DNY59

Introduction

While there is a chance that this title may suggest that I’m convincing myself to stay positive, I’m dedicating this article to the long-term dividend bull case for Public Storage (NYSE:PSA), one of the first stocks I added to my dividend growth portfolio in 2020. While I cannot make the case that Public Storage excels at the “growth” component of dividend growth, I’m delighted that I own the company as it continues to generate fantastic results investing in its business. Operating margins are high, the bottom line is accelerating, balance sheet health is extremely healthy, and external growth is high. Moreover, the company continues to benefit from very favorable industry fundamentals like strong demand, longer stays, and subdued pressure from competitors. Furthermore, a lot of weakness has been priced in as REITs, in general, have been hit hard by rising rates.

Long story short, I will explain why I’m adding to what is still my only REIT.

Favorable Industry Fundamentals

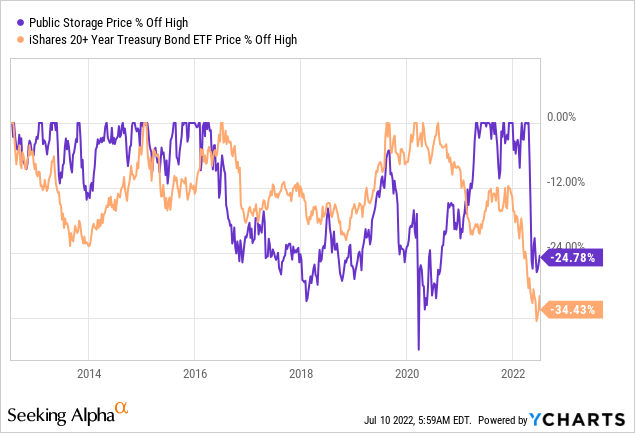

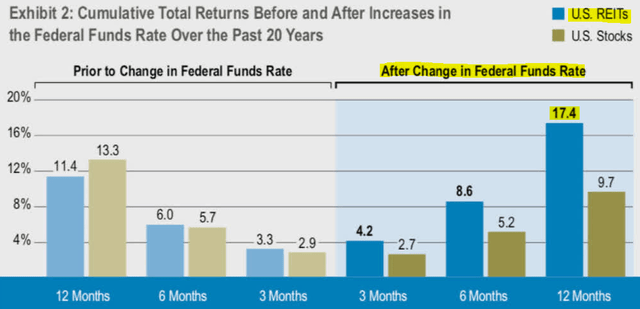

Let’s start with some macro. In a lot of cases, REITs are able to withstand pressure from selling, as so-called risk-off periods often lead to lower bond yields. In other words, investors rush to safe havens like bonds, causing bond yields to fall. This benefits REITs as dividend-generating income investments become more attractive in lower-yield environments and because REITs can borrow money at more affordable rates.

That is not the case in the current environment, as everyone will know by now. We’re in a very challenging environment consisting of (but not limited to):

- High inflation (caused by supply issues and monetary policy).

- An aggressive Fed.

- Slower economic growth as a result of high inflation and higher (expected) rates.

- Significant geopolitical issues in, i.e., Europe, adding to all the problems listed above.

This list could have been longer and much more detailed, but you get the point.

The good news is that REITs tend to outperform after positive changes in the Federal Funds Rate (rate hikes).

In a recent article, I used the following chart showing REIT outperformance after changes in the Fed Funds Rate.

Cohen & Steers (via Jussi Askola)

I retrieved this chart from Seeking Alpha’s Jussi Askola who wrote:

REITs own properties that cater to universal human needs. While businesses come and go, the need for high-quality real estate will never go away. This means that REITs have the potential for secular growth and will never become “irrelevant.”

This stuff cannot be inflated away, and in the long run, the value of these assets is almost certain to rise as long as they are well-managed and conservatively financed.

In fact, REITs tend to generate the highest returns when inflation is high and interest rates are on the rise. This makes sense, because the positive impact of inflation on rents and property values is far greater than the negative impact of rising interest rates.

It also helps that a lot has been priced in. The current Fed target range is 150 to 175 basis points. This is expected to rise to at least 350 basis points by February 2023 – using CME fed fund futures. This implies another 200 basis points worth of hikes between now and then on the back of a slowing economy.

With that said, this is by no means a promise that REITs have bottomed. It only means that the risk/reward is better. In other words, the odds of a bottom are favorable.

Based on this context, developments in PSA’s industry are favorable as well, according to last month’s National Self Storage report from Yardi Matrix, which you can access here.

Allow me to share a few quotes.

