JHVEPhoto/iStock Editorial via Getty Images

Thesis

I believe Capital One Financial Corp. (NYSE:COF) will fuel long-term earnings growth by continuing to digitize its business model. By shifting away from physical branches, Capital One has the ability to suppress maintenance capital expenditures (CAPEX). This may not only increase free cash flow but may also allow room for management to focus on its marketing strategy while keeping its cost structure competitive. I believe if Capital One can combine its digital business model with the ability to add new large retailers to their brand partnership mix, growth will be exemplary.

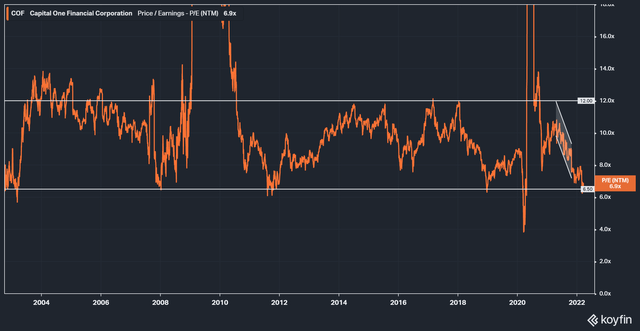

Capital One is currently 25% off highs and trading at the historic bottom level of its forward Price/Earnings (P/E) channel, in my opinion. While I believe there are legitimate reasons for Capital One to trade at historically depressed valuation levels (which I will touch on later), it may also be an advantageous time to enter for investors.

Background

I’ve covered Capital One in the past so I will link to my past article to cover the company’s more in-depth background but I will list some highlights below:

- Relative to more traditional banks, Capital One has a limited number of physical branch locations.

- The primary segment is credit cards which make up 40% of the company’s total loans and 62% of total revenues.

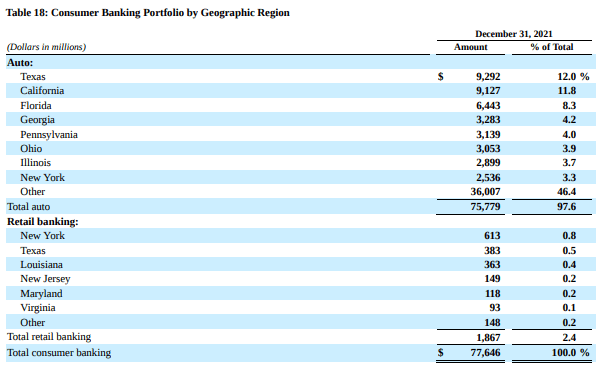

- The company also deals in consumer & commercial banking with auto loans making up the majority of the consumer side.

- Capital One has recently won over the co-branded credit cards with BJ’s Wholesale Club (BJ) and Walmart (WMT).

Capital One

Thesis Support

Digitization & Cost Structure

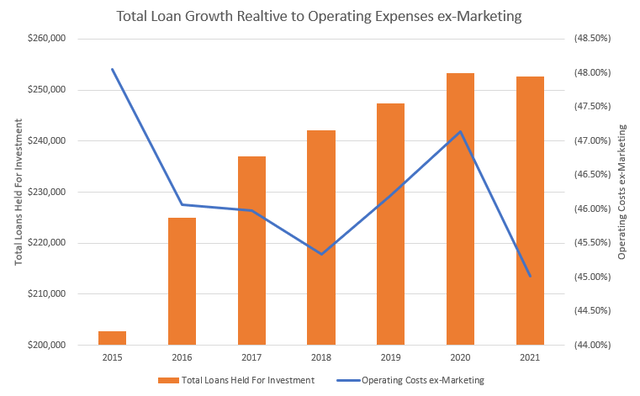

In the past few years, Capital One has reduced the number of branch locations it operates from 700 to 500. By shrinking the number of branches it operates, Capital One has been able to control operating costs while growing total loans:

Creating By Author Using Data From COF 10-Ks

Even as their physical footprint declines, which has helped reduce OPEX as a % of sales by ~300 basis points, loan growth achieved through heavy use of online deposits has increased 25% in 6 years.

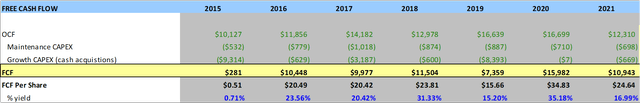

By controlling cost structure, Capital One has also been able to keep maintenance CAPEX consistent since 2015. Over the last 6 years, Capital One has grown operating cash flows by $2.2 billion while maintenance CAPEX has only increased $166 million. This has helped aid their elevated free cash flow yield shown below: (table below includes cash acquisitions (growth CAPEX) in the free cash flow formula).

