John Li

Prudential plc (NYSE:PUK) has strong growth prospects and a sound financial profile, while its valuation is quite cheap, making it attractive for long-term investors.

Business Overview

Prudential Plc is an insurance company based in the U.K. due to historical reasons, even though it has transformed its business profile in recent years and is now only present in Asia and Africa. This profile is similar to HSBC Holdings (HSBC) in the European banking sector, which is bank that is based in the U.K. but has a large part of its business generated in Asia.

While Prudential had a diversified business profile in the past, the company has performed the spin-off of its U.S. operations, called Jackson National Life Insurance Company, to its shareholders in 2021, and also demerged the asset management unit (M&G) in 2019.

This led to a streamline business profile, being nowadays exposed to the Life and Pension segments, exclusively in high-growth markets. Prudential’s current market value is about $31 billion and the company trades in the U.S. on the New York Stock Exchange.

Strategy & Growth Prospects

Prudential’s operating business is nowadays present in the savings, health & protection products and services, in several growth markets. From a geographic perspective, the company is exposed to high-growth markets in the Asia and Africa regions, including countries such as China, Singapore, or Indonesia.

Due to this unique business profile within the European insurance sector, Prudential has much better long-term growth prospects than other insurance companies, as usually they are mainly exposed to mature markets. Prudential has strong tailwinds supporting its growth for many years, as the company is well exposed to macro trends, such as an ageing population, and the rise of the middle-class across Asia, while in Europe the insurance sector has relatively low long-term growth prospects.

Following the separation of the asset management unit and its U.S. operations, Prudential’s main business is now health and savings in Asia, even though it also has some exposure to Africa. This means that Prudential has much better growth prospects over the long term compared to most European insurance companies, which rely much more in mature markets that offer rather limited growth prospects in the next few years.

Taking into account this business profile, Prudential’s closest competitor is AIA Group (OTCPK:AAGIY), which is also an insurance company with exposure to several Asian countries. Indeed, the vast majority of Prudential’s current premiums are written in Asia, thus European insurance companies can’t no longer be considered peers to Prudential, as the company’s business profile doesn’t have much overlap with other European insurance companies nowadays.

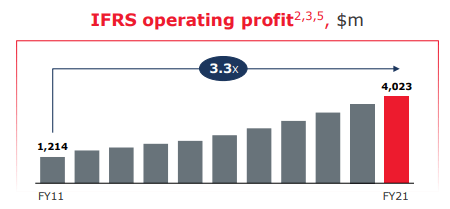

Regarding its growth history, Prudential has a very good track record over the past decade, as its business was already well exposed to growth markets beyond other mature markets, leading to a growing trend for operating profits even before its pivot to Asia.

Operating profit (Prudential)

Considering that Prudential is now only exposed to high-growth market, this trend is not expected to reverse soon, as its business is now exposed to markets with higher economic growth, favorable demographics, low levels of insurance penetration, and a growing potential customer base.

Reflecting this positive operating backdrop, Prudential has set some quite ambitious targets over the next few years, including growing its number of customers from about 17 million in 2021 to about 50 million by 2025, which would be a strong boost to its premiums and earnings growth. To achieve this goal, Prudential’s strategy is to offer its products and services across the board, from retail clients, to affluent and high-net worth individuals. It is also betting on a multi-channel distribution model, making several partnerships with agents and banks in the markets where it is present, to expand its total addressable market.

Financially, Prudential’s main targets are to grow sustainably its new business profit and achieve double-digit embedded value per share growth over the coming years, which seem possible considering the company’s strong growth history and current exposure to high-growth markets.

Financial Performance & Dividends

Regarding its financial performance, Prudential has reported very good financial figures over the past few years, which is a very good achievement in a sector that has relatively low growth prospects in developed markets. This clearly show that Prudential’s strategy to shift its business mix toward high-growth markets was the right one.