For example, demand remains extremely strong:

Demand for self storage is holding up despite growing economic uncertainty, pushing national street rates to new highs in May. Overall street rates rose $1 to $147, with 10X10 CC at $149 and 10X10 NON CC at $131. Storage demand remains extremely resilient, enabling operators to push both street rates and renewal rates while maintaining occupancy.

Demand drivers are ongoing work-from-home trends, high consumer spending, and the fact that housing has become very expensive, which means buyers tend to buy smaller properties, benefitting self-storage.

With regard to pricing:

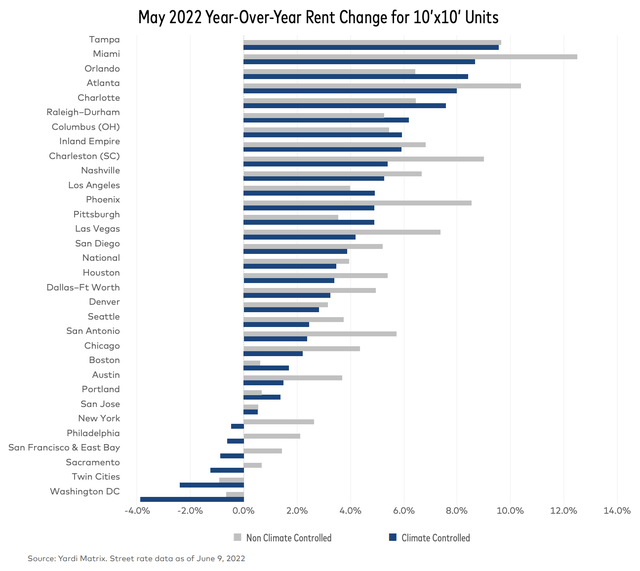

Rent growth is slowing in some areas of the country, but remains elevated in high-growth metros across the Sun Belt region. For 10X10 NON CC units, two of the top 31 metros had rate increases above 10.0% year-over-year in May, while rates decreased in two. For CC units, 10 of the top 31 markets had 5.0% or more growth, while six saw negative growth.

New supply isn’t low, but pipeline growth is slowing – more than likely a result of tougher financing conditions and material shortages:

The national new-supply pipeline continued to grow in May, with properties under construction or in the planning stages of development equal to 9.7% of existing inventory, up 20 basis points from the previous month. The number of properties under construction in the U.S. increased by 29 to 750 from the previous month, while the properties in the planning stage increased by 20 to 1,481. This is a drop in the number of projects added to the pipeline month-over-month compared to previous months, potentially signaling a slowdown in the rate of increasing development activity.

Based on all of this, let’s take a look at Public Storage.

Public Storage – Growth Over Dividends

Public Storage is a giant in its industry. The company has a market cap of $55.6 billion, that’s well-above Extra Space Storage (EXR), with a market cap of $24.4 billion.

Let me throw some facts at you. This S&P 500 member owns 2,800 properties in all states except for a few low-population states in the North, New Mexico, Arkansas, and Virginia.

PSA services 1.8 million customers covering 200 million square feet. Since the beginning of 2019, the company has expanded its portfolio by 23%, maintaining an A/A2 credit rating and a steady dividend.

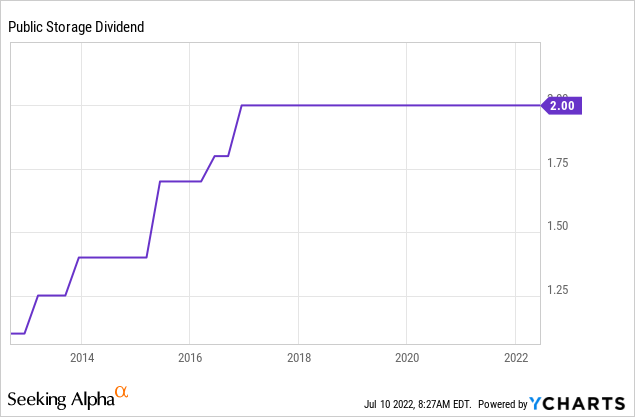

A lot of shareholders hate the fact that dividends haven’t increased in years, which I understand, as REITs are known for high yields and consistent (but moderate) dividend growth.

That said, PSA has invested a lot in external growth. Since early 2019, the company has invested $7.4 billion in acquisitions, development, and redevelopment. That’s 13.3% of the current market cap, to put things into perspective.

This increases the company’s total portfolio size by 38 million square feet, or 23%.

