Nastco/iStock via Getty Images

Investment Thesis

When I last covered Prothena Corporation (NASDAQ:PRTA) for Seeking Alpha back in late July 2021, shortly after Biogen (BIIB) and partner Eisai’s Alzheimer’s drug Aduhelm had been controversially approved by the FDA, biotechs developing Alzheimer’s drugs were all the rage, and Prothena stock had just hit a 4-year high of $52.

Prothena did not just have a single Alzheimer’s candidate in its drug development pipeline – it had three, plus a Parkinson’s Disease candidate, and a late stage asset – Birtamimab – targeting AL amyloidosis. Another candidate addressing ATTR Amyloidosis – diagnosed in ~3k – 5k patients per annum in the US – had just been sold to Danish Pharma Novo Nordisk (NVO), although Prothena remains in line for up to $1.2bn in milestone payments.

Prothena also partners with the US Pharma giant Bristol Myers Squibb (BMY) in developing tau-targeting Alzheimer’s candidate PRX005, plus two undisclosed targets, and with Swiss Pharma Roche (OTCQX:RHHBY) on development of its Parkinson’s candidate Prasinezumab. Between 2022 and 2026, the company could earn ~$360m in milestone payments based on various clinical milestones.

The future looked bright for Prothena, I concluded at the time, but then it became increasingly clear that Biogen’s newly approved Aduhelm was going to be a commercial failure – physicians felt the drug was unsafe, not effective enough, and too expensive, and the Centers for Medicaid and Medicare (“CMS”) refused to provide reimbursement outside of clinical trials.

Aduhelm’s failure was felt by all Alzheimer’s drug developers with candidates targeting amyloid beta – a sticky protein that is commonly found in the brains of Alzheimer’s patients, the removal of which, the theory went, would slow or halt patient’s cognitive decline – and after hitting an all-time peak value of $77 in September 2021, Prothena’s stock price began to fall, sinking to a price of just $27 at the end of August.

Two days ago, however, Biogen and Eisai announced that a pivotal trial of a new amyloid-targeting Alzheimer’s drug, Lecanemab, had met its primary endpoint, slowing cognitive decline in patients with early Alzheimer’s by 27% versus placebo based on Clinical Dementia Rating-Sum of Boxes (“CDR-SB”) scoring.

It is the first time – or second, depending on whether you accept that Eli Lilly’s candidate Donanemab met its endpoint – a scale custom designed by Lilly itself known as Integrated Alzheimer’s Disease Rating Scale (iADRS) – in a Phase 2 study – that the amyloid reduction leads to slowing of cognitive decline thesis has been demonstrably proven, and it has sent share prices soaring again.

Prothena stock rose in value by 87% yesterday, and is now up 10% since my July 2021 note. But are the gains sustainable?

It is hard to argue that Lecanemab’s study data emphatically proved the amyloid clearance thesis. The overall improvement in the 18-point CDR-SB scale was -0.45 points and it is questionable if that is significant enough to help patients with Alzheimer’s. These patients need to be identified early using expensive PET scans, and although Lecanemab’s safety profile in the study was superior to Aduhelm’s, instances of amyloid-related imaging abnormalities-edema/effusion (“ARIA-E”) – brain swelling – were observed in >12% of patients.

What is more, in Prothena’s case its Amyloid targeting drug is in a Phase 1 trial, meaning it could be years before the company is ready to apply to marketing authorisation, and it will have to prove itself in at least one more major studies after this one, and probably two.

On the other hand, Prothena believes that PRX012 – its anti-amyloid candidate – allows for subcutaneous, rather than intravenous administration, a lower dosing regime, and better binding potency than Aduhelm, and potentially Lecanemab and Donanemab also, meaning it could become the most convenient, safest, and effective Alzheimer’s candidate in clinical development.

Plus, Prothena is not only looking at targeting amyloid, but also tau – microtubule-associated proteins in the brain – which is the other major established Alzheimer’s drug target, as well as a vaccine targeting both tau and amyloid.

With >$500m of funding, and a cash burn of $77.5m across the first half of 2022, Prothena ought to be able to complete its studies without having to complete dilutive fundraisings, and the company’s market cap is still only $2.72bn at the time of writing.

Biogen’s market cap increased from ~$29bn, to $40bn yesterday, implying that the market believes its Lecanemab data added >$10bn of value to the company. If Prothena can produce similar results, theoretically at least, its share price ought to sky-rocket.

In this post I will take a closer look at the state of play in relation to Prothena’s pipeline, with a particular focus on the Alzheimer’s candidates.

PRX012 – The Natural Heir To Lecanemab/Donanemab?

