A money shaped dollar sign. Eilatan_A3/iStock via Getty Images

To point out that the financial markets have been volatile year to date would be stating the obvious. The war in Ukraine, surging interest rates, and elevated inflation have led the S&P 500 index 24% lower so far this year.

This begs the question: What’s an investor to do to remain calm and stay in the market for the long haul? What has worked for me in my five year investing career is to primarily focus on dividend growth stocks.

One such stock that has been a cornerstone of my portfolio is the insurer and asset manager Prudential Financial (NYSE:PRU). For the first time since May, I’ll discuss my buy case for the stock and the risk associated with it.

A Well-Protected And Market-Crushing Dividend

Prudential’s 5.30% dividend yield is significantly higher than the 3.57% average dividend yield of the insurance – life industry. And it’s far above the S&P 500 index’s 1.76% yield. Yet Prudential doesn’t appear to be a yield trap either.

This is supported by the fact that Prudential generated $14.58 in after-tax adjusted operating income per share in 2021 (page 8 of 11 of Prudential Q4 2021 earnings press release). Against the $4.60 in dividends per share paid during that time, this equates to a 31.6% after-tax adjusted operating income per share payout ratio.

The collapse in equity markets will weigh on the company’s after-tax adjusted operating income per share in the near term. That’s why analysts are anticipating $10.04 in after-tax adjusted operating income per share for this year. Compared to the $4.80 in dividends per share that will be paid in 2022, this works out to a 47.8% payout ratio.

This is a bit on the high end for Prudential, so that’s why I expect that dividend growth will slightly lag behind earnings growth for the foreseeable future. Considering a 5% to 6% annual earnings growth rate, my forecast is for a 5% annual dividend growth rate over the long run.

The First Half Was Characterized By A Major Macroeconomic Challenge

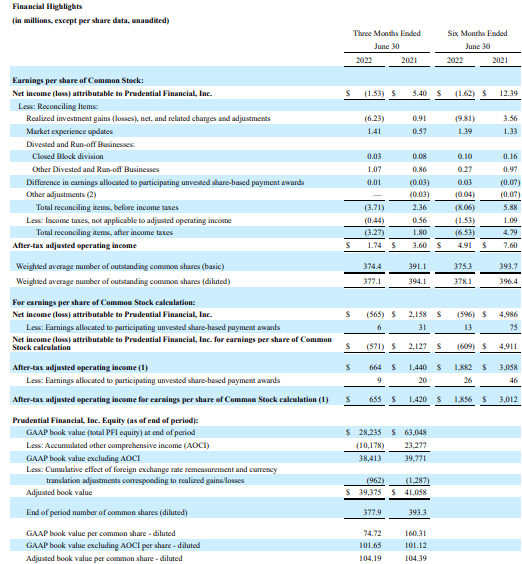

Prudential Financial Q2 2022 Earnings Press Release

At first glance, Prudential’s earnings results for the first half of 2022 may appear to have been weak. But with more context and a fuller understanding of its headwinds, the results aren’t as bad as they look.

Prudential reported $4.91 in after-tax adjusted operating income per share in the first half of the year. This was down 35.4% over the year-ago period.

This was the result of decreases in each of Prudential’s following three primary segments: PGIM, U.S. businesses, and international businesses.

The broader market decline led Prudential’s assets under management to fall from $1.73 trillion in the year before to $1.41 trillion at the end of the first half. This is how the company’s asset management segment called PGIM experienced a 59.2% year-over-year drop in pre-tax adjusted operating income to $394 million through the first half of 2022.

The U.S. businesses segment recorded a similar 30.5% drop over the year-ago period in pre-tax adjusted operating income to $1.31 billion for the first half of the year. And the international businesses segment posted a 19% year-over-year dip in pre-tax adjusted operating income to $1.36 billion during the first half of 2022.

Prudential’s adjusted book value per share remained relatively steady, decreasing by just 0.2% to $104.19 to close out the second quarter of 2022.

The good news is that the economy eventually bounces back after every recession. And with $7.1 billion in highly liquid assets, Prudential has the financial fortitude to come out on the other side of an economic downturn intact. That’s why rating agencies S&P, Moody’s, and Fitch have awarded Prudential with respective A, A3, and A- investment-grade credit ratings.

