jetcityimage

Thesis

Prudential Financial, Inc. (NYSE:PRU) and its insurance peers were battered into their respective lows through September. However, we also highlighted in our previous article in September that we saw a reasonable opportunity for investors to buy the deep pullback as the market forced weak holders into giving up their shares.

Accordingly, PRU has significantly outperformed the market since our previous update, posting a price gain of more than 13% against the S&P 500’s (SPX) (SP500) 0.7% gain. Moreover, we believe the gains are robust relative to PRU’s 5Y and 10Y total return CAGR of 4.57% and 12%, respectively.

Therefore, we believe it’s appropriate to update investors on whether PRU remains attractive to add exposure after its recent FQ3 earnings release. Our analysis suggests that the market had anticipated solid forward guidance heading into its recent earnings. As such, the company posted better-than-expected FQ4 guidance in its adjusted operating EPS, corroborating its robust recovery.

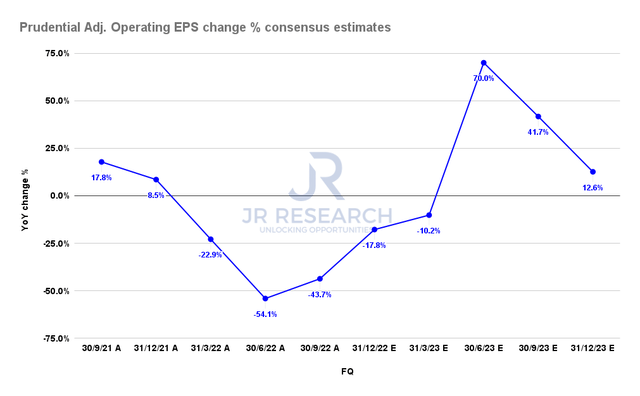

Therefore, we assess that Prudential’s FQ2 is likely the bottom in its adjusted operating EPS decline, as it laps challenging COVID headwinds and is also lifted by higher interest rates. Also, the likely bottoming of the equity and fixed income markets could continue to drive further fund flows and higher investment income moving ahead.

Moving forward, the company sees highly attractive investment opportunities in the fixed income space driven by the dislocation causing yields to surge. With interest rates expected to stay elevated for some time, Prudential remains in a solid position to capitalize on these investment opportunities to drive further growth, even though the Fed could slow down its rate hikes through early 2023.

However, we also assess that the recent rally has likely reflected the optimism in its current valuation. Coupled with price action that suggests near-term caution is appropriate, we urge investors to bide their time to add more exposure.

Revising from Buy to Hold.

Prudential Issued Robust Q4 Guidance

Prudential Adjusted Operating EPS change % (S&P Cap IQ)

Prudential reported Q3 adjusted operating EPS of $2.13, down nearly 44% YoY. Notably, it came well below the projections in our previous article of $2.32. The company highlighted a challenging macroeconomic backdrop, resulting in a broad-based slowdown in investment and fee income.

However, management was quick to point out that it expected Q4 to show a marked improvement, as CFO Ken Tanji articulated:

The key takeaway is that our underlying earnings power improved due to business growth, including the benefit of higher interest rates that more than offset equity market depreciation. Over the long term, a higher interest rate environment is economically beneficial. (Prudential FQ3’22 earnings call)

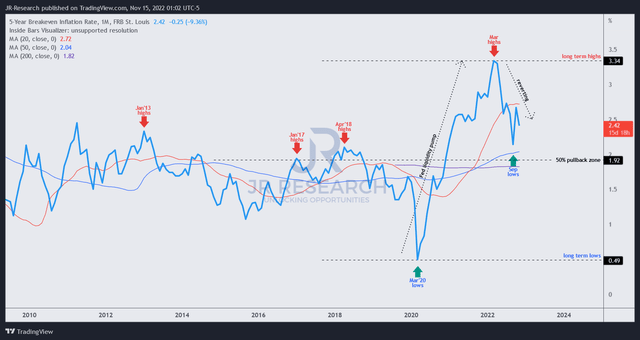

5Y Breakeven Inflation rate % (TradingView)

As seen above, the 5Y breakeven inflation rate remains well above pre-COVID historical highs even though it has recently pulled back to 2.42%. Therefore, we postulate that the low-interest rate environments we saw previously are unlikely to materialize in the medium term as global economies grapple with elevated inflation rates.

Moreover, even though the Fed is expected to slow down its rate hikes through early 2023, investors should not expect it to cut rates drastically unless a severe recession results in significant unemployment.

Furthermore, our analysis suggests that a mild-to-moderate recession is likely the base case, which indicates that the Fed should remain progressive and data-dependent in its momentary policy over the medium term.

Accordingly, the dislocation in the fixed income market has also given Prudential significant leverage to capitalize on the attractive investment opportunities, given its robust balance sheet.

Hence, we believe the medium-term tailwinds undergirding the strength in earnings recovery remain robust.

Is PRU Stock A Buy, Sell, Or Hold?

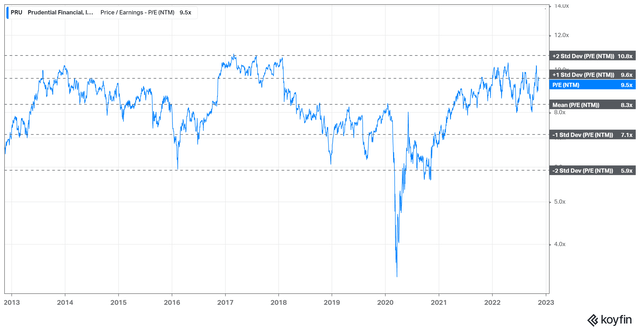

PRU NTM Adj. Operating EPS multiples valuation trend (koyfin)

With the sharp recovery from its September lows, PRU last traded at an NTM adjusted Operating EPS multiple of 9.5x, close to the valuation highs seen over the past year. It’s also well above its 10Y mean of 8.3x.

PRU also trades at a premium against its peers’ median of 8.8x (according to S&P Cap IQ data) but in line with the Insurance industry’s forward P/E of 9.8x.

We believe analysts have already baked in sufficient pessimism into the Insurance industry’s forward earnings estimates, as we gleaned that downward earnings revisions have continued through October.

However, we assess that PRU’s valuation seems well-balanced at the current levels and don’t see an attractive reward/risk entry opportunity.

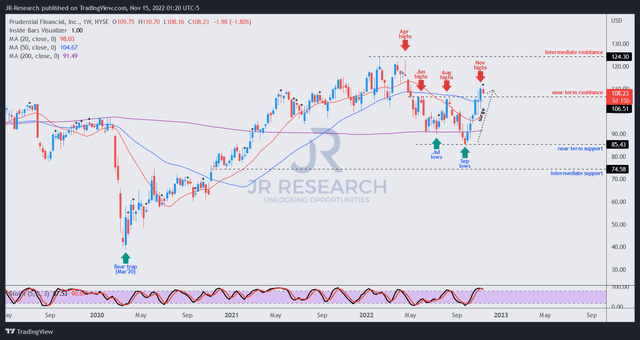

PRU price chart (weekly) (TradingView)

With its remarkable recovery from its September lows, PRU also surged into its near-term resistance that saw sellers defending that zone previously held in June and August.

Momentum and breadth indicators are also overbought, which corroborate near-term caution, as suggested by the spike in PRU’s price action.

We assess that a healthy pullback could be in store as the market digests some of the late buying momentum leading to more attractive entry levels for investors waiting to add exposure.

Revising from Buy to Hold.

Be the first to comment