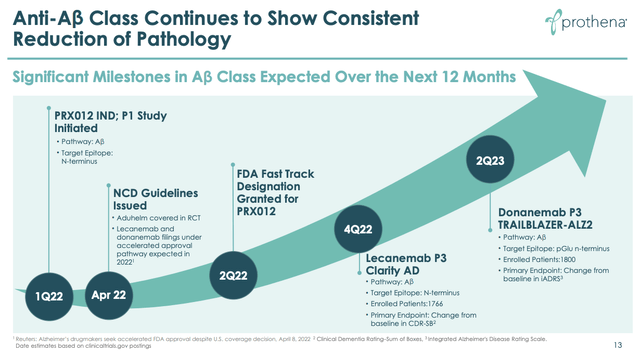

Looking at the slide below from a Prothena investor presentation gives us an idea of how Prothena believes it can position its anti-amyloid candidate PRXO12.

Progress of anti-amyloid Alzheimer’s drugs. (Prothena presentation)

With PRX012 now having been granted Investigational New Drug (“IND”) status by the FDA, and given a Fast Track designation, Prothena appears to have correctly predicted that Lecanemab’s Phase 3 CLARITY data would do much of the heavy lifting in terms of proving the amyloid reduction thesis, and also believes that Lilly’s Donanemab data from its pivotal trial may reinforce the Lecanemab data and potentially win an approval for the drug.

Both Lecanemab and Donanemab may make it to market, but Prothena may be able to position PRX012 as the next-generation of anti-amyloid drug, stressing its superior safety, efficacy and administration.

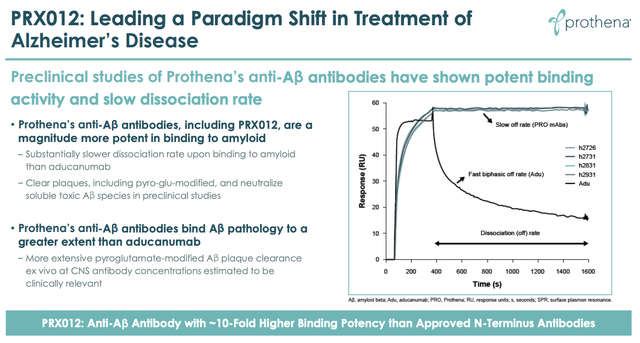

Of course, Prothena first needs to obtain the clinical data to prove what the company says it has observed in preclinical studies – namely that PRX012 is more potent and selective than Aduhelm.

Prothena preclinical observations PRX012 versus Aduhelm. (Prothena presentation)

In fact, Prothena must now prove that PRX012 is superior to Lecanemab and Donanemab as well as Aduhelm, which is a harder task, although both Biogen’s and Lilly’s drugs look vulnerable on both safety and efficacy, having met endpoints by the narrowest of margins.

Prothena has a long way to go – a Phase 1 multiple ascending dose study will initiate before the end of the year, with topline data expected in 2023, and a single ascending dose study has already been initiated. At this point it seems unclear as to which efficacy endpoints may be used in the trial – safety is the primary endpoint, followed by a secondary objective “to characterize the plasma PK profile of PRX012 and cerebrospinal fluid PK profile of PRX012”, which may mean we will not see any efficacy i.e. CDR-SB or ADAS-Cog (another “gold standard” test of cognitive decline) until a Phase 2 study.

Prothena’s share price gains yesterday prove that PRX012 is the company’s primary value driver. In truth, those gains may have overstated the work done by the company to date, although there is absolutely no question that positive Phase 1 data would drive Prothena’s valuation higher – perhaps even doubling it, provided no data from rival company trials damages the amyloid thesis in the meantime.

2 More Alzheimer’s Candidates To Consider

If the amyloid-reduction thesis was to be cast into doubt yet again – and that isn’t unlikely, given it has resulted in a single – disastrous – approved therapy after 20 years of research and billions of dollars of funding – then Prothena and Bristol Myers Squibb may be able to position anti-tau therapy PRX005 as an alternative solution.

Once again, Prothena’s data is all pre-clinical – mouse models show that “PRX005 treatment reduces pathological tau and ameliorates behavioural deficit in trangenic mouse models” (source: investor presentation) but encouragingly, topline Phase 1 data will be available before the end of the year, management has promised.

And if Prothena is unable to prove the tau-targeting thesis – a thesis that Eli Lilly carried into a Phase 2 trial with candidate Zagotenemab, failing to make meaningful progress – then how about a vaccine targeting both tau and amyloid?