Acquisition yields on properties bought in 2020 and 2021 are 3.5% and 5.2%, respectively. These numbers are net operating income (“NOI”) as a percentage of the total investment. Rent growth did help. In 2021, rent growth was 16%. In 2020, it was even higher at 23% when the housing boom started to gain momentum.

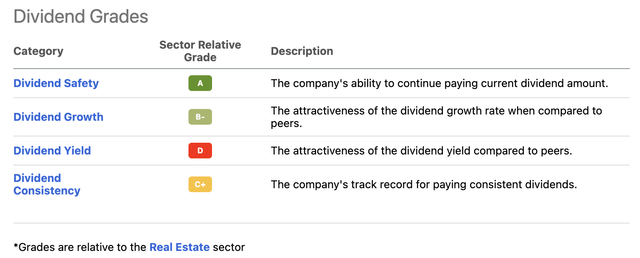

With that said, the company is still scoring more than decent on its Seeking Alpha dividend scorecard when compared to the real estate sector.

Dividend growth is scoring a B-, which is caused by an average 10-year annual dividend growth rate of 6.9%. Prior to the pandemic, the company consistently hiked with annual rates close to 20%.

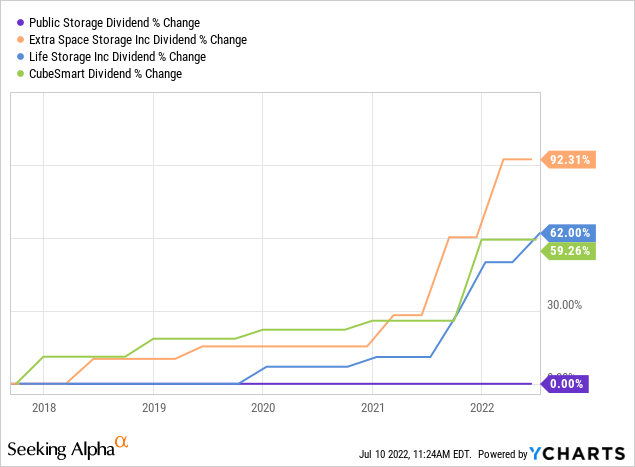

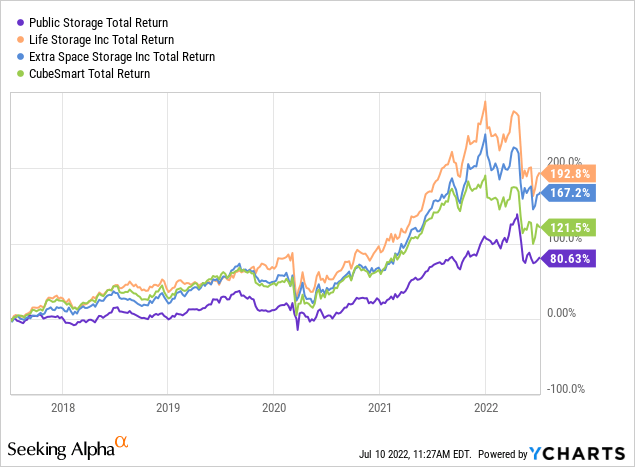

Now, the company is yielding 2.5% based on $8 in dividends per share, while its peers are hiking. As the chart below shows, its major peers have all hiked between 60% and 92% over the past 5 years.

During this period, PSA underperformed its peers by a rather wide margin as investors were looking for higher dividend growth, which makes sense.

With that being said, I didn’t bet on the wrong horse. Despite no dividend growth since I bought PSA in 2020 (and prior to that), I’m extremely optimistic. The company is aggressively buying new properties, which is something I love, and by now hiking dividends so much, it took good care of its balance sheet.

If there’s one thing I hate in REITs (or any business), it is aggressive expansions that lead to unsustainable or elevated debt levels. These tend to cause steep sell-offs in recessions that threaten housing/real estate health.

Between 2019 and the end of 2021, the company saw an increase in net debt from $1.5 billion to $6.7 billion (that’s a $5.2 billion difference). However, during this period, more than $6.0 billion in total assets was added. The book value of equity rose by $400 million. Needless to say, a lot of these properties are being (re)developed, as returns are just starting to pick up.