More recently, the company has maintained a positive operating performance, even though there were some headwinds, such as Covid and several lockdowns in China, which have hurt Prudential’s growth.

Nevertheless, during the first six months of 2022, Prudential delivered good results with Annual Premium Equivalent (APE) sales of $2.2 billion, up 9% YoY, with Southeast Asia and China accounting for more than $2 billion together in APE sales.

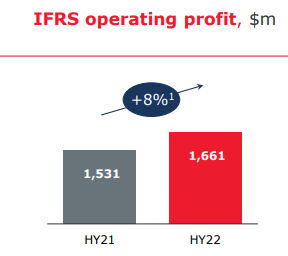

Its operating profit in the first semester amounted to $1.66 billion, up by 8% YoY, which means that Prudential had a good cost control despite inflationary and wage pressures and the company was able to pass higher costs to customers in the past few months.

Op. Profit H1 2022 (Prudential)

These positive operating figures show that Prudential’s growth path remains solid, and the company continues to invest in its business growth through expanding its multi-channel distribution model, digitalization of its processes, improve its operational efficiency, plus strong customer demand that continues to boost its top-line.

Despite its positive growth reported in the first semester, there are several headwinds that are impacting its business, namely Covid disruptions, capital markets volatility, and a tougher macroeconomic environment, thus growth may slow down in the coming semesters. Indeed, in the first semester, one of its main markets (Hong Kong) reported lower APE sales and profits due to business disruptions related to Covid, a situation that may also affect Prudential’s growth in the second half of the year as China remains committed to its zero-Covid policy.

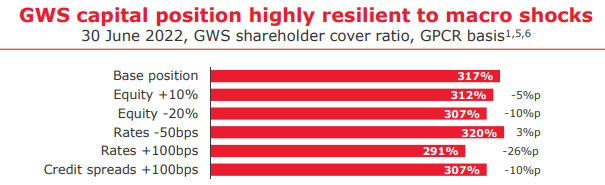

Regarding its capitalization, Prudential is very well capitalized given that is coverage ratio was 317% at the end of June, which means that on this measure it does not need to retain much profits as its surplus capital was about $16 billion. Moreover, its capital sensitivity to interest rates and equities is manageable, as shown in the next graph.

Capital (Prudential)

Moreover, after its steps to reduce debt over the past year, Prudential now has a leverage ratio of 22%, which is relatively low and in-line with credit rating agencies requirements for a strong credit rating. This strong financial profile is a strong support for Prudential to further invest in business growth, but also to return excess capital to shareholders.

This means that Prudential’s strong balance sheet is a positive factor for the company’s dividend sustainability, even though its dividend yield is not particularly much high. Prudential distributes two dividends per year, which have amounted to about $0.35 per share over the last year. At its current share price, Prudential offers a dividend yield of about 1.5%, which means that its income appeal is not particularly impressive within the insurance sector.

Nevertheless, as the company has good growth prospects and a strong balance sheet, its dividend is set to increase in the coming years. Indeed, according to analysts’ estimates, its dividend is expected to reach $0.47 per share by 2025, increasing by some 9% annually over the next three years, improving a little bit its income appeal.

Conclusion

Prudential is an insurance company with a unique profile within the European insurance sector, due to its exclusive exposure to high-growth markets. Even though its growth has been hit by external factors in recent months, namely Covid-related restrictions in Hong Kong and China, its long-term growth prospects and fundamentals remain good.

Reflecting its stronger growth profile and solid financial position, Prudential’s valuation is usually at a premium to European peers, which is clearly justified. However, due to some growth slowdown in recent months and general weakness in the equity market, Prudential is currently trading at 1.8x book value, a valuation that it’s cheaper than its historical valuation of about 2.2x book value over the past five years.

This means that Prudential’s valuation doesn’t seem to be aligned with its improved fundamentals compared to some years ago, creating a good entry point for long-term investors.

Be the first to comment