intends to make extensive use of the wholesale distribution channel. The corporate decision may be wrong. If management fails to sign new relationships with new partners, the investments in marketing could send the FCF/Sales margin down. In the worst-case scenario, the stock valuation would decline. Purple Innovation discussed these risks in the last annual report:

The majority of our sales are made directly to consumers through our website or certain other e-commerce platforms. We have been expanding our business into the wholesale distribution channel through relationships with our wholesale partners but there can be no assurance that we will continue to experience success with our wholesale partners or that anticipated new locations will be successful. Source: 10-k

Purple Innovation makes most of its revenue thanks to Internet-based advertising. In my view, advertising costs could increase in the coming years. If management has to use more money to sell more products, Purple’s profitability would most likely decline. As a result, future free cash flow could be lower than expected:

The costs of advertising through these platforms have increased significantly, which has resulted in decreased efficiency in the use of our advertising expenditures, and we expect these costs may continue to increase in the future. Source: 10-k

Purple Innovation requires Hyper-Elastic Polymer cushioning material, and uses its own Mattress Max machinery to manufacture products. Management recently warned that it may have issues related to sourcing some of the materials required. Besides, any issue with Purple’s machines could bring significant trouble including production capacity decreases. A reduction in production would likely bring a reduction in sales growth and perhaps diminishing reputation.

We manufacture our mattresses using our proprietary and patented Mattress Max machinery to make our Hyper-Elastic Polymer cushioning material. Because these machines are proprietary and we do not yet have a long history of their maintenance needs, we may not be able to sufficiently maintain them for operation at full capacity or at all when needed. We also have experienced inefficiencies in sourcing of materials and production of finished products. Source: 10-k

Under this case scenario, I assumed that Purple Innovation, in 2032, would have net sales of $1.527 billion, with an increase in net sales growth of -15%. EBITDA would stand at $45 million, with an EBITDA margin of 3%. I also expect 2032 FCF of $15.3 million and FCF/sales of 1%.

Author’s DCF Model

I forecast a net present value of future FCF of $87 million and an enterprise value of $447 million. With a share count of 90 million, along with a WACC of 9.70%, the equity would stand at $436 million, and the fair price would be $4.8 per share.

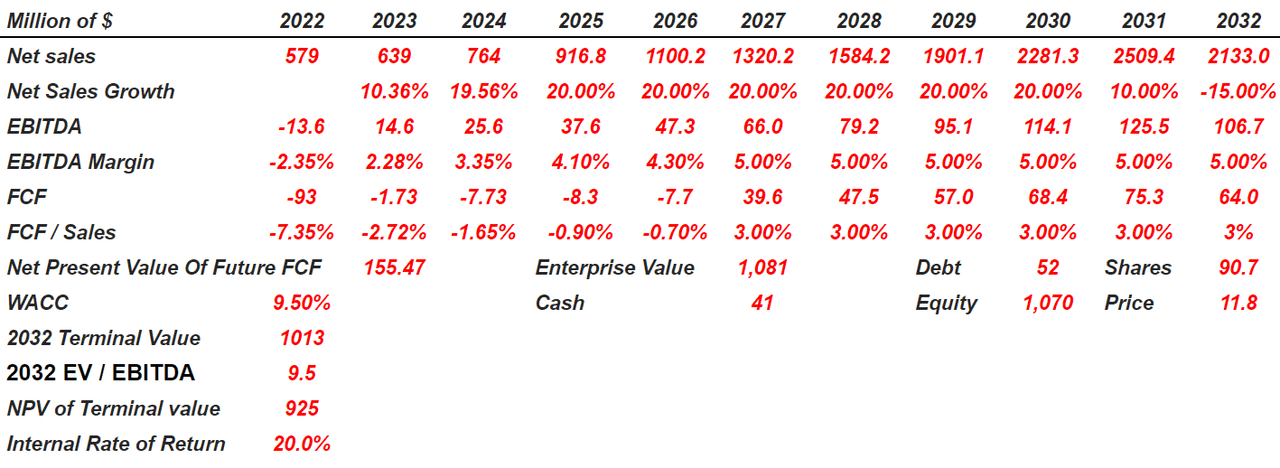

Purple Innovation Could Be Worth More Than $11.8

I believe that acquisition of other companies could bring significant revenue growth and free cash flow margin expansion. If the merger with Intellibed works successfully, management may decide to acquire other targets. With this in mind, let’s note that the company did mention that M&A transactions are a serious option for Purple:

We may seek to acquire businesses in the future as we encounter acquisition prospects that would complement our current product offerings, increase the size and geographic scope of our operations, or otherwise offer growth and operating efficiency opportunities. Source: 10-k

In 2021, the company invested more than $6 million in research and development, a larger figure than what was reported in 2020. In my opinion, further improvements in research and development would most likely lead to more product development. As a result, I would expect larger sales growth. Perhaps, economies of scale would also bring improvements in the EBITDA margin.

We incur significant research and development and other expenditures in the pursuit of improvements and additions to our product line. Source: 10-k

I also believe that the company could be worth much more than its current market value because of the accumulation of patents. After many years in business and a lot of millions invested in research and development, I believe that the company’s accumulated know-how could be worth much more than only the accumulation of future free cash flow. Keep in mind that Purple Innovation could make a lot of money thanks to partners willing to use Purple’s patents. Management discussed these assets more in deep in the last annual report:

We have hundreds of granted or pending patents and hundreds of patent filings that cover current and future products as well as proprietary manufacturing equipment we have designed and fabricated. In addition to intellectual property protection of key products and manufacturing capabilities, our team has decades of experience and unique insights derived from inventing and refining proprietary comfort technologies, machines and products. Source: 10-k

Finally, under this case scenario, I also assumed that Purple Innovation will successfully obtain manufacturing efficiencies. Besides, broader distribution channels from the recent acquisition could enlarge future free cash flow and EBITDA margins. As a result, as soon as journalists notice the increase in margins, demand for the stock could increase.

Our planned growth includes increasing our manufacturing efficiencies, developing and introducing new products and developing new and broader distribution channels, including wholesale and Purple retail showrooms, and extending our global reach to other countries. Source: 10-k

For 2032, I assumed net sales of $2.1 billion and EBITDA of $106.7 million, with an EBITDA margin of 5.00%. I also included free cash flow worth $64 million and FCF/sales around 3%. My results would include an enterprise value of $1.081 billion, equity close to $1.070 billion, and a fair price of $11.8 per share. Finally, the internal rate of return would stand at close to 20%.

Author’s DCF Model

Conclusion

With a considerable amount of patents and millions invested in research and development, product development could bring significant revenue growth in the future. I also believe that the new merger could bring a lot of new customers. Economies of scale could enlarge the free cash flow margin in the coming years. Even considering risks from an eventual increase in the advertising costs, in my view, the company is worth at least $11.80 per share.

Be the first to comment