Sundry Photography

Editor’s note: Seeking Alpha is proud to welcome Michele Pagliaro as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

With strong revenue and EPS growth, and attractive valuations, I believe an investment in PubMatic (NASDAQ:PUBM) might provide strong capital appreciation in the years ahead. In this article, I outline the case about why I believe PubMatic is a Buy today and has the potential to deliver 27.4% returns on a yearly basis over the next 7 years.

PubMatic Overview

PubMatic operates a cloud-based supply-side platform for programmatic advertising. Their purpose-built technology and infrastructure provide superior outcomes for both Internet content creators (publishers) and advertisers (buyers). The demand-side specialist PubMatic works at the other end of the advertising equation: it serves digital content publishers with “ad” space to sell. It plays nice with demand-side platforms, but its aim is ultimately to maximize the monetization potential of websites, mobile apps, and other online content providers.

PubMatic IR (PubMatic website)

Financial Highlights

Growth

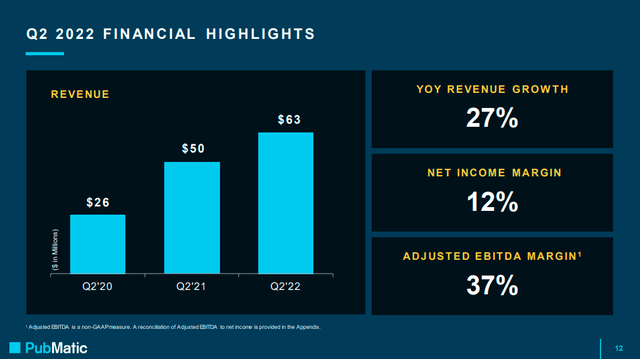

When PubMatic went public two years ago, its prospectus bragged about the platform serving 134 billion ad impressions a day. That did seem like a big number, but PubMatic is delivering roughly 400 billion daily ads just two years later. Revenue has picked up since the 15% increase it posted for all of 2019. The top line rose 31% in 2020, accelerating to 53% last year, though it slowed to 27% year-over-year growth in its latest quarter.

PubMatic’s long-term growth target is 20% or more, and it has reached that goal in each of the past eight quarters.

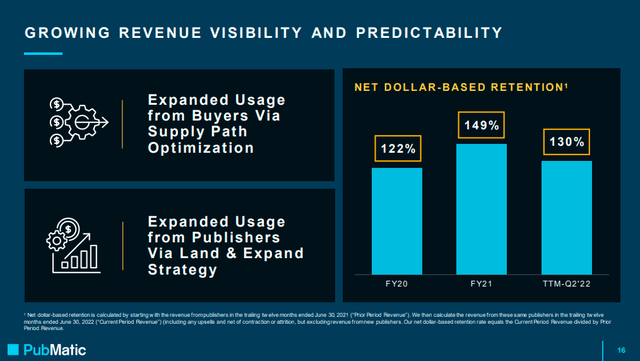

The net dollar-based retention rate can stay above 120%. PubMatic has excelled recently at getting its customers to spend more. Its retention rate has been as high as 150% – meaning that customers are spending 50% more in the past year than they did during the previous 12 months – and it was 130% in its most recent quarter.

Profitability

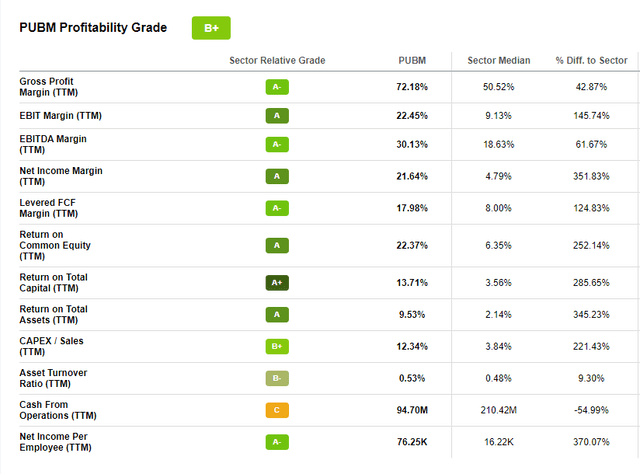

The business is highly profitable, both in absolute and relative terms if compared with the Sector Median.