Risks To Consider:

Prudential is a fundamentally and financially solid business. But no equity is risk-free. With that universal truth in mind, here is the biggest risk facing the company moving forward.

Due to the concerns that I alluded to in the opening of this piece, Ned Davis Research warns that there is a 98.1% probability of a severe global recession at some point in 2023. If the economic trough is deep and prolonged enough, a temporary dividend cut could be on the table. That’s because depressed equities would lead to a massive dive in earnings, which could also lead Prudential’s stock to sell off further.

A Wonderful Business Valued At A Discount

Buying quality companies is a start for investors looking to do well, but it’s only half of the equation. The other half is to avoid significantly overpaying.

Fortunately, Prudential looks to be attractively valued at this time. This is based on my assumptions for two valuation models.

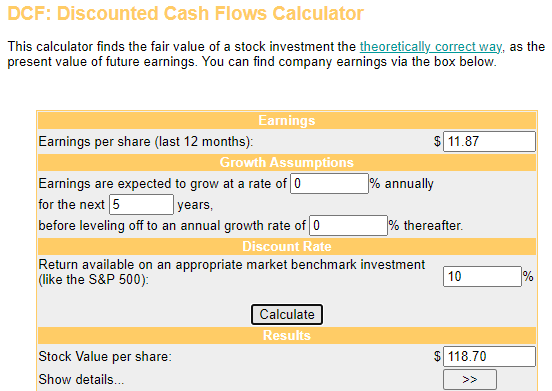

Money Chimp

The first valuation model that I will use to approximate the value of Prudential’s shares is the discounted cash flows model or DCF model. The DCF model has three inputs.

The first input into the DCF model is trailing twelve months after-tax adjusted operating income per share. In the case of Prudential, that amount is $11.87.

The next input for the DCF model is growth assumptions. I’ll factor in no further growth in Prudential’s earnings to err on the side of caution.

The final input into the DCF model is the discount rate, which is the required annual total return rate. My personal preference is 10% annual total returns, so that is what I will use.

Given these inputs, I arrive at a fair value of $118.70 a share. This suggests that shares of Prudential are trading at a 23.7% discount to fair value and offer a 31.1% upside from the current price of $90.57 a share (as of October 7, 2022).

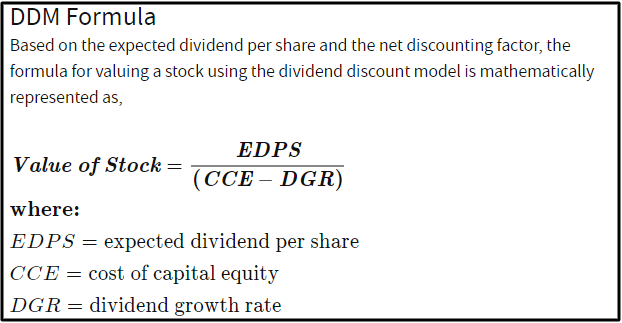

Investopedia

The other valuation model that I’ll utilize to appraise Prudential’s shares is the dividend discount model, which also involves three inputs.

The first input for the DDM is the expected dividend per share, which is the annualized dividend per share of a stock. Prudential’s current annualized dividend per share is $4.80.

The second input into the DDM is the cost of capital equity, which refers to the annual total return rate that an investor requires. I’ll again use 10% for this input.

The third input for the DDM is the DGR or annual dividend growth rate. As I noted earlier in the dividend section, I will use a 5% annual dividend growth rate for Prudential.

Factoring these inputs into the DDM, I get a fair value output of $96.00 a share. This indicates that shares of Prudential are priced at a 5.7% discount to fair value and can provide 6% capital appreciation from the current price.

When I average these two fair values together, I come out to a fair value of $107.35 a share. This implies that Prudential’s shares are trading at a 15.6% discount to fair value and offer an 18.5% upside from the current share price.

Summary: Prudential Is A Reliable Income Stock To Buy

Having upped its dividend for 14 consecutive years, Prudential is a Dividend Contender. And the relatively sustainable payout ratio should give the company the flexibility needed to continue building on this track record in the years to come. Not to mention that Prudential has plenty of liquidity on hand to overcome a looming economic tumble.

If that’s not enough for income investors to hit the buy button, Prudential is also 16% undervalued and offers income investors a whopping 5.3% dividend yield. That’s why I believe the stock is a compelling pick for yield-hungry investors.

Be the first to comment