Deejpilot

Investment Thesis

Churchill Downs, Inc (NASDAQ:CHDN) conducts its business in racing, online wagering, and gaming entertainment. The company has recently announced the acquisition of Ellis Park in Henderson, which I believe can act as a primary catalyst to boost the company’s growth. The company is vigorously executing expansion plans which can drive its performance and help to expand its profit margins. The acquisition of Ellis Park can provide geographic diversification in the prime market, which can help it to create a strong presence and dominance over its competitors.

About CHDN

CHDN deals in racing, online wagering, and gaming entertainment business anchored by its flagship Kentucky Derby event. It has approximately 3050 historical racing machines (HRMs) in Kentucky, which owns and operates three pari-mutuel gaming venues. The company has nine retail sportsbooks and owns one of the largest online wagering platforms, TwinSpires, for sports, horse racing, and iGaming. It also deals in brick-and-mortar casino gaming, which is operated in eight cities, including approximately eleven thousand slot machines, two hundred table games, and video lottery terminals. The company conducts its business in four operating segments: Live & Historical Racing, TwinSpires, Gaming, and All Other. The Live & Historical racing segment generates revenue from pari-mutuel racing at Churchill Downs Racetrack, Derby City Gaming, Oak Grove Turfway Park, and Newport. 26% of CHDN’s revenue comes from the Live & Historical racing segment. The TwinSpires segment primarily earns revenue from Horse racing and Sports and Casino businesses. It operates a sports betting platform in various states, such as Indiana, Maryland, New Jersey, Michigan, Mississippi, Tennessee, Pennsylvania, and Arizona. The TwinSpires segment contributes 27% to the total revenue. The gaming segment generates revenue from table games, slot machines, video poker, hotel services, food & beverage services, pari-mutuel wagering commissions, and other operations. The company earns 44% of its total revenue from the gaming segment. The revenue generated from certain corporate operations and immaterial joint ventures is classified as the ‘All Other’ segment. The All Other segment comprises 3% of the company’s total revenue. The company currently pays a dividend yield of 0.39%, which I believe can remain constant, looking at the cash balance. CHDN has recently acquired Ellis Park, which I will discuss in the next section.

Acquisition of Ellis Park

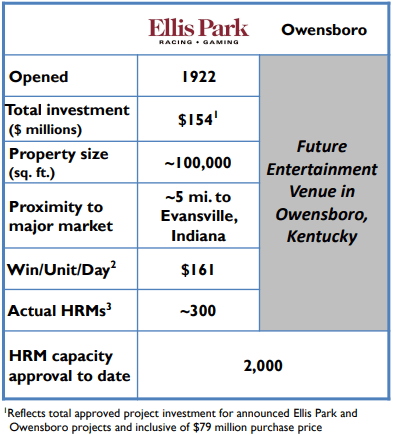

The Global Covid-19 Pandemic led to a significant decline in the horse racing and overall physical gaming industry due to physical distancing restrictions. As the restrictions of the pandemic are easing, we might experience solid recovery in horse racing and the overall physical gaming industry. The pandemic has increased consumers’ disposable income, which has enabled them to make more expenditures on entertainment activities. This has ultimately increased the demand for the entertainment industry, especially horse racing, an ancient sport in Kentucky. To address this growing demand, the company is making vigorous expansion plans. As part of this expansion, the company has recently entered into an agreement to acquire Ellis Park in Henderson. CHDN acquired Ellis Park for total consideration of $79 million in cash, subject to certain working capital and other purchase price adjustments. The company has planned to build racing infrastructure in Ellis Park and construct Owensboro Racing and Gaming. This racing infrastructure would be an entertainment venue featuring 600 HRMs and will also deal in food and beverage offerings, creating revenue-generating opportunities. As Kentucky is renowned for its horse racing culture, it is a significant market for the overall horse racing industry. I believe this acquisition can significantly help the company to provide enhanced entertainment and gaming experience in the historic gaming ground, which can add new customers to its business, increase its market share, and further expand its profit margins. This geographic diversification in the prime market can help it to create a strong presence and dominance over its competitors, as Ellis Park is considered the historic home of racing.

Future Entertainment Venue Details (Investor presentation: Slide no: 46)

What is the Main Risk Faced by CHDN?

Intense Competition

The company operates in a highly competitive industry. It faces competition from a large number of participants, including both physical and online gaming platforms. It mainly consists of participants from dockside casinos, land-based casinos, historical horse racing, fantasy sports, and internet-based gaming platforms. The competitors compete on various factors such as product offerings, customer base, geographic diversification of entertainment venues, and equipment and assets required for gaming. Constant innovation and expansion are required in the industry, which is also further challenged by high government regulation in licensing the expansion of the business. The low entry barriers in the company’s market make it highly competitive. The competition may become extremely fierce if new players with cutting-edge technologies enter the market. Additionally, if the company cannot effectively compete, it may lose market share. If the company is unable to keep up, it can result in a reduced customer base and market share, further contracting its profit margins.

Valuation

The recent acquisition of Ellis Park can help the company to address the growing demand and add new customers. I think this acquisition can drive future growth in the coming years. After considering all the above factors, I am projecting the EPS of FY2023 to be $10.50, which gives the forward P/E ratio of 18.57x. The company’s forward P/E ratio is significantly higher than the sector median of 11.62x. But the company has always shown a tendency to trade at a considerably higher P/E ratio compared to the sector median, as its 5-year average P/E ratio is 47.01x. Observing the current position of the company and the valuations, I believe the company has a lot of potentials to grow further. But, the intense competition in a high inflationary market can force the share to trade below its 5-year average P/E ratio. Hence, I estimate the company might trade at a P/E ratio of 25x, giving the target price of $262.50, which is a 34.6% upside compared to the current share price of $195.05.

Conclusion

CHDN operates in a highly competitive industry where innovation, expansion, and product offerings play a significant role. It faces challenges in expansion as it is one of the highly regulated industries by the U.S government. CHDN has recently acquired Ellis Park in Henderson, which I believe can accelerate the company’s growth by increasing its customer base and market share. It has also made various expansions in its other operating segments, which can help it grow in a competitive market. The company’s forward P/E ratio is higher than the sector median of 11.62x. But the company has always shown a tendency to trade at a significantly higher P/E ratio compared to the sector median, as its 5-year average P/E ratio is 47.01x. After analyzing all the above factors, I assign a buy rating for CHDN.

Be the first to comment