Created By Author Using Data From COF 10-Ks

Capital One’s cost structure management is also evident in the efficiency ratio.

- Efficiency ratio: non-interest expenses/revenue.

In the last decade, Capital One’s efficiency ratio has averaged below 55% while its peer group typically ranges between 55-60%. Capital One does typically spend more in the marketing department relative to peers but I believe this helps fuel their digital deposit growth. Marketing expense is also not vital for day-to-day operations meaning they can reduce spending in that area during periods of uncertainty (as seen in 2020).

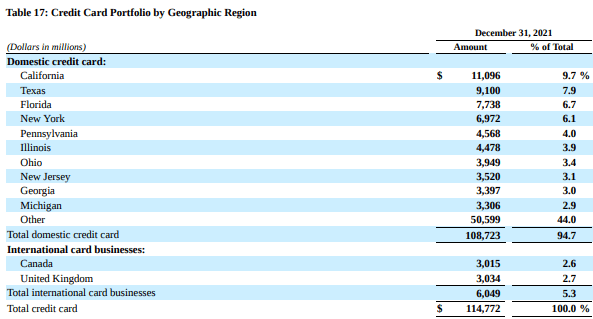

Not only has digital deposit growth aided loan growth while keeping cost structure under control, but it also provides a source of protection for Capital One in my opinion. This protection comes in the form of customer diversification. I believe the focus on digitizing their business model allows for them to expand nationally and reach a wider array of clientele, not limiting them to a specific demographic near branch locations. These benefits are similar to those of a large bank operating a massive interstate branch network without the costs associated. Below are the geographical loan breakdowns for the credit card & consumer banking segments:

COF 10-K COF 10-K

Brand Deal Drivers

Capital One’s most prominent business segment is credit cards which account for 62% of total revenues. One way Capital One has looked to expand this business segment is through co-branded deals. They were able to notch the Walmart co-branded credit card deal back in August of 2019 and the BJ’s Wholesale deal earlier this year. Continuing co-brand cards with massive retail brands will be a key way for Capital One to grow their top-line in my opinion.

Competitive Advantages

I believe investing in businesses with sustainable competitive advantages is key to long-term success. Capital One conducts business in a highly competitive industry, but in my opinion, they have created efficiencies in their business model that I believe protect them from the competition and aid them in future growth.

- Digitizing the banking business may continue to lead to higher efficiency ratios relative to peers.

- A higher efficiency ratio (operating margins) leads to the ability for higher investment in marketing/technology.

- Geographical loan diversification may reduce the economic cyclicality of certain regions.

- Not large enough to be globally systematically important avoiding the heaviest regulatory requirements (still required to participate in Fed stress tests)

Valuation

I believe Capital One is currently trading at the bottom of its historical forward P/E channel:

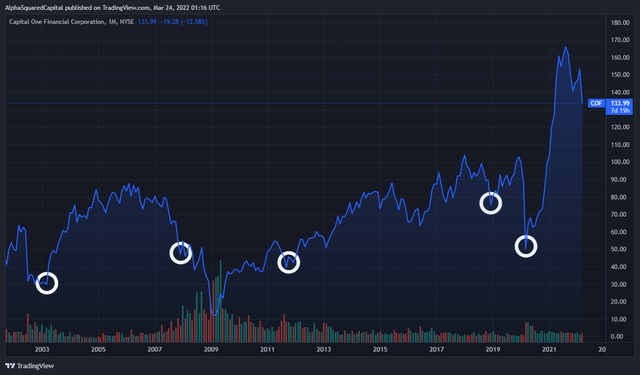

While I believe there are reasons Capital One currently trades at this level (I’ll highlight these later) and there were reasons in the past for it to trade at levels <6.5x NTM P/E, it has typically faired investors well who bought the stock <6.5x:

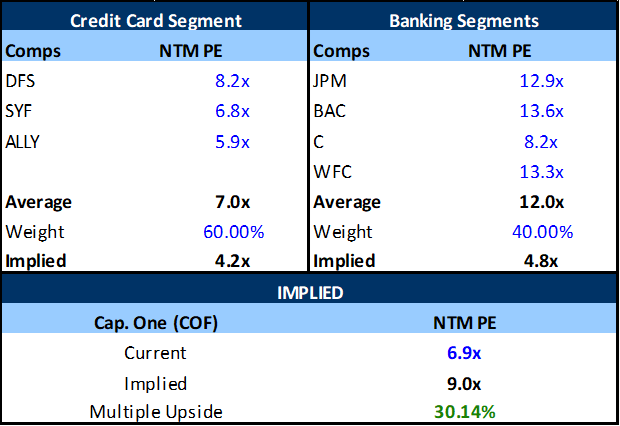

Based on Capital One’s business breakdown and where competitors are valued, I also believe Capital One trades at a discount relative to peers:

Created By Author Using Data From Koyfin

Risks – Why is Valuation Depressed?