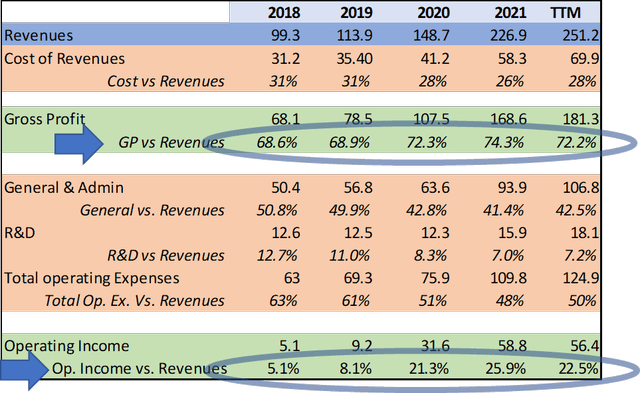

From a deeper point of view, the table below illustrates how the Cost of Revenues and the Total Operating Expenses decrease from 2018 in comparison to the revenue. This structural strategy allows PubMatic to perform “consistently” well above 70% in terms of Gross Margin and well above 20% in terms of Operating Income.

Author Calculation and Seeking Alpha

The trend of these numbers from 2018 suggests PubMatic has the right platform and the right approach to be at the forefront of its industry. They have built a business with structural advantages (owned and operated infrastructure and offshore R&D) that enable them to maintain profitability above the median range of the competitors.

PUBM Stock Valuation

To value PubMatic we could use the standard metrics like P/E, P/B, Price/Sales, and Price/Cash Flow. However, at the stage of the lifecycle PubMatic is at, I think these metrics are not completely able to capture the real strength (and the real value) of the company. The reason is related to the growth rate in terms of revenue but especially in terms of EPS. For this reason, I think the best way to evaluate a GROWTH stock like PubMatic is to focus on the growth rate.

I use an alternative formula that is mainly based on growth parameters and profitability. This formula was written by popular investor Benjamin Graham in Chapter 39 of the 1962 edition of Security Analysis:

Intrinsic value per share = EPS x (8.5 + 2 g) x 4.4/y

Where

EPS = earnings per share

g = EPS growth rate

y = yield on AAA corporate bonds (if yields > 4.4)

Evaluation of growth companies requires the application of Graham’s formula also to estimate the future intrinsic value.

And estimating a company’s future value requires the following steps:

- Calculate the normalized earnings per share

- Forecast the long-term earnings per share growth rate

- Calculate normalized earnings in the future (7 years)

- Calculate the future intrinsic value

Related to point 2, I calculated the average EPS growth rate of the last 4 years, and it is 172%. This number is too high to forecast the next year and, conservatively, I decided to use 20%.

| 2018 | 2019 | 2020 | 2021 | 2022E | |

| Diluted EPS | 0.09 | 0.15 | 0.46 | 1 | 0.71 |

| Average growth rate | 67% | 206% | 337% | 172% |

Data: Yahoo Finance and Seeking Alpha

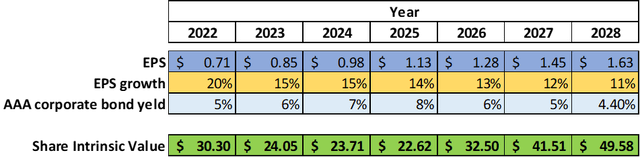

For 2023 and 2024, I used a safety-capped growth rate of 15%. Thereafter, I used a safety-decreasing growth rate of 1% a year.

Related to the yield on AAA bonds, I assumed a linear growth of 1 point until 2025 and then a normalization until 2028.