That is what Prothena’s candidate PRX123 is designed to do, with preclinical data again suggesting there is some merit to this approach. According to Prothena, in non-human primates and guinea pigs:

The immune animal sera reacted to Aβ and tau, induced Ab phagocytosis, and blocked tau interaction with a key mediator of cellular release and cell-to-cell transmission

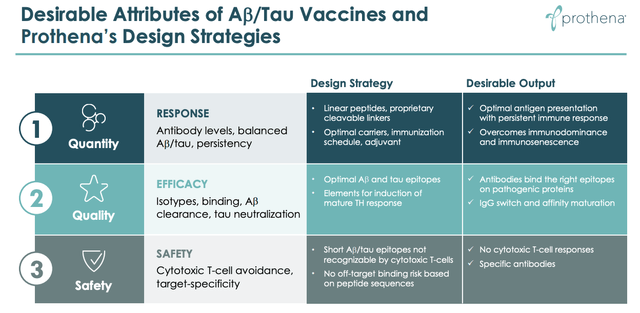

Slide from Prothena investor presentation. (Prothena presentation)

As we can see from the slide above, Prothena is promising “Quantity, Quality and Safety”, but so many medicines that look promising in mouse models or non-human primates fail in the clinic, so even more so than with its other two candidates, Prothena still has it all to do in terms of proving that vaccination is a viable approach to tackling Alzheimer’s.

Mapping Prothena’ Progress, Payments and Path To Commercialisation

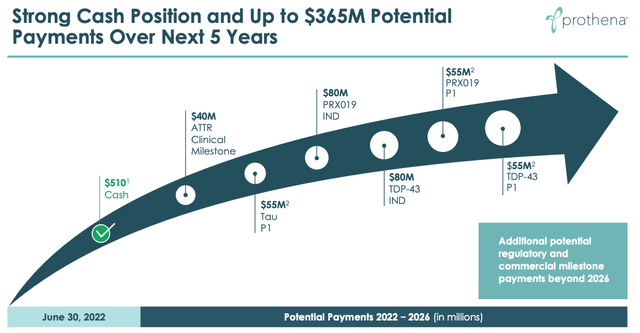

upcoming milestone payments (Prothena presentation)

The slide above shows that an absence of commercial products is not necessarily going to stop Prothena earning revenues, as there are development milestone payments arriving regularly over the next few years, from Novo Nordisk (ATTR), BMY (Tau, PRX019, TDP-43, targeting Amyotrophic Lateral Sclerosis) and potentially Roche too.

Roche-partnered Prasinezumab is now in a Phase 2b PADOVA study, with results expected in 2024. Earlier trial data has shown that the drug – an anti-a-synuclein antibody – slows disease progression on measures of motor function – by 35% versus placebo on the MDS-UPDRS Part III scale in the Phase 1/2 PASADENA study – and delays time to disease progression.

Prasinezumab is probably best described as a “slow-burner”, and the same could be said for Prothena’s most advanced candidate Birtamimab. As I discussed in my July 2021 post, Birtamimab once had blockbuster (>$1bn sales per annum) potential in AL Amyloidosis – a disease that affects vital organs and which is diagnosed in ~4k patients per annum in the US – but a pivotal trial was ended early after a futility analysis in 2018, before being resurrected after data suggested patients with a higher risk for early mortality may benefit from the disease.

Birtamimab’s confirmatory Phase 3 trial is enrolling 150 “Mayo Stage IV” patients (those at risk for early mortality) and data is expected in 2024, although interim data could be available earlier – the primary endpoint for the study is all-cause mortality, and interim analysis will be conducted when ~50% of events have occurred. An approval for Birtamimab could see Prothena earn revenues in the low triple digit millions, based on a reduced patient population of ~4k in the US, and 5k in Europe.

Conclusion – Smart Stewardship, Strong Partners and Promising (Preclinical) Data – But The Price Is Borderline Prohibitive

Reviewing Prothena’s pipeline one year after my last note, you could argue that the company has not made great progress, but in reality, drug development in CNS moves at a snail’s pace and Prothena should not necessarily be blamed for that.

The company looks to be smartly run – Prothena has attracted some big-hitting partners who have clearly seen something in the biotech’s approach to developing product candidates, and are prepared to pay significant sums to access.

In general, Prothena’s share price returns are dictated by the progress of other companies further advanced in the drug development process – Lilly and Biogen, for example, and that is a potential red flag.

Buying Prothena is to buy on the promise of preclinical data rather than in-human results, except for in the case of Birtamimab – which has a niche indication – and Prasinezumab – which I would still suggest is a highly speculative opportunity.

Prothena’s management team does have decades of experience, however, and excitement around PRX012 is likely justified, and even more so today thanks to the fresh “proof” that the amyloid beta thesis can work.

After the lecanemab data, investors must now pay a premium for Prothena stock, but the catalysts are beginning to arrive for the company, and it is not in any financial trouble, and not to be so thanks to the numerous upcoming milestones, which look achievable.

As such, I would give Prothena a “HOLD” rating for the time being. Things looked grim for the company as its share price sank and Aduhelm suffered, but typically, biotechs valuations drift downward when there is an absence of newsflow.

I would expect that to happen to Prothena in the coming months as the Lecanemab/Donanemab hype dies down, but it ought to be strongly revived in early 2023 when both Lilly and Biogen push for approval of their anti-amyloid drugs, and although risk averse investors may want to steer clear of Prothena stock, if you are betting money you can afford to lose, there ought to be some wild price swings to look forward to next year.

Be the first to comment