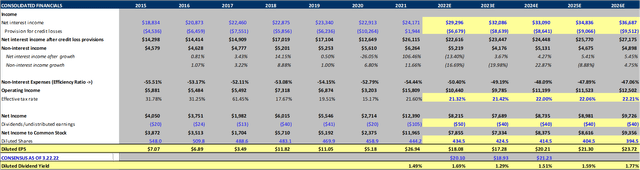

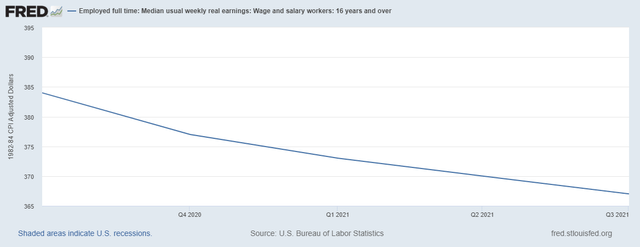

- Current Inflationary Environment: With inflation elevated and real wage growth suppressed, Capital One may see credit card loan balances increase. As the Federal Reserve looks to raise interest rates to fight inflation, Capital One may also see the yield on loans increase. While both of these are positives for Capital One, the tail risk lies within reduced consumer spending and credit losses & the expectations for them moving forward (provisions for credit losses). Customers with FICO scores <660 make up 29% of Capital One’s credit card portfolio. I believe if inflation continues to eat at real wages, Capital One will be forced to heighten its credit loss provisions which could lead to strong earnings revisions on the bottom line (I’ve accounted for this in my forecasts later in the article, attributing to my EPS forecasts being lower than Wall Street).

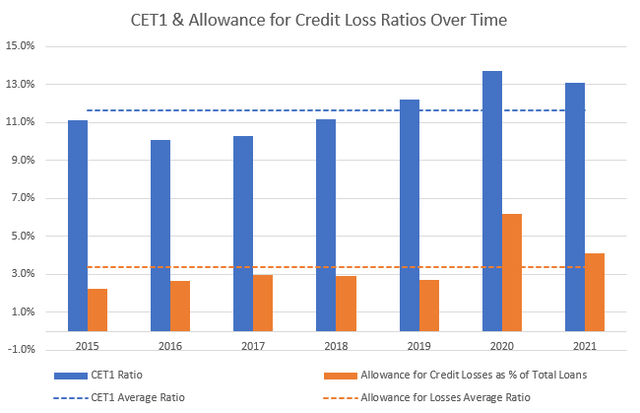

Inflation Risk Mitigant: I believe Capital One’s balance sheet is well-capitalized and conservatively positioned for this current environment. Capital One’s long-term CET1 ratio has been 11.7% while their average allowance for credit loss ratios (as % of loans held for investment) is 3.4%. Currently, their CET1 and allowance for loss ratios are 13.1% and 4.12%, respectively.

Created By Author Using Data From COF 10-Ks

2. Industry Competition: While I believe Capital One holds many competitive advantages, they still operate in a competitive industry. With co-branded card deals being an important growth focus, in my opinion, these deals could be pulled because of competing card issuers.

Competition Mitigant: Capital One’s current cost structure may give them an edge over the competition when creating a co-branded card package. With an efficiency ratio higher than the competition, they may be able to allow cushion competitors otherwise couldn’t afford.

Forecasts

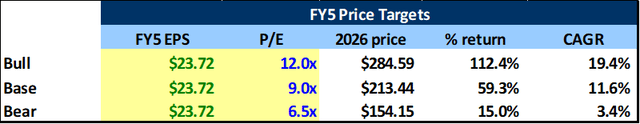

After reviewing valuation and projecting earnings forward 5 years, I created bear, base, and bull case price targets for Capital One.

Created By Author Using Data From COF 10-Ks Created By Author Using Data From Koyfin

(Returns are based on PV share price of $134, not inclusive of dividends)

Summary

Given current valuation levels and long-term future growth prospects, I believe Capital One presents an attractive investment opportunity. As they continue to digitize their business model, potentially leading to reductions in maintenance CAPEX and increases in their efficiency ratio, Capital One will continue to yield high free cash flow in my opinion. With this free cash flow, I believe they will be able to continue returning capital to shareholders through the form of dividends and share buybacks. With the stock trading below 7x NTM EPS, I believe it may present an opportunity for long-term shareholders.

Be the first to comment