Author Calculation Graham Formula

Example calculation for 2022:

Intrinsic value per share = EPS x (8.5 + 2 g) x 4.4/y = 0.71x(8.5+2×20)x4.4/5= $30.3

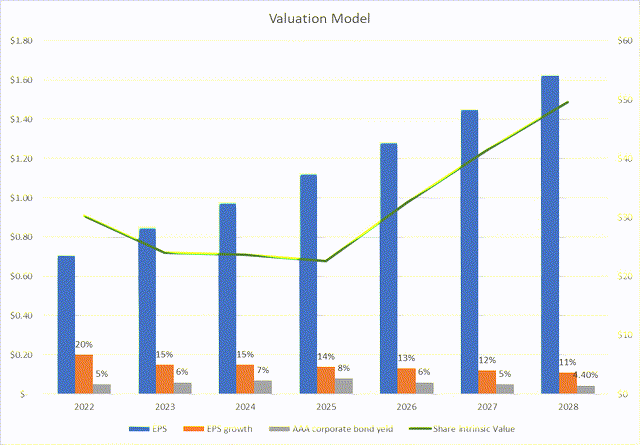

The last intrinsic value of $49.58 for 2028 underlines an annualized return of 27.4%. If PubMatic is trading, at the time of writing, at 17, the return is:

Annualized Return = (49.58 – 17)/17 divided for 7 years = 27.4%

Author Graphic Valuation Model

Peer Comparison

Infrastructure Advantage

PubMatic operates a cloud-based supply-side platform for programmatic advertising. This is a highly fragmented market, but the company is unique in that it owns and operates its ad-serving infrastructure. Most of its peers lean on public cloud-hosting giants to make their software hum, but PubMatic also owns all of the networking and hardware of its business. The company feels that this gives it an edge in terms of transparency and the ability to innovate. Having control of the infrastructure is important when dealing with the real-time and data-intensive nature of programmatic advertising, where algorithms and real-time bids are striking the right win-win connections.

Profitability leads to future excellence

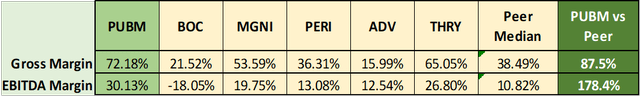

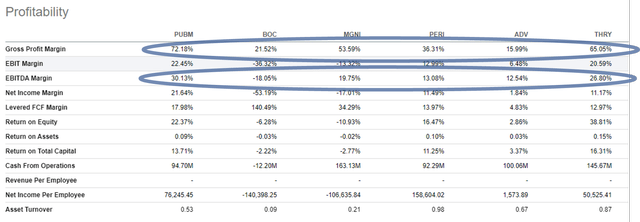

The table below shows the main profitability factor in comparison with the main peers. In my opinion, Gross Margin and EBITDA Margin are the most powerful factors that enable future growth also in terms of investment. If compared to the closest peers, PubMatic is the best in grade, and this factor represents extremely powerful moats.

The table shows the metrics of the following companies:

- Boston Omaha Corporation (BOC)

- Magnite, Inc. (MGNI)

- Perion Network Ltd. (PERI)

- Advantage Solutions Inc. (ADV)

- Thryv Holdings, Inc. (THRY)

The comparison between PubMatic and the selected peers shows that PubMatic’s Gross Margin is 87.5% better and that its EBITDA Margin is 178.4% better.

Author Calculation and Seeking Alpha

Risks

I covered the advantages of owning its infrastructure, but the reason that PubMatic stands out on that front is that it’s a lot more profitable in the near term to hand the keys to a cloud-hosting giant and let it make the investments in infrastructure. Building out networking and hardware isn’t cheap, and it could weigh on margins at a time when the industry is facing some challenges.

The current state of the ad market is also a risk. I feel that programmatic advertising is the future and that digital platforms will continue to gain market share for years to come. PubMatic has a cash-rich and debt-light balance sheet to weather the storm better than most, but consumer sentiment needs to bounce back for advertisers to prioritize paying up for new leads.

PubMatic has an impressive list of clients and strong partners, but it’s not necessarily immune from a rival platform devising a better mousetrap. Like most disruptive businesses, PubMatic itself can be disrupted.

Conclusion

Although the streak of revenue gains of 20% or better may come to an end soon, I still see PubMatic as a long-term winner and leader in this important and expanding field. It’s doing right by its digital content publishers, clocking a net dollar-based retention rate of 130%. Put another way, its clients are spending 30% more now than they were a year ago. The stock is also surprisingly cheap on a valuation basis for a solid performer that is still early in its growth cycle. Investors can grab PubMatic for just 17 times trailing earnings. Its enterprise value is just 2.7 times its trailing revenue. And last but not least, the share price could rise by about 27.4% on a yearly basis in the next 7 years.

Be the first to comment