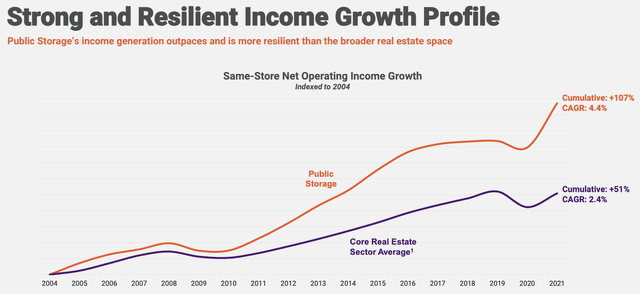

As of March 31, 2022, PSA is doing 78.8% in same-store NOI margins. Its closest competitor, Extra Space Storage, is at 75.2%. Total same-store net operating growth is beating the core real estate sector average by a mile.

And to continue the balance sheet discussion, since 2015, the company has increased total preferred equity by just $300 million. Euro debt was increased by just $700 million (translated to dollars). Total dollar debt rose from more or less zero in 2015 to $5.8 billion.

Despite the surge in rates, the company’s cost of debt and preferred equity is 2.7%. Down from 5.6% in 2015. Total net debt including preferred equity is 4.0x EBITDA.

As a result, the company has an A/A2 credit rating (outlook stable). That’s upper-medium grade debt, and one of the strongest ratings I’ve seen when researching REITs this year.

Valuation

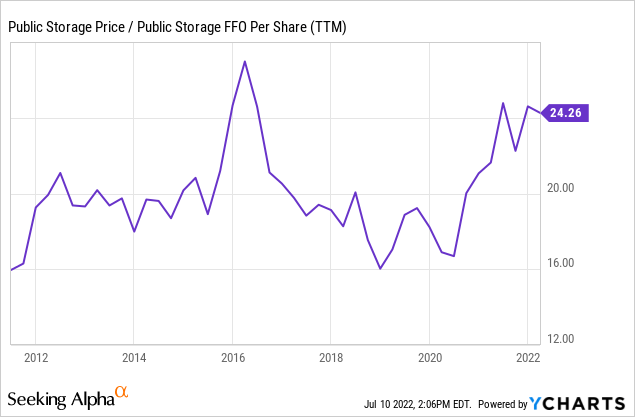

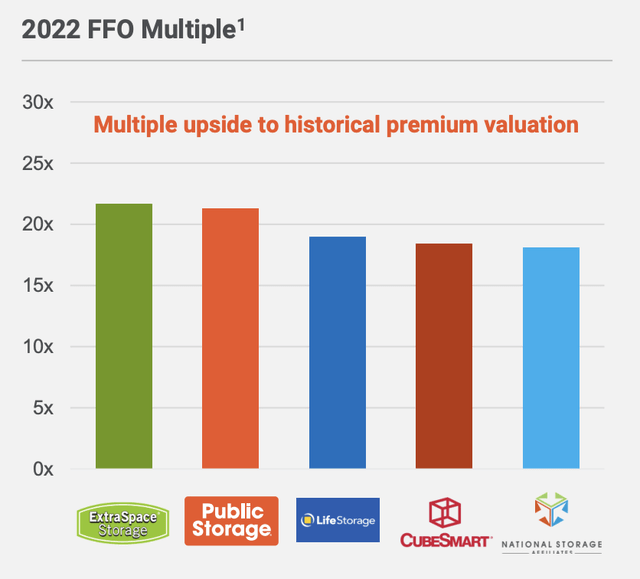

As of the end of June 2022, PSA has the second-highest multiple in the industry. The company is trading at roughly 21x this year’s expected FFO (funds from operations).

This valuation is close to the longer-term median after the company’s recent selloff.

I believe 21x FFO is a terrific deal.

- The company has a strong geographic mix with “A” locations.

- Margins are strong and improving despite high inflation.

- External growth is high, putting 25% of PSA’s portfolio in the high-growth non-same-store pool.

- Its balance sheet is stellar, protecting the company against high rates.

- Industry fundamentals continue to be supportive of strong growth.

Takeaway

Public Storage is giving investors mixed feelings. The company hasn’t hiked its dividend in years, while all of its major competitors have aggressively hiked shareholder distributions.

While I like to focus on dividend growth, I’m very comfortable in this situation. Public Storage has aggressively invested in external growth, expanding its business in key markets. These investments are starting to pay off handsomely on top of favorable industry trends boosting rents.

The valuation is attractive thanks to the most recent sell-off caused by higher rates. While higher rates are an issue, we’re at a point that – historically speaking – favors investments in REITs. On top of that, PSA has a fantastic A-rated balance sheet that not only allows it to aggressively invest in growth, but also to withstand interest rate “shocks”.

In other words, I happily remain invested in PSA and will use any weakness to gradually add exposure on a long-term basis.

(Dis)agree? Let me know in the comments!

Be the first to comment